Vale SA, the world’s largest iron ore miner, suspended its planned shareholder dividends, share buybacks and executive bonuses as it braces for the financial fallout from a Friday catastrophe in which a dam breach left at least 58 people dead and more than 300 missing. Vale’s board of directors also created independent committees to investigate the causes of the Friday dam burst in the state of Minas Gerais and monitor relief efforts in the devastated town of Brumadinho and surrounding area.

As Bloomberg notes, the collapse of a tailings dam at the Feijao mine in the rural state of Minas Gerais is Vale’s second fatal disaster since 2015, when the Samarco mine spewed billions of gallons of waste. More importantly for investors, Mayor Avimar de Melo of the city of Brumadinho, which was partly leveled by the spill, is seeking millions in damages and blamed Vale’s “incompetence” for the incident.

And, as many expected, the response from the market was instant, with Vale stock plunging 20% on Monday morning.

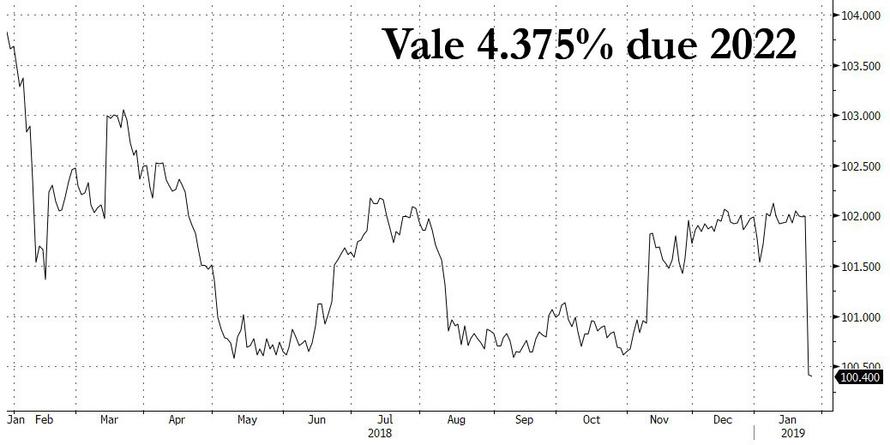

Worse, this may just the beginning of pain for investors, given that this is the second dam burst linked to Vale, we would expect more stringent remediation requirements and tougher penalties,” Macquarie Capital Ltd. analysts including Grant Sporre wrote on Monday. The company’s 750 million euro bond due in January 2022 dropped the most on record, tumbling 10 cents on euro to about 100 cents.

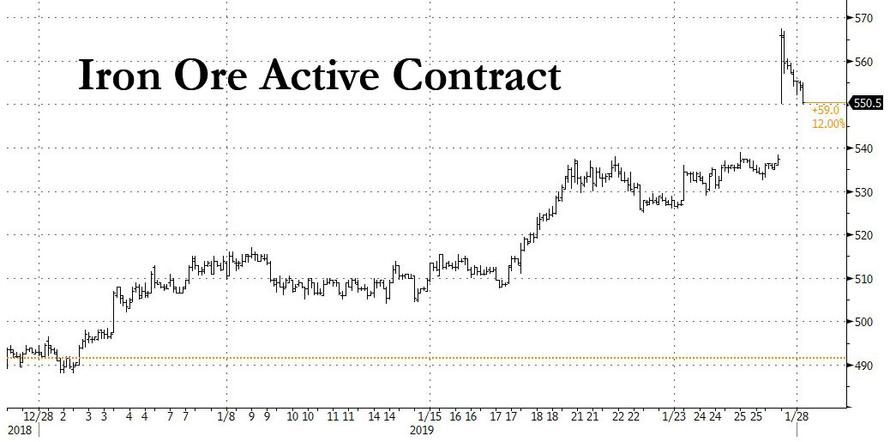

Meanwhile, as noted earlier, iron ore futures in China surged to the highest in more than a year on concern that global supplies will be interrupted.

As Bloomberg adds, the disaster will be the first major test of Vale Chief Executive Officer Fabio Schvartsman, who took the job less than two years ago. His predecessor, then-CEO Murilo Ferreira, was heavily criticized for his early reaction to the Samarco disaster. The seemingly lackluster response was later used against him by rivals eager to replace him.

Schvartsman said the latest disaster must spur the company to raise safety standards to a level “far superior to what we have today.” The Feijao project is one of its smaller operations, producing 7.8 million tons of ore in 2017.

Adding to the uncertainty facing the company, on Sunday, Renan Calheiros, a candidate for Senate president, tweeted that Vale’s top management should resign. Meanwhile, S&P Global Ratings put Vale’s bonds on CreditWatch on Friday, warning that it may be forced to shut some operations. Three judges have already frozen almost $3 billion of the miner’s funds to ensure it will be able to compensate victims and pay for the clean-up. Vale has also agreed to set up committees to probe the disaster and support the victims.

The disaster also comes less than a month after the inauguration of Brazil President Jair Bolsonaro and may upend his plans to ease environmental restrictions and boost mining production through reforms in Congress.

Following this perfect storm for the company, late on Sunday, Vale’s board decided to halt dividends after an extraordinary meeting. It was initially unclear whether dividends had been suspended or the board had just debated the possibility because an English-language statement on the company’s website said it “deliberated” over the matter. But a spokesperson for Vale in Beijing later directed Bloomberg toward the Portuguese statement.

Analysts at Macquarie estimated that the earnings hit would be limited because of the company’s balance sheet strength and robust cash generation.

“The company can cover the remediation cost with ease,” Macquarie said. “However, Vale’s equity re-rating story was in part a reputational one which has now been dealt a body blow.”

via ZeroHedge News http://bit.ly/2B9qIQi Tyler Durden