Futures Soar On Reopening, Corona Cure Optimism; Ignore Mountains Of Bad News

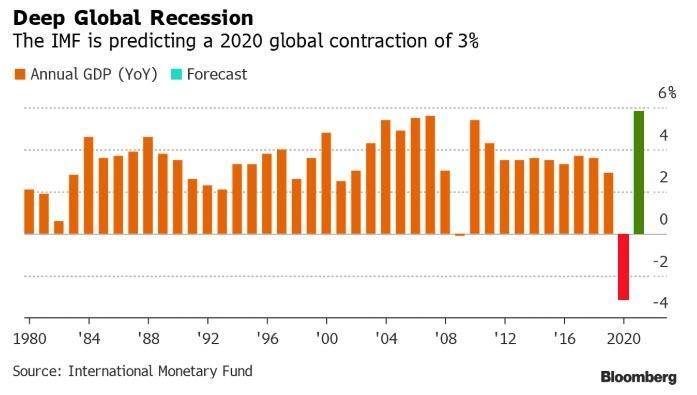

Even though the Gilead “miracle drug” report was refuted by the company itself, which slammed the market-moving Statnews article (sourced reportedly from hedge funds who were seeking to take profit in GILD) as “anecdotal reports with no statistical power”, and even though Trump’s plans to reopen the country turned out to be far less pressing than expected, with Trump effectively handing power into the hands of states, this morning futures and global stocks have continued their move higher after blasting off last night on the Gilead/reopening speculation, with the euphoria persisting overnight as the small steps toward restarting the world’s largest economy helped investors look past mixed progress on curbing the coronavirus and the latest dismal data from China, where GDP posted its first contraction in four decades, sliding 6.8% or more than expected.

The data from China showed the world’s second-largest economy shrank for the first time since at least 1992 because of the coronavirus woes. GDP contracted 6.8% in the quarter year-on-year, more than expected, and 9.8% from the previous quarter. Retail sales also fell more than expected in March, but industrial output dipped only slightly, suggesting its manufacturing sector at least is recovering more quickly.

As WTI oil slumped, further extending its divergence with Brent…

… the dollar tried to rebound and bond yields were generally unchanged, US equity futures rallied nearly 100 points, or 4%, from the Thursday close and approached the limit-up lock on several occasions, reflecting optimism that major economies will slowly start lifting lockdown restrictions and signs of medical progress against the virus.

The week is ending on an optimistic note after the White House set guidelines to reopen the economy, though it has yet to ensure that widespread testing will be available as many business leaders have urged. The president is under pressure, with 22 million Americans applying for jobless benefits in a month, erasing a decade worth of job creation. At the same time, infections have surged in Russia, Germany and Singapore. Investors also assessed a report that Gilead Sciences is seeing improvements in a group of coronavirus patients being treated with its drug, although the company itself refuted the report. German Chancellor Angela Merkel this week announced tentative steps to begin returning the country to normal.

“The market is a bit optimistic right now,” David Bailin, chief investment officer at Citi Private Bank, said on Bloomberg TV. “Ultimately we have to have really great coordination in order to see any real improvement in the economy.”

Prior to Friday’s cash open, the S&P 500 was up 0.4% this week and set for a second straight weekly gain – its first back-to-back weekly gain since before the market turmoil began in February – despite an unprecedented collapse in the US (and Chinese) economy, and 22 million people laid off in the past month, as investors scour first-quarter earnings to find signs of the novel coronavirus outbreak’s effects on companies’ balance sheets.

In Europe, the Stoxx 600 Index also climbed 2.6%, entering a bull market, after it rose 20% from its March lows, with the travel and leisure sector leading the gains although all 19 industry groups were in the green. Banking stocks helped the Stoxx Europe 600 Index jump to a session high as lenders are said to seek to avert stashing billions for soured loans; the banks subgroup surges as much as 4.3%. European lenders are set to report comparatively small increases in loan loss reserves in the first quarter and plan a similar approach during the rest of the year, Bloomberg News reports, citing senior bankers and regulators.

European countries have “no choice” but to set up a fund that “could issue common debt with a common guarantee”, French President Emmanuel Macron told the Financial Times on Thursday. Failure to do so would lead to populists winning elections in Italy, Spain, and possibly France, he also warned.

Yields on ultra-safe 10-year U.S. Treasuries US10YT=RR and German Bunds rose slightly, while Treasury futures TYc1 and the dollar firmed against the yen JPY=EBS, in another tentative sign of investor optimism.

“The market continues to look through terrible data… on anticipation of economies reopening,” said Steen Jakobsen, Chief Investment Officer at Saxo Bank. “And hopes that a new drug treatment will help lift longer term uncertainty about the COVID-19 pandemic.”

Earlier in the session, Asian stocks gained as traders shrugged off the catastrophic China GDP data noted above, led by IT and materials, after falling in the last session. All markets in the region were up, with Jakarta Composite gaining 3.4% and South Korea’s Kospi Index rising 3.1%. The Topix gained 1.4%, with Riken Technos and Kichiri Holdings & Co Ltd rising the most. The Shanghai Composite Index rose 0.7%, with Zhejiang Xinneng Solar Photovoltaic Technology and Jiangsu Boxin Investing posting the biggest advances.

In rates, the 10Y yield initially bounced sharply from its 0.62% close rising almost as high as 0.69% before reversing virtually all gains. Italian bond markets, which have been under pressure as the country’s virus difficulties push its debt-to-GDP ratio towards 150%, also rallied as France expressed support for joint euro zone debt issuance.

In commodities, spot gold fell 1.5% to $1,692 per ounce too and with investors looking to take on more risk industrial metal copper jumped 4% on track for its best week since February 2019. No such luck for battered oil markets however. WTI futures slumped 8% to an 18-year low after OPEC had lowered of its global demand forecast on Thursday, and Brent crude slipped back under $28 a barrel having been up nearly 3% at one point. OPEC now sees a contraction of global demand of 6.9 million barrels per day (bpd) this year due to the coronavirus outbreak.

“Downward risks remain significant, suggesting the possibility of further adjustments, especially in the second quarter,” OPEC said of the demand forecast.

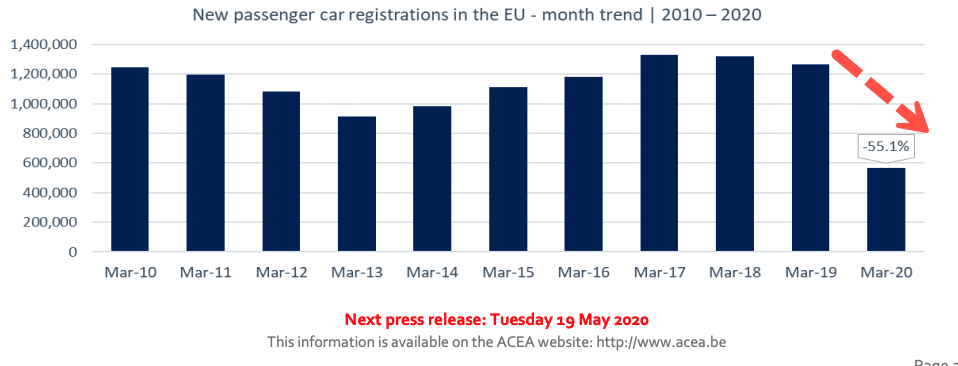

Looking at the day ahead, the data releases include new car registrations for March in the EU27, the Italian trade balance for February and the final Euro Area CPI reading for February. From the US we’ll also get the leading index for March. From central banks, we’ll hear from the Fed’s Bullard and the ECB’s Rehn.

Market Snapshot

- S&P 500 futures up 2.6% to 2,859.50

- STOXX Europe 600 up 2.5% to 333.14

- MXAP up 1.8% to 144.79

- MXAPJ up 2% to 468.07

- Nikkei up 3.2% to 19,897.26

- Topix up 1.4% to 1,442.54

- Hang Seng Index up 1.6% to 24,380.00

- Shanghai Composite up 0.7% to 2,838.49

- Sensex up 1.8% to 31,166.28

- Australia S&P/ASX 200 up 1.3% to 5,487.54

- Kospi up 3.1% to 1,914.53

- German 10Y yield fell 0.2 bps to -0.476%

- Euro down 0.09% to $1.0830

- Italian 10Y yield fell 5.0 bps to 1.659%

- Spanish 10Y yield unchanged at 0.831%

- Brent futures down 0.3% to $27.73/bbl

- Gold spot down 1.3% to $1,695.70

- U.S. Dollar Index up 0.1% to 100.13

Top Overnight News

- China’s gross domestic product shrank 6.8% from a year ago, the worst performance since at least 1992 when official releases of quarterly GDP started and missing the median forecast of a 6% drop

- Cantor Fitzgerald is shrinking its workforce, breaking with firms across Wall Street that vowed not to lay off employees during a pandemic that’s unleashed the worst unemployment crisis in decades

- The Italian government may set up a 70 billion-euro ($76 billion) package of spending measures in a decree due to be approved on Monday morning, Il Sole 24 Ore reported

- More than 15,000 U.K. companies fell into “significant distress” in the first three months of 2020 as the virus shutdown took its toll on the economy, according to a quarterly survey published on Friday by insolvency specialist Begbies Traynor

- The Trump administration issued a guideline to governors outlining steps for phased reopening. Some U.S. states and employers may be able to abandon most social distancing practices to curb the coronavirus outbreak within four weeks under guidelines.

- The U.S. Treasury Department is in talks with some airlines about accepting their loyalty programs as collateral against government loans to help them weather the virus crisis.

Asian equity markets notched firm gains after tracking the advances in US equity futures following the announcement of reopening guidelines for the US economy and amid hopes of a COVID-19 treatment after positive results for Gilead’s Remdesivir drug in closely observed clinical trials, despite the Co. downplaying the reports. In addition, Boeing shares took off after-hours as the Co. plans to resume commercial airline production in Washington state factories next week. ASX 200 (+1.3%) and Nikkei 225 (+3.2%) surged from the open with corporate updates contributing to the stock rally in Australia including Rio Tinto which posted higher quarterly iron ore output and shipments, while Tokyo sentiment benefitted from the government’s relief efforts including the JPY 100k cash handouts to all citizens, and the TAIEX (+2.1%) was also boosted with chipmakers inspired by strong earnings from global semiconductor giant TSMC. Hang Seng (+1.5%) and Shanghai Comp. (+0.7%) conformed to the broad optimism following reports the PBoC will continue to the guide credit funds to support smaller firms through targeted RRR cuts and with the gains maintained regardless of the slew of mixed tier-1 data which showed Chinese GDP Y/Y at -6.8% vs. Exp. -6.5% Y/Y, although GDP Q/Q was at a slightly narrower than expected contraction. Furthermore, Industrial Production and Retail Sales added to the varied narrative although China’s stats bureau remained optimistic in which it suggested a visible improvement in major economic indicators last month and likelihood of a continued recovery. Finally, 10yr JGBs were pressured amid spillover selling from T-notes with prices dampened as stocks rallied from US reopening guidelines and hopes of progress for COVID-19 treatment.

Top Asian News

- Car Inc. Stock, Bonds Soar as Warburg Pincus Unit to Boost Stake

- China Stocks Advance as Traders Look Past Poor Economic Data

- Indian Central Bank Boosts Liquidity to Offset Virus Hit

- RBI Halts Bank Dividends, Injects Cash to Help Indian Borrowers

European equities hold onto a bulk of sentiment-driven gains (Euro Stoxx 50 +3.6%), albeit the region has waned off highs alongside US equity futures. The slight fade in risk appetite follows questions regarding whether reopening the US economy soon will revive an outbreak of COVID-19. Meanwhile, the second catalyst is attributed to Gilead’s treatment showing rapid recoveries among severe cases, but the Co. caveated stating the data does not satisfy safety and efficacy profiles. Traders may also be wary to open/hold onto risky positions heading into another weekend of uncertainty. Nonetheless, broad-based gains are seen across major European bourses as April option expiries provided the region with impetus, with CAC 40 (+3.8%) modestly outpacing peers amid post-earning gains from giants L’Oreal (+2.7%) and LVMH (+4.9%) – which together account for almost 14% of the French index and around 5% of the Euro Stoxx 50. Sectors are in the green across the board and lean towards a risk-on session – with cyclicals outperforming defensive. The breakdown sees Travel & Leisure outperforming whilst the underperformance in Healthcare seems to be more of a risk-driven move. In terms of individual movers, Airbus (+8.7%) shares soar amid reports Boeing (+8.1% pre-mkt) is to resume production at its Seattle factory as soon as Monday next week. Thus, engine makers also gain impetus, with Rolls Royce (+11.3%) and Safran (+8.8%) buoyed. Elsewhere, Rio Tinto’s (+3.3%) iron ore shipment update supports share prices, with peers Antofagasta (+2.9%), Glencore (+9.0%), BHP (+5.1%) and Fresnillo (+2.0%) all higher in tandem. On the flip side, Diasorin (-7%) shares reside at the foot of the Stoxx 600, potentially Gilead seemingly leads the race between the Cos regarding antibody testing.

Top European News

- ECB’s Weidmann Tells Governments to Spend Now But Save Later

- Europe Autos Jump as Market Optimism Outweighs March Sales Slide

- Airbus Chief Says Virus May Require Difficult Jobs Decision

- Rate Cut ‘Main Option’ for Bank of Russia Next Week: Nabiullina

In FX, the Dollar is back in demand despite renewed risk appetite for global equities if nothing else on the back of more moves to scale back COVID-19 restrictions and positive anti-virus treatment results. The index has bounced firmly from 99.689 lows to reclaim 100.000+ status and is only marginally shy of Thursday’s 100.300 high amidst almost blanket Greenback gains vs G10 peers.

- JPY/NZD/AUD – The Yen continues to resist the Buck’s advances and the bulk of safe-haven unwinding, with reports of Japanese offers into rebounds over 108.00 in Usd/Jpy capping the headline pair, while crosses remain bearish barring extreme bouts risk asset buying. On that note, the Kiwi has regained a degree of stability after yesterday’s RBNZ-related jolt to retest 0.6000 climes and reverse some underperformance against the Aussie, as the cross slips back below 1.0600 and Aud/Usd fades ahead of 0.6400 following mixed Chinese data overnight (GDP contraction not quite as bad as feared overall, retail sales weaker than forecast, but ip vice-versa).

- CAD/EUR/CHF/GBP – All making way for the latest broad Dollar upturn, as the Loonie retreats from just under 1.4000 to sub-1.4100 against the backdrop of waning oil prices and the Euro loses more momentum having failed to retain grip of the 1.0900 handle earlier this week. However, the single currency may derive some traction from option expiries again given hefty interest between 1.0835-50 (1.9 bn) and the 1.0800 strike (1.7 bn), in contrast to Usd/Cad that could see 1.9 bn at 1.4000 defended or protected. Meanwhile, the Franc is still caught in the crossfire in terms of weakness around 0.9700 vs the Greenback and strength relative to the Euro as Eur/Chf skirts 1.0500, but Sterling is softer across the board as Cable tops out above 1.2500 and Eur/Gbp rebounds through 0.8700. Note, the former continues to respect the 200 HMA at 1.2525 and latter is prone to almost daily or intraday periods of fix induced volatility. Ahead for the Pound, Moody’s UK ratings review poses downgrade risk to current standing and/or outlook.

- SCANDI/EM – Contrasting fortunes for the Sek and Nok, as the aforementioned downturn in crude scuppers the Norwegian Krona irrespective of independent Euro weakness, while the Rub takes note of Brent contagion from WTI and guidance from the CBR Governor to the effect that a rate cut is on the agenda for the April 24 policy meeting.

In commodities, WTI and Brent June futures remain choppy in early European trade, with the former’s June contract quoted given the shift in volume as its front-month expires in the coming days. Due to the colossal contango in the market, WTI May contract trades lower by some 9% (around USD 18/bbl), whilst the June future sees prices in the green on the day above USD 25.50/bbl at the time of writing. Market fundamentals remain unchanged thus far as participants await the OPEC+ pact to go into effect on May 1st, whilst on the lookout for commitments from outside the group. On that front, desks highlight that ConocoPhillips’ announcement regarding 200k BPD to its North American output highlights somewhat meaningful unmandated cuts outside OPEC+. Analysts at ING note “instead, market forces will do the job, with the low-price environment forcing producers to cut back.” Looking ahead to next week, the Texas Railroad Commission (RRC) is expected to revisit the issue on mandated state cuts. Supporters at the prior meeting on the 14th April argued about sever storage shortages and potential record numbers of bankruptcies amid market conditions. The effectiveness of the OPEC+ deal was also downplayed whilst they added that the RRC must do its part. Adversaries contended that the least profitable wells are already being shut and that RRC actions will not solve the crude crisis. WTI June resides towards the bottom end of the its intraday range, having waned off USD 26.78/bbl highs, whilst its Brent counterpart similarly declined from highs near USD 29/bbl. Elsewhere, spot gold remains on the backfoot and trades on either side of USD 1700/oz as DXY reclaims 100.000 to the upside, and with market contacts earlier reporting stops through 1705-1700/oz. The yellow metal thus far printed an intraday base at USD ~1687/oz, albeit remains in the green for the week having opened at USD ~1660/oz on Monday. Copper meanwhile withstands the strength in the Buck and moves in tandem with stocks following a shallower than expected contractions in Chinese QQ Q1 GDP and March Industrial Production, but prices remain capped by resistance at ~USD 2.3675/lb.

US Event Calendar

- 10am: Leading Index, est. -7.2%, prior 0.1%

DB’s Jim Reid concludes the overnight wrap

Straight to China this morning where Q1 GDP has just come in at -6.8% yoy (consensus -6.0%). The previous weakest quarters (in data back to 1992 on Bloomberg) were the 6% seen over the last two quarters – so an historic moment for modern China. The rest of the activity data was a mixed bag. Industrial production was better than expected -1.1% yoy (vs. –6.2% expected) however both retail sales and fixed asset investment were much weaker than expected at -15.8% yoy (vs. -10.0% expected) and -16.1% ytd yoy (vs. -15.0% expected). So, industrial production got a lot better in March after a disastrous Jan-Feb, but fixed asset investment and retail sales is lagging. Elsewhere, the surveyed jobless rate printed at 5.9% vs. 6.2% last month. China’s National Bureau of Statistics said following the data that it is seeing good progress on work resumption; however added that the external situation is becoming more complicated.

Despite the weaker than expected GDP print the Shanghai Comp (+0.89%) and CSI (+1.23%) are both higher along with other major bourses including the Nikkei (+2.19%), Hang Seng (+2.31%), ASX (+1.87%) and Kospi (+2.96%). Instead, investors appear to be leaning on the encouraging news from the medical publication Stat, that a group of patients being treated in Chicago with a trial of Gilead’s drug Remdesivir were “seeing rapid recoveries in fever and respiratory symptoms”. The report added that most patients showed improvement and were discharged subsequently, with only two fatalities (read our Corona Daily for more on this).

Also helping sentiment this morning was the announcement from President Trump on new guidelines on easing restrictions and reopening the US. He announced that 29 states were in the “ballgame” to reopen soon, with a set of markers needed to be hit before state governors should open their states up. At this point many states are coordination with other states in their regions to coordinate reopening together. Dr. Birx, one of the top public-health experts on the White House coronavirus task force, reiterated that the state leaders will have a leeway based on their own judgement. The recommendations include that states show a “downward trajectory” in cases and flu-like illnesses for at least two weeks. Then they can begin a 3-phase process to reopen. States should then continue to show declining caseloads every two weeks before moving onto the next phase, while any significant “rebound” in numbers could mean needing to bring restrictions back. Schools, daycares and bars would not reopen before phase two, whereas restaurants, movie theaters and sports stadiums could open in phase one under certain restrictions. Regardless of the Presidents announcements, New York Governor Cuomo extended his state’s lockdown until May 15, with New Jersey following suit soon after. S&P 500 futures have gained +3.21% in response, also helped partly by double digit afterhours gains for Boeing following news that the company plans to restart manufacturing in the Seattle area next week.

While President Trump announced guidelines on easing restrictions, a number of other countries moved to extend them. In the UK, it was announced (unsurprisingly) that the lockdown would remain in place for another 3 weeks to early May. This is broadly in line with the timetables that other European nations have outlines in recent days. Meanwhile Japanese Prime Minister Abe extended the state of emergency across the entire country, having previously been just in 7 prefectures. And in Australia, Prime Minister Morrison said that there were no plans to change the baseline restrictions for the next four weeks. On the other end of the spectrum, Switzerland announced it will reopen some businesses and schools in three stages from April 27. For more on all things virus related see our Corona Crisis Daily for much more.

In markets, if yesterday had been a day in January of this year you would have said that it was very volatile as the S&P 500 saw 4 big swings around flat of at least 1.4%. We ended up closing at the top end of the range (+0.58%) as markets started to get excited as to what Trump was going to say after the bell about re-openings. Technology stocks outperformed, with the NASDAQ advancing +1.66%, meaning it’s now down “only” -13.09% from its closing peak back in February, out-pacing the S&P 500 which still stands -17.32% below its previous peak. Technology stocks have benefited from “stay-at-home” narratives and lower interest rates boosting growth multiples. Elsewhere in Europe the Stoxx 600 was -0.19%.

Over in fixed income, the move to safe assets saw both US Treasuries and bunds rally further yesterday. 10yr Treasury yields ended the session -0.5bps at 0.627%, just 8.6bps above their all-time closing low back in early March, while bund yields fell by -0.9bps. Southern European debt also managed to recover slightly yesterday, with the spread of 10yr yields on Italian (-4.2bps) and Spanish (-2.4bps) debt narrowing over bunds. However, those on Greek debt widened by a further +7.1bps.

On a related topic, President Macron yesterday expounded on the importance of a larger virus recovery fund and that without coming together in this crisis the EU will unravel, as Eurosceptism would rise in the countries not supported. France has been the largest country pushing the idea of joint debt issuance. In an FT interview posted as Europe was going home (well maybe commuting from the study to the kitchen) he remarked that, “we are at a moment of truth, which is to decide whether the European Union is a political project or just a market project. I think it’s a political project. . . We need financial transfers and solidarity, if only so that Europe holds on”. These comments come after European Commission President von der Leyen apologized to Italy while painting a picture of a Europe that was coming together, “too many were not there on time when Italy needed a helping hand at the very beginning,” she said. “For that, it is right that Europe as a whole offers a heartfelt apology.” ….The truth is that now Europe has become the true beating heart of solidarity. The true Europe is now standing up.” We will see if all this brings a more specific plan next week at the leaders’ summit.

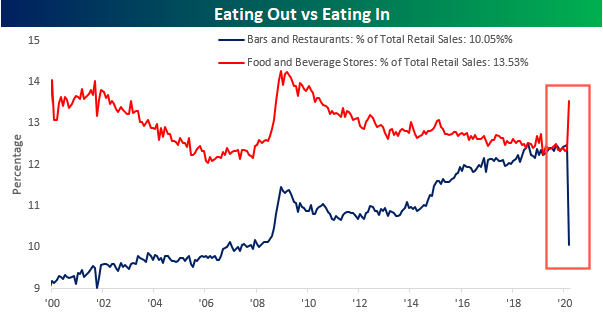

In terms of data, the weekly initial jobless claims from the US has lost some of its shock value now but we still saw an astonishing reading at 5.245m in the week ending April 11. There’s obviously no sugar coating how bad this is, but markets did have the small consolation that this was the first time in a month that the reading wasn’t quite as bad as the consensus estimate (5.5m). Furthermore, this is the 2nd consecutive week that the reading has fallen, down from a peak of 6.867m. Nevertheless, if you add up the last 4 weeks’ readings, which are the highest in the history of the series, they sum to over 22m, something that is simply unprecedented. For context, the total number of nonfarm payrolls in the US in March stood at 151.8m, so we’re talking well over 10% of the entire US workforce in the space of a month having made jobless claims. Yesterday’s report also means that practically an entire decade of employment growth has been wiped out in a single month. The 10 years of jobs reports from March 2010 to February 2020 saw nonfarm payrolls rise by a cumulative 22.8m. The two series do not completely correspond with each other but I’m sure you see the big picture.

Further hard data for March showed that the pandemic’s impact extended into the housing market, with US housing starts falling to 1.216m (vs. 1.3m expected). The decline of -22.3% on the previous month is actually the biggest monthly decline since March 1984, and comes only 2 months after January’s reading, which saw the largest number of housing starts since December 2006. Meanwhile the Philadelphia Fed’s business outlook survey for April fell to -56.6 (vs. -32.0 expected), which was its lowest level since July 1980.

Here in the UK, the government has refused to ask for an extension of the Brexit transition period. Downing Street added that they’d also refuse if Brussels asked them for an extension instead. The government spokesman said that it was “better to be clear now and minimise the uncertainty for businesses”. Under the Withdrawal Agreement reached with the EU, the UK government have until the end of June to decide whether to extend the standstill transition period past the end of the year, and while they’ve insisted throughout the process that they’d conclude negotiations by the end of this year, speculation has risen thanks to the coronavirus that they could be forced to delay. The next negotiating round is scheduled for next week, and a “high-level meeting” is also scheduled for June to take stock of progress so far. So something bubbling under the surface and something the EU could do without given all that’s going on with Italy.

To the day ahead now, and the data releases include new car registrations for March in the EU27, the Italian trade balance for February and the final Euro Area CPI reading for February. From the US we’ll also get the leading index for March. From central banks, we’ll hear from the Fed’s Bullard and the ECB’s Rehn.

Tyler Durden

Fri, 04/17/2020 – 07:49

via ZeroHedge News https://ift.tt/3bi8j3B Tyler Durden