Via EvergreenGavekal.com,

“Betting against gold is the same as betting on governments. He who bets on governments and government money bets against 6,000 years of recorded human history.”

– Charles De Gaulle, Leader of the French resistance during WWII and 18th President of France

SUMMARY

Gold bullion and gold mining stocks have rallied 18% and 51%, respectively, in recent months after a brutal bear market over the last five years.

Given gold’s proven ability to hold its value in the face of rising inflation and reckless monetary policy, we believe it plays an important role in any diversified portfolio.

At Evergreen Gavekal, we believe it may be time to to start initiating or adding to additional gold holdings for six reasons.

- Technical trading patterns suggest gold may finally be breaking out into a bull market (we do caution, however, that it appears to be temporarily over-bought).

- Gold remains out of favor despite the recent rally.

- The Fed’s ability to hike nominal interest rates is constrained.

- The overpriced US dollar has limited room to run.

- Real interest rates are heading lower around the world as central banks get creative.

- Physical gold may be difficult to acquire in the coming years.

SIX REASONS TO BUY GOLD IN 2016

The following commentary is from the Evergreen Investment Team:

Gold is one of the most hated asset classes on the planet.

In Wall Street’s eyes, it’s never been a legitimate investment. Gold reports no quarterly earnings, pays no dividend, and (until the rise of the launch of the SPDR Gold Trust ETF* in 2004, along with a flurry of similar products and services in recent years) generates no sales commissions for brokers still advising the majority of American investors.

But try as they may to paint the yellow metal as a “barbarous relic” or a “pet rock,” the financial establishment can’t change the fact that gold is money in virtually every country and every community on the planet.

While the average life of a fiat currency has been just twenty seven years and the average life of a reserve currency has been just ninety five years throughout the modern era, gold has held its value over millennia.

For example, an ounce of gold supposedly bought 350 loaves of bread in ancient Babylon (about $3.51 per loaf today) and first century Roman Centurions earned about 38.58 ounces of gold each year (about $47.5K today). Those numbers are remarkably close to today’s prices.

Needless to say, gold has stood the test of time.

From that perspective, the yellow metal’s proven ability to hold its value as the purchasing power of paper money erodes makes it an excellent long-term hedge against inflation and a safe haven in the face of governments and/or central banks gone wild.

So the shiny stuff should have been the perfect investment in a world where major central banks increased their collective balance sheets by almost $10 trillion, right?

Unfortunately not.

Conventional wisdom in 2009 and 2010 argued that ultra-low nominal interest rates and quantitative easing (i.e., massive money manufacturing) would inevitably lead to hyperinflation, that the US dollar and US Treasury bonds would collapse, and that gold would soon be the only safe haven left. But the consensus among gold bugs, dollar doubters, and bond bears was dead wrong… at least in terms of timing.

Instead of accelerating into an uncontrollable wage-price spiral, inflation has languished and inflation expectations have collapsed along with the price of almost every commodity.

Thus far, all that money printing has done nothing but encourage another $60 trillion in global debt growth according to a recent study by the McKinsey Global Institute. Rather than looking like Zimbabwe in 2008 or Weimar Germany in 1923, the United States and Europe are looking more and more like Japan with each passing year.

To be clear, we still don’t know where this debt-paved road will ultimately lead. Japan may yet fall into hyperinflation as the yen collapses from ¥111/$ today to ¥200/$ before we know it.

But thus far, the country’s massive debt load (660%+ of GDP) is weighing on growth and dragging the country toward outright deflation. Moreover, the Eurozone (debt 460%+ of GDP) and the United States (debt 350%+ of GDP) also appear to have hit the point of diminishing return when it comes to layering on more IOUs.

That’s why—as a result of diverging monetary policy between the less indebted United States and our more indebted peers—the US dollar has gained in excess of 30% and long-dated US Treasuries have returned more than 45% over the last five years. During that same timeframe, the price of gold bullion declined nearly 40% and gold mining stocks collapsed by a whopping 70%.

Needless to say, all those who abandoned diversified portfolios for the “safety” of gold have lost a considerable share of their purchasing power while US stocks more than doubled over the same period.

It’s no wonder that gold has lost its glitter for most investors, but as billionaire resources investor Rick Rule recently noted, “These periods of deep despair are the necessary component, the necessary factor to turn a bear market into a bull market.” Unsurprisingly, the towering in-flows that went into the gold exchange traded fund (GLD) when bullion was rising back in 2009 through 2011, turned into relentless out-flows during its multi-year decline. As is so often the case, the redemptions hit a crescendo as gold prices were nearing their lows, clearly reflecting the “deep despair” that typically occurs at bear market troughs.

GOLD ETF IN-FLOWS AND OUT-FLOWS VS GOLD PRICE

Source: Evergreen Gavekal, Bloomberg

At Evergreen Gavekal, we believe low valuations and entrenched bearishness on top of a fundamentally improving outlook (as we’re seeing in the market for gold bullion and gold miners) are the hallmarks of emerging opportunities. Conversely, high valuations and resilient optimism on top of a fundamentally deteriorating outlook (as we’re seeing in US equities) are the hallmarks of imminent corrections.

Reaping a profit from this still-reviled asset class will require discipline and patience, but we believe we are approaching a good re-entry point for gold and gold miners for six reasons.

(1) Technical trading patterns suggest gold may finally be breaking out into a bull market.

Year-to-date, gold prices have leaped by more than 18% and gold mining stocks have surged by more than 50% as the trade weighted US dollar softened.

Although we believe gold is currently short-term overbought here…

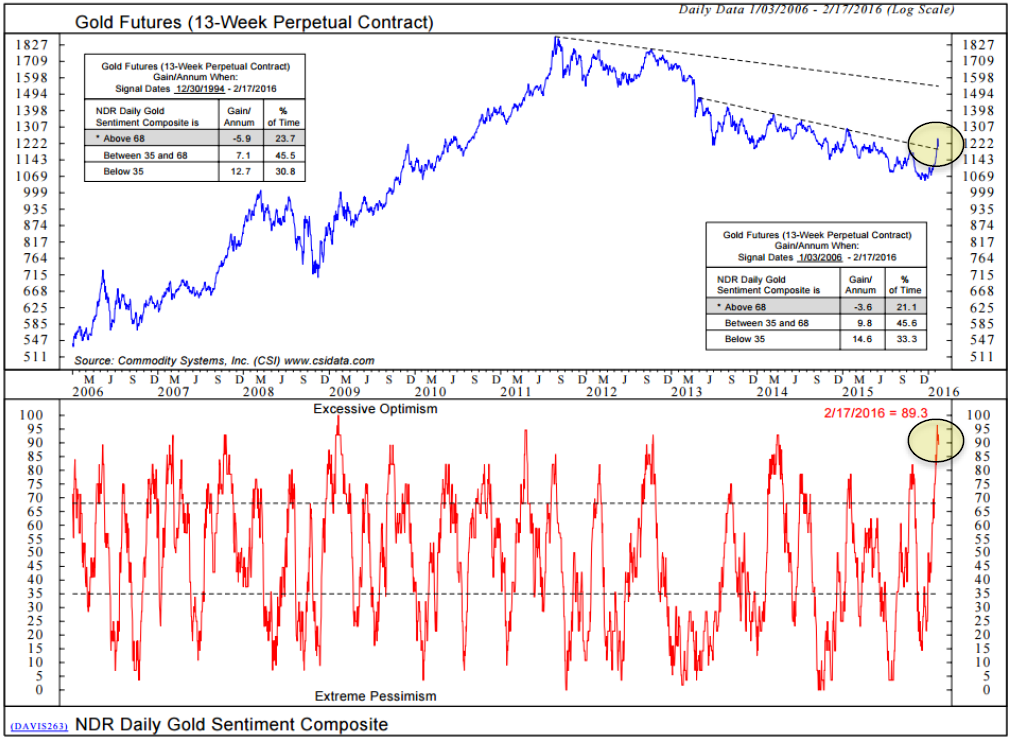

GOLD PRICE (TOP CHART) INVESTOR SENTIMENT TOWARD GOLD (BOTTOM CHART)

…technical trading patterns suggest the yellow metal may be rounding the corner and getting ready to break out into a full-fledged bull market.

(2) Despite the recent rally, gold remains remarkably out-of-favor.

Despite the surge we’ve seen in gold and gold miner stock prices in recent months, attitudes don’t change overnight. Trading volume and upside volatility are coming back, but investor’s hesitant re-embrace of gold may signal an even bigger shift in global sentiment. Buying gold today may be comparable to buying stocks in April 2009.

(3) The Fed’s ability to hike nominal interest rates is constrained by global economic risks and financial market volatility.

As the Evergreen investment team has been saying for several months, we believe the Fed’s decision to hike interest rates into an economic slowdown will limit its ability to normalize interest rates in the coming year. Additional rate hikes are possible if global markets are relatively calm when the backward-looking, model-obsessed Federal Open Market Committee meets at various points throughout the year. However, further tightening would only increase the odds of a policy reversal as the year drags on. If we are correct, short-term interest rates may rise ever-so-slightly for a brief period, but will inevitably fall back toward zero (and even below zero with the likely introduction of negative interest rates), as we’ve seen with every other central bank that has tried and failed to raise rates in recent years.

(4) The overpriced US dollar has limited room to run.

As the following chart from our partners at Gavekal illustrates, the US dollar may be running out of steam after approaching its most expensive valuations since the mid-1980s.

If that’s true, it could be VERY good news for gold investors given that bullion’s weakness has been the mirror image of US dollar strength in recent years. In the event that the dollar drops sharply on softening US economic data or a Fed policy reversal in the coming months, gold prices could rise considerably more than we have seen year to date.

GOLD PRICES (GREEN) VS TRADE-WEIGHTED US DOLLAR (WHITE)

Source: Evergreen Gavekal, Bloomberg

(5) Real interest rates are heading lower around the world as central banks get creative.

Central banks have failed miserably in their attempts to kick-start economic growth and stoke inflationary pressures in the wake of the global financial crisis. Dropping nominal interest rates to zero and expanding central bank balance sheets by more than $10 trillion has only had a marginal and short-lived effect on real economic activity. Consequently, policymakers are getting desperate.

As we discussed in last week’s EVA, nearly 25% of the global economy (the Eurozone, Denmark, Sweden, & Japan) is now governed by central banks charging negative interest rates on excess bank reserves with the hope that banks will start passing on those costs to their depositors.

Yes, you heard that right. Instead of paying a reasonable rate of interest on the bank deposits they so desperately need to stay in business, financial institutions in Europe and Japan may soon start charging for the privilege of holding cash on deposit.

The bright idea here is to force savers out of the safety of cash and stoke an inflationary mindset. But at this point, the specter of negative rates is just incentivizing savers to withdraw their funds and stuff their mattresses with cash.

So what comes next? Over the past few months, central banks have been thinking out loud and proposing some wild (and, frankly, irresponsible) ideas.

Some have suggested eliminating physical cash altogether to force savers to decide between investing in the real economy, taking risks in financial assets, or paying compound interest on their idle holdings.

Others have proposed printing money to support fiscal spending on things like infrastructure, defense spending, or student loan relief.

And, as if the first two ideas weren’t bad enough, the latest policy on the table is to start sending money directly to adult citizens via what Milton Friedman and Ben Bernanke both called “Helicopter Drops.”

From the hints being sent out by policymakers, it would likely involve checks sent directly to low-and middle-income citizens financed by central bank money creation. This, combined with the populist popularity of Bernie Sanders and Donald Trump, should send shivers up the spine of financial asset investors to whom the high inflation this could cause is toxic. But it would almost certainly light a fire under bullion prices.

Now, before you get too excited, let us be clear. We do not know—we cannot know—exactly where Fed policy is going in the coming years. But we do believe that nominal and real interest rates are likely heading a lot lower on the way to whatever wild experiment comes next. As you can see in the chart below, falling real interest rates have historically been one of the most important drivers of gold prices, so that’s a bullish development in its own right. And if inflation does pick-up as central banks get creative, then a spike toward $3,000 per ounce would be more than reasonable.

PRICE OF GOLD COMPARED TO THE FED FUNDS RATE

Source: Evergreen Gavekal, Bloomberg

(6) Physical gold may be increasingly difficult to acquire as investor attitudes shift in the coming years.

One of the underappreciated facts about the global gold market is that supplies are shrinking in Western markets as more and more bullion flows to Asia. Should prices spike on an aggressive turn in Fed policy and a sharp reversal in the US dollar, investors may discover that they are not able to secure enough physical gold… which in turn may trigger a spike in financial gold (like the gold ETF) and gold mining stocks. As you can see in the chart below, while gold has been in a garden-variety bear market, the miners have tumbled down an incredibly deep shaft, though they, too, appear to be breaking out of their long downtrend. Despite their recent recovery, they remain down 70% from their 2011 apex.

FIVE YEAR PRICE CHART OF GOLD MINERS (GDX)

Source: Evergreen Gavekal, Bloomberg

It’s fair to say gold and other precious metals were caught up in a bubble a few years ago when many retail investors—and even a number of professionals—were certain money printing would lead to high inflation. But now gold, and especially gold mining stocks, have achieved “anti-bubble” status, along with all things energy-related. (An anti-bubble is a condition where years of horrible performance and extremely negative investor sentiment set the stage for substantial future out-performance.)

Please realize we aren’t pounding the table with gold bugs who won’t be satisfied until gold rockets to $10,000/oz. and the gold standard is reinstated. But as investors, not traders, looking to hedge against what increasingly appears to be the dying days of central bank control over financial markets, gold is hard to ignore.

Speaking of energy (and we have a hard time not doing so these days), per the above chart, as cheap as gold is, oil is even more undervalued. But, then again, there isn’t the bullion-producing equivalent of a Saudi Arabia out there, flooding the market with cheap gold—fortunately. On the other hand, almost every ounce of gold ever mined is still around while nearly all the oil (and natural gas) produced has been consumed. But what the hey? Why not put some gold and energy into your portfolios? If reversion to the mean still rules—and we believe it does—both of them have a lot of positive reverting to do…unlike the US stock market where the reversion is likely to be mean indeed.

via Zero Hedge http://ift.tt/1plN3l2 Tyler Durden