“They’ve Created A Snowflake Market” – Mark Spitznagel Warns Of “Dangerous Over-Reliance” On Central Banks

Last year, before the market collapsed in the XIV debacle, Universa’s Mark Spitznagel warned “a reckoning always follows…something really big is coming”

This is an age of massive artificial economic imbalances and systemic risks.

Repress change, and you repress all that it means. Repressing it is sheer hubris and, in Dylan’s words, “beyond your command.” You can only defer it, not stop it. (Juxtapose this view with outgoing U.S. Federal Reserve Chair Janet Yellen’s ambitious claim that there will not be another financial crisis “in our lifetimes.”) When we try enforcing stability by decree, a reckoning always follows. An unsustainable boom leads headlong to an inevitable bust. A hard rain falls.

Rather than fear it, we should “tell it and think it and speak it and breathe it.” This is Dylan’s resolve. Something really big is coming. Let the central bankers try to keep standing in its way, but as investors we need to recognize and accept its logical consequence of a return to the meaning of volatility. Change and volatility are good. “There is nothing perpetual but change”—according to Mises, who surely must have loved Dylan just as much as I do.

While this is a common theme from the guru of tail risks, he nailed it then; and again late last year as he warned before the December collapse.:

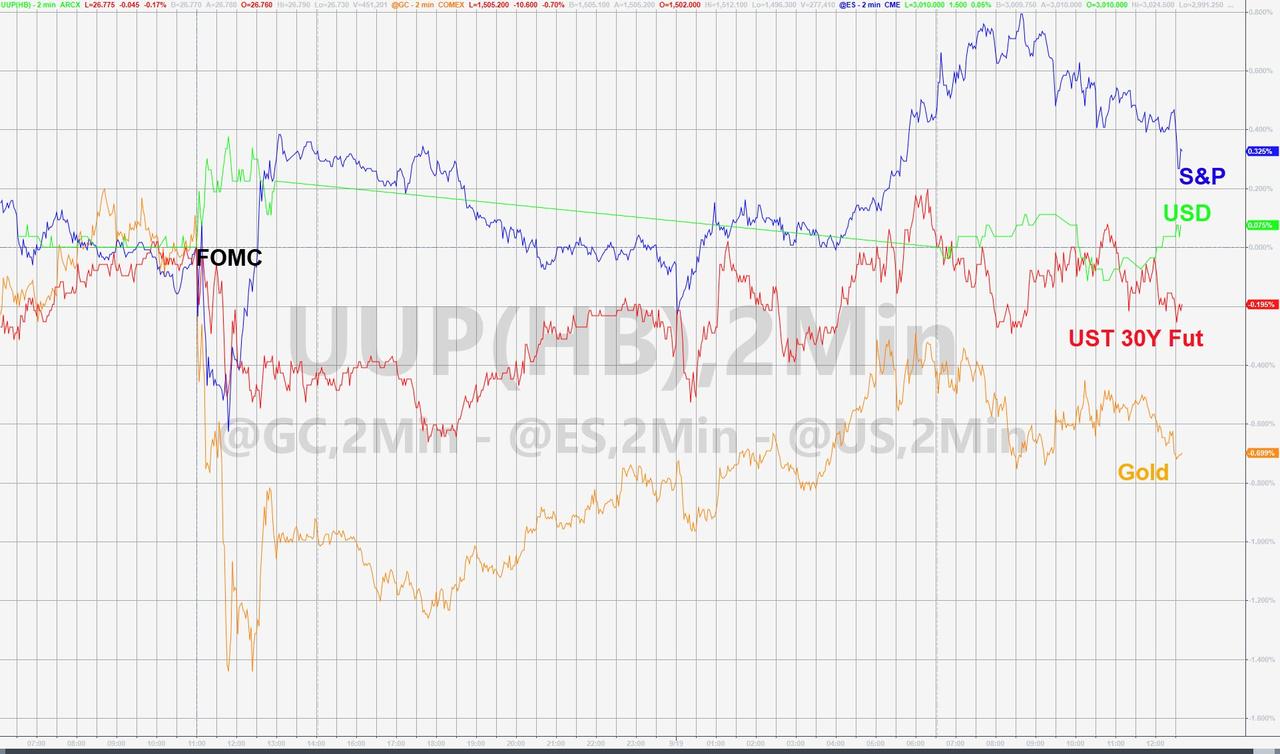

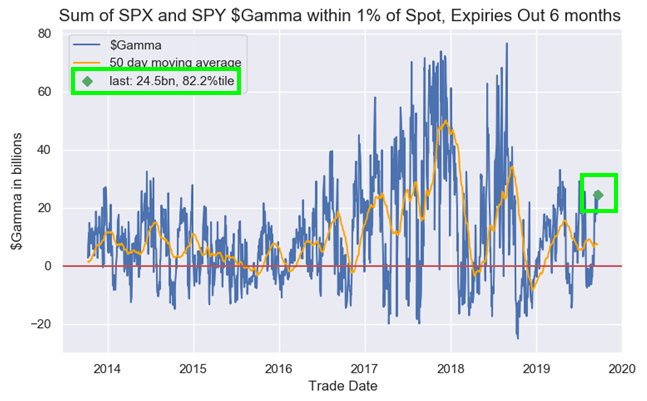

“All assets are priced where they are today because of central banks. That’s modern finance — it’s not about psychology or flows anymore, it’s about what the central banks are going to do next.”

And now he is back with perhaps his most ominous warning yet. In an interview with Bloomberg’s Eric Schatzker, the hedge fund manager exclaimed that “the negative rates we’re seeing throughout the world are an abomination, by any objective standards,”

“It’s part of this Rube Goldberg world we’re in where you’ve got these strange interconnectedness between different markets and they start lacking meaning…

“…making long term macro calls and macro trades like that successfully isn’t possible. I think it’s a fool’s errand.”

“…central banks can never step away from this. They can threaten to. And they can bluff, and they can do some probing bets like they did last year, and the market may fall for that, or call that bluff in the short term. But yes I think we’re in a position now where central banks can never back away…”

Full Transcript below:

ERIK SCHATZKER: Mark you and I have both been looking at and thinking about the bond market. Bonds are supposed to mitigate the risk of an equity slide in the event the economy slows down or perhaps even goes into recession. Is that still possible with the ten-year treasury yielding 160 basis points?

MARK SPITZNAGEL: It’s a lot harder today, that’s for sure. Bonds are kind of complicated by the fact that they have these cross-currents going on. When rates are low they raise the net present value of things like stocks. But at the same time there’s this historic flight to quality to bonds. So there are these informational cross-currents and it’s not clear what we’re going to see but of course rates where they are today and the negative rates we’re seeing throughout the world are an abomination and I think it’s pretty plain to see that bonds are not a safe place to be. Certainly not a good risk mitigation strategy.

ES: What about all the strategies that are built on the notion of bonds being a good risk mitigation strategy, specifically risk parity?

MS: Yeah, it’s a big problem. It’s a big, big problem. Especially when it’s done in the levered way that risk parity requires. It’s a big problem because—so what do we have, we have these sort of statistical hedges and we have more mechanical hedges. Bonds fall in the category of the statistical hedge, and we can extrapolate into this insanity where we can take such a levered bet thinking that this is going to balance our portfolio. A mechanical hedge would be something more like an option or even credit. By cap structure arbitrage credit has to go out in a crisis, vol has to go out in a crisis, really in a big enough crisis. Bonds it’s not clear. We don’t even know what the sign of that correlation could be in bonds versus stocks. That’s how bad it is.

ES: Now, from an investor’s point of view there are a number of ways f looking at this. You should be concerned about the risks you’re taking relative to the reward that you might get, but some people are just looking for returns and they say a year ago the ten-year treasury was yield 3 percent, today it’s yielding 1.60. Some people think it’s headed negative. If that’s the case, I just need to hold it, I’m going to make a lot of money.

MS: Yeah, yeah, that’s a great point. And I can’t argue with that. You make a great point in that we need to think about a trade like that, we need to think about bond investing much more as a tactical allocation as opposed to a strategic one. A tactical one would be you’ve got to make this call right, you’re making this macro call, you’re making this call on rates. You better be right. A strategic one would be more about how you structure your portfolio for the long run, how you’re going to balance your portfolio, how you’re going to raise your rate of compounding based on how all these pieces move together vis-à-vis each other. So I think it’s really important that people understand that when they’re putting all of this money in bonds it’s no longer a very good strategic allocation, but it might be a good tactical one, I don’t know.

ES: Well what if it is a strategic allocation and you need to hedge that. Where do you hedge your bond risk?

MS: So we need to hedge the hedges. Right? And then we need to hedge the hedges of the hedges. Once you start to even have to ask those questions I think it’s plain that this isn’t a very sound, safe risk mitigation strategy.

ES: You called the situation we’re in insanity. That’s a bit of a judgement don’t you think?

MS: Negative rates is insanity, by any objective standards.

ES: 17 trillion dollars of negative-yielding debt.

MS: It’s insane. And over a trillion of negative-yielding corporate debt. That too is insane. And how do you justify that with people thinking that rates so low and the yield curve so flat is signifying panic and coming recession?

ES: At the very least, the rate market in the United States is still positively yielding. But as we’ve just discussed, elsewhere in the developed world it’s mostly a situation of negative-yielding sovereign debt and in some cases if you will crazier things. Negative-yielding Danish mortgages. From a mechanical standpoint, because you think about things mechanically, what does it mean when assets are liabilities and liabilities are assets?

MS: Again, it’s insanity. It’s part of this Rube Goldberg world we’re in where you’ve got these strange interconnectedness between different markets and they start lacking meaning. So I can’t even answer that question because there isn’t any meaning to it any more. But I hear what you’re saying. Rates are higher here than elsewhere throughout the world, is it a bad tactical play to think that bonds could even edge higher, rates are going to go lower, and I do think there’s going to be endless accommodation by central banks and by the Fed specifically.

ES: So it might not be a bad tactical bet.

MS: See I’m not even in that business. I don’t want to make these macro calls. Frankly, I think long term making macro calls and macro trades like that successfully isn’t possible. I think it’s a fool’s errand.

ES: A lot of people have been carried out of the building trying to make those calls. Not this building. The other building. But to your point, Mark, that isn’t your business. Your business is providing what I have called before catastrophe insurance. People think of you as something of a financial Grim Reaper. Today as it happens you’re not dressed in black, but you have been before. Do you really want the markets to crash?

MS: No, I don’t want the markets to crash, I’ll be good if the markets crash, my clients will be good if the markets crash, at least in terms of the fact that they insured them. But, I don’t want the markets to crash. Would you ask a bodyguard if he wants his clients to get attacked. He doesn’t. He doesn’t want them to get hurt, or for someone to even try to harm them. He just knows that he is there so they can go on and do the things in their lives that they have to do—without the risks of getting attacked. So no, I’m a cheerleader for our economy, but I do think that we’ve done some insane things across the board.

ES: You’ve told me before, Mark, that you don’t think the Fed or the ECB or the BOJ or the Bank of England or the Bank of Canada, it doesn’t matter which central bank we’re talking about, will ever be able to normalize. In other words, the era of monetary intervention is, for all intents and purposes, never ending.

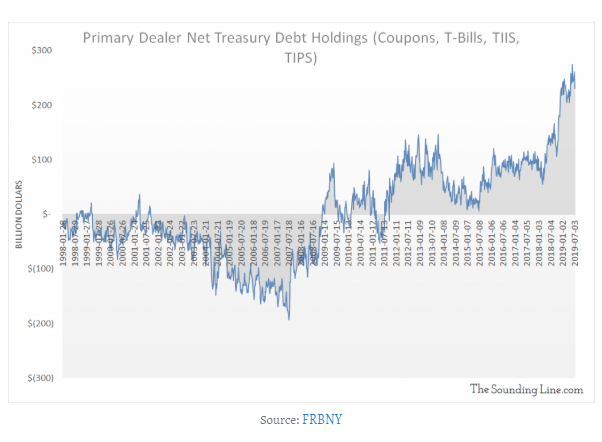

MS: That’s right. I’ve been saying for years that I’ve been saying for years that central banks can never step away from this. They can threaten to. And they can bluff, and they can do some probing bets like they did last year, and the market may fall for that, or call that bluff in the short term. But yes I think we’re in a position now where central banks can never back away, which sort of begs the question how can this ever end. Can asset markets get inflated forever? Of course they can’t. There are end games here, because this is unsustainable. There is a level of debt that becomes too much, too impossible to carry, at any rate environment. But we also have to think about price levels ticking up at some point. I know that to use the word stagflation is a bit quaint. But we have to think about that the more the world is printing money.

ES: Maybe, but nobody has been able to get paid thinking that way for the past ten years.

MS: Yeah, that’s the trap isn’t it?

ES: I suppose it is. Now, what happens if, in fact, the Fed continues to ease, which is what the market is pricing in? Is it inevitable that that just prolongs not just the downturn but makes whatever the next downturn looks like that much worse?

MS: It is inevitable. Because, you know, central banks have created this world where it’s the snowflake market, everyone gets a trophy. We know what happens, we know what that implies. It implies spoiled brats and a lack of resiliency, and that’s exactly what central banks have created in this market. An overreliance, a dangerous, dangerous overreliance.

ES: What about investors themselves? I think it’s a factual statement that the Capital Asset Pricing model doesn’t work in a negative rate environment, does it?

MS: I would argue it’s not such a good model in a normal environment. But, point taken. There’s a lot of things that we need to rethink in a zero or negative rate environment. But these are things that we should have been rethinking all along.

ES: A lot of people think, and when I say people I mean people in financial markets, that the safest place to hide is in private assets. There’s no mark to market in private assets. Hedge funds don’t have to puke out private assets, you know, in the middle of the downturn that we had in 2008, 2009. Do you believe that? Do you believe it’s a safe place to hide, and that it’s a better place to compound because you don’t have the mark to market, you’re not forced to mark to market?

MS: Not having mark to market is always a preferable thing, there’s no doubt about it. If I’m able to make a Buffet-type bet where I think the market is going to be at a certain point in ten or more years I would have much more confidence doing that without getting marked to market because it is path that ultimately gets people. Having said that, I wouldn’t want to make a broad statement about private equity any more than I would necessarily about all stocks. There are subsets of the market that are priced better and are better plays than others. So I wouldn’t want to throw the baby out with the bath water. But I certainly wouldn’t want to say that just because something is private equity and just because it’s not marked to market you should rush into that. There can be very expensive, bad deals, and mark to market or not it can be very costly.

ES: Do you think though that the nature of public markets today and the way that they are influenced if not manipulated, some would use the word manipulation by central banks, makes private markets more attractive?

MS: Well it might. You know, markets are very bad at pricing risk. They’re very bad at pricing risk. At best, markets price risk by looking in the rear-view mirror. At worst, they look ahead two feet. So the markets price things very poorly and, again, that path can really hurt you in that sense. Too much mark to market, too much looking at the ticks on your Bloomberg screen is a bad thing. And being exposed to that makes it even worse. I can agree with you, but having said that, I have to assume that much of the valuation in private equity is at least as bad as the historically high valuations we’re seeing in public markets today, pretty much across the board.

Tyler Durden

Thu, 09/19/2019 – 18:45

via ZeroHedge News https://ift.tt/30d8pas Tyler Durden