Something Impossible Just Happened: A CLO Just Failed Its AAA Overcollateralization Test

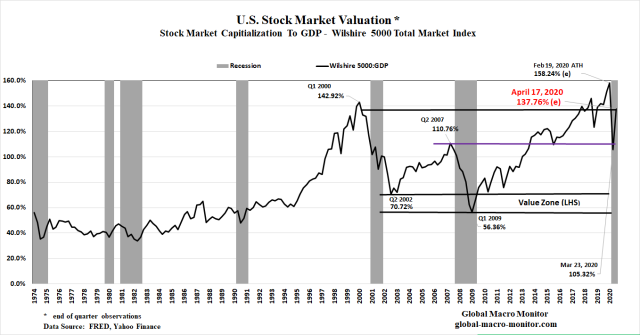

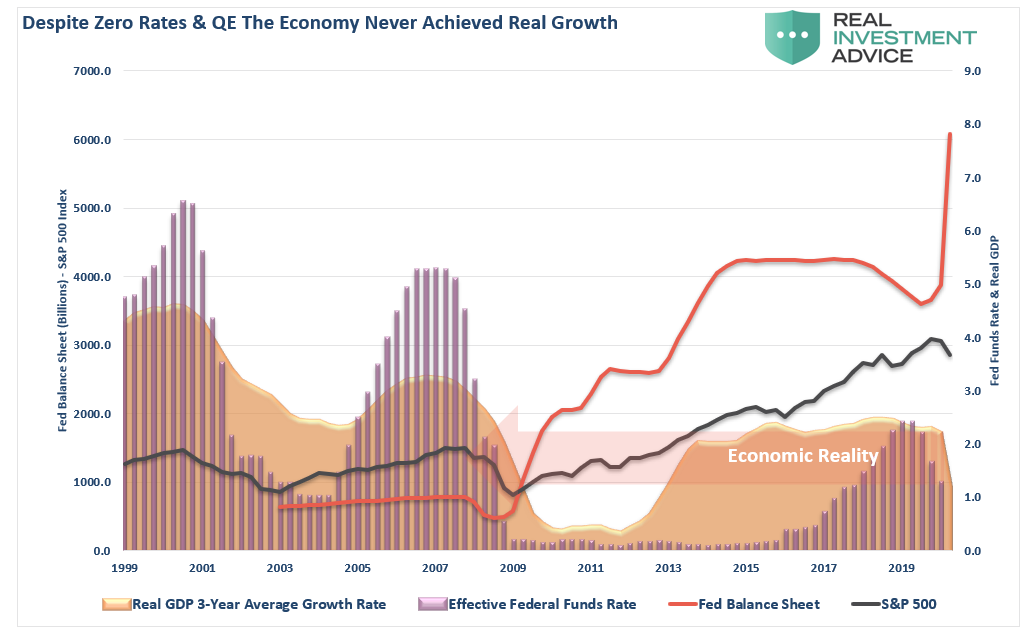

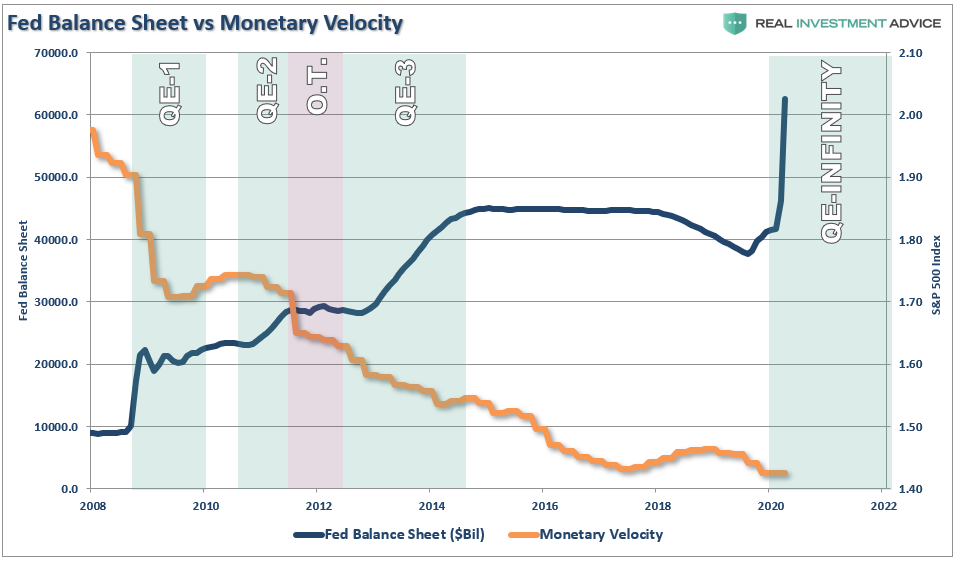

Over the weekend, we reported that in its quest to bailout the richest Americans and the country’s financial system, the Fed unleashed an unprecedented array of actions meant to backstop capital markets, going so far as buying investment grade, high yield bonds and even AAA-rated CLO bonds.

However, as we warned, it won’t be enough, for two reasons: first, recall that the expanded Term Asset-Backed Securities Loan Facility (TALF) announced by the Fed last Thursday only buys AAA-rated bonds of CLOs, which after the coming tsunami of CLO downgrades is complete, will not only collapse in nominal size but will mean that any further attempts to stabilize the CLO space will require yet another Fed backstop of even riskier – i.e., rated AA and lower – structured products.

The second reason – one which Bloomberg called a “bigger and more ominous force at work that has investors bracing for the kind of pain they’ve never experienced in the decades that the [CLO] market has existed” – is that late on Friday, in the most draconian and widespread ratings action since the financial crisis, Moody’s warned it may cut the ratings on $22 billion of U.S. collateralized loan obligations – a fifth of all such bonds it grades – as a result of the collapse in cash flows due to the Covid-19 pandemic.

The ratings agency took action on 859 bonds from 358 CLOs that package leveraged loans into securities of varying degrees of risk and return. The step – which according to Bloomberg affects about 19% of Moody’s-rated CLOs that purchase broadly syndicated loans – comes as the underlying debt gets downgraded at a record pace.

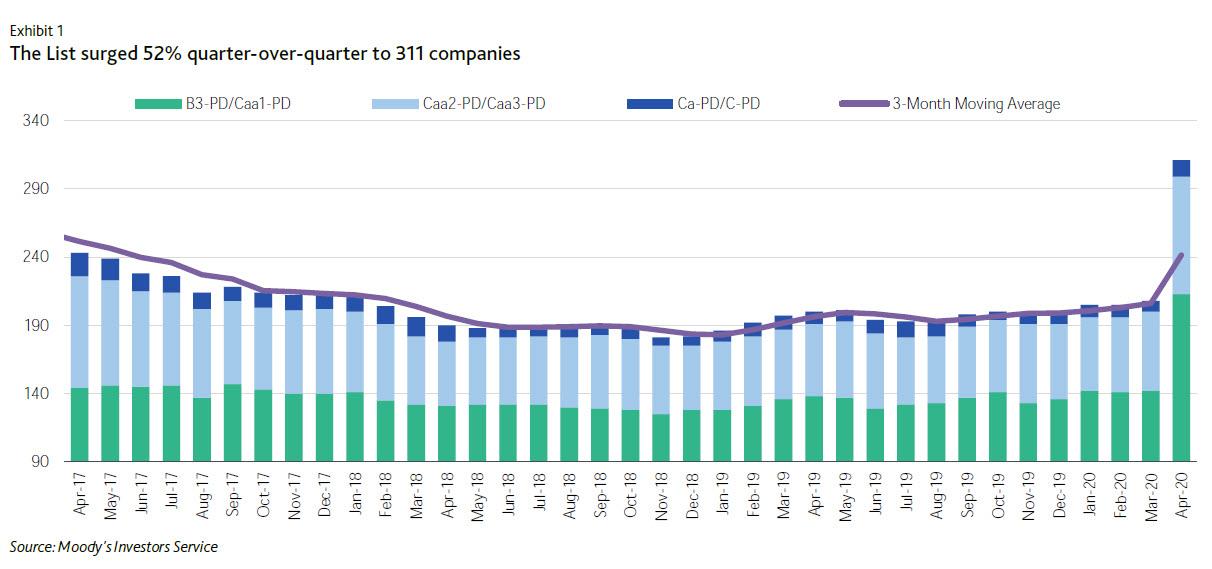

The action followed a report by Moodys earlier in the week in which it reported that its “B3 Negative and lower list” soared to its highest tally ever — 311 companies. That tops a former peak of 291 companies, reached during the credit crisis of 2009 and the commodity-related downturn in April 2016. At 20.7% of the total rated spec-grade population, the list also shot up above its long-term average of 14.8%, and closing in on its all-time high of 26.1%. This spike is the result of the confluence of a coronavirus outbreak, plunging oil prices, and mounting recessionary conditions, which created severe and extensive credit shocks across many sectors, regions and markets, the effects of which are unprecedented.

And with the underlying bonds set to suffer an unprecedented collapse in solvency, it is only a matter of time before the products where they are packaged are also hammered. Products such as CLOs.

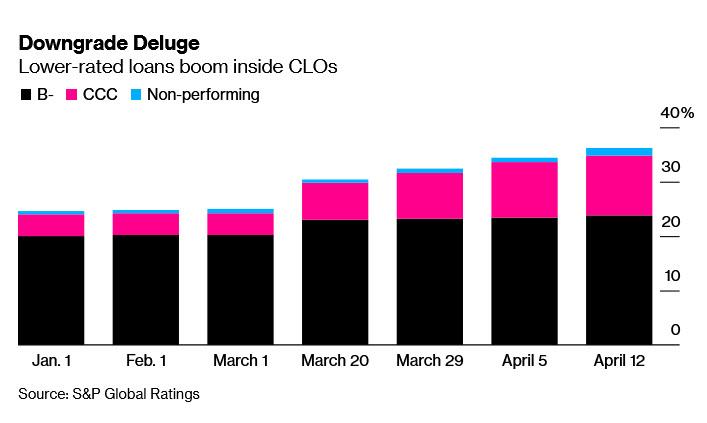

Today, picking up on this growing risk of widespread impairments across the CLO deal stack, Bloomberg echoes what we said, namely that credit ratings on risky corporate loans that were stuffed into the CLOs “are being downgraded at a pace so frenetic that it threatens to overwhelm safeguards that were put in place to ensure the securities’ financial strength.”

And “if that happens” Bloomberg continues, “the firms that manage the CLOs will be forced to dump under-performing debt at fire-sale prices or suspend the cash payments they hand over to their investors.”

It just happened.

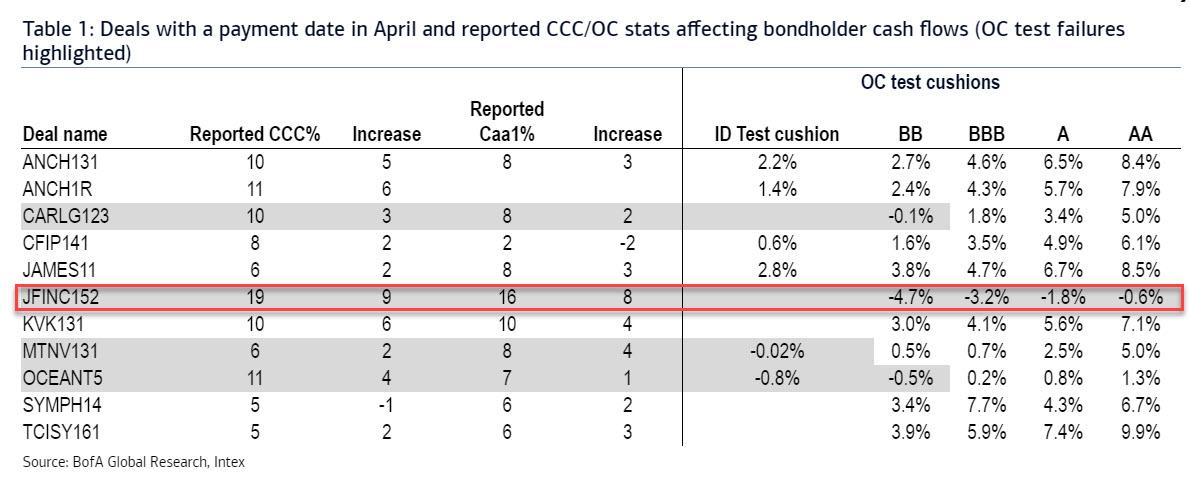

In yet another case of something that was previously deemed impossible becoming reality thanks to the Coronavirus depression – like oil trading at a negative $14 per barrel – Bank of America’s Chris Flanagan writes that with some deals already reporting late March/early April data, we find that some deals are failing, not just the junior overcollateralization (OC) test but in one case, even the AAA/AA OC test!

According to Flanagan, this will be the likely be the first “CLO 2.0” deal failing the senior most OC test; as a reminder, not even during the financial crisis were the supersafe AAA tranches impaired. This time it took just a few weeks for the cash flow collapse to impair the very top of the stack!

The CLO deal in question is JFINC152, where downgrades have sent the reported CCC percentage to 19%, up 9%, and the result is that every single test cushion is now showing impaired results, from BB (-4.7%) all the way to AA (-0.6%).

Those seeking the reason for this unprecedented development will find it in the dramatic deterioration of CLO credit ratings: for the deals that failed any one of the tests, the increase in CCC is almost 2x over the past month, BofA notes adding that the lack of reinvestment flexibility for some of the transactions as the deals were post the RP period implied managers could not take advantage of the volatile loan market condition in March.

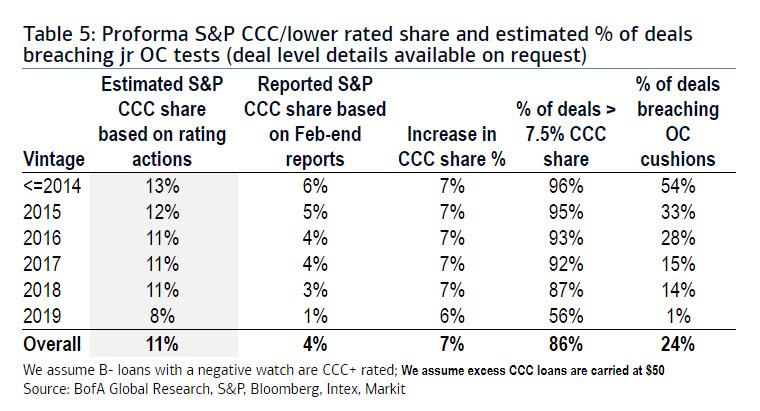

Looking at the past month, since March, S&P and Fitch have placed around 100 tranches on negative watch. The vast majority of these deals were initially rated BB/B and there are 8 IG-rated tranches (mostly BBB). BBB bonds continue to face a high risk of downgrade in the near term considering the increasing CCC share and the recent uptick in defaults. According to an analysis by S&P, should CCC’s increase to 18%, defaults to 5% and OC declines of 2pts, around 46% of BBB bonds could be downgraded to Non-IG.

This has important ramifications for both bondholders and investors as many deal documents initiate a restricted trading condition if any IG-rated bond is downgraded. This will further limit manager’s ability to trade in/out of loans.

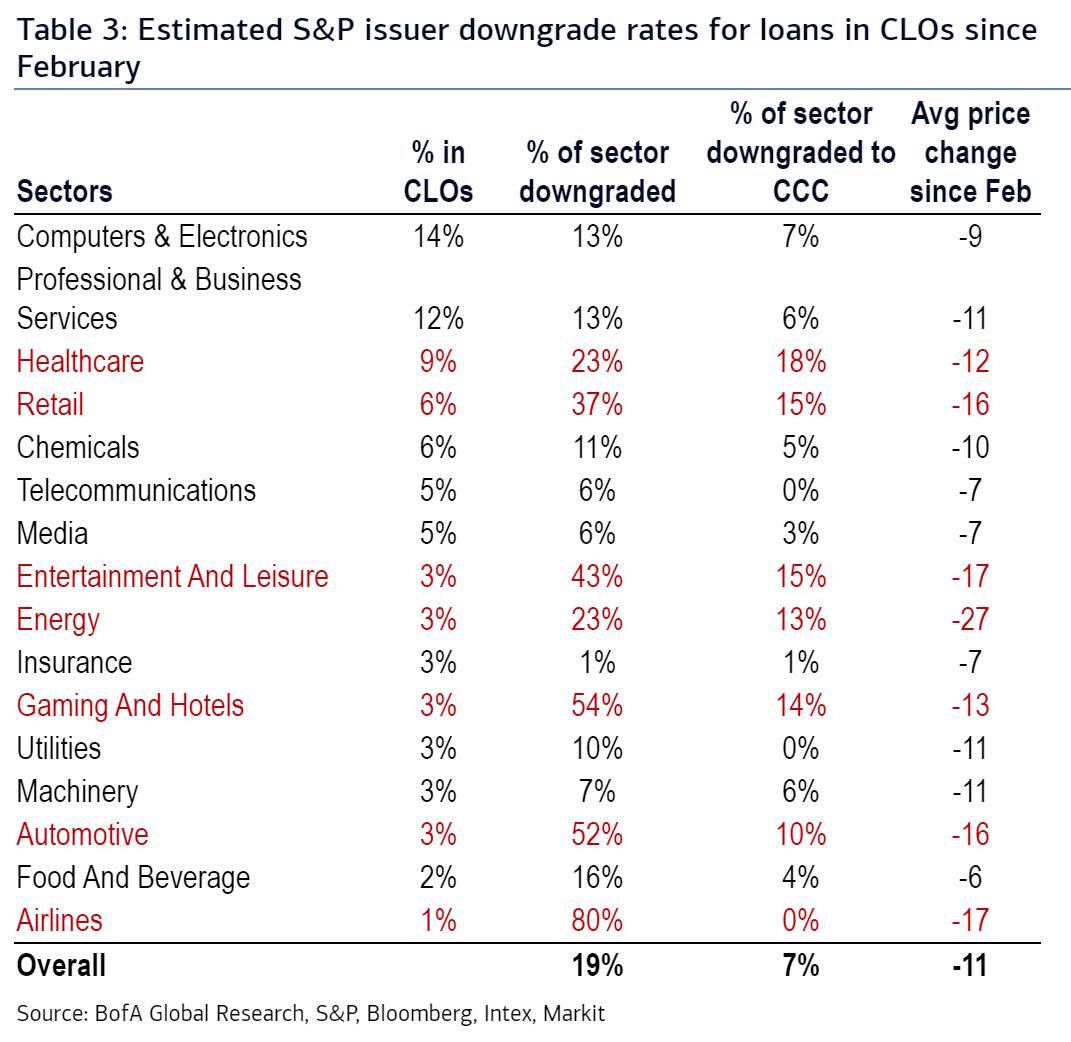

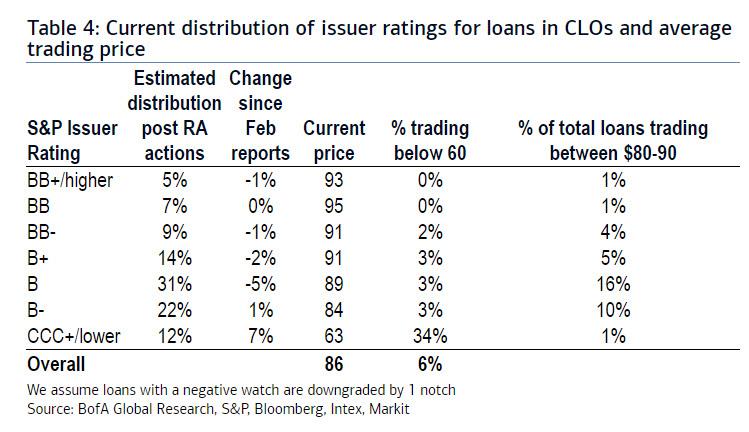

Additionally, the surging share of CCC downgrades has caused many deals to have lower OC ratios as a result of CCC excess and/or par burn as managers traded out of lower priced/lower rated loans. BofA currently estimates that around 17-19% (and counting) of loans in CLOs have been downgraded by both Moody’s and S&P since February, and many more downgrades are coming. Currently, the share of CCC+/lower rated issuers is estimated to be 10.5% and the share of Caa1/lower rated loans is estimated to be around 8.5% across CLO portfolios (assuming loans with a negative watch have been downgraded by a notch lower).

BofA also highlights the average price across each rating cohort currently (after adjusting for downgrades). There has been an increased dispersion between high/low quality names with B+/BB issuers trading around $90 and CCC issuers, around $60. As a result, to swap from a CCC name into a B or higher rated asset still implies taking a $25 hit to par.

Next, looking at updated CCC concentrations, BofA estimates that as many as 20-30% of deals are now potentially breaching their OC tests (assuming a $40-50 price for excess CCC assets and based off March portfolios). In some cases, the BB bonds may PIK as well. With April determination dates beginning and around the corner, managers have very less room/time to trade out of loans and cure these breaches.

Looking ahead, BofA thinks further OC breaches are likely to occur as more deals that make their payment in April report. With the estimated CCC share reaching 10.5%, roughly 20-30% of deals could breach their junior OC tests, and increasingly more deals will likely impair the AAA tranche as well – that’s where Japanese pensioners’ money is currently allocated – an outcome that until just a few weeks ago was inconceivable.

* * *

With the safest tranches facing impairments, the riskiest – or equity – tranches are set for a historic wipeout. According to Bloomberg, analysts expect as many as one in three CLOs may soon have to limit payouts to holders of the equity portion.

The loan downgrades have come so fast that Stephen Ketchum of Sound Point Capital Management compared it to a spill “at the Daytona 500, where the cars are crashing into each other.” It’s a lot different, he said, than the 2008 financial crisis, which “was a slow-moving train wreck.”

Another major difference between the financial crisis and now is that back in 2008, the CLO market emerged largely unscathed – especially the AAA tranches – an outcome which we now know will not happen. Corporate loans were far enough removed from the epicenter of the 2008 crisis – a housing bubble – to avoid much of the collateral damage and, besides, the CLO market back then was a fraction of its size today.

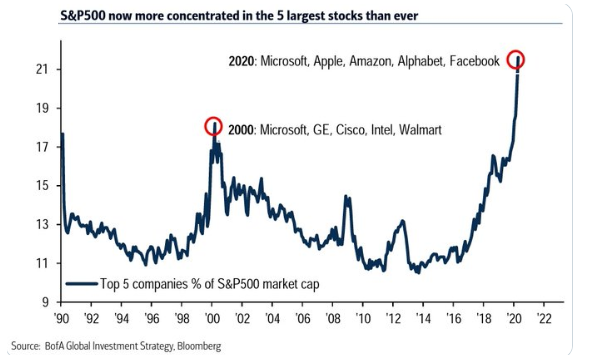

Ironically, the strong track record, the lack of major CLO impairments, along with the fact that the securities provided juicy returns in an era of near-zero global rates; fueled a boom in demand over the past decade. The same boom will now lead to hundreds of billions in losses.

Worse, it means that a key pillar of the credit market will be crushed for years: CLOs have been the biggest buyers in the $1.2 trillion leveraged loan market, helping fuel a surge in debt-fueled buyouts and other transactions.

In sympathy with the broader market, prices on CLOs have recovered some in recent days with AAA securities recouping most of their declines since the selloff began largely thanks to the Fed’s promise to backstop the supersafe tranche. However, as cash flows plunge and as a flood of downgrades hit the underlying loans which then leads to even more AAA tests being missed, the entire CLO space is in for a very violent repricing and unless the Fed is prepared to backstop the entire $1.2 trillion market, the consequences – for both the loan and broader bond market – will be catastrophic, while the Fed ends up holding paper that in a few months will be insolvent, at which point the Congressional hearings why Powell bought worthless securities with freshly printed dollars will be the hottest thing on TV.

Tyler Durden

Mon, 04/20/2020 – 14:21

via ZeroHedge News https://ift.tt/2VoJ4r2 Tyler Durden