Following the best month for global markets in seven years, February has started off with a whimper as S&P were following the lack of tangible progress in US-China trade talks, Nasdaq futures sliding after disappointing guidance from Amazon, a European rally fizzled dragged down by banks and dismal German and Italian PMI data, and mixed Asian markets after the worst Chinese Caixin PMI in 3 years.

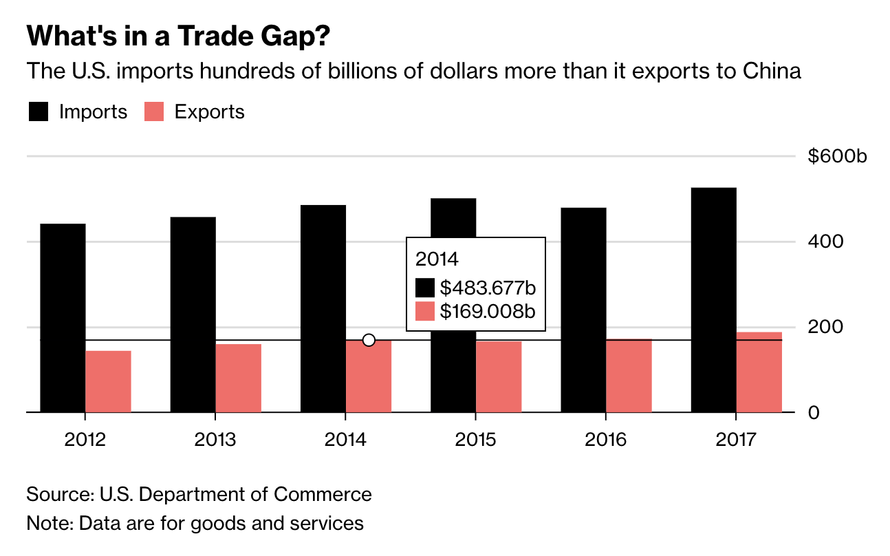

While stocks soared this week after the Fed all but abandoned plans for further rate hikes, and on optimism that a U.S.-China trade deal might be on the cards, the lack of any actual progress in trade negotiations coupled with the lowest Caixin/Markit index of Chinese manufacturing since February 2016, added to a growing list of economic readings indicating slowing global growth.

On Thursday, technology shares gained thanks to solid corporate reports, though a disappointing sales forecast from Amazon.com has now curbed optimism. On the trade front, Treasury Secretary Steven Mnuchin and U.S. Trade Representative Robert Lighthizer head to China in mid-February.

Meanwhile, Washington trade negotiations, that had been tipped as “determinative”, in the end broke up with an agreement to keep talking. Underwhelming news that China plans to buy substantially more American agricultural and energy goods failed to spark buying euphoria in either soybeans or global stocks.

MSCI’s World Index came off its highest level since Dec. 4 after its best January gain on record when it rose an unprecedented 7.79% on the month. The weak Chinese data also took MSCI’s broadest index of Asia-Pacific shares outside Japan down 0.2%, though that followed a 7.2% gain in January. The Australian dollar, the best barometer of investor sentiment towards China, tumbled half a percent.

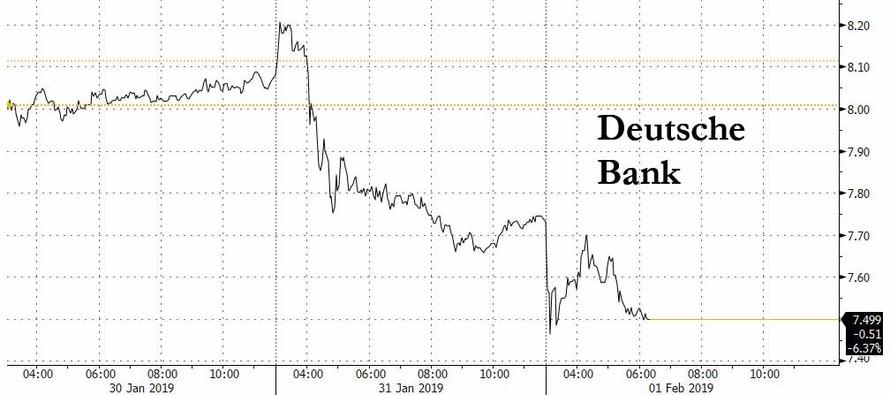

Europe’s mood was only slightly better as several strong earnings reports helped offset the Chinese survey, providing an early boost to Europe’s STOXX 600 index, although while most European bourses were slightly positive to start, the rally fizzled as banks slumped, and it wasn’t just the aforementioned Deutsche Bank: Spain’s CaixaBank and Sabadell fell Friday after they released fourth-quarter numbers. Jefferies called CaixaBank’s earnings “messy,” citing the one-time items that pushed profit below estimates. At Sabadell, provisions weren’t as severe as expected, but analysts said its business in the U.K. looked weak. CaixaBank slumped 7.3% and Sabadell 6%, making them the biggest decliners on the Stoxx 600 Banks Index.

Separately, PMI prints for Italy and Switzerland came in below expectations, and even though Germany’s was just below expectations, it still posted the first contraction in over 3 years.

Friday’s market slump followed another strong day for US markets, when stocks also gained after U.S. President Donald Trump said he would meet Chinese President Xi Jinping soon to try to seal a comprehensive trade deal as the top U.S. negotiator reported “substantial progress” in the talks. Beijing’s trade delegation said the talks made “important progress”, China’s official Xinhua news agency reported although neither side was willing to provide details, suggesting that little – if anything – was actually achieved.

The previously upbeat mood was also chilled somewhat by White House insistence that March 1 was a hard deadline for a deal, a failure of which would lead to an increase in U.S. tariffs on Chinese goods.

“Analysts mostly remain deeply skeptical that a genuine trade deal can be done on this time frame,” Commonwealth Bank of Australia economists wrote. “We are less pessimistic since these negotiations are being conducted by senior politicians, not by trade bureaucrats,” they added. “Both sides also have an incentive, and arguably a growing incentive, to get a meaningful deal done.”

Traders now turn their attention to Friday’s monthly American labor report amid an ongoing earnings season that’s given investors mixed signals.

In FX, the Bloomberg dollar index moved in a tight range before today’s January payrolls data, while Treasuries were little changed. The euro rose as core inflation in the area beat estimates, shrugging off PMI misses in Germany and Italy. On Thursday, the euro slumped when Bundesbank President Jens Weidmann painted an unusually bleak picture of the German economy, saying the slump will last longer than initially thought. The pound led G-10 currency losses amid euro-sterling buying and after U.K. manufacturing data came in weaker than expected. Bunds edged lower, leading core and semi-core bond declines.

In commodities, oil prices were subdued as the China data offset signs major exporters were reducing output in line with a pact to cut supply. Gold prices hovered just short of nine-month highs supported by the fall in bond yields and expectations for a softer dollar. Spot gold stood at $1,318.41 per ounce, having touched a top of $1,326.30.

Key events include the employment report, manufacturing PMI readings. Exxon Mobil and Chevron are due to report earnings

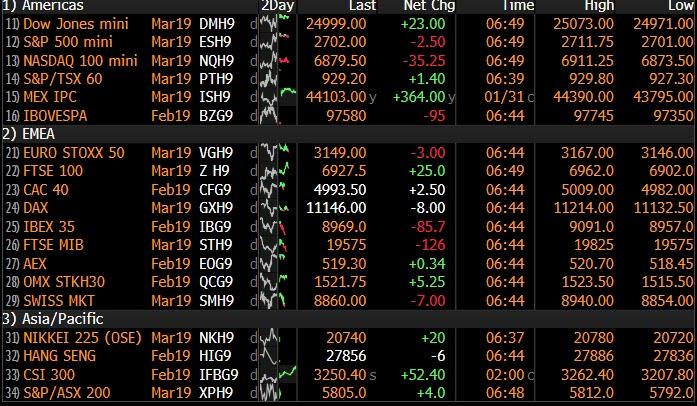

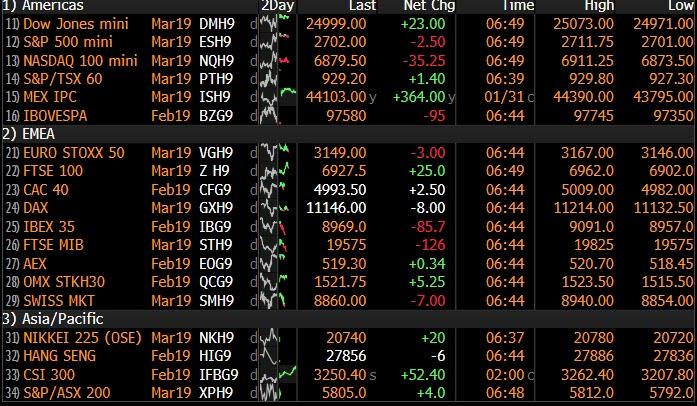

Markets Snapshot

- S&P 500 futures down 0.03% to 2,703.75

- STOXX Europe 600 up 0.3% to 359.69

- MXAP down 0.09% to 156.50

- MXAPJ up 0.01% to 511.47

- Nikkei up 0.07% to 20,788.39

- Topix down 0.2% to 1,564.63

- Hang Seng Index down 0.04% to 27,930.74

- Shanghai Composite up 1.3% to 2,618.23

- Sensex up 0.7% to 36,500.77

- Australia S&P/ASX 200 down 0.03% to 5,862.83

- Kospi down 0.06% to 2,203.46

- German 10Y yield rose 1.1 bps to 0.16%

- Euro up 0.1% to $1.1459

- Brent Futures down 1.9% to $60.71/bbl

- Gold spot down 0.1% to $1,321.48

- U.S. Dollar Index down 0.1% to 95.52

- Italian 10Y yield fell 1.0 bps to 2.233%

- Spanish 10Y yield rose 1.4 bps to 1.21%

Top Overnight Headlines

- China promised to “substantially” expand purchases of U.S. goods after the latest round of trade talks, and both sides planned further discussions to reach a breakthrough with only a month to go before the Trump administration is set to ratchet up tariffs

- Europe’s primary bond market racked up a record 221.7 billion euros of sales in January, allaying fears that the European Central Bank’s wind-down of stimulus measures would hammer issuance; Issuance jumped 18% versus January 2018, partly because of a rush to get covered-bond sales and sterling public- sector deals done before looming risks such as Brexit

- Ministers in Theresa May’s government are setting out to woo members of the opposition Labour Party, in the hope that they’ll provide enough votes to get her Brexit deal through

- Japan’s Government Pension Investment Fund lost 9.1%, or 14.8 trillion yen ($136 billion), in the three months ended Dec. 31. The decline in value and the rate of loss were the steepest based on comparable data back to April 2008

- Despite a recession in Italy and a significant loss of economic momentum in Germany, the ECB president isn’t showing much urgency to reverse course on a stimulus-withdrawal path that was originally supposed to include an interest-rate increase late this year, according to Oxford Economics

- There’s a gold rush on as investors pour more and more funds into bullion. Global holdings in exchange-traded funds surged 70.6 metric tons in January, bringing assets to the highest in almost six years as prices rally

Asian equity markets traded cautiously as disappointing Chinese data clouded over the momentum from Wall St. where most major indices finished positive and the S&P 500 posted its best January performance in over 3 decades, with sentiment driven by earnings and progress in US-China trade discussions. ASX 200 (Unch.) and Nikkei 225 (Unch.) both opened higher amid broad optimism following the trade talks and with corporate updates dominating news flow in Japan, although China slowdown concerns later pressured both indices off intraday highs. Hang Seng (Unch.) and Shanghai Comp. (+1.3%) traded indecisively after Chinese Caixin Manufacturing PMI printed its weakest in around 3 years. However, the mainland has kept afloat on trade-related hopes and after another liquidity effort by the PBoC ahead of the Lunar New Year week-long market closure, while Barclays also speculate the PBoC could lower interest rates as soon as today due to the weak data. Finally, 10yr JGBs were higher as they continued to track the upside in T-notes in the aftermath of this week’s dovish Fed, and as Japanese yields continued to decline in which 20yr and 30yr JGB yields fell to their lowest since 2016.

Top Asian News

- India Overshoots Budget Deficit Target for Second Straight Year

- India Stocks Rally as Budget Offers Tax Bonanza to Consumers

- Modi Woos Indian Voters With Tax Cuts, Payouts to Farmers

- Malaysians, Chinese Lead Record Influx of Tourists to Indonesia

Major European equities initially posted slight gains but have since deteriorated into negative territory [Euro Stoxx 50 -0.1%]. The FTSE 100’s Shell (+0.6%) shares strengthened after initially opening in the red as the energy sector is underperforming weighed on by the oil complex. Other sectors are broadly in the green. Other notable movers include, Electrolux (+9.8%) who are at the top of the Stoxx 600 following a revenue beat and the Co’s largest investor supporting their proposed split. JC Decaux (+9.4%) are also at the top of the Stoxx 600, following their earnings. At the bottom of the Stoxx 600 are Caixabank (-7.9%) as their net profit missed expectations. Deutsche Bank (-3.4%) were the mornings most notable earnings release as the Co. shrank for the 8th consecutive quarter, with sources stating that time is running out for the Co. to turn around on its own; making a merger with Commerzbank (-1.2%) or another European bank more likely. Separately Adidas (-2.9%) are in the red following a downgrade at UBS.

Top European News

- Thyssenkrupp Shares Jump as Major Holders Support Breakup

- UBS Downgrades Euro Forecasts, Still Sees Room for Appreciation

- Germany to Forfeit Billions in Carbon Sales With Coal Exit

- Italian Industry Slump Worsens Outlook for Economy in Recession

In FX, USD The Dollar is pretty evenly split in terms of relative performance against G10 counterparts going into the monthly US jobs data, as the DXY hovers around 95.500 and roughly midway between weekly highs and lows, so far (95.987-157). However, the Buck remains pressured after Wednesday’s dovish Fed and net short positioning for month end, so a bullish/upbeat NFP report is needed to confirm a near term base for the index, and expectations are not skewed to the upside after such a bumper payroll number last time around.

- GBP Sterling is the clear laggard, and already looking precarious before the UK manufacturing PMI miss. Indeed, the Pound succumbed to accelerated selling once Cable relinquished the 1.3100 handle and Eur/Gbp breached 0.8750, with the former subsequently declining through the 200 HMA (1.3085-90) and testing, but not yet breaking the 200 DMA (1.3045), while the cross got to within a few pips of offers said to be sitting up at 0.8800 before fading.

- AUD/CAD Also underperforming, albeit to a lesser extent, with the Aud undermined by benign Aussie PPI data and a sub-forecast/even deeper contraction in China’s Caixin manufacturing PMI. Aud/Usd is currently around 0.7260 having almost reached 0.7300 yesterday, while the Loonie continues to meet resistance ahead of 1.3100 and some key chart support just above the big figure following pretty sanguine comments from BoC’s Wilkins on Canadian wages.

- CHF/EUR/NZD All modestly firmer vs the Usd, with the Franc rebounding from 0.9950+ levels towards 0.9920 and not unduly deterred by weaker than expected Swiss retail sales or headline manufacturing PMI. Similarly, the single currency largely took more bleak Eurozone manufacturing PMIs in stride, before deriving some traction from firmer core inflation and technically a recovery in Eur/Usd of its 100 DMA (1.1441). The Kiwi remains above 0.6900, and perhaps benefiting from the Aud’s demise as the cross retreats back below 1.0500.

- JPY On a more even keel than major rivals and holding above 109.00 vs the Usd.

In commodities, Brent (-0.1%) and WTI (Unch) are choppy, with prices for both around the middle of a slim USD 1/bbl range; impacted by global growth concerns following the weak Chinese PMI data. In terms of recent news flow, Russian oil product exports from the Port of Tuapse are forecast at 1.128mln tonnes vs. 1.463mln in January. Markets are looking ahead to today’s Baker Hughes rig count, which previously showed total rigs increased by 9 to 1059, with gas rigs up by 9 at 862. Gold (Unch) is also around the middle of its range, with the yellow metal uneventful mimicking the dollar’s lack of direction ahead of today’s US jobs report. Elsewhere, Glencore have said they see 2019 copper production at 1.54MT, alongside the Co’s subsidiary being told to halt the production of a new system which removes uranium from their cobalt supplies. Separately, US metal importers are reportedly losing hope that the tariff exemptions, which some applied for over 8 months ago, will be approved by the Commerce Department as the US shutdown further delays the ruling.

US Event Calendar

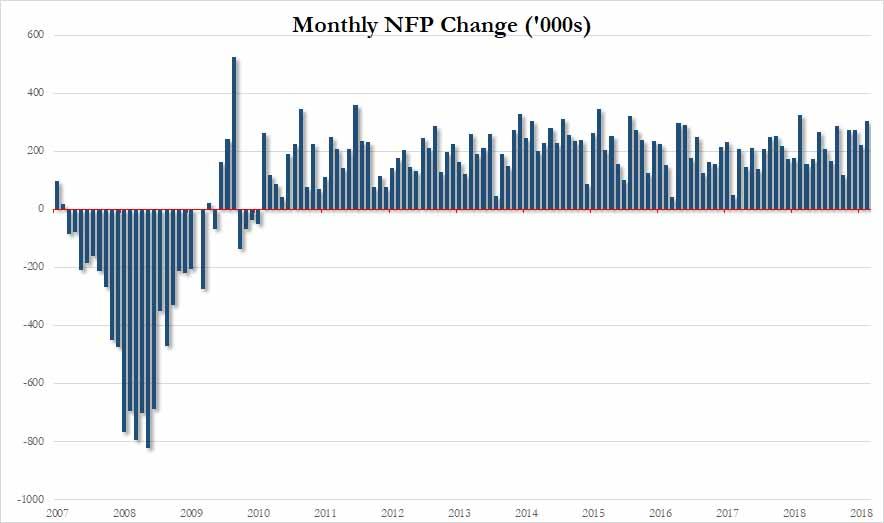

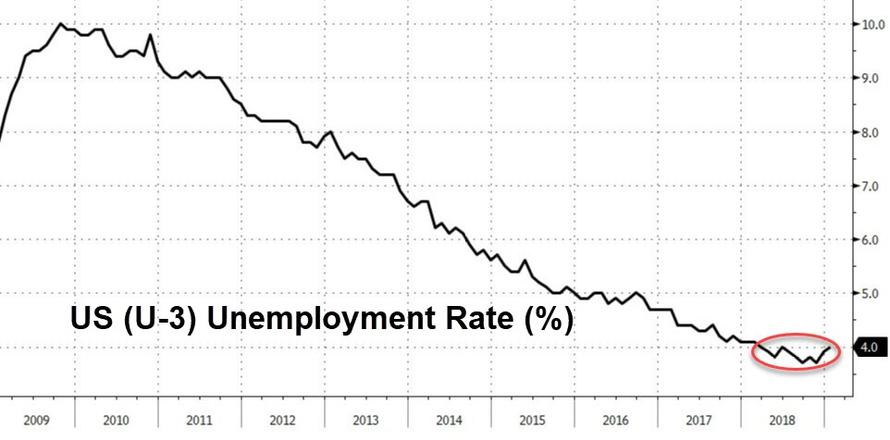

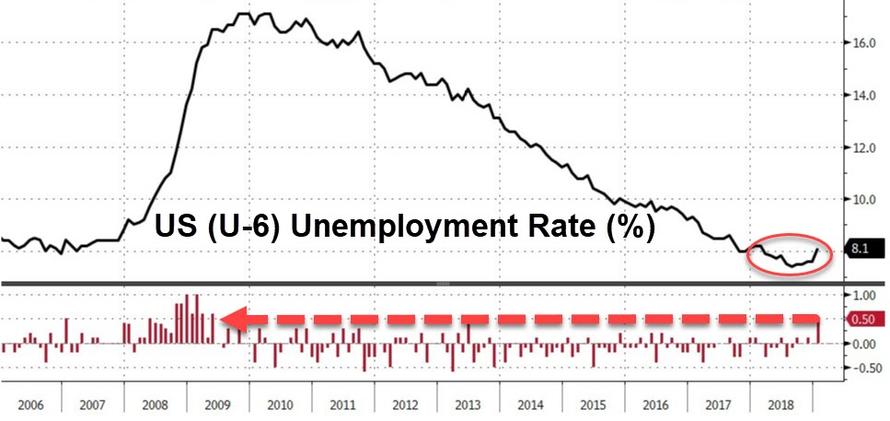

- 8:30am: Change in Nonfarm Payrolls, est. 165,000, prior 312,000

- 8:30am: Unemployment Rate, est. 3.9%, prior 3.9%

- 8:30am: Average Hourly Earnings MoM, est. 0.3%, prior 0.4%; YoY, est. 3.2%, prior 3.2%

- 8:30am: Labor Force Participation Rate, est. 63.0%, prior 63.1%

- 9:45am: Markit US Manufacturing PMI, est. 54.9, prior 54.9

- 10am: U. of Mich. Sentiment, est. 90.7, prior 90.7; Current Conditions, prior 110; Expectations, prior 78.3

- 10am: Construction Spending MoM, est. 0.2%, prior -0.1%

- 10am: Wholesale Inventories MoM, est. 0.5%, prior 0.8%; Wholesale Trade Sales MoM, prior -0.2%

- Wards Total Vehicle Sales, est. 17.2m, prior 17.5m

DB’s Jim Reid concludes the overnight wrap

Welcome to February where we’ve woken up to a few millimetres of snow here in the south of England. This will no doubt ground us to a halt here. Given it’s payroll Friday, it’s the 12 month anniversary of the higher than expected average hourly earnings print that broke the long period of ultra low vol and started the vol quake that saw the VIX trade over 50 just four days later. Back then, the expectation for AHE was 2.6% and it came in at 2.9% (eventually revised to 2.8%). Ironically 12 months later very few people are worried about inflation even though a print of 3.2% is expected today after a higher than expected surprise last month (3.2% vs 3.0% expected). Even the Fed have thrown the towel in and gone full circle in their dovishness. So we’ll see what today brings for the overall release. We’ll preview it in full later.

The last day of January proved in the end to be a decent microcosm of how the record-breaking month played out with US equities extending gains, credit tightening, and bonds rallying across the board. Indeed the tech sector led the charge again as the NASDAQ rallied +1.37% which means the index had 8 days in January with gains of at least 1%. That’s the most in a single month since October 2011. The NYSE FANG index also rose +2.74% which put it up +13.06% in January while the S&P 500 last night finished +0.87%. The index received a boost just before the US close, as USTR Lighthizer spoke positively about the US-China trade talks (details below). In fairness the DOW (-0.06%) did close a bit lower mainly due to DowDupont falling -9.23% following a profit warning. The other big laggards were US large-cap banks, with Goldman Sachs down -2.21% as lower yields weighed on the sector, with the S&P 500 banks index dropping -1.21%.

Indeed it was earnings that really dictated how things played out yesterday. The headliners were Facebook (+10.82%) and General Electric (+11.43%) which rallied by the most in 3 years and 10 years respectively. GE’s 2035 bonds rallied -24.6bps and they are now -128.5bps tighter from their November wides, around the time they got downgraded from A to BBB+ by the major credit ratings agencies. A reminder that it was GE which sparked all the concern about the swelling of the BBB credit market in the US last year.

Elsewhere Charter Communications (+14.19%), AmerisourceBergen (+6.19%), UPS (+4.09%), and Mastercard (+3.54%) deserve honorable mentions too after the market also viewed their latest earnings reports favorably. Much like how we saw companies get punished for small misses in previous quarters, the market has started rewarding companies who appear to be painting a less negative outlook picture.

After the close last night, Amazon beat consensus expectations on the profit and revenue fronts for the fourth quarter. Nevertheless, shares slid over -5% after hours as first quarter guidance was a touch lower than anticipated and international momentum softened surprisingly. To be fair, the stock is still up over 27% since its Christmas Eve though. Futures on the S&P 500 (unch) and NASDAQ (-0.40%) are trading flat and slightly lower respectively.

Overnight in Asia, stocks have fallen back after the China Caixin manufacturing PMI came in below expectations at 48.3 (vs. 49.6 expected), the second consecutive monthly reading below the 50-mark and the lowest since February 2016. The Nikkei (+0.12%), Hang Seng (-0.31%), and the Kospi (+0.06%) all fell after the release, although the Shanghai Composite (+0.77%) continues to climb as no dramas came out of the latest round of trade talks.

Indeed the sound bites trickling out of this week’s US-China trade talks have been on balance positive without necessarily seeing any breakthroughs. Yesterday we heard from President Trump who tweeted that “meetings are going well with good intent and spirit on both sides” however “no final deal will be made until my friend President Xi, and I, meet in the near future to discuss and agree on some of the long standing and more difficult posts”. He also suggested that both sides were working towards an agreement by March 1st which is when tariffs on China are due to go up. The WSJ yesterday reported that China are pushing for a Trump-Xi meeting this month, while Bloomberg reported that the Chinese negotiators offered no other major proposals or concessions in this week’s talks. Nevertheless, USTR Lighthizer, one of the more influential and hawkish members of the US administration, said that progress is being made and Chinese Vice Premier Liu He said that hopes to accelerate the timetable, possibly signaling increased confidence. President Trump then said that Lighthizer and Mnuchin will travel to China to continue talks and that have already made “tremendous progress,” though that “doesn’t mean we have a deal” yet. Both sides have released statements overnight. China have said talks went well and they will buy more goods from the US and “will actively respond to US concerns on intellectual property, creating (a) fair market environment”. The US statement was a bit more neutral. So all to play for over the next 4 weeks ahead of the current March 1st deadline for further escalation.

Back to yesterday where, as mentioned earlier, it was also a decent day for credit with cash HY spreads c.-4bps tighter in the US and Europe. EM hard currency spreads were also -2.9bps tighter while bond markets in Europe rallied anywhere from -1.1bps (in Italy – after the country officially entered a technical recession as expected) to -5.9bps lower (in Spain). Treasuries rallied -4.4bps and -4.3bps at the 2y and 10y points of the curve with the curve broadly unchanged while oil traded close to flat.

That move for Treasuries comes ahead of a busy end to the week for data today including the aforementioned first employment report of the year tonight in the US. In terms of what else to expect from the report the consensus is running at 165k for nonfarm payrolls (following 312k in December) while earnings are expected to have risen +0.3% mom which would keep the annual rate at +3.2% yoy as discussed above. Our US economists also expect a 165k payrolls reading however are slightly below market on earnings at +0.2% which in their view would lower the annual rate slightly to +3.1%. However, they also note that if hours worked remain at 34.5 as they anticipate, the payroll proxy for nominal income growth would rise to 5.5% (year-over-year), matching its post-recession high. Therefore they note that in short, while the January employment report may not be as eye-popping as the prior month, it should still be consistent with further tightening of the labour market and strong income growth.

Meanwhile yesterday’s economic data certainly caught the eye. It started with Italy which confirmed a technical recession with its second consecutive negative qoq GDP print (-0.2% vs. -0.1% expected). So that’s now 6 recessions since the inception of the euro for Italy. Contrast that with Australia that leads the developed world pack by not seeing a recession since 1991. Growth for the broader Euro Area was confirmed at +0.2% qoq as expected which leaves the yoy rate at +1.2% and down from +1.6% in Q3.

In the afternoon in the US the Q4 ECI disappointed slightly at +0.7% qoq (vs. +0.8% expected) however given the dovish pivot for the Fed this is perhaps less significant than it previously would have been. More notable was the jump in claims last week to 253k from 200k which was the largest jump since the September 2017 hurricane-impacted month. The report was probably influenced by some transitory factors (the government shutdown affecting DC, the public teachers’ strike in California, weather in the Midwest). Worth watching if these end up being one-offs or not in next week’s data. Also out yesterday was the Chicago PMI which plummeted unexpectedly by -7.1 points – the biggest in nearly four years – to 56.7 (vs. 61.5 expected). That perhaps raises the potential of downside risks to today’s ISM reading in the US. Finally new home sales in November were confirmed as rising a much greater-than-expected +16.9% mom (vs. +4.8 expected).

In terms of the day ahead, this afternoon’s January employment report in the US will almost certainly be the biggest crowd puller. However prior to that this morning we get the final January manufacturing PMIs in Europe where the market will be on close lookout for the sub-50 readings in Germany (49.9 expected) and Italy (48.8 expected) especially. We’ll also get the January CPI report for the Euro Area (no change to the +1.0% yoy core reading expected) while due out in the US is the manufacturing PMI (no change to 54.9 expected), November construction spending (+0.2% mom expected), November wholesale inventories (+0.5% mom expected), January ISM manufacturing (54.0 expected), final January University of Michigan consumer sentiment survey revisions (headline 90.7 reading expected) and January vehicle sales data (17.2m expected). In addition to that, the Fed’s Kaplan is due to speak this afternoon while the earnings highlights include Exxon Mobil, Chevron and Merck.

via ZeroHedge News http://bit.ly/2Snpfzm Tyler Durden

It has been around 15 years since Orange County tried to build a $1 billion light-rail system that would have gone from one suburban parking lot to another. It would have moved around half of 1 percent of the county’s commuters. The so-called

It has been around 15 years since Orange County tried to build a $1 billion light-rail system that would have gone from one suburban parking lot to another. It would have moved around half of 1 percent of the county’s commuters. The so-called

A number of people die for their art in Velvet Buzzsaw. Others manage to survive, but only after enduring onslaughts of art-biz babble like, “Our gallery has cutting-edge analytics to optimize deal-flow and global demand.” The smartest person in this new Netflix movie might be a good-hearted office assistant named Coco (Natalia Dyer, of Stranger Things), who bails out of the LA art scene at the end and heads back home to the Midwest, happy, no doubt, to be alive.

A number of people die for their art in Velvet Buzzsaw. Others manage to survive, but only after enduring onslaughts of art-biz babble like, “Our gallery has cutting-edge analytics to optimize deal-flow and global demand.” The smartest person in this new Netflix movie might be a good-hearted office assistant named Coco (Natalia Dyer, of Stranger Things), who bails out of the LA art scene at the end and heads back home to the Midwest, happy, no doubt, to be alive.