Why Is A Sensible Immigration Policy Discussion So Hard

By Mish Shedlock of MishTalk

Why is the choice between shutting down the border and no controls at all? And what about demographics? Fertility rates?

Immigration Talks We Should Be Having

Eurointelligence discusses the Immigration Talks We Should Be Having.

The ideas also apply to the US.

Last week, the European Commission set out its ambitions to strike a deal with Lebanon, to stop asylum-seekers reaching the EU from there. Giorgia Meloni [Italy’s Pime Minister] now spends so much time in Tunisia, where the EU signed another agreement to limit migration, that she should consider buying a time-share in Bizerte.

Fabio Panetta, the Banca d’Italia’s governor, recently made a welcome intervention on this. He made a point which you do not hear very often: that without more immigration, the EU will sink demographically. That will mean both its economic and fiscal situation becoming unsustainable. According to Panetta, a common EU-level policy is necessary. Migrants, legally or not, come into the EU as a whole. Even if they are legally restricted to one member state, practically speaking there is often little to stop them moving across borders in a border-free Schengen area.

In Panetta’s own home country, the situation is especially bad. Italy’s total fertility rate is now 1.25 as of 2021. This is far below the so-called replacement level of 2.1, which is necessary to keep a country’s population stable. The only thing stopping its population from cratering is the immigration it receives already. Even if the government could stumble on a way to increase the total fertility rate to replacement level, something virtually no developed country has managed, there would still be inertia.

This basic demographic reality is acute in Italy, but not unique to it. The only countries mitigating it so far are those that accept high numbers of immigrants and integrate them into the workforce, like the UK, Spain, and Portugal. Yet it is something politicians skirt around, for fear that their voters are not prepared to hear the truth.

What you end up with is a worst-of-both-worlds situation. Politicians, especially if they act on their own and not on the EU level, cannot get a handle on irregular migration and asylum-seekers, despite repeatedly promising to. All they accomplish is raising the issue’s salience, while driving disillusioned voters to the far-right.

But on the other hand, they dodge the other side of the coin, the need to accept and properly integrate migrants to keep demographic, and fiscal, balances stable. Until governments are prepared to acknowledge these trade-offs, we should be wary of the feasibility of any commitments they make to consolidate public finances in the long term.

US Fertility Rate

The lead image is from MacroTrends.

The following snip is from VOX.

In the US, the birth rate has been falling since the Great Recession, dropping almost 23 percent between 2007 and 2022. Today, the average American woman has about 1.6 children, down from three in 1950, and significantly below the “replacement rate” of 2.1 children needed to sustain a stable population. In Italy, 12 people now die for every seven babies born. In South Korea, the birth rate is down to 0.81 children per woman. In China, after decades of a strictly enforced one-child policy, the population is shrinking for the first time since the 1960s. In Taiwan, the birth rate stands at 0.87.

The US numbers from VOX are a bit low. The lead chart is more current but I like the VOX discussion. Were it not for immigration, the US population would be in decline.

Is that necessarily a bad thing? At what point does increasing population become a Ponzi scheme due to the energy and food needs?

There are a lot of questions and the only thing everyone seems to agree on is that uncontrolled migration is bad. Even Biden admits that, but he is unwilling to do anything about it.

Progressive Irony

Progressives want open borders but they also want guaranteed living wages, clean energy, slave reparations, a right to shelter, a right to free health care, and net zero carbon. The goals are incompatible.

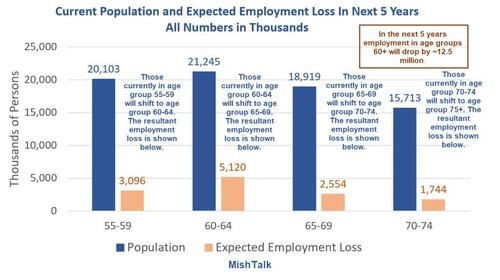

In the next 5 years employment in age groups 60+ will drop by ~12.5 million

On March 21, I commented In the next 5 years employment in age groups 60+ will drop by ~12.5 million

Due to age demographics, I expect employment in age groups 60 and over to decline by about 12.5 million. Let’s go over the math to see how I arrived at that number.

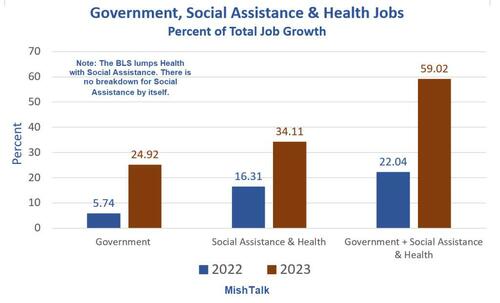

Government + Social Assistance Accounted for Nearly 60% of Job Growth in 2023

On January 5, I noted Government + Social Assistance Accounted for Nearly 60% of Job Growth in 2023

The welfare state is booming along with social assistance for illegal immigrants.

Family Formation

Taking a step back from immigration policy, why is it that family formation is so low? The unfortunate answer is Fed policy and fiscal policy is so inflationary, that young adults have come to expect they will be worse off than their parents.

If so, and that seems accurate, this will be the first time in US history.

Importantly, houses are too expensive. Zoomers and younger millennials are angry over housing costs. And millions of illegal immigrants need a home and services.

Rent is so expensive and anger so high over housing costs that People Who Rent Will Decide the 2024 Presidential Election

Finally, a recurring theme: The Fed’s Big Problem, There Are Two Economies But Only One Interest Rate

The Fed is largely responsible for the housing mess and Biden/Congress is responsible for the rest.

Yet Biden refuses to do anything lest he upset the Progressives who want open borders, guaranteed living wages, clean energy, a right to shelter, a right to free health care, and net zero carbon.

Tyler Durden

Thu, 04/25/2024 – 15:45

via ZeroHedge News https://ift.tt/nCjEUs3 Tyler Durden