To anyone who carefully read yesterday’s dismal Citi earnings report, which was a major disappointment in virtually every way and especially in the bank’s FICC group, with the exception of Citi’s core lending business which traders decided to focus on and push Citi’s stock price 4% higher, today’s disappointing JPMorgan results should not come as a surprise.

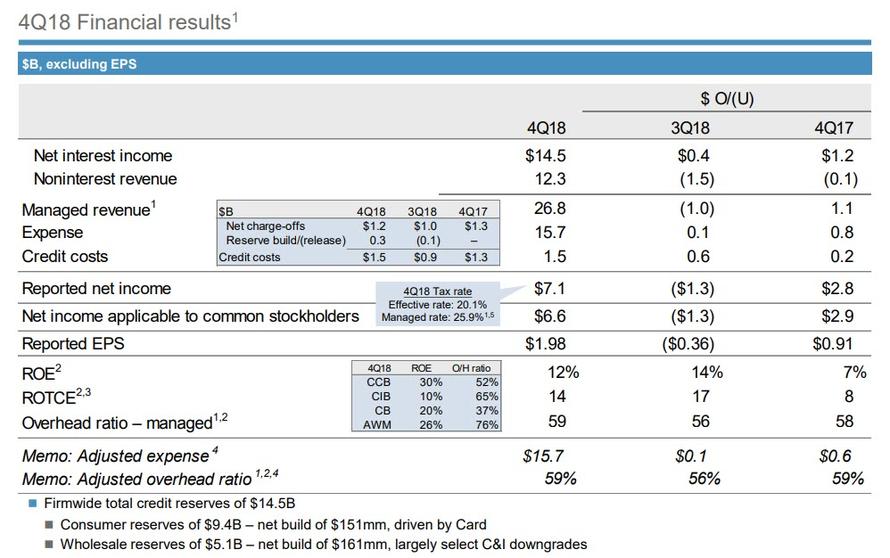

Actually, JPMorgan Q4 results were even worse than Citi’s as they were a disappointment across the board, with both reported revenue of $26.1BN and “managed” revenue of $26.8BN missing consensus expectations of $26.9BN, while EPS of $1.98 was not only well below the $2.20 consensus, but was also the first JPM earnings miss in nearly five years.

While JPM also posted a modest increase in Net Interest Income, which rose $1.2BN Y/Y to $14.5BN, noninterest income for the largest US bank declined $0.1BN to $12.3BN Y/Y and also declined $1.5BN Q/Q.

JPMorgan also reported 4Q compensation expenses $7.81 billion, right on top of the estimate $7.81 billion; while the 4Q provision for credit losses of $1.55 billion was surprisingly higher than the estimate $1.31 billion. The bank also reported a firmwide net reserve build of $15mm – net build in Consumer of $54mm and net release in Wholesale of $39mm.

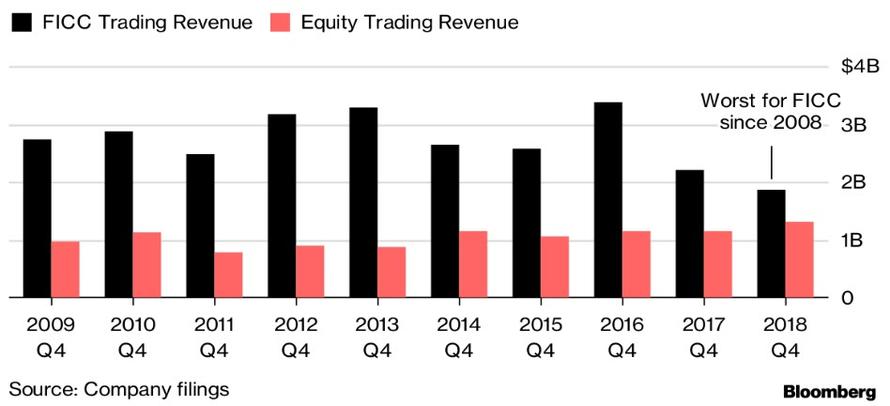

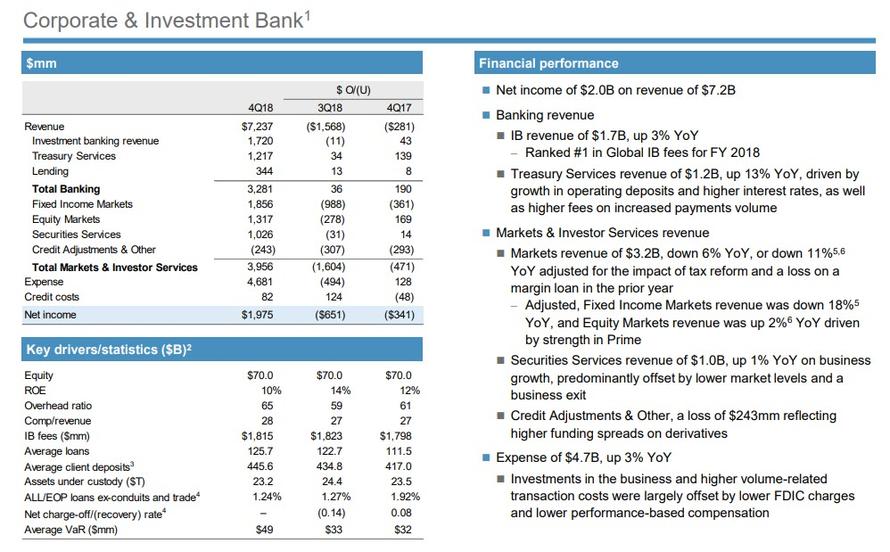

But while the top and bottom-line miss were hardly what the market was expecting, what has slammed JPM stock this morning is the huge miss in the bank’s trading group, with 4Q FICC sales & trading revenue of just $1.86 billion, down $361MM from a year ago (and $1.0BN from Q3) and far below the estimated $2.29 billion. And while equity sales & trading revenue was in line, printing at $1.32 billion or right on top of the estimate $1.32 billion (if also down $278MM from Q3), the FICC plunge stole the show with the worst Q4 FICC trading revenue since the financial crisis.

Elsewhere in the bank’s investment bank group, 4Q investment banking revenue of $1.72 billion also missed estimates of $1.77 billion, virtually unchanged from a year ago.

Commenting on these disappointing trading results, JPM said that markets revenue of $3.2B was down 6% YoY, or down 11%YoY adjusted for the impact of tax reform and a loss on a margin loan in the prior year. Adjusted, Fixed Income Markets revenue was down 18% YoY, and Equity Markets revenue was up 2% YoY.

Surprisingly, JPM also reported a $243MM Credit Adjustments loss “reflecting higher funding spreads on derivatives.” We hope to learn more on what this was for during the earnings call.

Meanwhile, even as trading revenue tumbled, JPM reported Ibanking expense of $4.7B, up 3% YoY reflecting investments in the business and higher volume-related transaction costs, which however were offset by lower FDIC charges and lower performance-based compensation.

While the rest of the earnings were generally uneventful, it is worth noting (especially with Wells about to report) that JPM’s Q4 mortgage origination volume was $18.7BN in Q4, down 30% from $26.6BN in Q4 2017 as mortgage activity continues to collapse across the industry.

And in another potential warning sign, home Lending numbers were also unexpectedly weak, with net revenue down 8 percent to $1.3 billion, “driven by lower net production revenue on margin compression and lower volumes.”

Not surprisingly after what was easily the worst earnings report for JPM in over four years, the stock has tumbled.

And as we await Wells Fargo’s earnings due out shortly, here is JPM’s full earnings presentation.

via RSS http://bit.ly/2FA8hqY Tyler Durden