The COVID-19 Crisis Is Driving The EU To The Brink

Authored by Philipp Bagus via The Mises Institute,

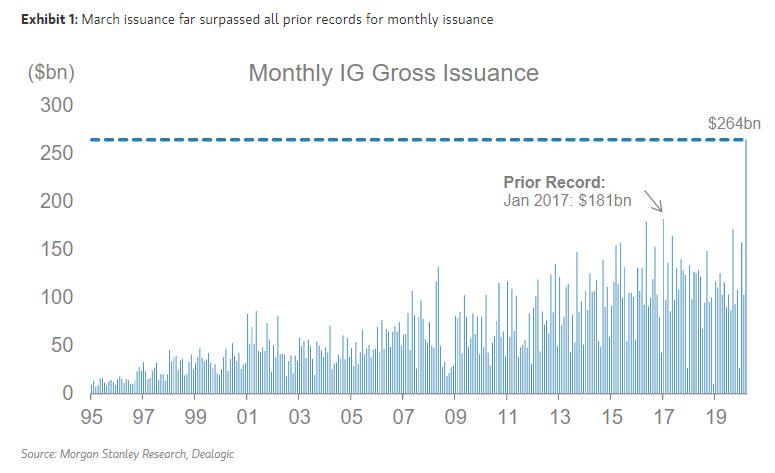

The eurozone is a gigantic machine of monetary redistribution. Several independent governments can finance their expenditures through deficits that are monetized directly or indirectly by one printing press. More specifically, the European Central Bank (ECB) may buy eurozone government bonds directly from market participants or accept them as collateral in its lending operations, effectively increasing the monetary base.

Through this monetization, a government can externalize the costs of its deficit partially onto the citizens of other eurozone countries in the form of a lower purchasing power for the euro. The setup resembles a tragedy of the commons. The commonly owned resource is the purchasing power of the euro, which is exploited by several users. These users are the eurozone governments. They issue debts resulting in an increase in the money supply. By running comparatively higher deficits than their peers, eurozone governments can attempt to live at the expense of foreigners.

It cannot be surprising that most governments have ignored the new treaty instituted in the wake of the European debt crisis to bring down debts and deficits. During the last years of moderate economic growth, with interest rates at virtually zero, highly indebted governments did not take advantage of the situation to reduce their debts. Rather they took advantage of the higher tax revenues and reduced interest spending to boost government expenditures in other areas. Governments think that they will get away with it. The rationale for this irresponsible behavior was simple: when there was another crisis someday, these governments would just print more government bonds, have their banks buy them, and make others pay in form of a loss in the euro’s purchasing power.

These governments believe that no one will put an end to the monetization, because ending this mechanism would trigger a sovereign debt default, which would harm the other eurozone governments. European banks and especially the ECB are loaded with eurozone government bonds. A government default would imply losses not only in the defaulting country, but for all eurozone banks. It would lead to cascading bankruptcies, an immense banking, sovereign debt, and economic crisis. The confidence in the euro could be severely shaken by the risk of (hyper)inflation.

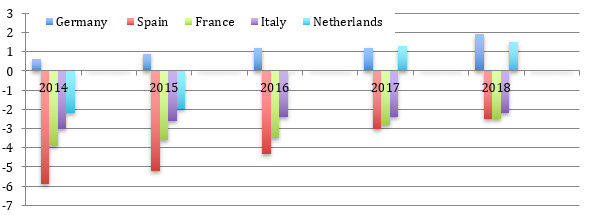

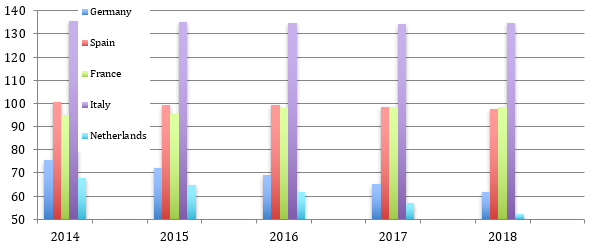

Although southern governments such as Italy, France, and Spain did not use the last years to reduce their deficits, Germany and other northern countries such as the Netherlands did reduce their debts, thereby increasing, ironically, the possibility of southern government relying on Germany and the north for bailouts.

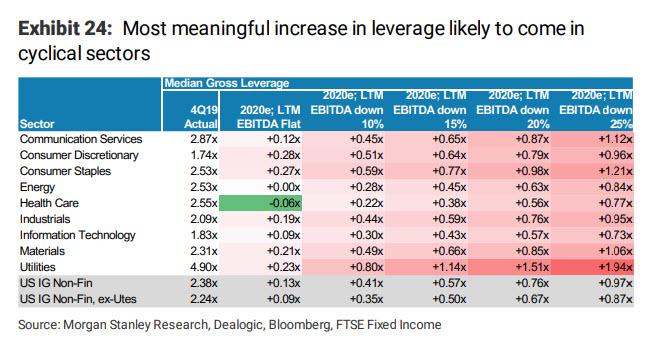

Government Deficits and Surpluses in Percentage of GDP

Government Debts in Percentage of GDP

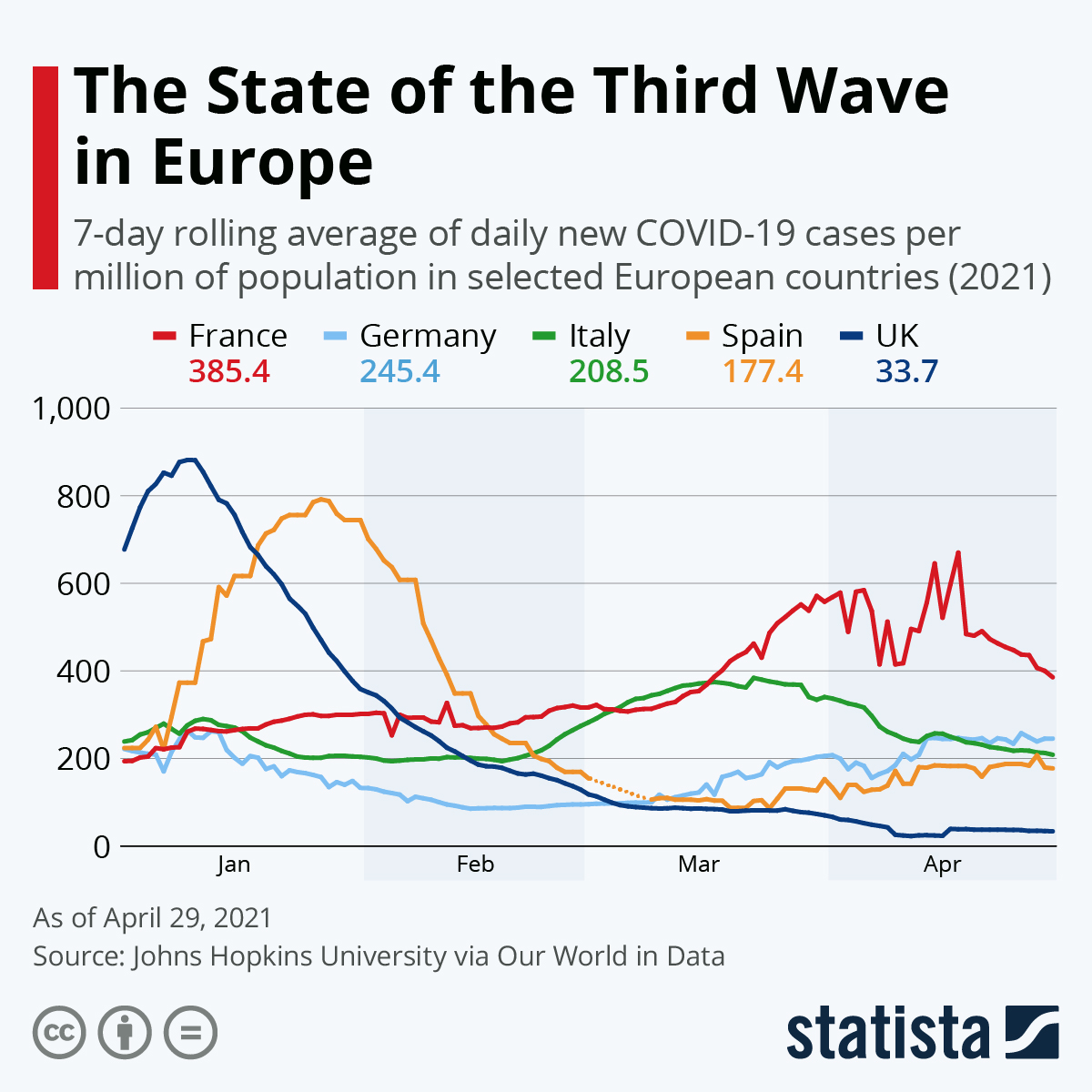

During the COVID-19 panic and resulting lockdowns, Italy, Spain, and France have vehemently demanded “solidarity” from Germany, bluffing about leaving the EU if their demands remain unfulfilled. In spite of their failure to reduce government spending and deficits in good times, they believe it to be their right to be bailed out. Their past excessive deficits can be explained by the prospect of European debt mutualization. Indeed, several bailout schemes have already been instituted during the corona panic. The ECB announced that it would buy €750 billion in bonds, and the EU has agreed upon a €540 billion bailout package.

Unfortunately, the moral hazard implied in the euro setup not only influenced excessive government spending before the corona crisis, but most likely is influencing government responses to the epidemic as well. The costs of lockdowns and government bailouts of citizens and companies are enormous. A government must carefully consider the decision to enforce a costly lockdown. But what if a government can externalize part of the lockdown costs on others through new debts or bailouts? If this possibility exists, as it does in the eurozone, it becomes more likely that a government will declare a lockdown and continue with it for longer. Instead of lifting the restrictions as fast as possible, southern governments maintain them, because they count on a bailout and the support of governments with better fiscal balance sheets. By ruining their own economies, southern governments actually increase the pressure for the institution of new redistribution schemes, and finally a European superstate.

The reasoning, as exemplified by infamous former Greece finance minister Yanis Varoufakis, is:

if you do not rescue us, we will default, leading to a European banking crisis, high losses for the ECB, and a severe depression. So, you better bail us out.

Thus, the setup of the euro may be responsible for suicidal lockdowns in some eurozone countries that will be longer than in other places, with all their detrimental social, political, health, and economic consequences. And it is possible that this crisis will lead to a final decision for the future of the euro and toward a European superstate.

Tyler Durden

Sun, 04/26/2020 – 08:10

via ZeroHedge News https://ift.tt/2Y3b6dj Tyler Durden