Is It Time To ‘Buy The Dip’?

Authored by Lance Roberts via RealInvestmentAdvice.com,

Over the last few weeks, we have discussed the outsize market advance driven by the Fed’s massive liquidity injections into the market. As we discussed with our RIAPRO subscribers (30-day RISK FREE Trial) we stated:

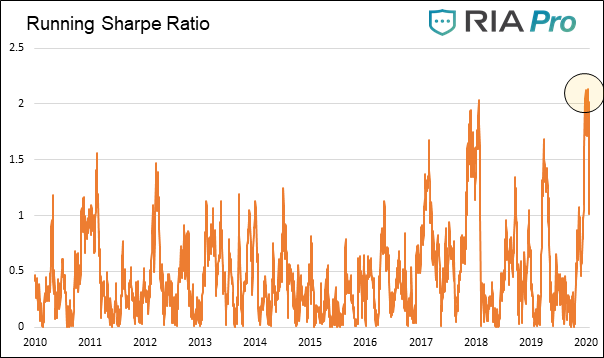

“If it appears to you that the recent rally is an anomaly, your thoughts do not deceive you. The graph below shows that recent returns divided by annualized volatility (risk) have been running higher than at any time since the financial crisis.

This standard calculation of return per unit of risk is technically called the Sharpe Ratio. The ratio has been sitting around 2.0 for most of January. To put that into context, the current reading is about 4 sigma (standard deviations) from the norm, an event that should statistically occur in one day out of every 43 years. Since January first, there have been 5 daily readings that were greater than 4 sigmas!”

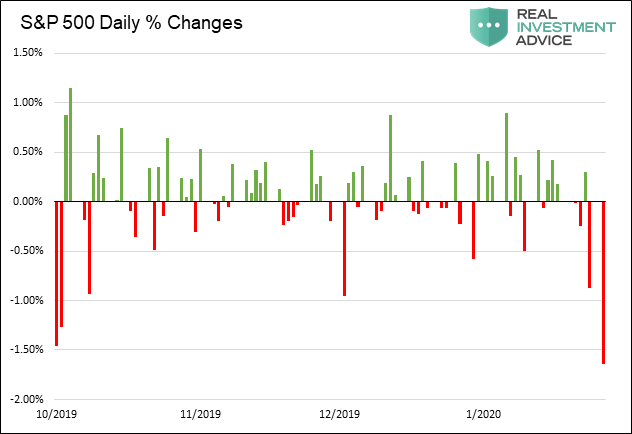

Not surprisingly, due to that extreme reading the correction on Monday was the largest we have seen since the Federal Reserve started intervening into the financial market in mid-October of last year.

This analysis, along with several other posts over the last couple of weeks, detailed our concerns about inherent market risk and why we reduced portfolio exposure a couple of weeks ago. To wit:

“On Friday, we began the orderly process of reducing exposure in our portfolios to take in profits, reduce portfolio risk, and raise cash levels.

In the Equity Portfolios, we reduced our weightings in some of our more extended holdings such as Apple (AAPL,) Microsoft (MSFT), United Healthcare (UNH), Johnson & Johnson (JNJ), and Micron (MU.)

In the ETF Sector Rotation Portfolio, we reduced our overweight positions in Technology (XLK), Healthcare (XLV), Mortgage Real Estate (REM), Communications (XLC), Discretionary (XLY) back to portfolio weightings for now.

The Dynamic Portfolio was allocated to a market neutral position by shorting the S&P index itself.

Let me state clearly, we did not ‘sell everything’ and go to cash. We simply reduced our holdings to raise cash, and capture some of the gains we made in 2019. When the market corrects we will use our cash holdings to either add back to our current positions, or add new ones.”

While I received a lot of emails and comments questioning why would we “sell out of the market” and “go to cash,” such was NOT the case. We did raise our cash position from 5% to 12%. Just prior to increasing cash, we had previously added defensive exposure in fixed income, gold, gold miners, and REIT’s. However, we still maintain the majority of our long equity exposures currently.

You Can’t Time Market Corrections

At the time we made these changes, it appeared we were clearly wrong as the market continued to grind higher. As Howard Marks once quipped:

“Being early, even if you are right, is the same as being wrong.”

However, from a portfolio management, and more particularly, a “risk mitigation” view, our job isn’t necessarily to hit the exact tops or bottoms, just to provide a cushion against losses.

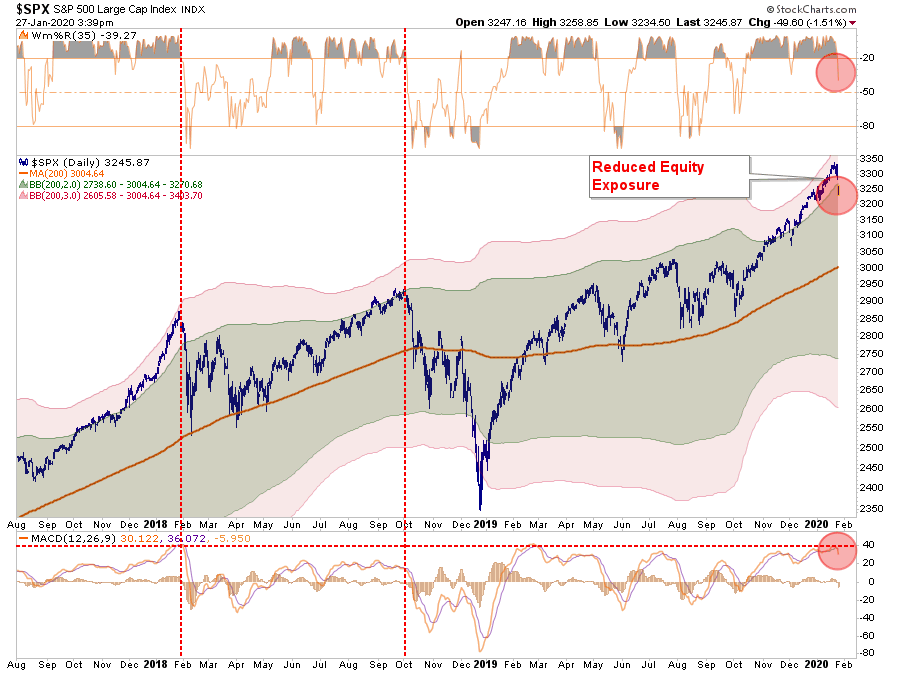

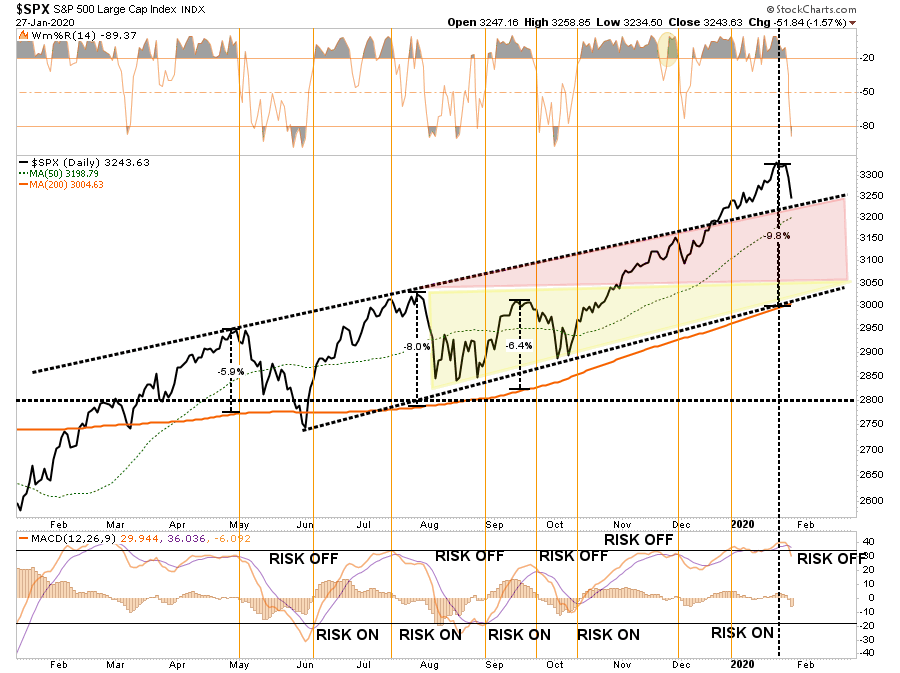

During the last couple of weeks, we have noted the extreme overbought, overly bullish, and over complacent conditions of the market. Here is an updated chart of the S&P 500 from two weeks ago when we discussed taking profits.

With the markets pushing into 3-standard deviations above the 200-day moving average, it was only a function of time before a correction occurred. Therefore, while we were early taking profits, the end result is it reduced portfolio risk against a pending correction. As I wrote then:

“While the markets could certainly see a push higher in the short-term from the Fed’s ongoing liquidity injections, the gains for 2020 could very well be front-loaded for investors.

Taking profits and reducing risks now may lead to a short-term underperformance in portfolios, but you will likely appreciate the reduced volatility if, and when, the current optimism fades.”

When discussing portfolio management, it is often suggested that you can’t “time the market.”

That statement is correct.

You can not effectively, and repetitively, get “in” and “out” of the market on a timely fashion. I have never suggested that an investor should try and do this. However, I have discussed managing risk by adjusting market exposure at times when “risk” outweighs the potential for further “reward.”

While our actions are almost always misunderstood, and labeled as “bearish,” I am actually neither bullish or bearish. In our practice, we follow a very simple set of rules, which forms the core of our portfolio management philosophy which focuses on capital preservation and long-term “risk-adjusted” returns.

As long-term investors, we don’t worry about short-term rallies, we only need to worry about the direction of overall market trends, and focus on capturing more of the positive and less of the negative. This philosophy stems from Baron Nathan Rothschild’s view:

“You can have the top 20% and the bottom 20%, I will take the 80% in the middle.”

While our assessment of the market two-weeks ago was that risk versus reward was unbalanced, such can remain the case for extended periods of time.

The problem with an economy being propped up by artificially appreciated assets is that this pendulum swings both ways. At some point, prices eventually decline. No one knows what will cause the decline;

-

Higher interest rates like in 2018,

-

A presidential tweet, when he launched the “trade war” with China.

-

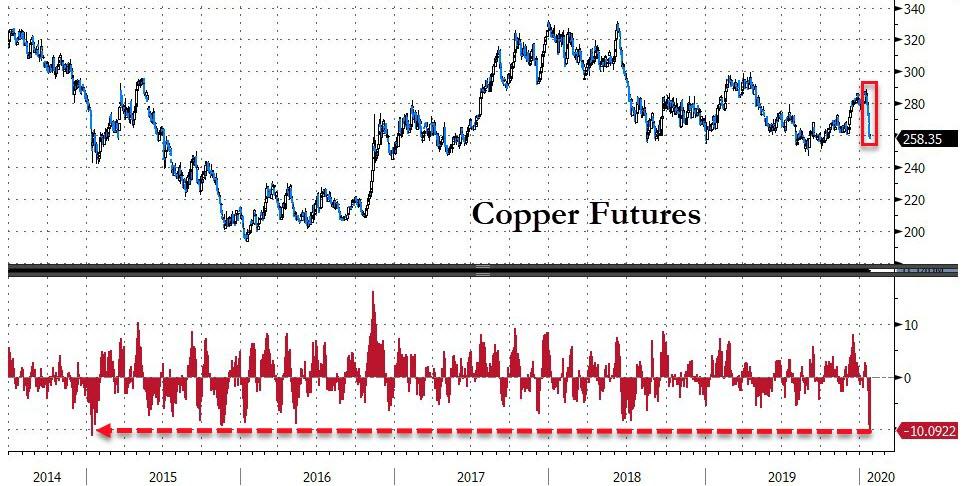

The ongoing implosion of the Chinese economy is still a threat.

-

It could just be the realization by the markets that asset prices don’t grow to the sky.

-

Or, it could be triggered by an unexpected, exogenous event, which results in the markets “repricing” risk.

The “coronavirus” was the exogenous event the markets had not priced into its view.

Is It Time To “Buy The Dip?”

With the “sell off” on Monday, the immediate reaction by investors is to jump in and “buy the dip.” This would seem to be the logical action given the Federal Reserve is still supplying liquidity to the market currently.

Maybe not.

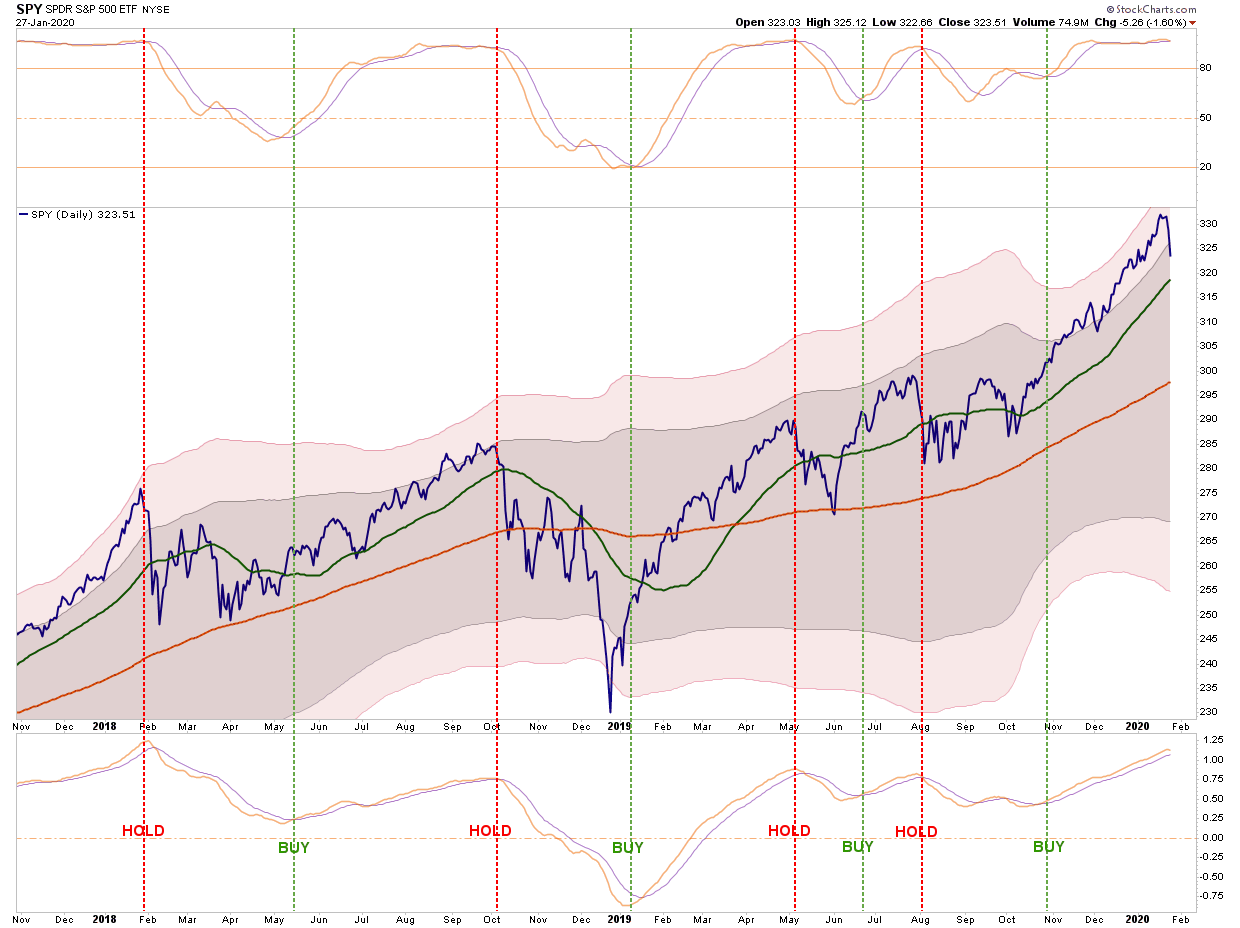

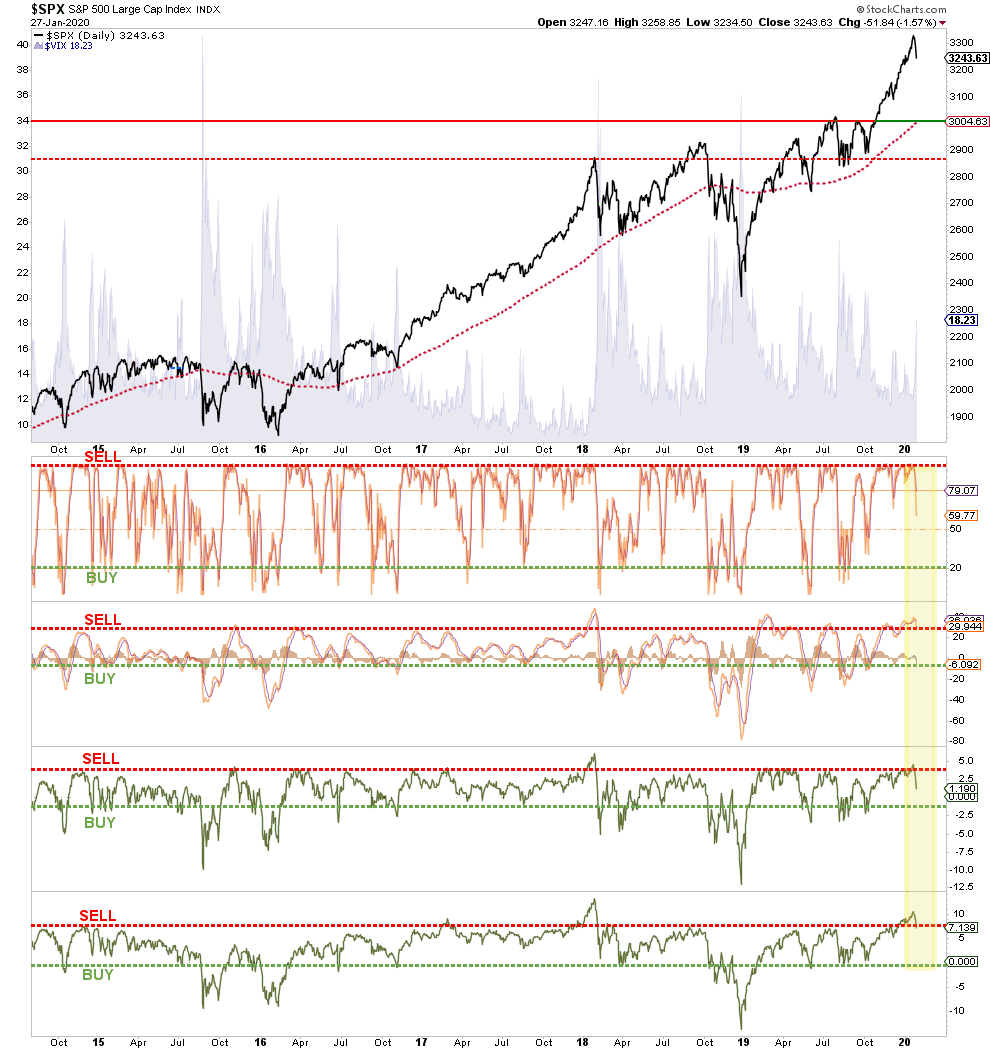

The chart below is part of the analysis we use to “onboard” new client portfolios. The purpose of this measure is to avoid transitioning a new client into our portfolio models near a short-term peak of the market. The vertical red lines suggest we avoid adding equity risk to portfolios and vice versa.

There are a few important points to denote in the chart above.

-

The top and bottom signals are essentially relative strength and momentum measures. Both are currently still on “buy” signals and the current “sell off” has not reversed those signals as of yet.

-

With the market still very deviated above the longer-term 200-dma, and just clearing out of 3-standard deviation territory, there is currently more downside risk, than upside reward.

-

Note that corrections, once the “sell signals” are triggered can last from several weeks, to several months. During the correction process there are often multiple opportunities to reduce risk and raise cash accordingly.

-

The last two times the market pushed into 3-standard deviation territory, the resulting corrections were fairly sharp and lasted for several months.

However, on a VERY short-term basis the market is indeed oversold, and is testing the breakout of the upward trending trading range from last year. Given the MACD has registered a “sell signal” from a fairly high level, investors must consider the risk of further downside even if the market rallies over the next couple of days.

Don’t be fooled that a short-term reflexive rally is an “all-clear” for the bull market to resume. With the bulk of our momentum, relative strength, and overbought/sold indicators just starting to correct from recent highs, it is likely short-term rallies will be “selling opportunities” over the next couple of weeks as the market either corrects further or consolidates recent gains.

As we have detailed over the last few missives, due to the rather extreme extension of the market, this is likely the beginning of a correction which could encompass a 5-10% decline in totality before it is complete.

The problem for investors is they tend to make to critical mistakes in managing portfolios.

-

Investors are slow to react to new information (they anchor), which initially leads to under-reaction but eventually shifts to over-reaction during late-cycle stages.

-

Investors are ultimately driven by the “herding” effect. A rising market leads to “justifications” to explain over-valued holdings. In other words, buying begets more buying.

-

Lastly, as the markets turn, the “disposition” effect takes hold and winners are sold to protect gains, but losers are held in the hopes of better prices later.

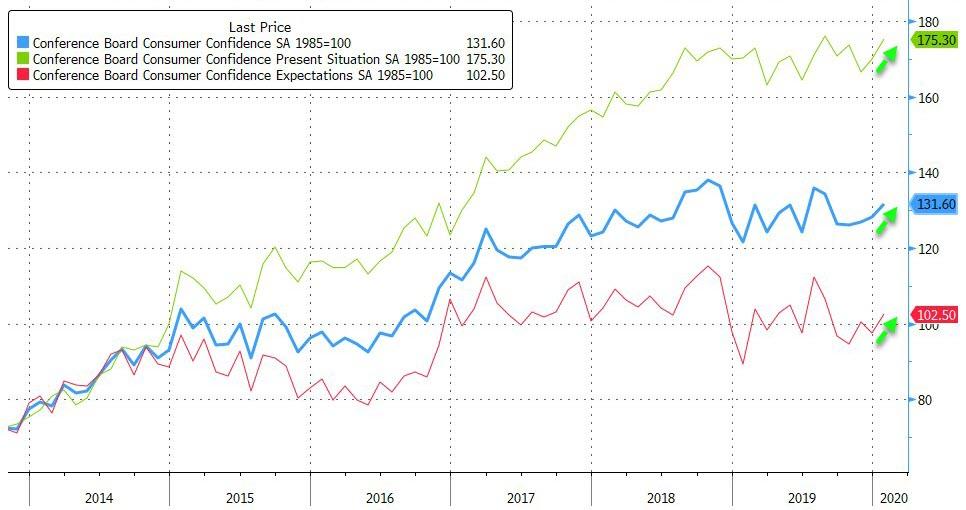

With the Federal Reserve reducing slowing its torrid pace of liquidity, still weak economic growth, and potential for weaker than expected earnings growth, the risk remains to the downside currently.

From that perspective, we are continuing to maintain our higher levels of cash, and we will use reflexive rallies in the short-term to rebalance portfolio risk as needed according to our investment discipline.

Tighten up stop-loss levels to current support levels for each position.

Hedge portfolios against major market declines.

Take profits in positions that have been big winners

Sell laggards and losers

Raise cash and rebalance portfolios to target weightings.

Notice, nothing in there says, “sell everything and go to cash.”

As Michael Lebowitz previously noted:

“The point being made here is essential; risk management is generous. Based on the past 100 years of market data, there is no evidence that long-term returns are penalized by taking a defensive investment posture at high valuations. Investors today do not need to ‘buy and hold’ stocks and remain heavily invested when expected returns are paltry. The historical record, though imprecise, affords an excellent map for navigating and managing risk.”

By having reduced risk, we can afford to remain patient and wait for the next opportunity. Much like a professional baseball player, by reducing risk we create an environment that is “emotionally” controllable and we can exercise patience until a “fat pitch” comes along.

One thing is for certain, swinging at every pitch, won’t get you into the “hall of fame.”

Tyler Durden

Tue, 01/28/2020 – 11:30

via ZeroHedge News https://ift.tt/30ZFSmV Tyler Durden