Today is the official launch date of the EU Parliamentary elections in Europe, which as Deutsche Bank’s Jim Reid writes, used to be fairly dull affairs but with the rise of anti-EU and populist party support, and the bizarre situation where the UK is taking part but likely to leave the Union this year, “the next few days should be a fascinating political backdrop for a turbulent few years ahead for Europe.”

First some logistics: the EP elections actually take place over the next four days, with each of the 28 countries voting on the day they normally hold national elections. The UK and the Netherlands will kick off proceedings today, but most of the big EU countries (including Germany, France, Italy, Spain and Poland) don’t vote until Sunday. In spite of some countries finishing before then, the votes won’t actually be counted until the polls right across Europe have closed, so as Reid notes, Sunday night is when we can start to expect results, with the final outcome on Monday.

Here Deutsche Bank makes an interesting (or worrying depending on your view) fact about the EP elections: in every vote since they began in 1979, EU-wide turnout has fallen, from a high of 62% at the first set in 1979 to just 43% last time round in 2014. As a result of the EU’s crackdown on unpopular, if democratic, choices, the votes are simply not seen as anywhere near as important as national elections but for the EU to succeed it will be difficult if Eurosceptic politics dominate in Brussels. Indeed, populists are expected to perform strongly in the first EP election since the migrant crisis and Britain’s vote to leave the EU in 2016.

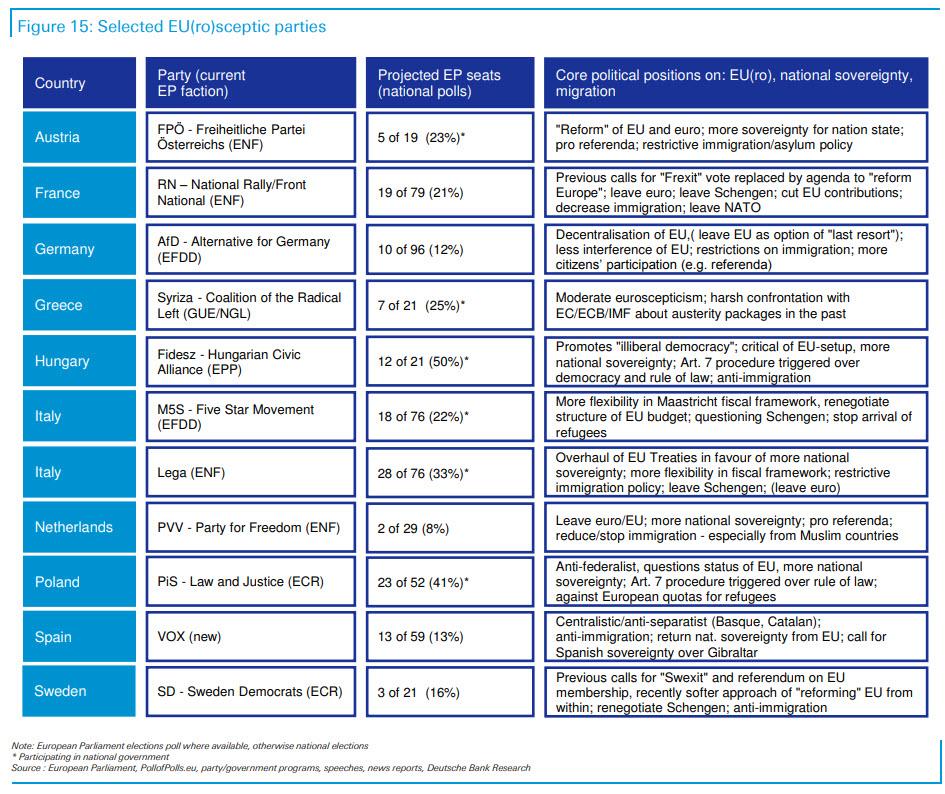

As the chart below shows, while nowhere near a majority yet, EU-sceptics are rapidly approaching the critical threshold level, and away from Hungary, where the anto-immigration Fidesz party is expected to hit just about 50%, the most critical country to track will be Italy, where the League is expected to win roughly 33% of the Projected Europarliament seats.

What to look forward to?

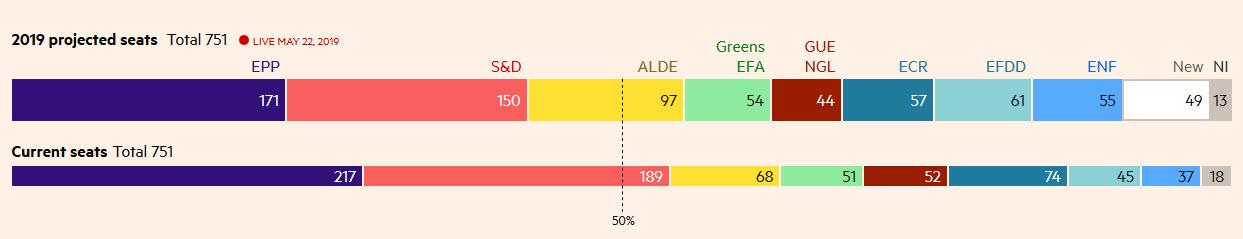

According to the polls, we can expect to see some pretty striking results across the continent, with Eurosceptic parties of both left and right expected get more than 35% of the seats if the current polls are correct, while for the first time ever the two main centre-right and centre-left groupings are projected to not have a majority between them, although pro-European forces as a whole are expected to.

In the UK, Nigel Farage’s Brexit Party, which explicitly backs a no-deal Brexit, is polling in first place, while polls have put the governing Conservatives as low as fifth, something for which there is quite literally no precedent. The Brexit party, having only been formed a few months ago, are now poised to come first in a national election, prompting the following question from Deutsche Bank: “Has a political party ever gone from non-existence to first place in a national poll so quickly?” (The answer is no)

Meanwhile, and just as important, in Italy the right-wing Lega is expected to come first, with its leader Deputy Prime Minister Salvini having railed against EU deficit rules and clashed with other countries over taking in migrants. In France, President Macron’s party has been running neck-and-neck with Marine Le Pen’s Rassemblement National, with the final polls putting Le Pen’s party marginally ahead. This will be one to watch when results come through Sunday night/ Monday morning.

With the big picture in place, here courtesy of RanSquawk are the full details to look for in the next 4 days:

May 23rd-26th will see EU citizens take to the polls to elect 751 MEPs from the 28 member states (inc. UK) with the election taking place against a backdrop of increasing populism across the continent and rising anti-EU sentiment. Investors will be watching the election for any signs of European disintegration.

Voting system

As part of a five-year cycle, EU citizens will be electing 751 MEPs to the European Parliament with each individual nation’s seat allocation based largely on population size. Note, if the UK had been able to ratify a Brexit deal by May 22nd, out of its current 73 seat allocation, 27 seats would have been re-allocated to member states with the remainder reserved for future enlargements.

There is no uniform voting system across the process, however, all nations use some form of proportional representation. In terms of the order of play, the vote count in each nation will commence when polls close in each member state with the results to be released from Sunday 26th May at 2100BST when polling stations in all countries have shut. Note, exit polls will be published after all polling stations have closed with results updated throughout the night.

Current Parliamentary Composition

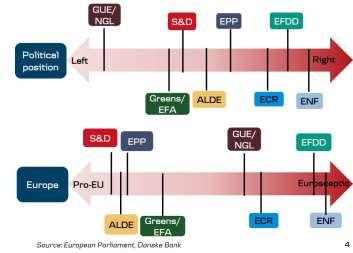

Given the multi-national composition of the European Parliament, there is a wide-range of political views held by MEPs, however, lawmakers broadly fit into one of 9 Parliamentary groups (one of which is non-attached members). These Parliamentary groups are divided by political leaning and not necessarily geographical location. These groups are as follows (in order of current Parliamentary representation):

- European People’s Party (EPP): 217 MEPs. Leader: Manfred Weber. Stance: This is the biggest group in the European Parliament, containing some of the EU’s longest-established political parties. It is broadly centre-right and enthusiastic about deeper EU integration. Around half of the European Commission is comprised of members of the EPP party.

- Progressive Alliance of Socialists and Democrats (S&D): 189 MEPs. Leader: Gianni Pittella. Stance: The main center-left group in the Parliament and for many years was the biggest group in Brussels, although that crown has since been taken by the EPP. (MUEZ)

- European Conservatives and Reformists (ECR): 74 MEPs. Leader: Syed Kamall. Stance: Broadly centre-right and Eurosceptic, it contains a mixture of groups that are more socially conservative and those that promote economic liberalism.

- Alliance of Liberals and Democrats for Europe (ALDE): 68 MEPs. Leader: Guy Verhofstadt. Stance: It is the main centrist group in the Parliament. One of the most Euro-enthusiastic groups in the Parliament and has often held the balance of power in key votes and has been courted by both the Socialists and the EPP when majorities are sought.

- European United Left–Nordic Green Left (GUE-NGL): 52 MEPs. Leader: Gabriele Zimmer. Stance: Group sits on the far left of the political spectrum, containing members from a number of Communist and traditional Socialist parties. It is broadly Eurosceptic but from an anti-austerity or anti-capitalist point of view, rather than specifically on issues of national sovereignty.

- Greens–European Free Alliance (Greens–EFA): 51 MEPs. Leader: Rebecca Harms and Philippe Lamberts. Stance: As its name suggests, this group is an alliance of two parties – the European Greens and the European Free Alliance. The group generally takes a left of centre position on most issues.

- Europe of Freedom and Direct Democracy (EFDD): 45 MEPs. Leader: Nigel Farage. Stance: Contains MEPs who disagree with the idea of European integration from a broadly, but not exclusively, right-wing perspective. The UK provides the largest number of MEPs in this group.

- Europe of Nations and Freedom (ENF): 37 MEPs. Leader: Marine le Pen. Stance: The bulk of the group’s MEPs come from the French Front National (FN), The far-right FN had previously struggled to find members from enough countries to form a group. The bloc also includes Italy’s Northern League and MEPs from the Dutch Freedom Party.

- Non-Inscrits (NI): 18 MEPs. Leader: N/A. Stance: Generally speaking, this cohort is made up of MEPs who have not been able to find enough allies to form a group of their own, or who have been rejected by other parties.

Please see below for a useful graphic from Danske Bank depicting the political leanings of various groups

Polling

Polling for the election is somewhat opaque as there is no pan-EU polling for the elections within all member states. Instead, pollsters project theoretical seat allocations for the EU Parliament on the basis of national polls within member states. A bulk of the polling up until recently had excluded the UK from the election race, however, since the extension of the Brexit deadline to October 31st, UK parties have been reworked back into forecasting models. Given this development and the sheer scale of the data required to build polling models, it is possible that there could be a larger margin of error than seen with previous polling. Furthermore, participation rates could also pose some issues for pollsters with HSBC highlighting that the increased press coverage and political debate across Europe could see a marked pickup in Europeans heading to the polls vs. the record-low 2014 turnout of just 42.6%.

Please see below for the latest polling data via the FT:

Overall, Danske Bank concludes that the EPP will remain the largest faction in Parliament with the S&D to remain in second place. However, the EPP and S&D will likely lose their absolute majority (for the first time since the 1970s) amid the backdrop of populism and French President Macron throwing his weight behind the ALDE. That said, Danske Bank notes that this might not be perceived as too much of a negative as it could spark broader debates within Brussels. Furthermore, doubts over whether or not the populist factions will be able to provide a united front under the potential leadership of Italian Deputy PM Salvini, could help limit the influence of anti-EU sentiment within the decision-making process. Furthermore, when/if the UK leaves Parliament after securing a Brexit deal with the EU, this will also limit the scope of the Eurosceptic reach. Additionally, HSBC suggest that Eurosceptic parties could be further isolated if the EPP and S&D opt to reach out to ALDE and the Greens.

Market Impact

Overall Impact

In terms of the overall market impact, given the potential outcomes discussed above which will most likely see the preserving of some sort of status-quo between pro-EU parties, analysts broadly believe that the elections will not be too much of a market-mover; a view backed by Goldman Sachs. However, any surge in allocations for anti-EU parties would likely challenge this view, albeit, Danske Bank believe that any impact on the periphery wouldn’t be particularly significant.

A somewhat cynical view comes from the Telegraph’s Ambrose Evans-Pritchard:

”The election of 170 part-time dilettantes from the eurosceptic Left and Right might shake up French or Italian politics. It will change absolutely nothing in the governing structure of the EU…The EU’s permanent machinery will reassert iron control once the noise has subsided. Few euro-rebels ever learn where the light switches are at the Espace Leopold in Brussels. They do not master procedure or lay siege to the powerful committees that ‘codecide’ – i.e., can veto or rewrite – 60% of new legislation descending on national parliaments. Their vocation is criticism.

Day-to-day matters are left to Team Germany and its satellites. This is not to make an anti-German point but simply to state a fact of European life. German MEPs are career legislators. Election is the path to a lifelong job. Protest movements barely scratch the surface of this regime. They take up their seats – and salaries – but their influence over daily governance is scarcely greater than Sinn Fein’s at Westminster. The game is symbolism. European elections are to promote the brand at home and gain fungible funding – if you can slip the money past the Strasbourg police or Questors.

Nigel Farage, France’s Marine Le Pen, and Italy’s Beppe Grillo, and Greece’s Syriza (before it was co-opted) all levered gains in the 2014 elections into uprisings of sorts in their own countries, but they did not deflect the EU juggernaut one inch from its rigid, imperial, integrationist course. Not even Brexit has done that. Au contraire. Perhaps it will be different this time. Matteo Salvini and Hungary’s Viktor Orban are not outsiders any more. They are in government. Yet as a grizzled, scarred veteran of EU trench warfare for almost thirty years, I remain deeply sceptical. My working premise is that nothing of substance will change unless or until Germany loses faith in the euro project or – much the same thing – Italy’s corrosive debt dynamics finally compel the Bundesbank to cut off Target2 support for the Bank of Italy. Winning elections is never quite enough in the European Union.”

National Impact

ING attribute greater market relevance towards the potential national fallout of the election with the Dutch Bank citing the fragility of the German government “which could eventually fall in case of severe defeats for at least one of the coalition parties”. This view is also backed by BNP Paribas who suggest a potential change in government from a CDU/SPD coalition to a ‘Jamaica’ coalition of CDU/FDP/Greens. Elsewhere, ING highlight France as another area of potential interest whereby “voters could use the elections to voice their assessment of recent policy announcements”.

However, BNP Paribas downplay the likelihood of a snap election in France and instead suggest the fallout of the EU elections will be more pertinent for the 2022 Presidential race. Furthermore, a strong showing for Italian Deputy PM Salvini could heighten the likelihood of a domestic election with the League and 5SM currently at loggerheads and the League’s polling numbers having increased markedly since last year’s election. However, HSBC caution that potential delays to passing the Italian budget from an election could make the President (who is responsible for dissolving Parliament) reluctant to send Italian voters to the polls once again. From a UK perspective, the 2019 elections will be of great importance given that the nation was not initially intending to partake in them, with the outcome of the vote likely to reflect the leave/remain divide in Britain. In terms of the fallout from the election for UK politics, the situation very much remains a moving target with PM May aiming to once again put her deal before Parliament at the beginning of June. However, recent polling suggests a victory for the Brexit Party and a dismal performance from the Conservatives which could provide Tories with enough ammunition to finally remove their leader. Obviously, the election could have a follow-through for all EU28 members, however, for the purpose of this report, our analysis has largely been placed on Germany, France, UK and Italy.

Spitzenkandidaten

Of greater importance for the election could be the knock-on effect to top-level appointments within the EU/Eurozone. Firstly, there is the Spitzenkandidaten process (introduced in 2014), whereby “each party on the European level can publicly announce who their transnational spitzenkandidat will be, informally making them the face of their election bid. The spitzenkandidat who can secure a majority governing coalition in the European Parliament (353 MEPs) will become European Commission President if approved by the European Council (Heads of national governments and states)”, as explained by Europe Elects. At the time of writing the process will likely be used at the 2019 election, however, objections from French President Macron could see this process scrapped. The French President has stated that his party will not support any political group that backs the process as believes it strips politicians of “the power to pick Europe’s most senior official”, as reported by Politico. Nonetheless, should the system be used, please see below for the current list of Spitzenkandidatens

- European Peoples Party (EPP) – Manfred Weber (National party: German CSU); Current EPP Chair and therefore polling suggests he could have the greatest chance of becoming European Commission President if Spitzenkandidaten process is used. Hardliner on immigration.

- Progressive Alliance of Socialists and Democrats (S&D): Frans Timmermans (National party: Dutch Labour Party); First Vice-President of the European Commission and said to have the next best chance of success after Weber. Key figure in the fight against nationalism and Euroscepticism.

- European Conservatives and Reformists (ECR): Jan Zahradli (National party: Czech Civic Democratic Party); Yet to be officially confirmed and has a very slim chance of victory. Supports a multi-speed EU which is responsible for protection of external borders and the single market. However, believes member states should remain in charge of migration, taxation and currencies.

- Greens–European Free Alliance (Greens–EFA): Ska Keller and Bas Eickhout (National parties respectively: German Greens and Dutch GreenLeft). Want to impose higher environmental standards on the EU with focus also on issues such as immigration, social justice and equality.

- Other notables: Guy Verhofstadt (ALDE), EU Commissioner Vestager, Luis Garicano (ALDE), Nicola Beer (FDP MP) (Sources Europe elects, Danske Bank)

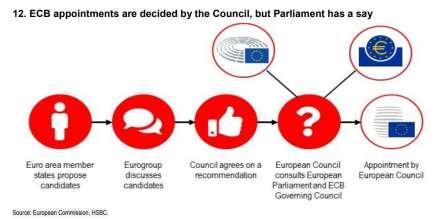

ECB

Once the Spitzenkandidaten or equivalent process for naming the European Commission President has been carried out, focus will then turn towards what appointments that President will make to key positions. From a market perspective, a lot of focus will be on the ECB with Mario Draghi’s term due to come to an end on October 31st. Please see below for HSBC’s illustration of how this process will unfold:

HSBC highlights that ultimately the appointment of the European Commission President will likely impact who becomes ECB President with it unlikely that both the EC and ECB President will be from the same nation amid fears of over-representation. For example, should Manfred Weber replace Juncker, it is unlikely that the top job at the ECB will end up being awarded to a German. With this in mind, the current two front-runners to succeed Draghi, according to a Bloomberg News poll (here) are Francois Villeroy de Galhau (FR) and Erkki Liikanen (FI). If Weber fails in his bid to be elected European Commission President, Germany could look to push for Jens Weidmann to become ECB President, a move which could lead to a slightly more hawkish stance at the central bank.

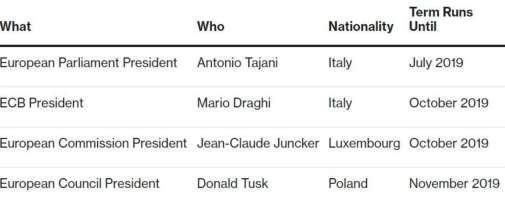

Please see below for an overview of key positions in Europe that will need to be filled following the election via Bloomberg News:

Budgeting

In terms of the broader fallout from the elections for the EU-wide economy, HSBC reminds us that overall, Parliament is relatively limited in terms of economic powers, albeit have had a greater role in recent years on matters such as trade deals, taxation and climate change. For the purpose of this report, we will not place too much emphasis on more medium-term measures such as the 2021-2027 budgetary framework as it is unlikely to have too much of an impact in the near-term for European assets. Instead, greater attention should be placed on the European Commission’s assessment in June, which will see the body potentially make some country-specific recommendations for the likes of Italy, Spain and France. Given the ongoing tensions between Rome and Brussels since the 5SM/League alliance came to power, markets will be bracing themselves for any further conflict.

Recommendations will come in the context of the EC recently forecasting the Italian deficit/GDP ratio to hit 2.5% this year and 3.5% next year. SocGen outlines that the EC could opt to re-launch the Excessive Deficit Procedure (EDP) following the election or extend Italy’s deadline to correct its deficit deviation until around 2022. The path chosen by the EC will likely be a by-product of how intent the newly formed body will be on dispelling populism across the continent, or as suggested by HSBC, the EC might not actually be fully formed by this point or if they are, might not feel legitimised at that stage to take action on Italy. Elsewhere, France and Spain will pose some food for thought in Brussels with the former forecast to enter into a temporary excessive deficit, albeit SocGen believes that the temporary nature of their excess should see the nation avoid EDP. With regards to Spain, a deterioration in the nation’s structural balance has been flagged by the EC, however, Brussels is likely to wait for a government to be formed before considering their next course of action.

via ZeroHedge News http://bit.ly/2EtEgYl Tyler Durden