Authored by Bloomberg markets commentator, Ye Xie

It’s starting to look a lot like Christmas, at least in markets. While Federal Reserve officials are singing in chorus that the economy is in good shape, just as they did in December, financial markets are saying otherwise. As U.S. President Donald Trump’s administration keeps throwing wrenches into the works of the economy, the markets may sell off further, forcing the Fed to change course yet again.

Recall that in December, the triple concerns about the trade war, a China slowdown and Fed policy error sent the markets reeling. These days, the trade tension has escalated and the Chinese economy is suffering from a double-dip following a recovery earlier this year. The only saving grace is that the Fed has shifted from tightening to wait-and-see. The risk, however, is that the central bank may react too slowly as the market and economy deteriorate.

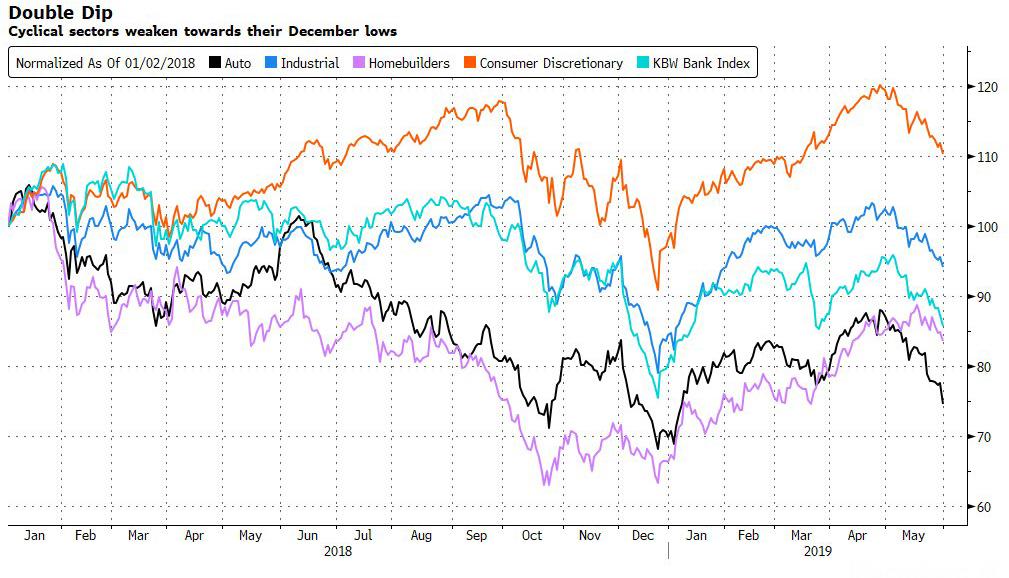

Five months ago, legendary investor Stanley Druckenmiller urged the Fed not to raise rates, citing the weakness in cyclically sensitive sectors such as automakers, banks and industrial companies as a signal that something is “not right” in the economy. Today, those sectors are moving in the wrong direction again.

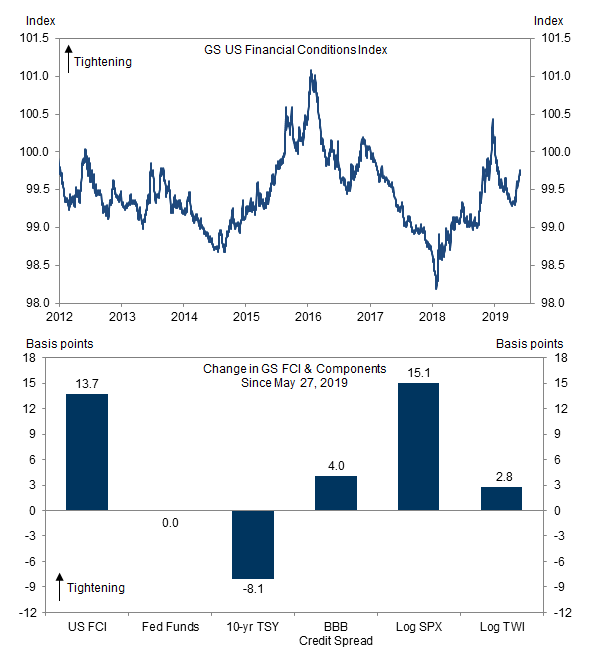

Goldman Sachs’ gauge of financial conditions tightened last month at a rate similar to what it did in December. While the current level is still not severe enough for the Fed to take action right away, the ongoing trade tension means that things may get worse.

Trump’s threat to impose tariffs on Mexican exports because of immigration issues means he is using U.S. imports as a weapon for both trade and political goals. Even if the latest tariffs are called off at the last minute, the threat of them won’t go unnoticed in Beijing. China may stretch the trade war out until after the 2020 elections, hoping to have someone more reasonable to deal with. Already, Beijing is laying the groundwork for counter-attacks, from blacklisting “unreliable” entities to potentially restricting rare earth exports.

It’s difficult for the Fed to cut rates preemptively based on a judgment of what Trump may tweet next. After all, data Friday showed that consumer spending and inflation were recovering before the trade tensions escalated in May.

Without a helping hand from the central bank, risky assets are likely to decline further until they hit the strike price of a Fed Put, or perhaps a Trump put, if there is one.

via ZeroHedge News http://bit.ly/2Xp6mLU Tyler Durden