Lies…

Authored by W.J.Astore via BracingViews.com,

They’re Everywhere in America

Soon after Joe Biden took office as president in 2021, I remember hearing that his VP, Kamala Harris, was put in charge of immigration, informally known as the “border czar.” Yesterday, the House passed a resolution condemning Harris for her handling of the border crisis. Yet I’ve also been hearing from Democrats and the media that Harris never was the border czar, even as there’s plenty of video evidence of networks like ABC, CBS, and NBC referring to her using that term.

Denying that Harris was the border czar is a fairly small lie immersed in much larger sea of lies, and of course it’s a bipartisan effort. Donald Trump exaggerates and lies just to stay in shape. Democrats love to attack Trump for lying even as they lie themselves. Truly, it’s hard to run a government and a country when lies confuse every issue.

Another lie being told about Kamala Harris is that her candidacy is the result of democracy in action. She’s the people’s choice! Except almost nobody voted for her as a presidential candidate. She’s been elevated and selected by the DNC and the donor class. She is a packaged product of the so-called elites within the party, the very opposite of a candidate chosen by the people. And yet I’m told this packaged product is going to “save democracy” from Trump, who was actually selected as a candidate in a more democratic process.

Of course, there are far bigger and more serious lies than whether Harris was the border czar or whether she’s the people’s choice as the savior of democracy. U.S. troops’ deadliest enemies, I’d argue, are most often the lies told by the U.S. government, abetted and amplified by senior officers in the military. Think here of Iraq and Afghanistan, or go back further to Vietnam.

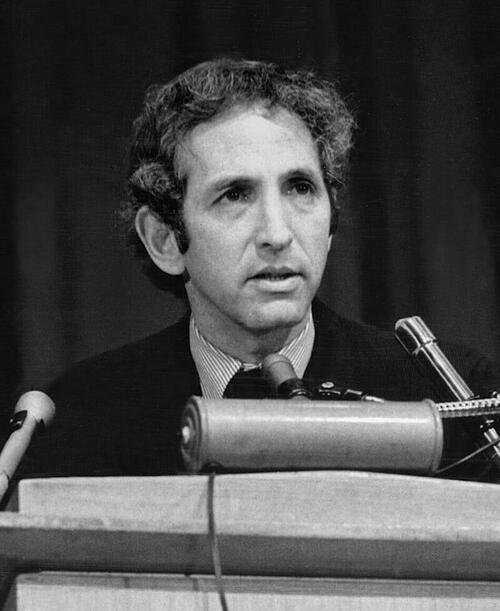

Daniel Ellsberg, truth-teller about the Vietnam War and so many other things

Knowing (or sensing/feeling) you killed for lies, or knowing your friends died for lies, is surely a contributing cause to a rash of suicides in the U.S. military today. The sacrifices and horrors of war may be eased by a “just” war, like World War II, but they are aggravated by unjust wars. And they are further aggravated when you try to get help through the VA only to be turned away or stonewalled.

All this is prologue to a note I received from a regular reader of Bracing Views about lies in America. I’ve decided to retain the profanity because it’s more than appropriate:

I don’t know about you, but I find it quite amazing that, despite decades of bold-faced lying about US wars, all of it proven and even reported in the NYT and other mainstream media, the narrative of the each subsequent war is always accepted as true, until it too is exposed as being nothing but lies.

Let’s look at the recent record:

1) Vietnam–exposed as nothing but lies by the Pentagon Papers.

2) Iraq–exposed as lies when the infamous WMD were never found and there was nothing found to back up the claim of links to Al Qaeda.

3) Afghanistan–exposed as pure fiction as revealed by the Washington Post “Afghanistan Papers” which said that “senior U.S. officials failed to tell the truth about the war in Afghanistan throughout the 18-year campaign, making rosy pronouncements they knew to be false and hiding unmistakable evidence the war had become unwinnable.”

Add to the above list the fact that the Mueller report investigating the Russiagate hoax came up with nothing, ZERO.

Currently, there are a couple of new false narratives duly reported by the mainstream media and, for the most part, swallowed by most people. First is the false narrative about the US war in Ukraine, that NATO expansion has nothing to do with it but rather was caused by naked Russian aggression and Putin’s plans to re-create the Soviet Union and take over the rest of Eastern Europe. Second, the false narrative that Israel is just defending itself against Palestinian terrorism rather than committing grotesque war crimes, completely ignoring the fact that the Israelis have been keeping the Palestinians under illegal occupation for over 50 years, since June 1967.

Lie after lie after lie after lie. And yet none of it matters. It is all sent down the memory hole as if it never happened. And then it is on to the next war, when the official narrative spewed out by the DC blob will once again be swallowed hook, line and sinker. It appears to be never ending. No matter how much lying is exposed, it simply does not matter.

I think it is pretty fucking amazing. What will it take to get people to come out of their coma and realize what the fuck is going on?

And keep in mind…..it has nothing to do with party affiliation. The lying is endemic, it’s in the DNA of the National Security State. Presidents come and go, but the lying for war-making never stops. And no one is ever held accountable either.

It’s pretty fucking impressive, when you think about it.

Keep this is in mind……one would think that, after this abhorrent track record, the appropriate response would be to assume that the narrative justifying the new war of the moment was not true and nothing but more of the same lying. But that NEVER happens. NEVER.

How is that possible? Is it just a serious form of denial? Is it due to mental illness? Is it just some perverted form of patriotism? In what other realm is it possible to lie non-stop and never be held accountable? Even worse, to continue to have credibility despite a track record of pathological lying?

A friend of mine pointed out that, in the old USSR, people knew that the official news on their TV every night was nothing but lies.

So, this begs the question: Which system is more pernicious and has more effectively brainwashed its people? The one where people are controlled but they are aware that they are being fed nothing but lies, or the one that is constantly lied to but the people still believe they are being told the truth?

To those keen insights, I made this reply:

Our [American] system of lying is better! We have state/corporate media too, it’s just more subtle and advertised as “free.” We have our own “Pravda” except it rarely tells the truth, unless that “truth” is in the interests of the powerful.

To which our BV keen reader replied:

Exactly. But to suggest that we have our own version of “Pravda,” only worse because it has the cover of supposedly being “free,” is tantamount to treason, you realize.

This is the reason why Julian Assange/Wikileaks was such a threat…for actually challenging the right of the National Security State to lie non-stop about its war making and never be exposed for its lying or held accountable.

Of course, that is exactly why Assange was locked away in prison for so long and tortured, not because he was spreading lies but because he was revealing truths.

And we can’t have that in America!

Tyler Durden

Fri, 07/26/2024 – 18:20

via ZeroHedge News https://ift.tt/rUDnI9Q Tyler Durden