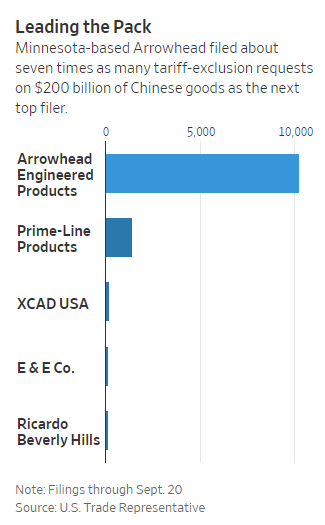

Meet The Company That Has Flooded The Government With Over 10,000 Tariff Appeal Requests

In sum, the U.S. government has received about 16,000 requests for exemptions from the $200 billion in tariffs it has levied on Chinese goods. And according to the Wall Street Journal, over 10,000 of those have come from just one company: Arrowhead Engineered Products of Blaine, Minnesota.

The company imports thousands of aftermarket repair parts for cars, lawnmowers, ATVs and other items from China – all of which are currently being taxed with a 25% tariff that is due to jump to 30% on October 15.

The tariffs have had a profoundly negative effect on Arrowhead’s business model, which is based on selling cheaper alternatives to manufacturers parts. This has made appealing the tariffs the company’s main focus.

John Mosunic, Arrowhead’s chief operating officer said: “We basically put everything else on the back burner to appeal the tariffs.”

Arrowhead also contacted its local congressman, Rep. Tom Emmer, to see if he could help streamline the appeals process. The company was told to be as specific as they could in seeking exemptions, so they wound up filing appeals for every gasket, air filter, spark plug and other part it imports. The company of 1,000 even hired a crew of temporary workers to submit the requests manually.

Trade attorneys are unsure as to whether filing more appeals will be a more effective process. Some companies choose to file for only key items, or to bunch products under the same 10-digit code in the tariff schedule.

Ted Murphy, a partner in the international trade practice at Sidley Austin LLP said: “If I had figured out the secret recipe that explains approvals, I’d be speaking from the beach.”

He has said that companies are overwhelmed by the complexities of the process: “We’re taking clients through the stages of grief. They’re in denial; they’re angry. Eventually you get to acceptance that this is U.S. trade policy.”

The Office of the U.S. Trade Representative, meanwhile, says it is evaluating appeals individually and weighing factors like if a product is only available from China and whether the tariffs would harm the company significantly.

Clark Packard, the trade policy counsel at the free market think tank R Street Institute said: “Small businesses wouldn’t have that kind of money to hire one of the well-connected firms. For an administration that claims to be ‘draining the swamp,’ it’s certainly been a bonanza for trade lawyers and lobbyists.”

A website that is maintained by the USTR and shows filings for exemptions shows hundreds of new filings per day.

While President Trump claims that the tariffs are being paid for by China, they are mostly shouldered by U.S. importers. Companies have been claiming in exemption requests that the higher costs threaten their survival and that there’s no alternative to Chinese products.

XCAD USA, an Idaho-based maker of sprinklers and other irrigation components wrote: “It is not economically feasible for this irrigation-grade component to be manufactured in the U.S.”

Becky Oja, the company’s controller and the lone employee filing requests, said: “We only have 15 employees—we’re very small potatoes over here in Idaho. Every little fitting and tube for the plumbing of [a product] has to be input into the exclusion request.”

American Scientific, which supplies science products for educational purposes, has submitted more than 100 requests for products like litmus paper and beakers.

“The school-system budgets are remaining the same and will have to buy 25% less equipment in an environment where education materials are already scarce and [the] level of education is suffering,” the company wrote in its filing.

John Hoge of Sea Eagle Boats, a company that imports inflatable sea kayaks from China, said: “These are not products that can lead to strategic dominance of the world. The tariffs were an existential threat to our business. We’ve been in business for 62 years, but we’ve never experienced anything like this and it was vital to get ahead of it.”

The company has seen 7 of its requests granted and 11 others denied.

Meanwhile, about 35% of the exemption requests filed by Arrowhead on the $34 billion in tariffs from July 2018 were granted.

Mosunic concluded: “The whole idea with aftermarket parts is to find a lower-cost source. And for a lot of these components there’s no U.S. source, period. You can’t do it anymore—it’s gone. Alternators, starters haven’t been manufactured in the U.S. for 20 years.”

Tyler Durden

Mon, 09/23/2019 – 21:25

via ZeroHedge News https://ift.tt/2l1a0hc Tyler Durden