All eyes were on industrial bellwether Caterpillar’s Q4 earnings this morning for confirmation whether the China slowdown is indeed trickling down into China-facing US companies (after China reported overnight that total industrial profits posted a second consecutive Y/Y decline in December, sliding -1.9% vs -1.8% in November), and that’s precisely what CAT reported, when it announced Q4 EPS of $2.55, a huge miss to expectations of $2.99, on revenue of $14.3BN, also slightly below the $14.36BN expected.

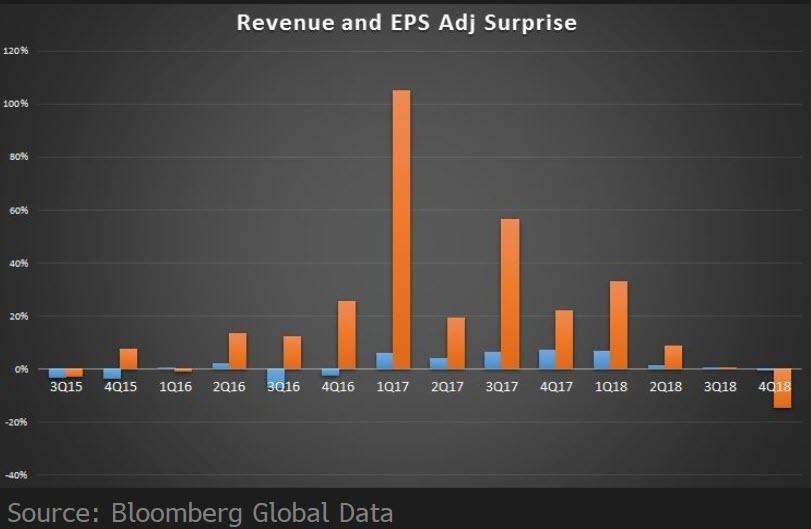

While the numbers were not a disaster on a comparable basis, with sales up 11% from a year earlier, while adjusted EPS also rising 18% from Q4 2017, the EPS miss was the biggest in over 3 years as Wall Street failed to adjusted its expectations lower for what is clearly a China slowdown story.

Some more troubling highlights from the report via Bloomberg:

- For 2018, the mark-to-market adjustment on pension and OPEB plans was a net loss of $495 million, primarily due to lower than expected returns on plan assets, partially offset by higher interest rates

- During the fourth quarter of 2018, CAT recognized a $50 million increase to the estimated charge for the cost of mandatory deemed repatriation of non-U.S.

- Dealer machine and engine inventories increased about $200 million during the fourth quarter of 2018

- At the end of the fourth quarter of 2018, the order backlog was $16.5 billion, about $800 million lower than the third quarter of 2018

Just as troubling as the huge historical miss was the company’s guidance, with the company now expecting “2019 profit to increase to a range of $11.75 to $12.75 per share”, which is dangerously on the low end of Wall Street’s consensus of $12.72

Adding to investor angst, the company said that after several quarters of stellar growth, CAT is now assuming “modest sales increase based on the fundamentals of our diverse end markets as well as the macroeconomic and geopolitical environment.”

Sure enough, just like Apple, CAT was quick to blame… who else: “Sales in Asia/Pacific declined due to lower demand in China, partially offset by higher demand in a few other countries in the region” the company said in its earnings reports, adding that “unfavorable currency impacts also contributed to the sales decline.”

It was not all bad news, however, with the company making the following comment on the energy sector where Caterpillar is a major supplier of pumps and engines, noting that oil and gas-related sales were up due to higher engine demand, citing oil and gas-related activities helping construction equipment demand in North America. All this despite the big dip in oil prices during the fourth quarter.

Furthermore, despite concerns that a global trade war will hurt demand for industrial metals, miners are still spending. Caterpillar said “mining activities were robust as commodity market fundamentals remained positive.” Although judging by the EPS miss, just not “positive enough.”

There was another troubling note in the CAT Financial results, where the company’s Financial Products’ operating profit was lower primarily “due to an increase in the provision for credit losses, which was mostly driven by a $72 million unfavorable impact from an increase in allowance rate and an increase in write-offs of $13 million, due to continued weakening in the Cat Power Finance portfolio. “

Despite, or perhaps due to the slowdown in the business, CAT was even busier repurchasing stock, and in Q4 Caterpillar repurchased $1.8 billion in company stock, and $3.8 billion for the full year.

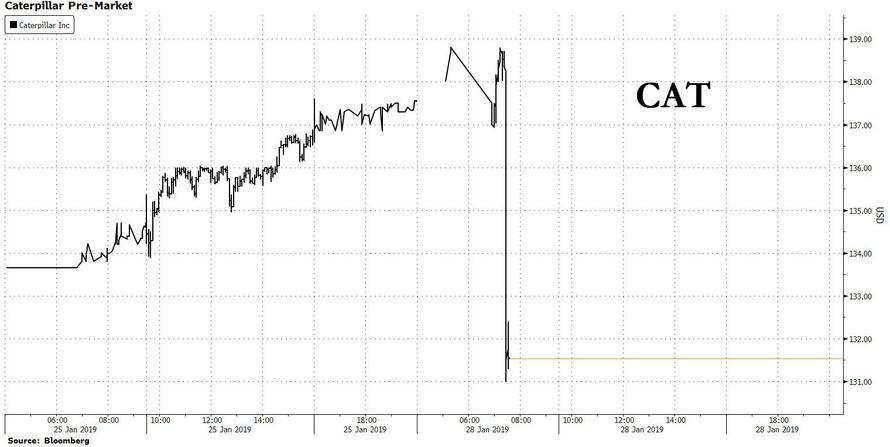

And after what may be the first big earnings miss of the quarter – aside from Apple’s guidance cut of course at the start of the year – CAT stock is tumbling more than 5%…

… and is not only dragging its peers such as Deere and CNH Industrial lower by more than 1.5%, but has also hit the Dow Jones index, adding over 50 points in losses to the industrial index.

via ZeroHedge News http://bit.ly/2RUbpW5 Tyler Durden