Australia Is Burning: Blame The Greens & The Arsonists

Authored by Mike Shedlock via MishTalk,

At least 15 million acres of Australia have been devastated by wildfires. Climate change activists are up in arms.

Please consider Why Down Under Is Burning Up

The current round of blazes started late last year. It has charred at least 15 million acres and killed more than two dozen Australians, including brave volunteer firefighters who rush into the inferno to save homes and lives.

The climate-change narrative grossly oversimplifies bush fires, whose causes are as complex as their recurrence is predictable: Australia is in the midst of one of its regular droughts.

Byzantine environmental restrictions prevent landholders from clearing scrub, brush and trees. State governments don’t do their part to reduce the fuel load in parks. Last November a former fire chief in Victoria slammed that state’s “minimalist approach” to hazard-reduction burning in the off-season. That complaint is heard across the country.

On Monday a parliamentarian from the Australian Greens tweeted about one day holding “climate trials” to deal with conservative politicians.

Main Causes

-

Arson: More than 180 people have been arrested for allegedly starting blazes since the start of the current bush-fire season.

-

Secondary Cause: Environmental Restrictions and misguided Green ideology.

Perhaps I have those backwards.

Not Climate Change

Please consider Australian Wildfires Were Caused by Humans, Not Climate Change

The similarities between Australian and Californian politics, vegetation, and climate have always been striking. Both places are drop-dead beautiful, far-left, and politically green. In both places, people like living around vegetation that every year dries out enough to burn sky high — with or without climate change.

This is thanks to relatively short rainy seasons surrounded by perfect beach weather. It is spectacularly green when it rains and tinder-dry brown when it stops. When rainfall is high, as it was for recent years in Australia, vegetation grows even thicker, only to provide even more fuel for wildfires.

At the same time, our culture of vegetation worship militates against purposefully burning things down. In California, these “prescribed” fires are now largely prohibited (because burning releases dreaded carbon dioxide), ensuring that disaster is always just around the corner. Ditto for Australia, where some burning is allowed but nowhere near enough.

Australia has been ready to explode for years. David Packham, former head of Australia’s National Rural Fire Research Centre, warned in a 2015 article in the Age that fire fuel levels had climbed to their most dangerous levels in thousands of years. He noted this was the result of “misguided green ideology.”

It’s very convenient for alarmist greens to blame the fires of Australia and California on global warming. In reality, the policies they themselves advocate are the culprits.

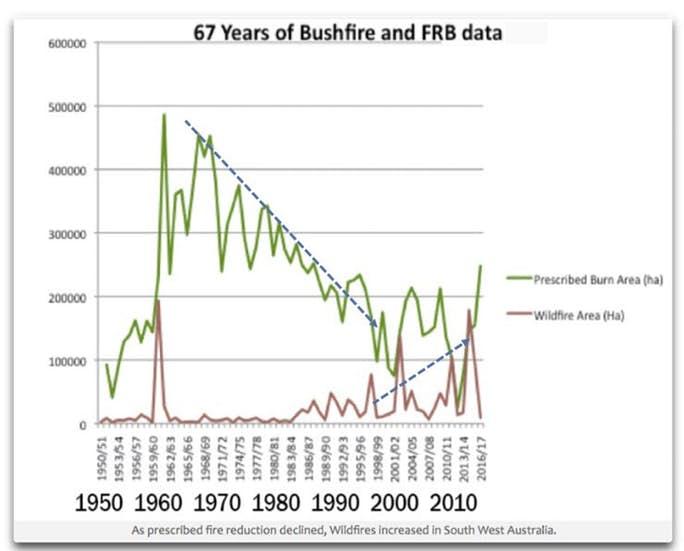

67 Years of Brushfire Data

Arson Crisis

Please consider We don’t just have a bushfire crisis. We have an arson crisis, too.

The number of individuals around Australia whose arson has contributed to the current bushfire crisis has now passed 200.

Here is my favorite: “A volunteer firefighter in Australia has been charged with deliberately lighting blazes during the nation’s bushfire crisis. Police arrested the man, 19, for seven counts of alleged arson in an area south of Sydney, New South Wales.”

There are no conspiracies here. Though arson has been tried and called for before as a tool of terror, the Australian fires seem to result from the actions of unconnected individuals who are either disturbed or reckless. This is nothing new; as ecological criminologist Paul Read wrote back in November:

A 2015 satellite analysis of 113,000 fires from 1997-2009 confirmed what we had known for some time – 40 per cent of fires are deliberately lit, another 47 per cent accidental. This generally matches previous data published a decade earlier that about half of all fires were suspected or deliberate arson, and 37 per cent accidental. Combined, they reach the same conclusion: 87 per cent are man-made.

Scourge of Eucalyptus

Here’s an interesting article from 2013: Australia’s Wildfires: Are Eucalyptus Trees to Blame?

“Looking at the eucalyptus forest outside my window in Tasmania, I see a gigantic fire hazard,” David Bowman, a forest ecologist at the University of Tasmania in Australia, told KQED. “On a really hot day, those things are going to burn like torches and shower our suburbs with sparks.”

Like many plants native to fire-prone regions, eucalyptus trees (aka gum trees in Australia) are adapted to survive — or even thrive — in a wildfire. Fallen eucalyptus leaves create dense carpets of flammable material, and the trees’ bark peels off in long streamers that drop to the ground, providing additional fuel that draws ground fires up into the leaves, creating massive, fast-spreading “crown fires” in the upper story of eucalyptus forests.

Additionally, the eucalyptus oil that gives the trees their characteristic spicy fragrance is a flammable oil: This oil, combined with leaf litter and peeling bark during periods of dry, windy weather, can turn a small ground fire into a terrifying, explosive firestorm in a matter of minutes. That’s why eucalyptus trees — especially the blue gums (Eucalyptus globulus) that are common throughout New South Wales — are sometimes referred to wryly as “gasoline trees.”

The threat posed by eucalyptus groves spreading beyond Australia was highlighted in 1991, when a wildfire torched the hills surrounding Oakland, Calif. That conflagration killed 25 people and obliterated more than 3,000 homes, according to the Federal Emergency Management Agency (FEMA), and was blamed primarily on the thousands of eucalyptus trees found throughout the Oakland Hills.

Despite their well-earned reputation as a firefighter’s worst nightmare, eucalyptus trees remain a favorite landscape specimen, renowned for fast-growing stands of tall shade trees that, according to some research, help repel insects through the same fragrant eucalyptus oil that’s blamed for fueling wildfires.

“Eucalyptus groves on steep hillsides — like those in the East Bay hills — are extremely flammable when hot … winds of late summer and fall start blowing and make control of a moving flame front impossible until the winds stop,” Tom Klatt, UC Berkeley campus environmental manager, said in a report from the university’s Division of Agriculture and Natural Resources NewsCenter.

Three Eucalyptus Ideas

-

Hey, let’s plant eucalyptus. It grows fast.

-

When it dries out, let’s not do prescribed burns because that would release CO2.

-

Blame global warming if anything goes wrong with points 1 and 2.

“What the hell have humans done?” Bowman said. “We’ve spread a dangerous plant all over the world.“

But that story doesn’t sell. Hype that sells. Like this:

Climate Deniers Cooking Themselves

Climate deniers are cooking themselves — and everyone else.

Australia, like many countries (very much including the United States) is pathologically addicted to fossil fuels, and is roasting itself and the world in the process. Without strong international climate policy, there will be future droughts, fires, and other disasters that make the current crisis seem like a friendly daydream.

On the whole, that only rates a B- or a C+ because it does not end with a projection like AOC’s that the World Will End in 12 Years if We Do Nothing

Everyone in Miami Will Drown in 6 Years

“Cooking yourself” is OK but the article itself fell flat.

To gain real traction one needs a headline like this: “Everyone in Miami Will Drown in 6 Years“

Now, that’s an A++ story headline guaranteed to garner attention.

Lies and manipulations

@DavidBCollum @MishGEA Australia scrubbing and changing climate records from the past to make the present appear warmer. https://t.co/6frT8EMTcE

— Stunned Mullet (@StunnedMulletNZ) December 21, 2019

Amazing stuff.

The Green police discarded temperatures all over the board and manipulated early temperatures lower.

In my favorite example, the climate police discarded a record high temperature because the person who measured temperatures did so on a Sunday. They claim the recorder was not supposed to be working on Sunday, thus the record high should not have been recorded.

Of course they moved thermometers to airports with increasing numbers of planes and hot asphalt, etc. And finally, they switched to electronic measurement recently which tends to be hotter than mercury-based thermometers.

All About Climate Change Except

Other than lies, temperature manipulations, piss poor burn management, arson, environmental restrictions, and other misguided Green ideology, this story is all about climate change.

Unfortunately, a politically incorrect story like this is going nowhere. But “Everyone in Miami Will Drown in 6 Years” just might.

By the way, I propose the most likely reason for arson is global warming activists wanting to blame climate change.

Tyler Durden

Thu, 01/09/2020 – 11:55

via ZeroHedge News https://ift.tt/2sd0Cuo Tyler Durden