Rabobank: “Policy Awe Is Behind Us While Sheer Economic Shock Is About To Overwhelm Markets”

Submitted by Michael Every of Rabobank

Awe & Shock; Questions & Quislings

Last week was about policy-makers keeping us in awe. Central banks have done what central banks do – slash rates and pump in liquidity (the latest being the Bank of Canada taking rates to 0.25%, joining the zero-lower-bound-and-let’s-do-QE gang). Governments have done what they had long decided not to do – ramp up spending and pump in liquidity (the latest being Australia now offering to pay 80% of salaries for those laid off too). None of this should be a surprise. As we published recently, and as many others in the market are echoing, this is being treated as a war on the home front: and wars on the home front mean zero rates, yield curve control, and fiscal deficits from 15 to 20% of GDP. Markets have, of course, tried to rally on that front. It’s even been seen as patriotic in some cases.

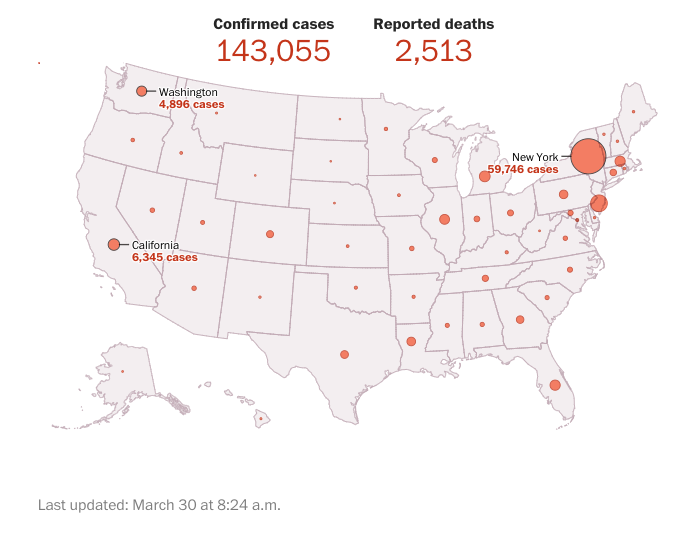

However, here comes the shock that has required all that awe. Last week US President Trump was talking about reopening the economy around Easter: now lockdown is extended through to 30 April. Moreover, Dr Fauci, the leading medical expert on the White House team, has stated he expects to see millions of infections and 100,000 – 200,000 US deaths. Even Trump has said 100,000 deaths would be a “very good job”. To put that in context, were we to exceed that total by just a little it would mean more civilian deaths than the US suffered in combat in WW1, Vietnam, and Korea combined. In other words, a major shock.

In the UK, the Deputy Chief Medical Officer briefed that the current lockdown could be extended for six months, and perhaps even longer – and at the minimum Britain seems to face three months under the present new normal. Much of 2020 is going to be under virus controls of some kind. Again, a major economic shock.

In China, which has apparently turned the corner vis-à-vis the virus, we have the Western media openly questioning the official figures for deaths in Wuhan; stories underlining that while people are getting back to work, exporters have nobody to produce for; a wave of consumer debt defaults seems inevitable; and, in a don’t-listen-to-what-they-say-but-watch-what-they-do way, Beijing ordered all of the country’s cinemas closed again just days after reopening them to great fanfare. Looks like a major after-shock – and in response China is already talking about more awesome fiscal stimulus in response. Let’s see how that is compatible with economic rebalancing, deleveraging, and balance of payments and currency stability.

So to Questions & Quislings (which, in a lighter moment in these dark times, sounds like an unpopular niche 1970’s role-playing game.)

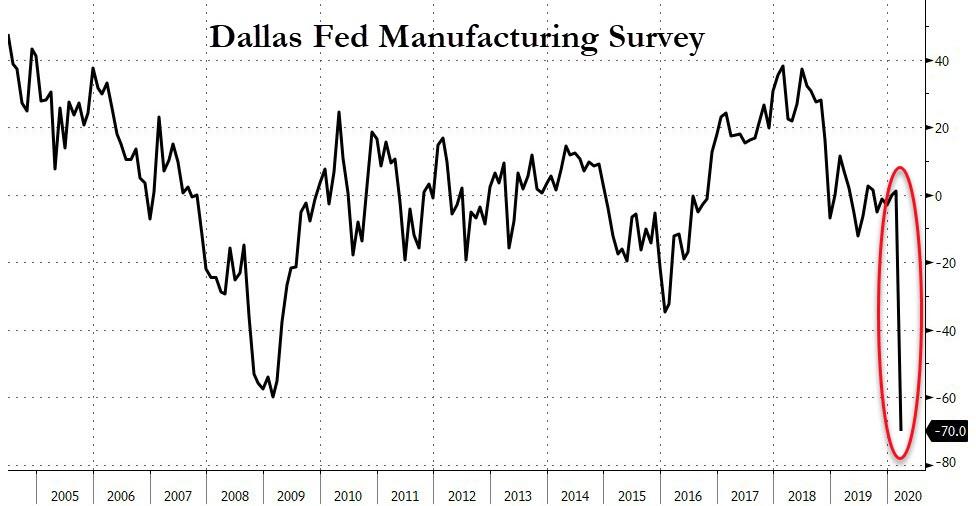

Question: How bad is this going to get economically? Worse than central bank and government largesse can overcome? Is it now insolvency not illiquidity we risk? After all, US Q2 GDP is openly being discussed as falling as much as -50% q/q annualised by ne ex-Fed official; UK Q2 GDP is seen -15% y/y by the Centre for Economics and Business Research; and nobody else is looking much better.

Question: so what do we do about it? Which leads us to Quislings.

To try to relax this weekend I made the decision to listen to UK talk radio for a ‘taste of home’. One particular host was insistent that the economic shock we are experiencing was so severe that a cost-benefit analysis needed to be done immediately – and a return to work was almost certainly the best overall outcome in his mind even if he would not say so directly. In support of his position, he interviewed Professor Philip Thomas from Bristol University, whose work involves the kind of grim trade-offs highlighted in ‘Fight Club’, where car firms look at the cost of improving vehicle passenger safety features over paying out insurance claims to those who are injured or die. Thomas argued that the virus, if unchecked, might kill over a million people in the UK, and 400,000 in middle age. This was economically unacceptable, of course. However, based on his modelling (in turn based on a simple regression analysis of GDP per capita and life expectancy), if UK GDP were to fall more than 6.4% y/y then the country would see more deaths due to poverty and depression than the virus would imply, and so it would arguably be better off opening up its economy again regardless of the virus.

A philosopher(!) immediately called in to respond and pointed out what I did in an email they didn’t opt to rad: that this is an entirely false exercise in that is assumes: (1) the virus would not destroy the economy anyway even if no lockdown were in place (i.e., voluntary lockdowns); and (2) that the government cannot shift economic policy to mitigate the decline in GDP per capita under lockdown. To which the host seemed outraged: “So we have to rip up the economics textbooks?! Really?!”

Then an experienced ex-Bank of England economist called in. He supported the philosopher’s stance, and noted that the paper from Thomas had not been peer reviewed and was published in a minor non-economics journal. In his view, it belonged in the wastepaper basket. The host’s response, in so many words: “You are being too emotional saying that. Bye!”

So what’s the takeaway, apart from the obvious fact that intellectuals can be idiots and I was one for listening to talk radio? That policy awe is behind us while sheer economic shock is about to overwhelm markets ahead; and we will require even greater policy responses.

Markets are far less likely to enjoy them, however. Wars aren’t just about pump-priming. We also see regulation and excess profit taxes rather than headlines lionizing hedge funds for making USD2.6bn in profits. (That said, some of the people running this war seem like the kind of blokes who in WW2 always had black-market chocolate and nylons for sale…)

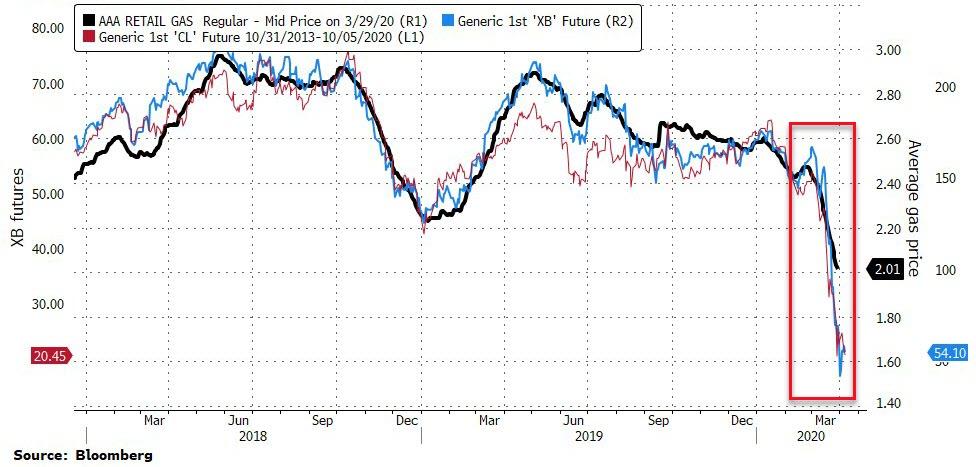

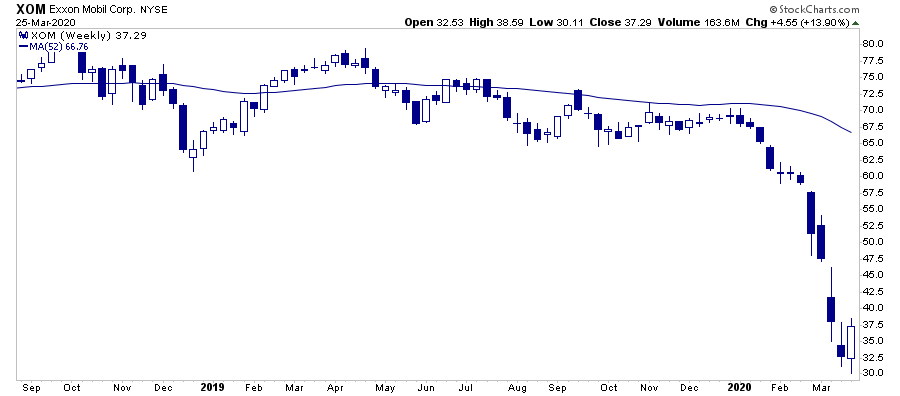

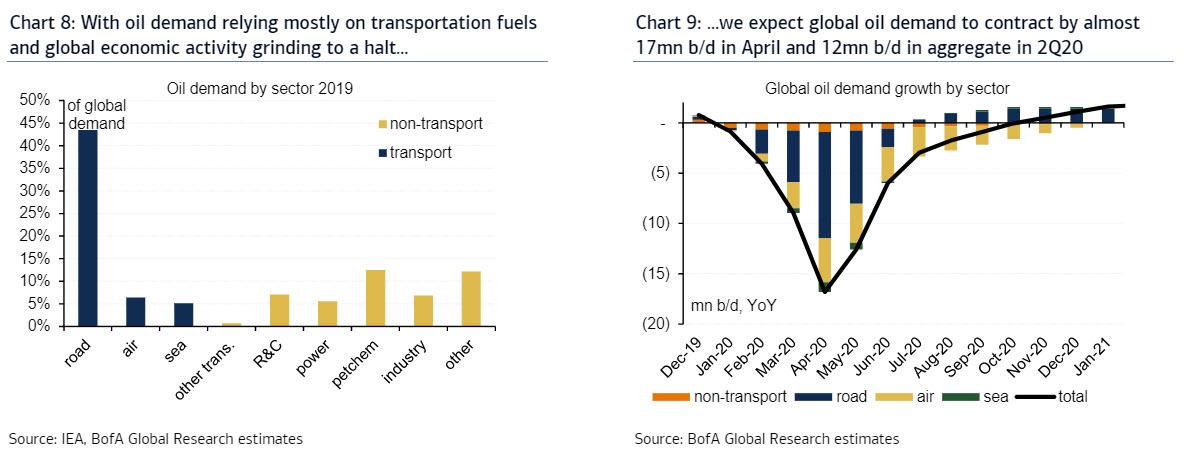

Yet for now markets need to grapple with what is going to be cheap and what is going to be expensive. Do we face deflation as the economy implodes? Oil sub USD20 per barrel says yes. Do we face inflation as supply shocks hit home? Stories suggesting countries are hoarding food and that food production could be hit by the virus also say yes.

And, looking ahead to when we win the war, which we will one day, what does the economic and financial world look like when debt to GDP will be 20-30ppts higher at least, behaviour will have changed, SMEs may have been savaged, globalisation undermined, and the government will have many large fingers in many pies? Which asset class, if any, looks a winner on that basis? Short of USD, answers are short on the ground.

So time for a quick game of Questions & Quislings!

Tyler Durden

Mon, 03/30/2020 – 11:50

via ZeroHedge News https://ift.tt/2UNS4V6 Tyler Durden