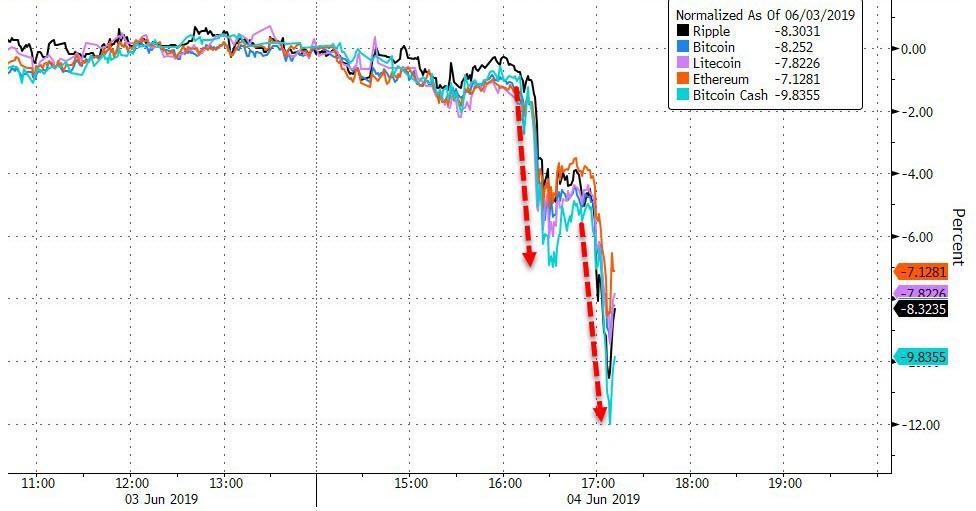

Having survived the day’s bloodbath in US tech stocks, cryptos are crashing in the early Asian session, apparently playing catch-down to the day’s de-risking.

The entire crypto space is down 8-12%…

With Bitcoin back below $8000 and oddly attracted lower to Nasdaq’s collapse…

However, as CoinTelegraph reports, macro strategists remain bullish, despite the recent overnight crashes (many of which appear to synchronize around the Korean morning). The following factors have been mentioned in recent weeks as potential catalysts for an increase in bitcoin’s price:

-

Rise in institutional demand, as seen in the drastic increase in Bitcoin Investment Trust (GBTC) premium.

-

The entrance of major financial institutions such as Fidelity, Etrade and TD Ameritrade.

-

Scheduled block reward halving of bitcoin in May 2020.

-

A noticeable improvement in the infrastructure supporting the asset class.

-

Rising institutional demand, triggering the recovery of retail interest.

Technical analysts in the crypto sector, such as Josh Rager and Cred, foresee $8,200 as a crucial support level that could prevent the asset from dropping to the $7,000 region once again.

The last time bitcoin’s price dropped below $7,000 was in a flash crash on March 17, when it fell to $6,400, triggered by the unexpected sell-off of 5,000 BTC on Bitstamp, which then led to the mass liquidation of contracts on BitMEX.

Bitcoin has since demonstrated strong momentum, with signs of “fear of missing out” (FOMO) among investors, creating a vertical rally to the upside.

Cred told Cointelegraph in an interview that, as long as the $8,200 support level is defended, a rise to $9,600 remains a realistic target and a high time frame resistance level.

“I think the vertical rally is more a sign of FOMO and disbelief as opposed to something to be inherently concerned about. I’m looking at the $9600 area as the next high time frame resistance area if price trades higher. Closer to current price (which is pulling back at the time of writing), I think losing $8200 — the level price broke out from and thus nearest support — will take us to the $7300 area. Mid $6000s remains the best and final area for longs. Losing that level and staying below $6000s would shift my bias to bearish.”

In the past month, within a 30-day span, the price of bitcoin has increased from $5,322 to over $8,700 by a staggering 54%.

Still, based on the historical performance of bitcoin and its tendency to see a major correction in the tune of 30% to 40% following a large spike in price, Cred noted that a 30% drop in the future remains a possibility.

Throughout the past three years, bitcoin has generally shown sustainable momentum, especially from 2016 to late 2017. However, it was regularly prone to relatively corrections in short time frames.

“In 2017 and years before that, Bitcoin would regularly correct circa 30% before continuing higher. I think we will see something similar, but trying to short this market presumptively is a bad play. Any significant pullback above the old $6000 floor is a dip I’m interested in buying, the closer to $6000 the better,” Cred said.

via ZeroHedge News http://bit.ly/2WHpGXw Tyler Durden