Authored by Brandon Smith via Alt-Market.com,

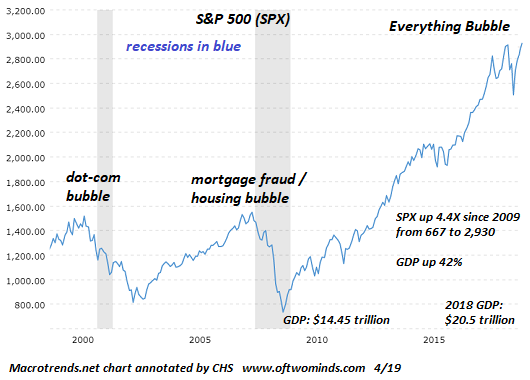

In the months leading up to the 2016 election I had been predicting a Trump win based on a particular theory which I believe still holds true today – namely the theory that the global banking elites in power were allowing so-called “populist” movements in the US and Europe to gain political traction near the very end of the decade long “Everything Bubble”. Once populist groups were entrenched and feeling overconfident, the cabal would then tighten liquidity into existing economic weakness and crash the system on their heads. Populists would get the blame for an economic disaster that the central banks had engineered many years in advance.

Once enough suffering had been dealt to the populace, globalists and extreme leftists would arrive on the scene to offer anti-populism as a solution; meaning the centralization and socialization of everything on a scale never before witnessed except perhaps in the darkest days of the Bolshevik Revolution.

This theory allowed me to predict the success of the Brexit vote in the UK, Trump’s entry into the White House, the Federal Reserve’s interest rate hikes and balance sheet cuts into economic weakness, and now it is looking more and more like my March prediction of a “No Deal” Brexit will turn out to be correct with Boris Johnson rising to the position of Prime Minister. So, I continue to stand by it.

By extension, for a couple of years I have been examining the strange correlations between the background and policies of Donald Trump and the background and policies of Herbert Hoover; the Republican president that oversaw the great crash of 1929 and the beginning of the Great Depression.

One of Hoover’s first actions as president in response to the fiscal tensions of 1929 was to support increased tax cuts, primarily for corporations (this was then followed in 1932 by extensive tax increases in the midst of the depression). Then, he instituted tariffs through the Smoot-Hawley Act. His hyperfocus on massive infrastructure spending resulted in U.S. debt expansion and did nothing to dig the U.S. out of its unemployment abyss. In fact, infrastructure projects like the Hoover Dam, which were launched in 1931, were not paid of for over 50 years. Hoover ended up as a single-term Republican president who paved the way socially for Franklin D. Roosevelt, an thinly disguised communist and perhaps the most destructive president in American history.

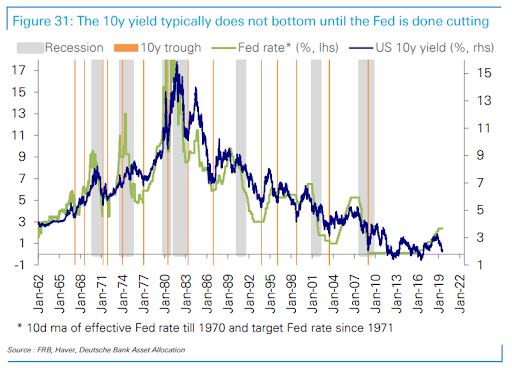

It was Hoover and his “protectionist” policies that were blamed for the Great Depression (along with the gold standard), yet it was the Federal Reserve which created the entire calamity. The Fed’s policy easing in the 1920s led to the extensive bubble in banking and stock markets, and the Fed’s rate hikes and liquidity tightening in the early 1930’s exacerbated the crash and extended the depression for many years. Former Fed chairman Ben Bernanke even openly admitted that the Fed was responsible for the Great Depression in a speech made in honor of Milton Friedman in 2002. He stated:

“In short, according to Friedman and Schwartz, because of institutional changes and misguided doctrines, the banking panics of the Great Contraction were much more severe and widespread than would have normally occurred during a downturn.

Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.”

Of course, the Fed IS doing it again. For over a year and a half the Fed has been instituting liquidity tightening into economic weakness at the onset of the crash of one of the biggest financial bubbles in the history of the economic world. It is a bubble they created with the intention of deliberately imploding it, and the process has already begun. As I have noted numerous times, the crash in fundamentals is well underway, with almost every sector of the economy in retreat except the three indicators that the Fed and the government statistically manipulate: GDP, employment, and stock markets.

Trump is not innocent in this scheme, either. After months of rightly criticizing the Fed during his campaign for inflating a fake economy and stock market, Trump pulled a 180 on his supporters after becoming president and has now attached his administration so completely to the Everything Bubble (and stock markets in particular) that it is assured he and his conservative followers will take the blame as it collapses.

I am also not the only person noting the comparison between Trump and Herbert Hoover. Trump’s similarities to Hoover are being mentioned endlessly the past year in the mainstream and leftist media with a particular focus on the trade war. Trump’s trade conflicts are providing the perfect cover for the banking elites to pull the plug on the economy, while escaping any blame. The narrative is being set up for a crash and the plan is to make populists, nationalists and sovereignty activists the scapegoats.

So, the question is, if Trump is playing the role of a modern day Hoover, and the current crash in fundamentals is set to become another long term depression, then who is the next Franklin D. Roosevelt; the communistic president or political group to push America even further into the socialist fold?

It is hard to say at this time if Trump, like Hoover, will be a one term president. If the economic crash continues on its current pace then it is unlikely that Trump could secure a second term in 2020. That said, the advent of a shooting war with a country like Iran could conceivably change the dynamic even in the midst of a financial crisis.

Whether in 2020, or 2024, I believe Trump and the populist revolt will be replaced with a socialist fervor beyond anything we saw during the Obama Administration. Just as conservatives surprised the world in 2016, I believe the hard left will surprise the world in the next 5 years.

I find it rather suspicious the amount of media attention hard leftist politicians with little experience are receiving in the mainstream media these days. I am also suspicious of the amount of attention Donald Trump is paying to these same politicians in what appears to be another scripted wrestling match for the benefit of the public. Yes, I’m talking about the “four horsewomen of the Apocalypse” and the ongoing soap opera dramatics between them and Trump that continually keep these junior upstarts in the spotlight despite all reason.

It is perhaps very hard to notice right now in the middle of Trump fever, but I see the beginnings, the root or the seed, of a massive narrative change in the elevation of political extremists like Ayanna Pressley, Alexandria Ocasio-Cortez, Rashida Tlaib and Ilhan Omar, also known as “the squad”. Yes, they seem to be universally hated in Washington right now, and the abject failure of AOC’s “Green New Deal” makes it appear as if there is little support for their ideas, but again, look at how much attention these nobodies are accumulating…

I am reminded of the early hints of Barack Obama’s run for president even though he had little political experience compared to his opponents, most of it as a state senator. People running against him during his early career on the Democratic and Republican sides seemed to keep dropping out of the races due to sexual scandals. Then, Obama received overt attention from the mainstream media and even The Daily Show before he ever announced his run for the Oval Office. The build up was obvious for analysts that recognized the signals. Obama had been anointed by the elites.

AOC and “the squad” are being marketed in a very similar manner to Obama; as hopeful, young, vibrant, full of energy and ready to take on the world. The kind of cheesy, heart-clutching Disney movie sales pitch that Democrats and leftists go crazy for.

Today, comparatively “moderate” Democratic presidential candidates for 2020 such as Bernie Sanders and Elizabeth Warren are falling all over themselves to promote “the squad” and get their political approval and support. It is clear that hard line leftists are dictating the conversation on America’s future governmental path, and that path is one of extreme centralization, globalization, and bureaucratic tyranny in the name of fraudulent environmental panic.

Interestingly, Elizabeth Warren is garnering attention lately with her warnings of coming economic calamity under the Trump Administration. Her observations are very obvious to most of us and not worth noting here; it’s nice that Warren is mentioning the prospect of economic danger in the mainstream, but she’s years late to the party. I would point out, though, that this marks a turning point in the 2020 election conversation. Suddenly, the Democrats are seriously talking about the potential for a financial crash – which says to me that the crash that is already happening today is about to accelerate even more in the next year. The globalists are setting the stage for the Democrats to say “See, we told you so”, as an election year approaches.

At this point, given her recent statements, I will have to predict that Elizabeth Warren is the intended Democratic candidate for the 2020 election.

It is important to remember that public sentiment is fickle, and can change so swiftly it boggles the mind. With the advent of a major economic disaster and maybe even a kinetic war that the US cannot sustain or win in the long run, the predictions of globalists and leftists that populist movements are a “crisis waiting to happen” would be fulfilled. Trump has no real control over the economy, of course, and the Fed determines when and how a financial bubble will pop; but that will not stop the majority from laying the blame on the feet of Trump and his political base. The introduction of hardcore socialism as the preeminent American ideal would be a much easier sell at that point.

In the middle of societal catastrophe, that which we once thought impossible becomes probable. I predict that the “four horsewomen of the Apocalypse” and their ilk are chosen by the globalists to take control of the US in the next decade after Trump and the populists are fully discredited in the eyes of more than half the country and the world. To be certain, there are many of us who will not accept open socialist/communist governance and all the tidings that come with it (including carbon controls and disarmament of the population), and I have no doubt civil war would erupt.

The point is, we should expect this outcome as one the globalists will force. The signs are visible now. The policies of these women, which are utterly insane and bankrupt of logic, are going to become the prevailing ideals of the next political revolution. Count on it.

* * *

If you would like to support the work that Alt-Market does while also receiving content on advanced tactics for defeating the globalist agenda, subscribe to our exclusive newsletter The Wild Bunch Dispatch. Learn more about it HERE.

via ZeroHedge News https://ift.tt/32NvTl1 Tyler Durden