In June 2022, when inflation was raging at over 9% in the US, Fed Chairman Jerome Powell admitted to a reporter, “we now understand better how little we understand about inflation.”

“Uh, that’s not very reassuring,” the reporter chuckled.

Talk about an understatement. The Fed Chairman has the power to control virtually everything in the economy.

He can conjure trillions of dollars out of thin air practically at will. He can raise and lower interest rates, push businesses and governments into bankruptcy, and cause people to lose their jobs.

Yet he flat-out admitted they didn’t have a clue about inflation.

Of course, nearly everyone else on the planet— normal people who go grocery shopping, rent their homes, fill up their gas tanks— could feel the sting of inflation back then, as they still do today.

They may not understand where inflation comes from, but they understand the profound effect it’s having on their standard of living. Many people are working harder than ever juggling multiple jobs yet struggle to afford basic necessities they once took for granted.

But the Fed doesn’t understand such realities. Just like politicians with ‘decades of experience’, central bankers live on a completely different planet than the rest of us— a place where out of touch ‘experts’ who are disconnected from the real world come up with idiotic theories that are consistently wrong.

Remember when inflation was supposedly “transitory”? Or when, TWO DAYS before Silicon Valley Bank went bust, the Fed Chairman told Congress that they saw absolutely no consequences from their interest rate hikes?

These people have been wrong at every turn. And the latest episode is stagflation— which the Fed Chairman outright dismissed yesterday afternoon.

“I don’t see the ‘stag’ or the ‘flation’…” the Fed Chairman quipped, seemingly quite pleased at how witty he sounded.

His conclusion is nuts; stagflation is hitting him squarely between the eyes, yet he STILL doesn’t see it.

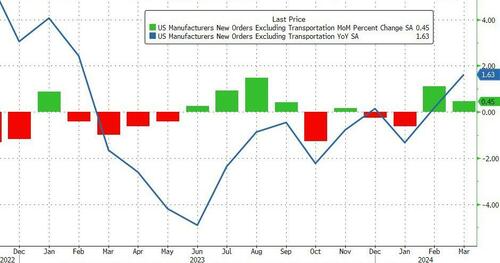

The ‘stag’ data is everywhere. Even the government’s official numbers on the US economy last week showed GDP growth coming to a screeching halt. New hires are down to the lowest level in EIGHT years, and by some metrics in ELEVEN years. Productivity growth last year was an anemic 1.3%. The list goes on and on.

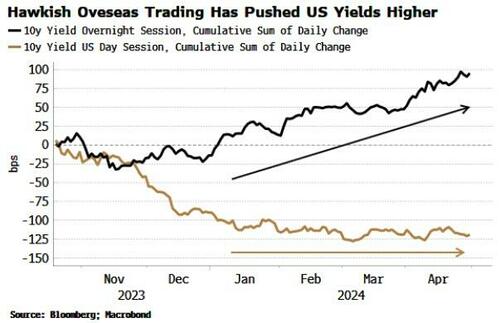

And the fact that the Fed Chairman doesn’t see the “flation”, i.e. inflation, is just intellectually dishonest. Even the Chairman himself has admitted over the past few weeks that inflation remains too high. Both statements cannot be true at the same time… except in the mind of a central banker.

It’s noteworthy that yesterday the Chairman completely ruled out RAISING interest rates. There will be no rate hikes. Period.

Raising interest rates is what a central bank is supposed to do when facing obvious inflation. But they’ve taken that option off the table, entirely abandoning their responsibility to keep prices under control.

But just like they didn’t understand inflation, it’s clear the Fed doesn’t understand stagflation either.

Economists will tell you that stagflation is the combination of higher inflation and lower economic output— usually inflation combined with a recession. That’s what happened quite famously in the 1970s.

But while economists and central bankers define inflation based on econometric data (that is usually incorrect anyhow), the average person recognizes stagflation in a different way: stagflation is simply a decline in your standard of living. It means you’re worse off because the economy just sucks.

Stagflation is uneven. It doesn’t hit all people in all places at the same time. Politicians and central bankers, for example, are immune to the effects of stagflation because they rarely lose their jobs and have outrageously good benefits.

The average person, however, is worse off today when compared to the last several years. It’s not a complex calculus at all. Yet the Fed just doesn’t get it.

For example, they’ve continued to talk up how great the US economy is… which is probably not how the average person feels. In fact, the Fed doesn’t even understand what’s been the key driver of the US economy over the past few years: government deficit spending.

The US government has been shoveling money into the US economy hand over first and going deeper into debt in the process. Clearly this is going to drive some economic growth. But the government isn’t even getting a 1:1 return on that deficit spending.

Think about it— last year the federal government’s budget deficit was around $2 trillion. But even before factoring in inflation, the US economy only increased by about $1.5 trillion.

You’d think that if the government spent an extra $2 trillion, that the US economy would see at least $2 trillion in extra growth. But no. The economy grew $1.5 trillion, versus a $2 trillion deficit (all of which was funded by increasing the national debt).

The level of incompetence is mind-blowing.

There are plenty of other signs that the economy is starting to lag.

Just a few days ago, Starbucks reported dismal earnings. No surprise there: when people start tightening their belts, small luxuries like $6 coffees are the first thing to go because they have to plow that money into their gas tank, electric bill, or weekly grocery trip.

This is stagflation— a small decline in the standard of living. The economy sputters, prices go up, and wages don’t keep pace.

Yet the Fed doesn’t see it.

They don’t understand stagflation.

They don’t understand inflation.

They don’t understand the catastrophic growth trend of the US national debt.

They don’t understand the risks to the US dollar and the coming loss of its status as the dominant global reserve currency.

And they don’t even understand that they don’t understand. They’re so out of touch that they still believe they have the situation under control.

Frankly it’s pretty scary that the most powerful people in the US economy don’t have a clue.

Fortunately, there is something you can do about it.

Every economic decision that policymakers (whether the President, Congress, or central bank) have ever made or WILL ever make in the future, is ultimately reflected in the currency.

If Congress runs up the debt… if the President passes a host of idiotic, productivity-killing executive orders… if the Fed launches ‘quantitative easing’ to infinity and beyond… the consequences will ultimately be reflected in the US dollar.

This could be a range of consequences, from a decline in purchasing power (inflation) to loss of reserve status in global trade.

Either way, if you don’t want to suffer those consequences, the solution is simple: don’t hold all of your savings in that currency.

Consider other options, including, in my opinion, one of the world’s oldest forms of money that has a 5,000+ year track record of value and marketability: gold.

Source

from Schiff Sovereign https://ift.tt/i9xWEN1

via IFTTT