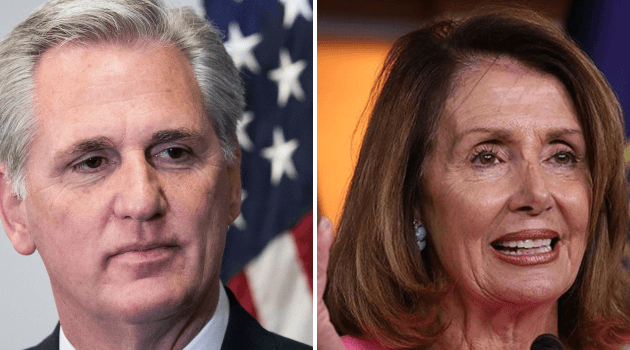

McCarthy Demands ‘Reckless’ Pelosi Suspend Impeachment Inquiry Until She Defines Procedures

House Minority Leader Kevin McCarthy (R-CA) fired off a Thursday letter to House Speaker Nancy Pelosi (D-CA) demanding that she halt the impeachment inquiry into President Trump until she can answer a series of questions defining her game plan for the process.

“As you know, there have been only three prior instances in our nation’s history when the full House has moved to formally investigate whether sufficient grounds exist for the impeachment of a sitting President,” writes McCarthy. “I should hope that if such an extraordinary step were to be contemplated a fourth time it would be conducted with an eye towards fairness, objectivity and impartiality.”

“Unfortunately, you have given no clear indication as to how your impeachment inquiry will proceed – including whether key historical precedents or basic standards of due process will be observed.”

“In addition, the swiftness and recklessness with which you have proceeded has already resulted in committee chairs attempting to limit minority participation in scheduled interviews, calling into question the integrity of such an inquiry.””

READ⬇️ I’ve written to Speaker Pelosi to halt the impeachment inquiry until we can receive public answers to the following questions. Given the enormity of the question at hand—impeaching a duly elected president—the American public deserves fairness and transparency. pic.twitter.com/EFKOghyf9w

— Kevin McCarthy (@GOPLeader) October 3, 2019

McCarthy’s reference to participation refers to reports that House Intelligence Committee Chairman Adam Schiff (D-CA) will limit GOP questions during Thursday’s testimony by former US Ukraine envoy, Kurt Volker.

In his letter to Pelosi, McCarthy asks a number of questions, including whether Pelosi plans to hold a full House vote on authorizing the impeachment inquiry, whether she plans to grant subpoena powers to both the committee chairs and the ranking members, and whether she’ll allow trump’s lawyers to attend the hearings.

After concerns were first raised about an “equal playing field” during the Volker session, Fox News is told Democrats made concessions and agreed to equal representation from Democratic and Republican counsels in the room. However, even though there are representatives from the Intelligence, Oversight and Foreign Affairs Committees, only the Intelligence Committee can ask questions. –Fox News

In response to McCarthy’s letter, President Trump tweeted “Leader McCarthy, we look forward to you soon becoming Speaker of the House. The Do Nothing Dems don’t have a chance!”

Leader McCarthy, we look forward to you soon becoming Speaker of the House. The Do Nothing Dems don’t have a chance! https://t.co/uWPdGJg99F

— Donald J. Trump (@realDonaldTrump) October 3, 2019

Pelosi appears to have a poor grasp on what she’s even trying to impeach Trump over – as evidenced by her Wednesday insistance that Rep. Schiff was “using the president’s own words” when he read a fabricated account of a phone call between President Trump and Ukrainian President Volodomyr Zelensky during a hearing last week with the acting director of national intelligence.

Okay what Twilight zone have I entered because this is 2x in one week where @GStephanopoulos called out a Democrat for lying. Here he asks Pelosi about Schiff lying about what’s said in the transcript and correcting her when she says it was Trump’s words. pic.twitter.com/8YrhRNCPJ6

— Robby Starbuck (@robbystarbuck) October 3, 2019

Tyler Durden

Thu, 10/03/2019 – 13:55

via ZeroHedge News https://ift.tt/35714ZB Tyler Durden