Could the world’s most popular “widowmaker” trade – shorting Japanese government bonds – be finally died itself?

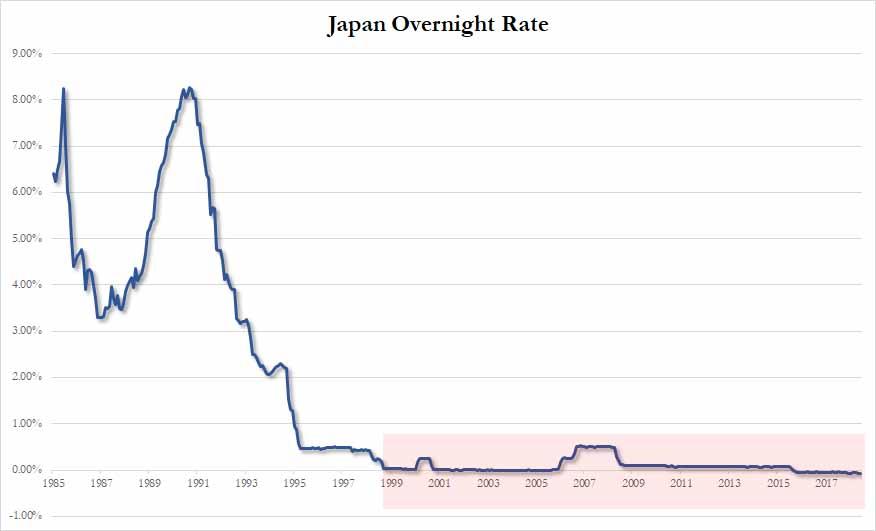

While over the past 20 years, ever since the BOJ cut rates to 0% for the first time back on February 12, 1999…

… all too many investors have repeatedly shorted JGBs, expecting the collapse of Japan’s fiscal and monetary house of cards at any moment, only to be carted out feet first as Japan has has successfully prevented a blow up in its bond market for over two decades, entirely thanks to the BOJ which thanks to NIRP and QE, now owns 43% of all government debt, just shy of 1.1 quadrillion yen, an amount which is more than 100% of Japan’s GDP.

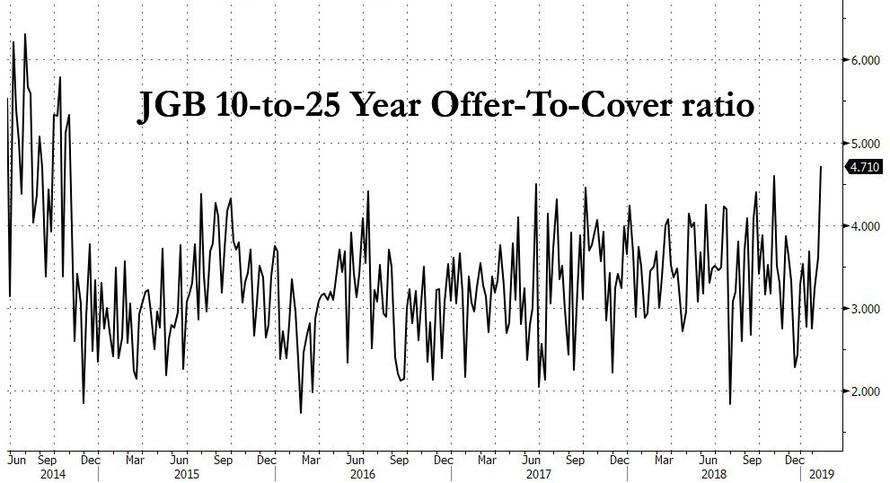

And yet, despite this amazing track record which saw anyone who fought the BOJ crumble and suffer massive losses for over 20 years, increasingly JGB traders are casting nervous glances at the exit door, especially after the Bank of Japan unveiled its first taper of 2019 on February 12, when it cut bond purchases in the key 10-to-25 maturity bucket from 200 to 180 billion; this was the first taper by the BOJ since mid-December, and it’s only set to accelerate as the BOJ runs out of eligible bonds to monetize.

And, as Bloomberg notes, the move is already impacting market behavior, with signs that traders are already bracing for further tapering by the central bank. Case in point: following the BOJ’s offer to buy bonds due in more than 25 years on Monday, the offer-to-cover ratio surge to 4.71 times, the highest since October 2014, showing traders’ surging “willingness”

to part with the super-long securities by selling them to the central bank.

Monday’s was the first open market operation in the long-end of the JGB curve since the BOJ trimmed purchases of debt due in 10-25 years, on Feb 12.

The rise in offers for bonds due in more than 25 years was due to “caution that the BOJ may cut purchases in the segment” following last week’s reduction in the 10-25 year zone, says SBI Securities chief bond strategist Eiji Dohke.

Meanwhile, investors’ positioning for further reductions in long-end purchases – i.e., accelerating selling of duration – can be seen as an attempt to steepen the JGB curve, which on one hand would be consistent with the BOJ’s previous guidance about the negative impact of excessive flattening. On the other, if the selling accelerates from a trickle to an avalanche, the market will once again call the BOJ’s bluff and force it to ramp up purchases of long maturities lest the 10Y yield spike above 20bps, signalling to the market that after two decades, the BOJ has finally lost control.

Finally, what is even more surprising is just how quickly sentiment has flipped: it was just 10 days ago when appetite for long-term JGBs seemed insatiable, when an auction of 30-year debt drew the strongest demand since July on Feb. 7, two days after a blockbuster 10-year sale that lured the highest investor interest since 2005. And to think all it took was for the BOJ to fractionally taper purchases and the market freaked out.

One wonder just how, if ever, the BOJ will be able to “normalize” its own QE if just a gentle tapping on the breaks can send such a shockwave across the bond market (please don’t answer, that’s rhetorical).

via ZeroHedge News http://bit.ly/2Ikvr7z Tyler Durden