One week after unveiling its latest monetary easing in the form of an RRR cut, China unveiled yet more stimulus, this time fiscal, announcing it will cut taxes “on a larger scale,” increasingly relying on tax cuts as the first line of defense against a slowing economy, in a departure from the infrastructure binges of the past. And while this was sufficient to boost global equities overnight, and helped push most global markets into the green…

… much of the rally fizzled as US equity futures trimmed half of their overnight gains…

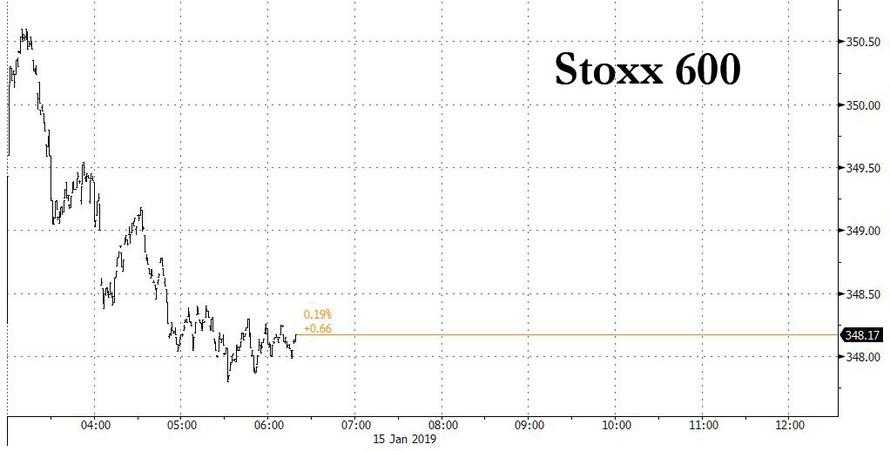

… while European stocks were almost unchanged after starting off sharply higher.

Earlier, Asian stocks rose on Tuesday, supported by a bounce in Chinese shares amid hopes for government stimulus following the latest dismal Chinese trade data. MSCI’s index of Asia-Pacific shares ex-Japan recovered from early losses and advanced 1.3%. South Korea’s Kospi hit a one-month high and Japan’s Nikkei added 1 percent as the USDJPY rebounded in early trading.

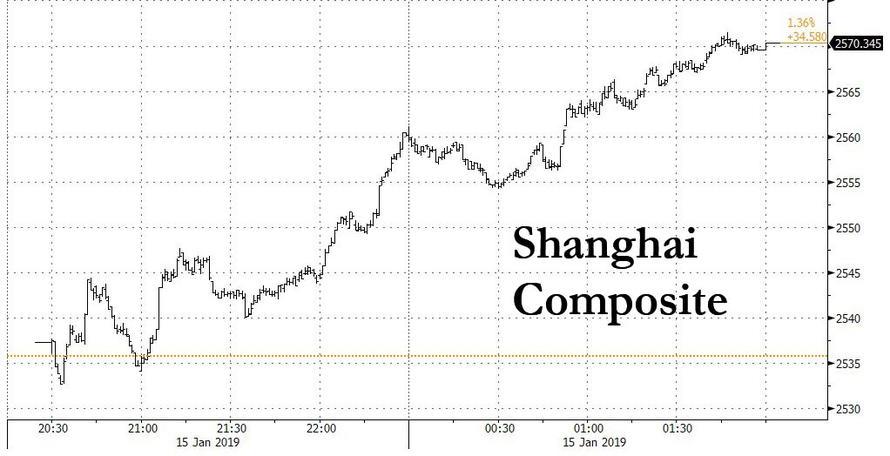

In China, the CSI300 index of Shanghai and Shenzhen shares was up 1.7% amid expectations of more government policy measures to prop-up a slowing economy while lending data from the country beat estimates in December. The Shanghai Composite closed at session highs, up 1.4%.

China’s state planning agency said on Tuesday it will aim to achieve “a good start” in the first quarter for the economy in a signal of more growth-boosting steps. State television also quoted Chinese Premier Li Keqiang as saying the government is seeking to establish conditions helpful to meeting this year’s economic goals.

As Bloomberg notes, the potential stimulus in China and warm welcome it received from markets reflects the delicate balance underpinning 2019’s risk-asset rebound: The same weak macro data that prompted a sell-off at the end of last year has the potential to spur looser monetary policies and therefore ignite a rally.

Cyclical shares led the gains in Asia-Pacific, with Australian financial shares at their highest since early December while Japanese electronics and machinery makers shares rose to their best levels in six weeks. “It is interesting that cyclicals are leading the gains today. It appears some contrarian investors are starting to buy cyclicals, looking beyond the last economic slowdown,” said Nobuhiko Kuramochi, chief strategist at Mizuho Securities. “But I would suspect there will be heavy selling if we go up further, to around 2,650 in the S&P500 and 21,500 in the Nikkei,” Kuramochi added.

The rally carried over to Europe with the Stoxx Europe 600 Index still higher for the fifth day in six, though the rally fizzled as the session progressed as traders discounted China’s latest promise stimulus.

Gauges in Hong Kong and Shanghai were among the biggest gainers after senior Chinese officials vowed tax cuts to boost growth,

Contracts on the S&P 500, Nasdaq and Dow Jones indexes all rose, with the EMini briefly breaching the 2,600 resistance level before heading lower.

The dollar strengthened and the yen fell. The euro dropped after German data confirmed the weakest year for growth since 2013 although after German GDP dipped 0.2%, the Federal Statistics Office said the country had narrowly avoided a recession.

Treasuries edged higher as most European bonds gained. The sterling braced for the vote in parliament over the British government’s plan to exit the European Union.

However, despite a barrage of bank earnings, the British pound is expected to steal the limelight later in the day as the Britain’s parliament votes on the proposed Brexit deal. On Monday, May urged lawmakers to take a “second look” at her deal, which lawmakers are expected to reject. Such a result could produce a wide range of outcomes, from a disorderly exit from the union to a reversal of Brexit.

“Markets have priced in a rejection of May’s plan and there are many scenarios after that. Still I’d think the most likely outcome is to extend the (March 29) deadline of Brexit,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management.

Indeed, currency option markets are barely pricing in the chances of sharp moves in sterling. The pound’s one-month implied volatility stood at 12.625 percent, above the average for the past year of around 8.8 percent well off 20-percent plus levels seen in the days just before the UK referendum on June 23, 2016.

The pound dropped below $1.29, having hit a two-month high of $1.2930 on Monday after a report, subsequently denied, that a pro-Brexit faction of lawmakers could support May’s deal. Additionally, Germany denied reports that German Chancellor Merket offered concessions to UK PM May; following reports that German Chancellor Merkel has offered PM May certain last-minute assistance, while reports also noted that PM May is considering a 2nd vote on Brexit deal if first one is rejected. German Foreign Minister Maas later said that if the current deal is rejected by UK parliament there could be new talks with the EU. UK cabinet ministers suggested that PM May will be expected to stand down if she is heavily defeated in the Brexit vote, according to source report.

UK Labour MP Benn has confirmed he has pulled amendment this morning as part of an effort by Labour party to table vote of no confidence this evening. The amendment, if passed, would reject the withdrawal agreement, convey a lack of support for no deal and pave the way for MPs to put forward alternative plans for Brexit. Opposition for the amendment comes from Labour leadership believing that it’s passage would offer PM May the opportunity to pull her deal, therefore sparing her a crushing defeat. Furthermore, Sky analysis believes that the UK Government are to lose the meaningful vote by 226 votes.

In geopolitical news President Trump is said to have sent a letter to North Korea leader Kim and reports also noted North Korean official Kim Yong Chol may visit Washington D.C. this week regarding a 2nd Trump-Kim summit. Furthermore, it was also reported that US Secretary of State Pompeo may conduct talks this week with North Korea. Additionally, US President Trump tweeted that he spoke with Turkish President Erdogan in which topics discussed included economic development between US and Turkey, while he also suggested that there is great potential for a significant expansion.

China’s Foreign Ministry says facts show China is safe and Canada has arbitrarily detained foreign citizen; adding that the Canadian side can abandon prejudices and quit making irresponsible remarks. Adding that it is clear the Huawei Executive Meng’s case is not normal and is an abuse of legal procedures

Elsewhere in commodities, oil prices also rebounded on supply cuts by producer club OPEC and Russia. International Brent crude oil futures were at $59.80 per barrel, or 1.37 percent from their last close.

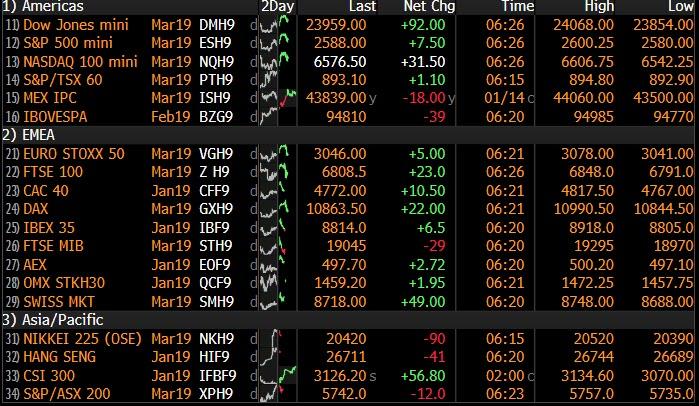

Market Snapshot

- S&P 500 futures up 0.3% to 2,588.75

- STOXX Europe 600 up 0.4% to 349.02

- MXAP up 1.1% to 152.24

- MXAPJ up 1.4% to 492.62

- Nikkei up 1% to 20,555.29

- Topix up 0.9% to 1,542.72

- Hang Seng Index up 2% to 26,830.29

- Shanghai Composite up 1.4% to 2,570.34

- Sensex up 1.2% to 36,281.60

- Australia S&P/ASX 200 up 0.7% to 5,814.56

- Kospi up 1.6% to 2,097.18

- German 10Y yield fell 2.6 bps to 0.205%

- Euro down 0.3% to $1.1432

- Italian 10Y yield fell 1.1 bps to 2.483%

- Spanish 10Y yield fell 3.5 bps to 1.384%

- Brent futures up 0.9% to $59.52/bbl

- Gold spot down 0.3% to $1,288.12

- U.S. Dollar Index up 0.2% to 95.84

Top Overnight News

- British and European Union diplomats are now working on the assumption that the U.K. will leave the bloc later than the planned exit date of March 29 if Prime Minister Theresa May loses Tuesday’s Brexit deal vote in Parliament

- China’s government is turning increasingly to tax cuts as the first line of defense against a slowing economy, in a departure from the infrastructure binges of the past

- China’s credit growth exceeded expectations in December, with the second acceleration in a row indicating the government and central bank’s efforts to spur lending are having an effect

- Germany’s economy narrowly avoided a recession at the end of 2018 after a slump in industry raised concerns over Europe’s growth engine

- Swedish Social Democrat leader Stefan Lofven has one day to form consensus for a new government

- Donald Trump and Turkish President Recep Tayyip Erdogan spoke by phone and tamped down their public rhetoric Monday after the U.S. president warned the country risked economic ruin if it defies him. Wild lira ride awaits if the central bank cut rates

- OPEC and its allies plan to hold a meeting in March to assess their oil-production accord in Azerbaijan, and then ministers will gather to set policy in April, according to the organization’s top official

- Kim Jong Un told the world this month that North Korea took steps to stop making nuclear weapons in 2018, a shift from his earlier public statements. The evidence shows production has continued, and possibly expanded

Asian equity markets were mostly higher as sentiment in the region recovered from the recent China-triggered weakness that had been due to disappointing trade data which dragged the US major indices to their first consecutive loss of the year. Nonetheless, risk appetite improved overnight with both ASX 200 (+0.7%) and Nikkei 225 (+0.9%) positive, in which the latter recovered from early selling pressure as it initially tracked the prior day’s losses on return from its long weekend. Elsewhere, Shanghai Comp. (+1.4%) and Hang Seng (+2.0%) were underpinned amid a deluge of comments from Chinese agencies including the Finance Ministry which stated that China will implement larger tax and fee cuts, while the NDRC said China will continue implementing proactive fiscal policies. In addition, the PBoC conducted a respectable liquidity injection of CNY 180bln but expects a rapid decline of banking liquidity in the approaching days, while there were also hopes for an improvement in the trade environment after reports that super tankers carrying 6mln bbls of crude left the Texas coast and are likely heading to China. Finally, 10yr JGBs were subdued as the gains in stocks sapped demand for safe-havens and following the recent similar pressure in T-notes, but with losses stemmed amid the BoJ’s presence for JPY 1tln of JGBs with maturities spread across the curve.

Top Asian News

- China’s Yuan Defies Dismal Economy to Head for Six-Month High

- China Is Making Tax Cuts the Key Weapon Against the Slowdown

- China Adding Stimulus Emboldens Asia Stock Traders to Hit ‘Buy’

- UBS Asset Turns Bullish on Junk China Property Dollar Bonds

Major European indices are relatively flat [Euro Stoxx 50 +0.1%] as equity markets gave up initial gains post German FY GDP of +1.5%. Marginal underperformance is seen in the FTSE MIB (-0.2%) where banking names such as UBI Banca (-5.7%), Bper Banca (-4.3%) and Banco BPM (-3.8 %) are at the bottom of the index following the ECB asking Italian banks to set aside additional money to fully cover impaired loans by 2026. Sectors are similarly all in the green, with outperformance in materials and industrials. Other notable movers include gambling names after the US Justice Department stated that all online gambling is now illegal; as such William Hill (-1.6%) and Paddy Power (-1.8%) are in the red. At the bottom of the Stoxx 600 are Provident Financial (-18.0%) following the Co stating that they expect 2018 profits to report towards the lower end of market expectations.

Top European News

- Draghi Readies for First New Year Speech as Economy Falter

- Brexit Donor Hargreaves Says U.K. May’s Deal Should Be Rejected

- Hungary Faces Price Dilemma as Core Inflation Quickens Again

- Russia Has Room to Cut Dollar Reserves by Another $35b, ING Says

In FX, EUR largely on the backfoot amid a strengthening Dollar and following the release of German annual GDP which printed in-line with forecasts at 1.50% Y/Y, the weakest performance in five years with market participants noting that a German technical recession could have been narrowly missed (with the Q4 release scheduled on 14th Feb). EUR/USD sits around the bottom of a 1.1423-91 band ahead of a double-Draghi day, his first speech however provided little in way of monetary policy commentary. Back to the dollar, DXY received a wave of demand shortly after the German numbers with DXY spiking to highs of around 95.900 from overnight lows of 95.450 with State-side news flow on the light side.

JPY, CHF – Conforming more to the bout of dollar strength rather than an unwind in safe-haven positions with both USD/JPY and USD/CHF higher by around 0.4% on the day ahead of the Brexit meaningful vote. USD/JPY advances further above 108.00 after having reclaimed the handle during overnight trade and currently resides nearer to the top of a 108.15-75 range ahead of a Fib a 109.16 with little to report on the options expiry front. Similar action with the Franc as USD/CHF breached 0.9850 to the upside ahead of its 100 and 200 DMAs at 0.9878 and 0.9889 respectively.

- GBP – Choppy session for the Pound thus far as traders eye the long-awaited House of Commons meaningful vote scheduled for later today (full schedule available on the headline feed), as PM May attempts to accumulate MP backing to pass her deal. According to the Sun’s Political Editor, Senior Tories believe the Premier is poised for a 150-160 vote defeat tonight, though a list of amendments will be released at the start of the Parliamentary session around 12.45GMT with special focus on Murrison amendment (setting an expiry date of 31st December 2021 to the NI backstop) as a way of snatching a narrow defeat. Tory Brexiteers and the DUPs are known to not support a deal which includes a timeless backstop or a unilateral exit clause, Murrison’s amendment seeks to readdress this and if passed, may shore up some support from the rebels, DUP are said to have rejected this amendment in belief the EU will not be bound by the expiry date. Earlier in the day Hilary Benn’s amendment was pulled out amid the opposition leaders’ desire for PM May to suffer a crushing defeat (the amendment, if it was to be passed, would have rejected the withdrawal agreement, convey a lack of support for no deal and pave the way for MPs to put forward alternative plans for Brexit). As such, Cable pared back overnight gains and gave up the 1.2900 handle to test the psychological (and 50 HMA) at 1.2850 to the downside and currently resides at the bottom of a 1.2831-1.2915 intraday range. Meanwhile, Morgan Stanley assumes that Cable at current levels is pricing in a lot of uncertainty and assumes GBP/USD to reach 1.30 in around 6-month and 1.50 by year-end as Cable’s PPP fair value estimate stands at 1.40.

In commodities, Brent (+1.7%) and WTI (+1.6%) are higher as the risk tone improves from the Chinese-trade sparked downturn seen in yesterday’s session, with prices just under the USD 60/bbl and USD 51/bbl respectively. Focus is on the API weekly release later in the day, where crude oil inventories are expected to have declined by 2.5mln/bbl; separately, the EIA are to release their Short-Term Energy Outlook today which contains their expanded forecast discussion. Saudi Energy Minister Al Falih says he sees oil demand growth for the foreseeable future, and that the 1.2mln BPD OPEC+ cut will have a strong impact which will take some time to be reflected within the market. Gold (-0.1%) prices are down as the demand for safe havens has declined with the improvement in risk sentiment; with the yellow metal trading towards the bottom of its USD 5/oz range. Elsewhere, the US Senate are to begin voting today on a resolution which criticises the Trump administration’s decision to reduce sanctions on companies which are connected to Russian oligarch Deripaska; which includes aluminium company Rusal.

US Event Calendar

- 8:30am: Empire Manufacturing, est. 10, prior 10.9

- 8:30am: PPI Final Demand MoM, est. -0.1%, prior 0.1%; PPI Ex Food and Energy MoM, est. 0.2%, prior 0.3%

- 8:30am: PPI Ex Food, Energy, Trade MoM, est. 0.2%, prior 0.3%;PPI Ex Food and Energy YoY, est. 2.95%, prior 2.7%

DB’s Jim Reid concludes the overnight wrap

If you want to depress yourself this morning read the guidance from the British Nutrition Foundation released yesterday which suggested that for optimum health food portion sizes should be measured by hands, thumbs and fists. After reading it I indeed wanted to use my fists but not for the reason intended by the author.

As examples, if you’re having jacket potatoes the correct portion size is a clenched fist (I might try to use Mike Tyson’s). For cheese it should be the size of two thumbs (I note that the largest thumb ever recorded was a Chinese man who had one measuring 10.2 inches), for pasta or rice two handfuls is the recommended amount (I shall resort to wearing wicket keeping or baseball gloves while cooking). All rather depressing. Maybe instead you should join me in “Dry January”. Yes this month I shall only be indulging in dry white wine, dry champagnes, dry martinis, dry sherry and dry gins and tonics.

You may need a stiff drink to work out what happens next after tonight’s Brexit vote in the House of Commons. On timings the vote is due to take place after the debate finishes at 7pm GMT with votes on amendments coming first. In all likelihood the vote looks set to fail given that PM May has failed to secure the necessary support from MPs in recent weeks. DB’s Oliver Harvey estimates a 20% probability of May resigning post the vote (or cabinet collectively withdrawing support) and an 80% chance of her staying on as leader. In the case of the latter, the government will have to provide an updated strategy by Monday after last week’s surprise amendment that voted to shorten it from over three weeks to three days.

Throwing all the balls into the air, DB’s Oli Harvey believes there are five corresponding scenarios. The most likely scenario (at a 30% probability) is May pivots towards a cross party consensus on a new mandate which would instruct the government to renegotiate the Political Declaration on the Future Relationship towards a softer relationship. For this to be reached, it might be necessary for the Labour Party to call, and lose, a vote of no confidence in the government first. A small extension on Article 50 is probably necessary for this scenario as well as another round of EU negotiations. The other four scenarios are; a 10% chance of May using multiple votes to force through the existing deal in the face of a crash Brexit, a 15% chance of a second referendum, a 15% chance of a new election and a 10% chance of no deal/crash Brexit. Regarding the worst case latter scenario, the news that the EU appears prepared to extend Article 50 to July or beyond does appear to be a material positive to lowering the odds of no deal at all. Anyway more in Oli’s note from yesterday here .

Ahead of vote today on PM May’s deal, the Commons Speaker, John Bercow will select amendments from those suggested by MPs. The amendments to be considered range from Labour’s, which rejects the current deal while also repudiating a no-deal Brexit and calling for the Government to examine all available options, to the Lib-Dem’s, which calls for a second referendum. A vast majority of others are related to the Northern Ireland backstop arrangement with the Conservative MP Andrew Murrison calling for an amendment that would put a time limit on the Northern Ireland backstop, aimed at reducing the scale of the expected government defeat. Meanwhile, Labour MP Hilary Benn is withdrawing his amendment, which had cross-party support and rejected both the current deal and a no-deal outcome (similar to Labour’s proposal). Mrs May is reportedly considering amendments which would put time limits on the Northern Ireland backstop, in an effort to regain support from the DUP. Such a framework has already been rejected by the EU, so it’s not clear how useful a winning vote on this would be. Sterling is up +0.26% in early trade this morning ahead of today’s vote.

Onto markets and for only the third time this year US equities closed lower across the board yesterday as that soft trade data out of China in the morning, in addition to a bit of general fatigue for risk assets following the recent strong run, appeared to be enough of an excuse for investors to pull back a little. The S&P 500, NASADQ and DOW closed -0.53%, -0.94% and -0.36% respectively although at one stage it looked like it might have been worse firstly with PG&E (-53.36%) taking the wider utilities sector (-2.23%) down after announcing plans to file for Chapter 11 and then Citigroup reporting lower than expected Q4 revenues. However, the latter never really fed its way through to the wider banks sector with Citi’s shares, actually closing up +3.95% after the CEO said that conditions have improved so far in January. Plus, digging into the results, credit quality improved for both corporate and consumer loans, and expenses declined. The wider S&P Banks sector ending +1.36% in what was a rare bright spot for the broader index. JP Morgan and Wells Fargo, two of the three largest US banks by market cap, are due to report earnings later today.

Meanwhile, US HY cash spreads edged +4bps wider, while 10-year Treasury yields traded flat. Two-year yields rallied -0.6bps, helping the 2s10s curve to steepen slightly at 16.5bps and more or less in the middle of the range since the start of December. The USD was a touch weaker, as Fed Vice Chair Clarida reiterated his recent guidance in an interview. He said the Fed can afford to be patient and assess policy “meeting by meeting”, so continuing to signal no immediate urgency to raise rates. WTI oil ticked down -1.61% to mark the first two-day decline for oil this year.

A quick refresh of our screens this morning indicates that risk-on is back in Asia with the Nikkei (+0.80%), Hang Seng (+1.54%), Shanghai Comp (+0.96%) and Kospi (+1.31%) all up as China indicated that it will cut taxes “on a larger scale” to help support its slowing economy, according to agreements reached by top leadership at the economic work conference last month. China’s onshore yuan is up +0.23% alongside most Asian currencies. Elsewhere, futures on the S&P 500 are up +0.58% while crude oil prices (WTI +1.15% and Brent +1.12%) are also trading higher.

Aside from the China data yesterday, the only other major release of note came in Europe with the November industrial production reading for the Euro Area. The data was worse than feared at -1.7% mom (vs. -1.5% expected) and means the year-on-year reading is now down to -3.3% and the lowest since 2012. In Germany, wholesale prices fell -1.2% mom, the sharpest drop since 2014 and the second sharpest since 2009. There is increasing chatter about a technical recession being possible in Germany for Q4 and Q1 so data like this isn’t helping rule that out.

To the day ahead now, where the early data releases in Europe this morning include the final December CPI revisions in France and the final 2018 GDP reading for Germany. For the latter the consensus is expecting a 1.5% increase in real GDP after 2.2% in 2017 (our economists forecast 1.6%). Also out this morning is the November trade balance for the Euro Area, while this afternoon in the US, we’ve got the January empire manufacturing print and December PPI report. The latter is expected to show a -0.1% mom decline in the headline and +0.2% mom increase for the core. Away from the data, we’re due to hear from ECB President Draghi this afternoon, followed by Fed officials Kashkari, George and Kaplan later on. Needless to say the aforementioned Brexit vote this evening will be a big focus while the key companies reporting earnings include JP Morgan, Wells Fargo, Delta Airlines and UnitedHealth.

via RSS http://bit.ly/2RTtEtE Tyler Durden