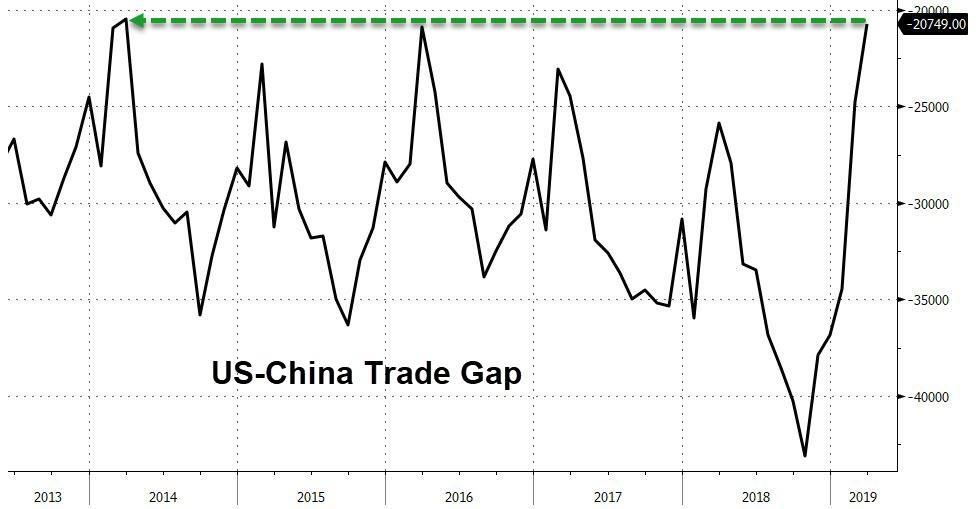

While the US trade deficit declined only marginally in March, we posited that the unexpectedly large decline in the US-China bilateral trade deficit might be of greater interest to both the Trump Administration and the general investing public because – as both Zero Hedge and Bloomberg argued – it is an unequivocal sign that President Trump is, in at least one respect, “winning” the trade war.

In March (the most recent month for which data are available), the bilateral trade gap shrank to just $20.75 billion, the lowest level since March 2014.

All told, official US data showed that official Chinese exports to the US tumbled by $15.2 billion, or 12%, in the late January-March quarter of 2019 on an annualized basis.

Since these data were collected before President Trump raised tariffs on $200 billion in Chinese goods in the latest round of trade-war escalation, the conventional wisdom would dictate that the bilateral deficit will probably continue to improve, as US companies source their goods from other foreign markets, or – as President Trump would undoubtedly prefer – opt to manufacture them in the US.

And while that may or may not turn out to be true, Nikkei Asia Review raised questions about whether these data accurately reflect the impact of the tariffs on Chinese exporters – and, by extension, the Chinese economy – with an explosive report published Monday describing how Chinese exporters are using intermediaries to get around the tariffs.

In an analysis of data from the US International Trade Commission and the International Trade Center, Nikkei revealed that while exports of machinery, electrical equipment and some other products impacted by tariffs have reflected particularly sharp declines, shipments of these goods from China to the US via Vietnam, Taiwan and Mexico actually rose during this period, a sign that exporters are rejiggering their supply chains to compensate for the US tariffs.

Of course, Chinese companies have other ways of compensating for American tariffs. President Trump railed against China’s “subsidizing” of goods to keep them competitive in American markets. Washington has repeatedly criticized Beijing for unfairly subsidizing state-backed companies, and although the Treasury once again declined to name China a currency manipulator, the weakness in the Chinese yuan has also elicited criticism.

China is subsidizing its product in order that it can continue to be sold in the USA. Many firms are leaving China for other countries, including the United States, in order to avoid paying the Tariffs. No visible increase in costs or inflation, but U.S. is taking Billions!

— Donald J. Trump (@realDonaldTrump) June 3, 2019

But Nikkei’s calculations suggest that the tariffs are being offset, at least in part, by exports to Vietnam, Mexico and Taiwan, much of which are then routed to the US.

Five key items which have suffered the biggest declines were analyzed: machinery and parts; electrical equipment and parts; furniture; toys; and automotive equipment and parts.

In the case when China’s exports to the U.S. are classified in accordance with customs codes, the volume of products including machinery and parts, and electrical equipment and parts, slumped conspicuously.

In the first quarter of this year, exports of machinery and parts plunged by $5.77 billion from a year earlier, while exports of electrical equipment and parts plummeted by $4.46 billion year-on-year.

With the exception of toys, four of these five items have become subject to three rounds of punitive import tariffs imposed by the administration of U.S. President Donald Trump.

While exports of the five items from China to the U.S. between January and March declined by 16%, equivalent to a value of $12.2 billion, exports from China to developing countries and from developing countries to the U.S. have generally climbed. Exports via Vietnam, Taiwan and Mexico have increased particularly steeply.

In January-March 2019, exports of the five items from China to Vietnam rose by $1.5 billion, or 20%, while exports of the five items from Vietnam to the U.S. surged by $2.7 billion, or 58%.

In the same three-month period, exports of the five items from China to Taiwan increased by $1.4 billion, or 23%, while such exports from Taiwan to the U.S. expanded by $2.0 billion, or 31%.

Exports from China to the U.S. via Mexico also increased. Mexico’s exports to the U.S. surpassed those of China to become the biggest source in March.

Here’s a breakdown of the chart:

To be sure, the tariffs have also created opportunities for other Southeast Asian nations to export goods to the US that hey hadn’t previously.

Since the U.S. first slapped punitive tariffs on a broad range of imports from China, the six major Southeast Asian nations and Taiwan have started shipping nearly 1,600 new categories of products to the U.S. that they had never exported to America before.

Of these new U.S.-bound exports, about 1,000 items, or over 60% of the total, are on Washington’s blacklist.

These exports amounted to some 30 billion yen ($277 million) during the period from July 2018 through March 2019. The amount is likely to keep growing if the U.S.-China trade spat continues.

With all of this in mind, slumping Chinese factory output would suggest that tariffs are having an impact. But as time passes and supply chains are reorganized, Chinese exporters might bounce back, with most of the impact negated.

When this happens, will the Trump Administration abandon the strategy of hiking tariffs (something markets would probably celebrate) and opt instead for another retaliatory strategy (like, say, ending the student visa program fro Chinese students?).

via ZeroHedge News http://bit.ly/2WmB5N0 Tyler Durden