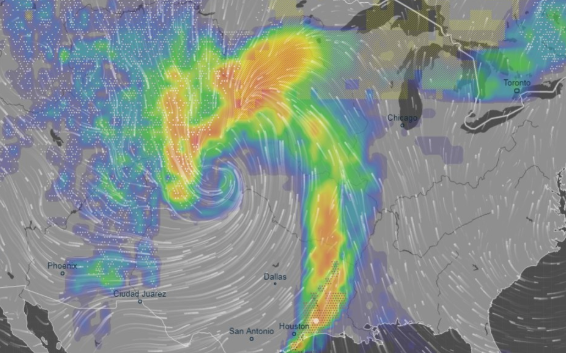

A powerful winter storm is forecasted “to intensify explosively” in the southwest US on Tuesday into Wednesday, unleashing a wide array of life-threatening weather hazards for tens of millions of Americans, reported Axios.

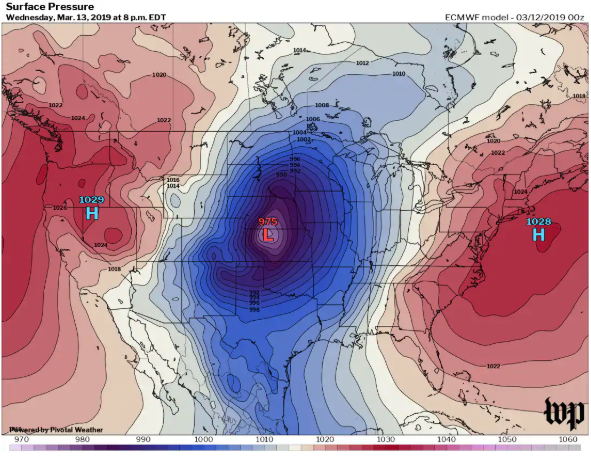

The impact area is expected from North Texas through the Dakotas and Minnesota is expected to be hit the hardest. The storm will likely qualify as a meteorological “bomb” — short for bombogenesis, which describes storms whose central pressure drops 24 millibars in 24 hours. The lower the pressure and the quicker it drops, the more powerful the storm. This could be one for the record books.

“A strong storm is poised to rapidly develop across the Plains this week, meeting “bomb” criteria (deepening of 24mb or more in 24 hours).

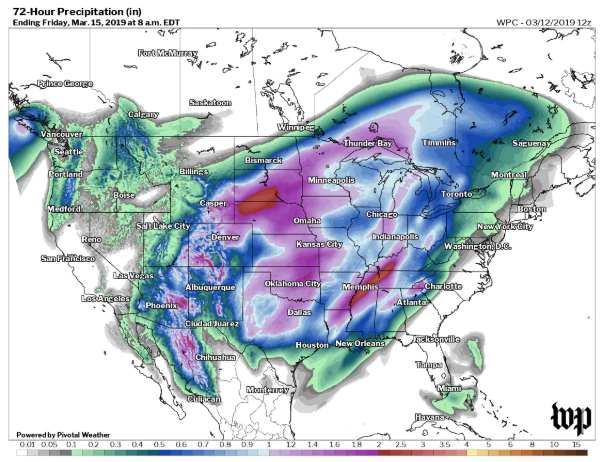

This will spread heavy rains, thunderstorms, and flooding risks into the central Plains into Wednesday, then spread snow into the Dakotas later Wednesday into Wednesday night.

This storm is particularly strong for this time of year in this part of the world. Data suggests this storm will be the strongest (via minimum central pressure) storm since at least 1979 to impact the central Plains. With a central pressure equivalent to that of a category 2 hurricane, wind, rain, and snow will all be threats.

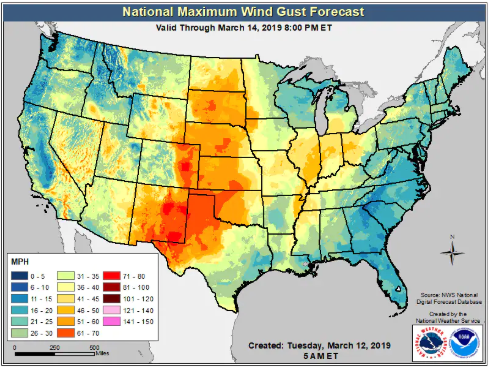

This will spark heightened wind generation in the southern Plains, and combined with melting snowpack, offer significant flooding risks across the northern Plains and Upper Midwest. This will halt any progress farmers were making toward fieldwork in this part of the country,” Meteorologist and owner of Empire Weather LLC., Ed Vallee.

The bombogenesis will detonate over Central Plains and bring almost every weather hazard possible at once. Severe thunderstorms are expected to hit south Texas to eastern Nebraska on Wednesday, which includes the potential for tornadoes.

-

Meanwhile, in the plains of eastern Colorado and parts of Nebraska and Kansas, rain, freezing rain, sleet and heavy snow are forecast as the storm intensifies. Some areas may pick up more than a foot of snow as wind gusts to 70 miles per hour lead to blizzard conditions. The closures of entire interstates, including I-70 in Colorado, is possible.

-

Blizzard warnings have been posted from northeastern Colorado into southeastern Wyoming, as well as Nebraska and southwest South Dakota.

-

As the storm spins northeastward, it’s predicted to bring heavy rain on top of a deep snowpack in the Upper Midwest, with the potential for severe flooding in some areas.

-

Because of the storm’s low air pressure, it will generate a huge and powerful wind field as air rushes toward the storm center. High wind watches cover a vast region from South Texas to Iowa, and wind gusts of up to 70 miles per hour are possible in the hardest-hit regions, the National Weather Service warns.

The storm will affect the entire Central Plains, from the U.S.-Mexico border to the U.S.-Canadian border. Axios notes that it’s highly unusual to see a low-pressure system intensify so rapidly over land, since these type of storms are more common over tropical oceans.

via ZeroHedge News https://ift.tt/2u6ZGos Tyler Durden

To resolve the Israeli-Palestinian conflict, Israel must first achieve defeat of the Palestinian movement.

To resolve the Israeli-Palestinian conflict, Israel must first achieve defeat of the Palestinian movement.

It’s my pleasure to inform you, dear reader, that Reason is a finalist in 10 categories at the 67th annual Maggie Awards, hosted this year by B2B Media.

It’s my pleasure to inform you, dear reader, that Reason is a finalist in 10 categories at the 67th annual Maggie Awards, hosted this year by B2B Media.

The American Civil Liberties Union (ACLU) is

The American Civil Liberties Union (ACLU) is