The question we posed last night whether or not the ECB will finally unveil another TLTRO during its press conference tomorrow, may have been answered.

According to a Bloomberg trial balloon floated this morning, and citing “people with knowledge”, the ECB is set to cut its economic forecasts by enough to “justify another bout of loans for banks”, according to people with knowledge of the matter. In other words, bad news is most certainly good news… if only for risk assets.

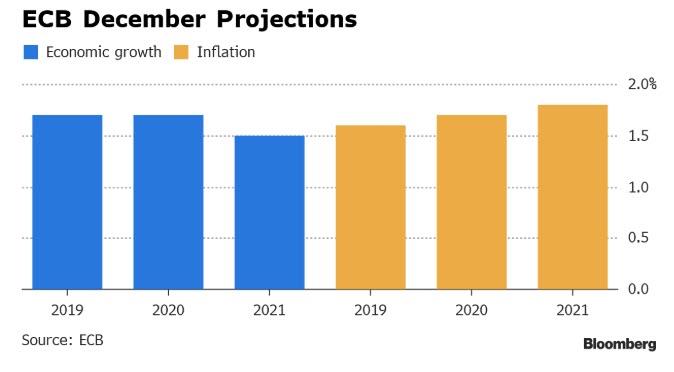

Bloomberg notes that the latest projections show extensive downgrades for inflation and economic expansion in 2019, with an assumption of a pickup toward the end of the year, while the inflation outlook will be cut through 2021.

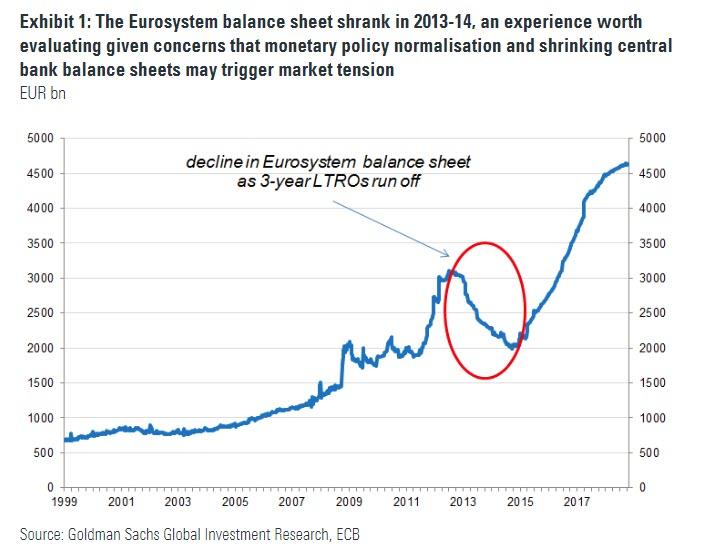

New forecasts in hand, “ECB policymakers will debate on Wednesday the design of fresh funding operations based on their existing targeted lending program, with a focus on how long they should last and at what interest rate”, the sources said, although Bloomberg hedged by saying that not all details of a decision will be available this week, and in fact, despite the revisions, “a full announcement on new loans may not come on Thursday.”

In other words, something may or may not happen tomorrow, especially since Draghi will be again forced to explain how after years of negative rates and QE, Europe is again on the verge of a crisis, as the TLTRO was previously framed as an event that would only take place “only in case of a serious economic shock“. Indeed, Draghi has in the past framed TLTRO extension discussions around having a monetary-policy case, rather than simply pandering to the needs of individual lenders.

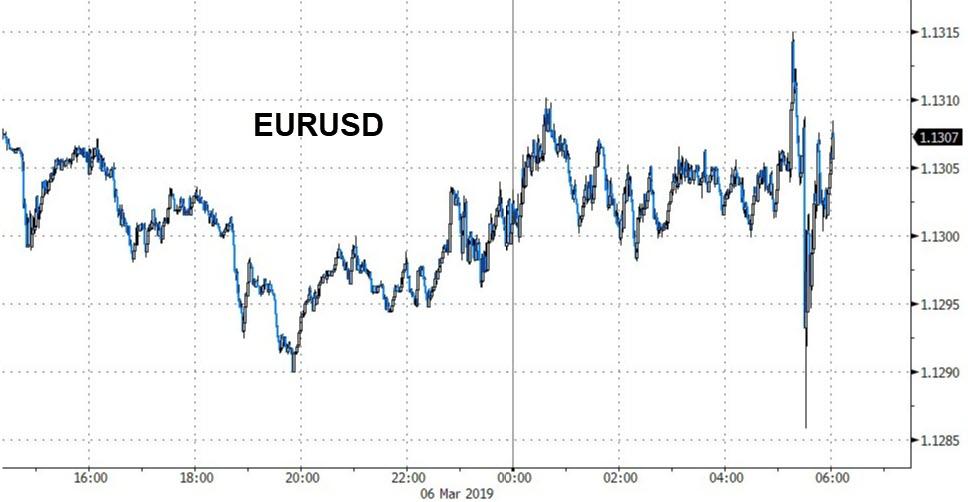

In response to the report, the euro stumbled after bank stocks erased their decline, with Euro Stoxx Banks Index rising 0.2% after earlier sliding as much as 1 percent following the latest money laundering allegations. However, the EUR promptly rebounded with Credit Agricole noting that the TLTRO is “at least partly expected by now” given the price action in EUR and EGB yields and rates.

In other words, there is a distinct risk that not only has the market fully priced in a new TLTRO (alongside Trump’s trade deal with China), but that the ECB’s admission an “economic shock” is imminent – hence the need for another TLTRO – could send risk assets sliding in what would be a nightmare outcome for Mario Draghi who may soon be facing another “whatever it takes” moment.

via ZeroHedge News https://ift.tt/2C7aojj Tyler Durden