By the SRSrocco Report

The U.S. and world economies are in serious trouble. Unfortunately, the majority of analysts continue to put out increasingly worthless forecasts as they fail to understand the true nature of the problem… or rather, the predicament we are facing.

We must remember, problems have solutions while a predicament may be too difficult to solve. According to the Cambridge definition of Predicament:

Predicament: noun[c] /pr??d?k·?·m?nt/: an unpleasant or confusing situation that is difficult to get out of or solve.

With no money and no job, he found himself in a real predicament.

Mankind enjoys slapping itself on the back when it comes up with new technologies to solve problems. However, solving problems with technology in the short run creates even larger problems in the longer run. For example, how does the U.S. Federal Government maintain the massive infrastructure that technology help to create if there aren’t available funds to do so???

You see this is very similar to the example given above in the predicament definition. With no money and no job, he found himself in a real predicament. Some individuals would just scoff at the unemployed person and tell him to get a job at McDonalds or some other high-class establishment. But, what if there were no jobs to be found as was true during the Great Depression?

Furthermore, the employment situation in the United States is much worse than the official estimates put out by the Bureau Of Labor Statistics. If we go by the unemployment measures we used a few decades ago, true U.S. unemployment is closer to 25%. It is just impossible to get all of the 25% of unemployed Americans a job today. So, this is a serious chronic unemployment predicament with no real solution.

Why? Because it all has to do with ENERGY. The following charts and data will provide the precious metals investor the critical reason to own gold and silver.

NOTE: If you haven’t checked out our new PRECIOUS METALS INVESTING PAGE, please do.

The United States Is In Serious Trouble… And Most Americans Don’t Realize It

If you look at the SRSrocco Report Icon on the top left corner of the site, you will see this EROI Red Square with a silhouette of the United States in it. There is a very good reason I designed that graphic to be included in my icon. According to my analysis of the top minds who study the EROI – Energy Returned On Invested, this is the most important factor that controls life as we know it.

If you look at the SRSrocco Report Icon on the top left corner of the site, you will see this EROI Red Square with a silhouette of the United States in it. There is a very good reason I designed that graphic to be included in my icon. According to my analysis of the top minds who study the EROI – Energy Returned On Invested, this is the most important factor that controls life as we know it.

The collapse of the Ancient Roman Empire was attributed to many factors, but the overriding reason was due to the Falling EROI. The Roman Empire grew by acquiring lands and their resources. Some of these resources were stolen wealth from the rich families in the lands the Romans had conquered. However, as the years went by, the Romans conquered less lands, but spent an increasing amount of wealth (energy) to defend what they had.

The collapse of the Roman Empire came as the wealth (energy) needed to keep foreign invaders out as well as the masses happy, exceeded the wealth (energy) the empire could acquire. Thus, the Falling EROI of the Roman Empire (as well as most empires in the past) was the number one cause of its demise.

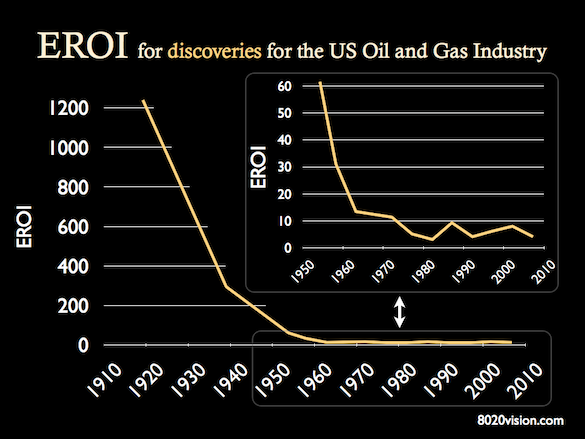

This will also be true for the U.S. Empire. I am not proud to say that, but this is no secret if you read those who research and study the EROI. The following chart was taken from the 8020vision.com website based on a white paper, A New Long Term Assessment of Energy Return on Investment (EROI) for U.S. Oil and Gas Discovery and Production, from scientists Megan Guilford, Charles Hall, Pete O’ Conner, and Cutler Cleveland:

This chart shows the falling EROI – Energy Returned On Invested of U.S. oil and gas discoveries. In 1910, the U.S oil industry was finding more than 1,200 barrels of oil for each barrel of oil (energy equivalent) consumed in the process. The small EROI insert chart shows the huge decline since the 1950’s. At last count in 2007, the U.S. oil and gas industry was discovering five barrels of oil for the cost of one barrel (5/1 EROI) versus the 60+/1 EROI during the 1950’s.

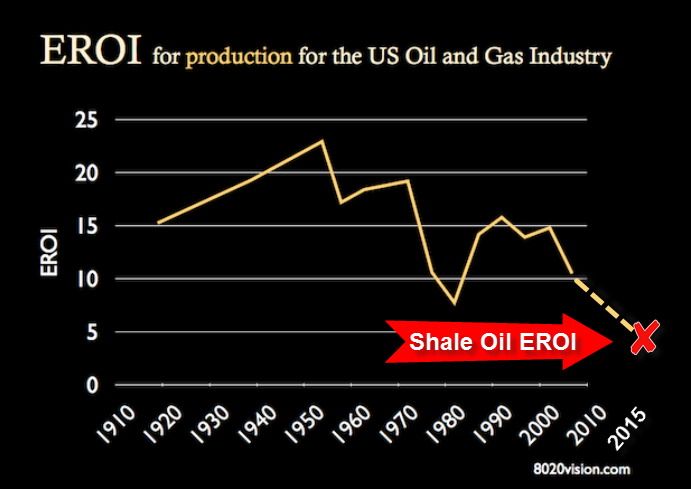

This next chart shows the Falling EROI of U.S. oil and gas production. It peaked in 1950 at an EROI of 23/1 and trended downward to the 5/1 EROI for Shale Oil production today:

The data for the chart ended in 2007. I added the dashed line showing the EROI of U.S. shale oil production. The reason the EROI declined so much in the 1980’s was due to huge increase in drilling activity as the price of oil surged during the 1970’s. Regardless, the EROI of U.S. oil and gas production has experienced a downward trend since the peak in 1950.

Simply put, as the EROI falls, there are less profitable barrels to run the U.S. economy. Charles Hall recently stated that a modern society needed at least a 12/1 EROI of energy to sustain itself. The Shale Oil Industry has provided a much needed liquid energy supply, but the 5/1 EROI of shale oil does not meet the minimum requirements of a modern society.

If we look at these two charts, we can see that EROI of U.S. oil discovery and production fell significantly since the 1950’s. This had a profound impact on the U.S. economy and outstanding debt. Ever since the 1970’s, top paying U.S. manufacturing jobs have been exported overseas. It’s no coincidence that this occurred right at the same time as the U.S. oil discovery and production EROI rapidly declined. Again, please check the small EROI insert chart in the U.S. oil and gas discoveries graph. You can see the collapse of the EROI more readily.

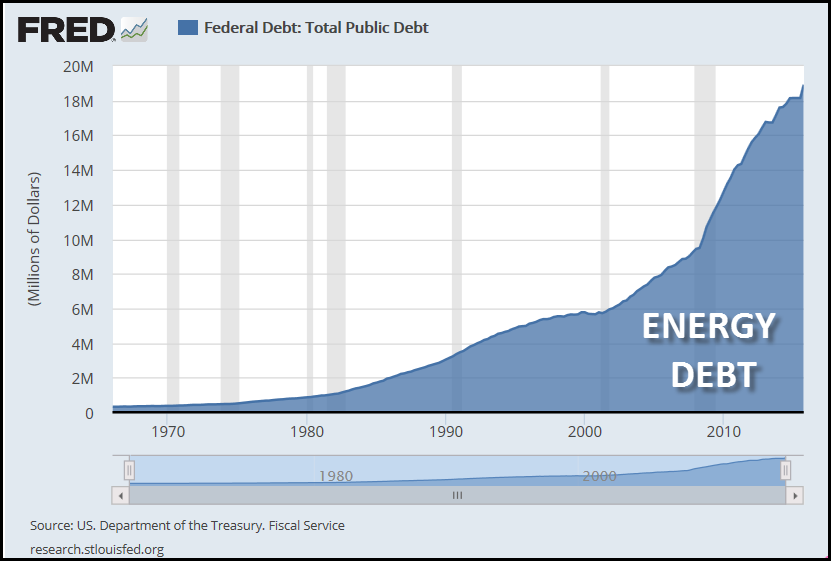

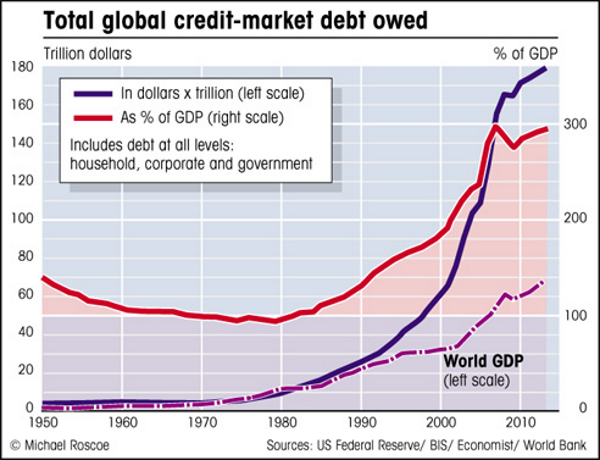

How did the Falling EROI impact the outstanding debt of the United States? Please look at the following chart:

You will notice that the total U.S. debt started to increase in the 1970’s and picked up considerably in the following decades. I labeled the FRED chart as “ENERGY DEBT” because this is exactly what all financial debt should be called. Energy has to be burned to create economic activity to pay back debt. So, all financial debt is actually “ENERGY DEBT.”

Why did U.S. ENERGY DEBT increase so much since the 1970’s?? This was due to the falling EROI of U.S. oil discoveries and production. Basically, the United States economy and system could no longer sustain itself as a commercially viable enterprise with the Falling EROI and declining domestic oil production, so it increased the amount of outstanding debt. Thus, the increased debt is an inverse relationship to the Falling EROI and production of U.S. energy.

It’s that simple folks. However, most analysts don’t understand this as they create all sorts of complicated models and charts showing how the U.S. will continue to grow well into the 22nd Century (2100).

Precious Metals Investors Are Mislead By Faulty Superficial Analysis

One of my readers forwarded the link to a recent article, Getting It Wrong On Silver by Keith Weiner. Mr. Weiner is famous for his gold-silver basis charts which describes the inherent tightness or abundance of metal in the market. While this is a valuable tool for traders who have a half a dozen monitors in front of them looking to scalp profits on short-term movements in the precious metals, it will be worthless for Americans who will be trying to survive as the U.S. oil supply contracts by 70-75% over the next decade.

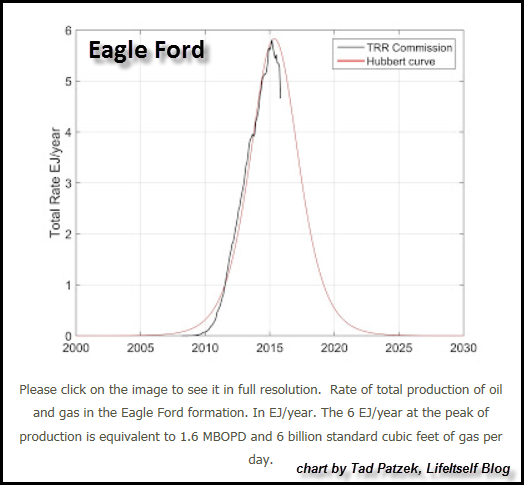

Here is a chart of the largest shale oil field in the United States, the Eagle Ford by Tad Patzek. You can read more about it in my previous article, THE REAL REASON TO INVEST IN PRECIOUS METALS… It’s The Fundamentals.

As you can see, Mr. Patzek forecasts Eagle Ford oil production to collapse back to very little by 2020. This is only four years away. Again, if you check out the link above you can read his vast experience and background in Petroleum Geology.

Unfortunately, Mr. Weiner’s gold-silver basis charting analysis wont put food on the table when the complex supply chain system disintegrates due to the collapse of U.S. energy production. However, owning physical gold and silver at this time could help considerably.

Mr. Weiner brings up several NO-NO’s written about silver in a Bloomberg article that is no longer available at the link he provided. One of the items Mr. Weiner tries to debunk in his article is the subject of “STOCK to FLOWS.” Here is his commentary:

Mankind has been accumulating silver for many thousands of years. Unlike gold, some of it is consumed. Unlike any ordinary commodity, most of it is not. Economists call this the ratio of stocks to flows — inventories divided by annual production.

In gold and silver, stocks to flows is measured in decades. In ordinary commodities, it’s months. In wheat, crude oil, or lithium if inventories build up too much, that is called a glut. The price crashes until the glut is worked off.

There is no such thing as a glut in gold or silver, nor a shortage. This is part of what makes them money.

Mr. Weiner is making the point that there is no real shortage of silver or gold. He states that the analysis showing a decline in global silver production is meaningless because there is so much above-ground available silver. As he states, “Mankind has been accumulating silver for many thousands of years.”

While Mr. Weiner is correct that Mankind has been accumulating a lot of silver for thousands of years, it has also been accumulating a massive amount of debt over the past 40 years. When the Roman Empire collapsed, it may have debased its currency to continue business as usual as best it could, but it didn’t have much debt.

This is much different scenario for the U.S. and world today. Here is a chart of total World debt:

Unfortunately, Keith Weiner doesn’t factor in this debt when he produces his gold-silver basis charts. I imagine Mr. Weiner believes this debt will continue to head exponentially until it reaches Mars or Pluto.

Think about this for a minute. Gold and silver are real stores of wealth, while paper assets and debt’s are ENERGY IOU’s. Moreover, most assets are really debts to be paid in the future. Think about all the Pension Plans we are now hearing about that are underfunded. How about the viability of Social Security in 5-10-20 years?? Or how about all the 401K’s that Americans believe are going to be fully funded when they retire in say five or ten years??

How on earth do Americans think they will receive their monthly payment from a 401k, Pension plan, IRA or etc if U.S. energy production declines by 70- 75% in the next decade. And don’t forget about the falling EROI.

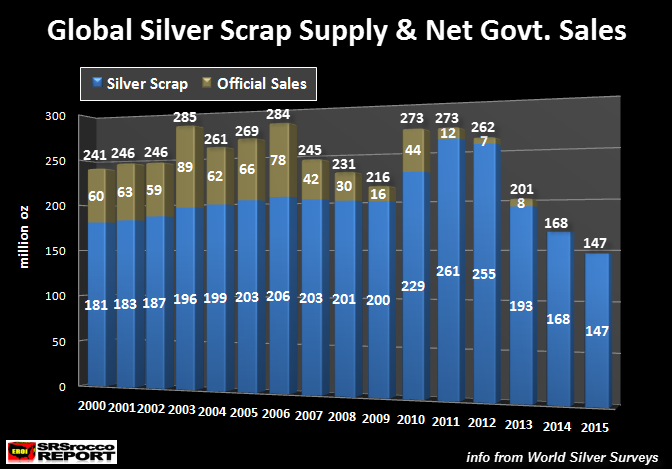

Okay, let’s get back to silver. Here is a chart I just made to show how much silver came on the market each year due to scrap supply and net Govt sales:

You will notice a few interesting trends in the chart above. First, total supply from these two sources peaked in 2003 at 285 million oz (Moz) and has been trending lower. The majority of Government Silver sales came from China, Russia and India since 2000 (ironic aye, the very same countries acquring the most gold today). However, Official Govt silver sales were ZIP in 2014 and 2015.

Secondly, even though the high silver price in 2011 and 2012 brought about a larger scrap supply, the total for those years didn’t surpass 273 Moz. In regards to total global above ground silver stocks, I have seen the following estimates by the CPM Group:

3 billion oz Silver bullion & coins

24 billion oz Jewelry, Decorative & Religious

27 billion oz Total

So, if we assume the 27 billion oz figure is correct of all the public and private held silver in the world, then in 2011 only 273 Moz of silver came into the market when the price nearly touched $50. Thus, only 1% of total world STOCKS came into the market when the price of silver reached $50. That is not an impressive figure at all if we are discussing silver stock to flows.

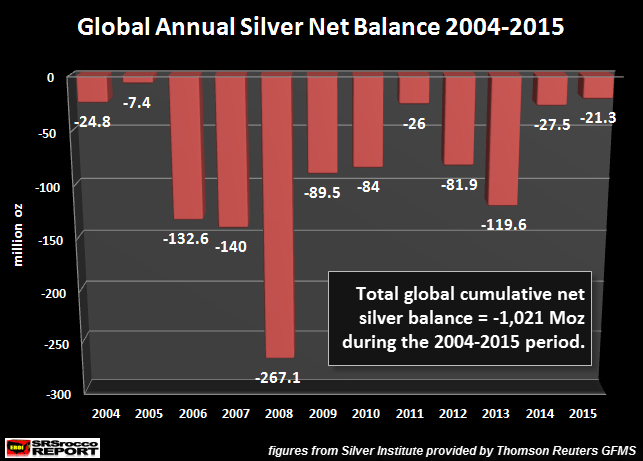

Of course there are likely other silver stocks we don’t know about that have been supplementing the one billion oz cumulative global supply deficit since 2004.

However, those stocks are likely declining as Central Banks are no longer dumping silver on the market. This is also true for gold as well.

Truth be told, the STOCKS to FLOWS factor will become totally meaningless when investors start moving out of increasing worthless paper assets and into physical gold and silver to protect wealth due to the decline of U.S. and world energy production.

As I explained above, the Falling EROI has been creating havoc on the U.S. economy since the 1970’s. Americans have enjoyed a 40 year reprieve due to the U.S. Petro-Dollar arrangement and the exporting of high-paying manufacturing jobs overseas. Unfortunately, this is not a sustainable business model. Either is the $19+ trillion in debt.

Precious metals investors need to understand the difference between short-term superficial analysis that provides traders with scalping profits versus the mid to longer term fundamentals that suggest owning physical precious metals in the troubling times ahead.

As more investors wake up to the upcoming economic and financial collapse, the need to analyze the gold-silver basis will no longer be necessary or relevant. Shortages of the precious metals will occur in the future (even though Mr. Weiner may disagree) as investors move into physical gold and silver to protect wealth.

Lastly, the days of earning interest, dividends or scalping profits are growing short. Keep an eye on the Falling EROI and world energy production for the key going forward.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter, Facebook and Youtube below:

via http://ift.tt/1O3tCU6 SRSrocco