Submitted by Rabobank strategist, Michael Every

There is so little real understanding of our present reality out there in markets. For example, US industrial production collapsed on Friday at a 2009 pace. Either we are heading for a repeat of that epic recession, or these data were another “glitch”, like retail sales. What’s it to be?

And on the US-China trade talks, Friday wrapped up with nothing agreed. The Chinese media put a very positive spin on it –US President Trump is not the only one who can try to frame an outcome like that– and we are going to see negotiations continue in the US this week as both sides apparently press ahead towards signing a “Memorandum of Understanding”. But an MoU is nothing. It’s not a trade deal, and to think China would take one seriously when it doesn’t stick to things like WTO commitments in US eyes is laughable.

On Sunday Trump tweeted “Trade negotiators have just returned from China where the meetings on Trade were very productive. Now at meetings with me at Mar-a-Lago giving the details. In the meantime, Billions of Dollars are being paid to the United States by China in the form of Trade Tariffs!”. So as far as Trump is concerned, ‘the money is rolling in’, and as far as China is concerned, the investment and jobs are rolling out the door. And what exactly are Lighthizer and Navarro going to report to Trump? That China offered to comply with the WTO commitments it should have carried out 20 years ago in an unspecified manner; suggested the US should sell it more of what it wants to buy anyway (gas and soy and agri, etc., hitting Australia and NZ on the latter, I would imagine); also suggested the US should onshore semiconductor jobs away from Mexico and Malaysia so US-China trade could be rebalanced without China’s net trade position being impacted at all; and made clear that fundamental changes to its “Xi says it, we do it” economic model are not debatable. I am sure Lighthizer and Navarro are going to give Trump a glowing review! And consider this: Trump mentioned bringing Democrats Schumer and Pelosi into the trade discussion. If these China talks were going to be a triumph, wouldn’t it be preferable to win solo? Bringing in the Democrats, who are also hawkish on China, means the market turbulence that follows any deal shoot-down is then shared. Allow Catch-22 to explain:

“It takes brains not to make money,” Colonel Cargill wrote in one of the homiletic memoranda he regularly prepared for circulation over General Peckem’s signature. “Any fool can make money these days and most of them do. But what about people with talent and brains? Name, for example, one poet who makes money.”

“T.S. Eliot,” ex-P.F.C. Wintergreen said in his mail-sorting cubicle at Twenty-seventh Air Force Headquarters, and slammed down the telephone without identifying himself.

Colonel Cargill, in Rome, was perplexed.

“Who was it?” asked General Peckem.

“I don’t know,” Colonel Cargill replied.

“What did he want?”

“I don’t know.”

“Well, what did he say?”

“‘T.S. Eliot,'” Colonel Cargill informed him.

“What’s that?”

“‘T.S. Eliot'” Colonel Cargill repeated…

“I wonder what it means,” General Peckem reflected…

General Peckem roused himself after a moment with an unctuous and benignant smile. His expression was shrewd and sophisticated. His eyes gleamed maliciously. “Have someone get me General Dreedle,” he requested Colonel Cargill. “Don’t let him know who’s calling.”

Colonel Cargill handed him the phone.

“T.S. Eliot,” General Peckem said, and hung up

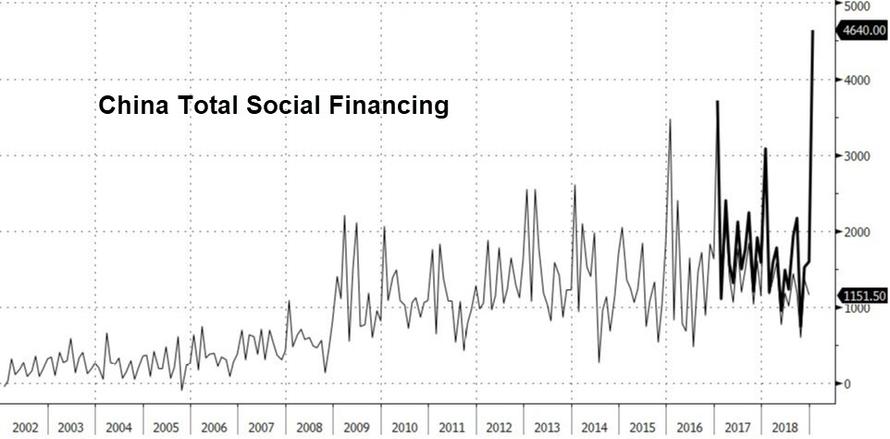

From China’s side, Friday’s PPI data said it is sliding into deflation again – and borrowing for January was insane. I won’t describe the numbers because they are so large it is meaningless. Yes, this is one month, and Lunar New Year means we need to see the February/March data too; but if the January pace is kept up China is already throwing the whole kitchen at the economy. It borrowed FIVE PERCENT OF GDP IN ONE MONTH. That’s 60% of GDP in a year. That’s a peak-WW2 level of borrowing. Does it suggest a real trade deal is coming? Or that China is backing away from its state-led model? Try to understand that. (And be very nervous on CNY.)

Meanwhile, others still don’t seem to be able to put two and two together and get four. The Munich Security conference saw US Vice-President Pence again try to rally the EU to the US side in a struggle vs. Russian/Chinese/Iranian illiberalism. Quite literally, nobody clapped. No-one.

German Chancellor Angela Merkel instead gave a speech about globalisation and free trade with no plan for how to hold it together when the US sees China as undermining it and Europe as freeloading. Merkel even teased Trump over US tariffs on German autos on “national security” grounds; but what is her plan to deal with Germany’s egregiously large current-account surplus, which is in breach of recommendations from the IMF? Nothing, of course. And there are going to be consequences for that at some point from this US administration, I would suspect.

Likewise, the UK has demonstrated its left hand has no idea what its right hand is doing well beyond Brexit. The Defence Secretary recently given a speech on the UK’s national security strategy, pledging to send naval vessels through the South China Sea and to open a new navy base in Asia; and China then shot down trade talks with the UK, in the same way that China is squeezing NZ for banning Huawei from its 5G network. Why would China do otherwise? The West seems to be utterly unable to recognise you cannot confront China on its foreign policy, like seizing the South China Sea, or spying on everyone to steal technology; or its domestic policy, like concentration camps and allegations of organ harvesting; or its economic policy, like mercantilism and massive state subsidies, and then turn around and do free-trade deals with it. So swallow China as it is…and accept the global liberalism Merkel is extolling is dead; or confront it…and accept large parts of the global liberalism Merkel is extolling is dead. Governments and markets appear unable/unwilling to understand that key fact.

via ZeroHedge News http://bit.ly/2SGrNd4 Tyler Durden