Summary

-

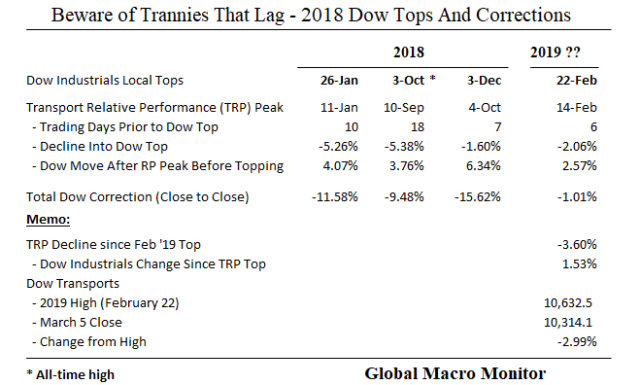

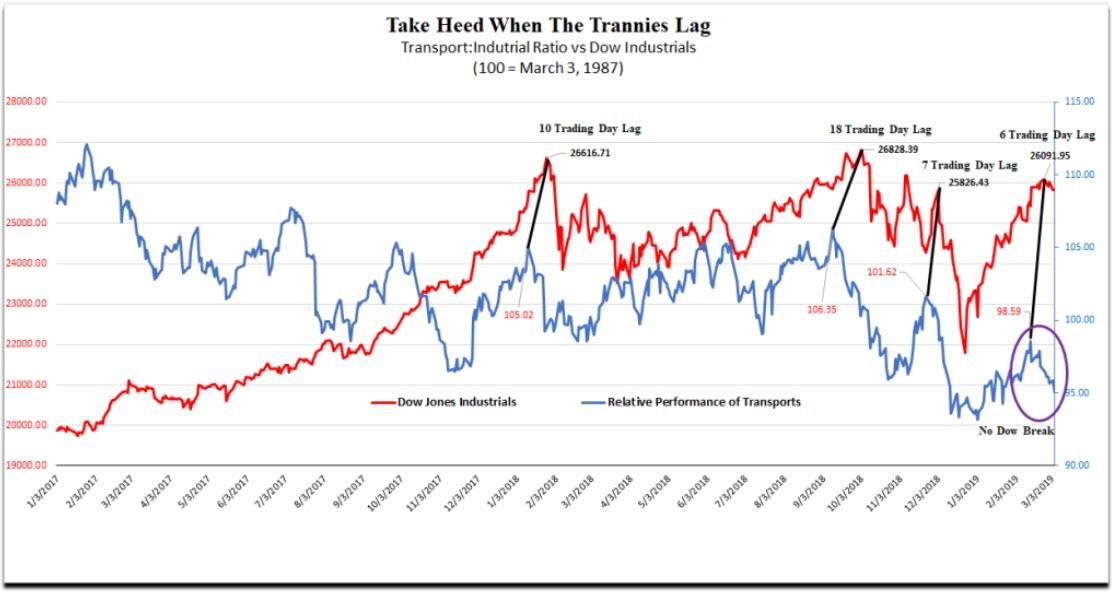

We construct a relative performance index (TRP) of the Dow Transports and Dow Industrials Index

-

In all three large and major 2018 sell-offs, the TRP signaled an impending correction 7-18 trading days before markets rolled over

-

The TRP peaked on this past Valentine’s Day and is down 3.60 percent yet the Dow Industrials is still up 1.53 percent has yet to roll over.

-

The Dow did hit a high on February 22 and is down just around 1 percent

-

We don’t know if the TRP is confirming an impending sell-off but investors and traders should closely monitor the relative performance of the Transports

The Dow theory on stock price movement is a form of technical analysis that includes some aspects of sector rotation. The theory was derived from 255 Wall Street Journal editorials written by Charles H. Dow (1851–1902), journalist, founder and first editor of The Wall Street Journal and co-founder of Dow Jones and Company. Following Dow’s death, William Peter Hamilton, Robert Rhea and E. George Schaefer organized and collectively represented Dow theory, based on Dow’s editorials. Dow himself never used the term Dow theory nor presented it as a trading system. – Wikipedia

We constantly monitor the Dow Transports Index and its relative performance as a signal of future equity price action. There is a growing concern that the Trannies have been underperforming other indices, including its father, the Dow Jones Industrials, since Valentine’s Day.

The concerns are reinforced by the signals the deterioration in the TRP sent in 2018 just before last year’s three major corrections. The table and chart below should not be viewed in isolation from one another but as compliments.

January 2018 Correction

The relative performance of the Transports or the TRP (Transport/Industrials) peaked 10 trading days before the Dow’s high on January 26th, declining by more 5 percent before the Dow and stock market rolled over and experiencing a historic spike in volatility.

Only three times since 1950 has intraday volatility jumped so high as measured by a modified version of the Average True Range: 1) September 1955 after an extraordinarily period of calm the S&P500 tanked on September 26th when markets opened after President Eisenhower’s heart attack on the 8th hole of Cherry Hills Country Club over the weekend. The market quickly recovered; 2) January 1962 when the “Kennedy slide” began to accelerate; and 3) the October 1987 stock market crash. – GMM, February 11th

The first correction of 2018, close-to-close in the Dow Industrials, was 11.58 percent.

End September 2018 Correction

After spending most of the year recovering and making new all-time highs into the end of Q3, the Dow and stock market rolled over again with the Dow peaking on October 3rd, 18 trading days after the relative performance of the Transports (TRP) topped out on September 10th. The TRP fell over 5 percent while the Dow was making a new high, similar relative price action to the January correction.

We maintain the bear market that began at the end of Q3 2018 was rooted in the breakout of long-term interest rates.

We warned that long-term interest rates were about to spike, which they did breaking out to 3.26 percent causing the fourth quarter collapse in stocks. The one thing that Mr. Market really fears, in our opinion and inference from the price action, is a spike in long-term interest rates. – GMM, February 26th

The Dow fell 9.48 percent before rallying into the December crash.

December 2018 Crash

The Dow and the overall stock market partially recovered into December but had trouble breaking through stiff price resistance, particularly the 2800 S&P level.

Once again, the relative performance of the Transports sent a signal of future price weakness. The TRP peaked 7 trading days before the Dow topped out falling — albeit much less than the year’s prior two corrections – almost 1.6 percent before the market rolled over hard and fast.

The Dow eventually fell 15.62 percent in a very short timeframe causing the Market Socialists, led by Mr. President, Mr. Cramer, Mr. Market, and the many clowns paraded on CNBC, to put tremendous pressure on the Fed to rescue the market from itself. That is begging the government to effectively nationalize the stock market losses.

Yeah, yeah, the Fed was too tight with an almost zero percent real fed funds rates. Right.

Chairman Powell and the Fed eventually caved. Nothing new but “they’re not even pretending anymore.”

…Nixon alternately bullied and cajoled and threatened and rewarded his hand-picked Federal Reserve Chair, Arthur Burns, to do the right thing and keep the money spigot open … wide open. Complaints about too much liquidity sloshing around were “bullshit”, and so what if they were running the economy hot? Good lord, man, imagine who would take over the White House in 1972 if he were defeated! Imagine the insane fiscal spending policies that those Democrats would push on the country if he lost!

Donald Trump has EXACTLY the same problem.

Donald Trump has found EXACTLY the same solution.

Jay Powell is the Arthur Burns of our day.

The only difference is that Nixon did all of his bullying and cajoling and threatening and rewarding in private, and Burns wouldn’t dream of saying out loud what Powell is shouting about the “important signal” of financial market “volatility” on monetary policy decisions.

They’re not even pretending anymore. — Ben Hunt, Epsilon Theory

All is well now with the markets, or is it?

Transports Rolling Over Again

The data in the above chart illustrate the Transports are rolling over once again. The TRP index peaked on Valentine’s Day, is now down 3.60 percent with the Transports Index down 2.99 percent from its February 22nd high. The Dow has yet to roll over as the administration continues to dangle the prospects of a “good” China trade deal in front of the markets.

Upshot

We don’t know if the stock market is about to roll or the TRP is sending a false positive signal but investors should always sit up when the Trannies lag. Heeding the signal last year could have made traders lots of money. We are certain some did.

The Transports fell 0.8 percent today with a flattish Dow.

Keep it on your radar, folks.

Transports are under pressure and it could be a warning sign

Click here to view video

via ZeroHedge News https://ift.tt/2UowxAW Tyler Durden