On Tuesday, the BLS engrossed in the same frenzy of openly making up data like the Dept of Labor has been with the initial claims data ever since early September when it started upgrading its California “systems” and never finished, announced that while only 140K or so jobs were created in September, nearly 700K full-time jobs were added as over 500K part-time jobs were converted into full-timers. On the surface this is great news… until one actually looks for empirical evidence that this is happening anywhere besides the data manipulating, massaging and fabricating models used by the BLS. And one certainly won’t find it at the biggest private employer in the US – Walmart, which just announced that a whopping 475,000 of its employees earn at least $25,000 a year. Great news, right? Sure, until one considers that WMT has over 1 million employees, which means that well over 50% of Wal-Mart’s employees make a tiny $25,000 year.

From Bloomberg:

Wal-Mart has provided some new and useful information: More than 475,000 of its 1 million hourly store employees earn at least $25,000 a year for full-time work. This figure comes from Bill Simon, the president and chief executive officer of Walmart U.S., who presented (PDF) it at Goldman Sachs’s (GS) Global Retailing Conference last month. The statistic, which was listed under the heading “Great job opportunities,” means as many as 525,000 full-time hourly employees earn less than $25,000 a year.

OUR Walmart, the union-backed workers’ group that’s been staging protests and asking for higher wages, pointed this out during a press conference in Washington, D.C., on Wednesday. (The company’s presentation is also on its website.) Three store associates, as well as three Democratic members of the House of Representatives, called on the retail giant to pay all of its full-time workers at least $25,000 a year.

Wal-Mart is adamant: the pay is fair.

“We have hundreds of thousands of associates who are making $25,000 a year or more,” says Kory Lundberg, a Wal-Mart spokesman. “And the opportunity exists for those who aren’t to grow into the career they want. We promote 160,000 people a year.” Lundberg also explained how to parse some of Wal-Mart’s figures. The company has 1.3 million hourly workers, which led OUR Walmart to claim at the press conference that 825,000 of them made less than $25,000 a year. Lundberg points out that Simon’s presentation was referring to the 1 million who work in the stores. (The rest work as truck drivers and at the Bentonville (Ark.) headquarters, among other places.) So about 52 percent of its associates make less than $25,000 a year—not 63 percent.

The other side disagrees. As expected, the minimum wage workers demand – what else – higher wages.

“A decent wage is their demand—a livable wage, of all things,” said Representative George Miller (D-Calif.). The problem with companies like Wal-Mart is their “unwillingness, not their inability, to pay that wage,” he said. “They hand off the difference to taxpayers.” Miller was referring to a congressional report (PDF) released in May that calculated how much Walmart workers rely on public assistance. The study found that the 300 employees at one Supercenter in Wisconsin required some $900,000 worth of public assistance a year. Catherine Ruetschlin, an analyst at Demos, the progressive policy center, noted during the press conference that raising wages can be good for the overall economy. “Putting money into workers’ wallets puts cash in the registers of retailers, and with it the need for new employees,” she said. “We estimate that a raise to $25,000 a year would lead to at least $11 billion of new GDP and generate 100,000 new jobs.”

Trite platitudes aside – and if the workers are unhappy they sure can try to get a higher paying job elsewhere: surely their skillset is worth it – the reality as we pointed out in “When Work Is Punished: The Tragedy Of America’s Welfare State“, the comp more than half of WMT’s workers get is actually in the sweet spot for “middle class” equivalent cash flow. Recall: “the single mom is better off earning gross income of $29,000 with $57,327 in net income & benefits than to earn gross income of $69,000 with net income and benefits of $57,045.”

And that, incidentally, is precisely why the motivations of the lower and middle classes are so warped: because when those who think they are worse off making just below the magic cutoff level are in fact better than those who make $40,000 more in gross income, then the desire to work and be “aspirational”, upwardly mobile simply disappears, and with it the marginal productivity of the economy.

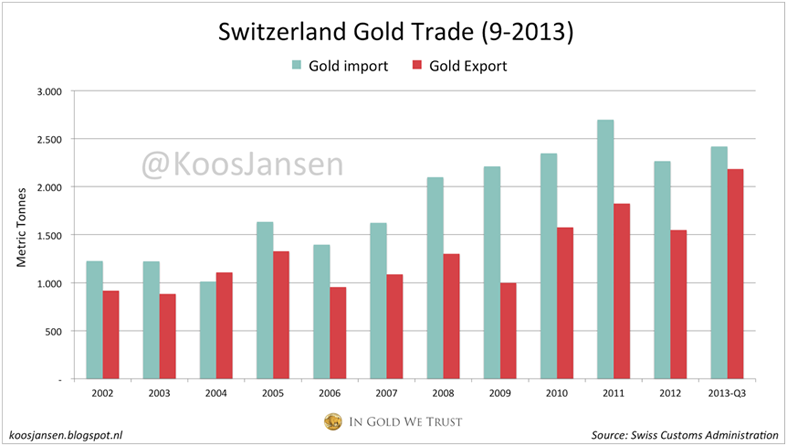

As for the angry minimum wage Wal-mart employees, we have one piece of advice – look at the chart below…

… and realize why it is in your interest to make just as much as you are making and not a dollar more.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/t1Hvx5GpBcE/story01.htm Tyler Durden