Total credit card debt among American consumers jumped 29% since 2015, reaching a whopping $807 billion in 1Q19, according to the latest Experian data. In the past year, as the economy cycles down, overall credit card debt rose 6%.

More than 60% of Americans used credit cards for basic purchases in 1Q19. That’s an 11% increase when compared to 1Q16, and a 3% increase from 1Q18.

The average American carries four credit cards with a balance of $6,028.

Experian said all 50 states plus Washington, DC, saw an increase in its average credit card debt on a YoY basis.

Hawaii had an average credit card debt increase of 3.4% over the past year, experienced the most significant growth in credit card usage among any state.

Experian said the average credit card debt in Hawaii is approximately $6,500, which is $500 more than the national average.

Separately, a report from WalletHub suggests why Hawaiians are increasingly using their credits cards. The report collected data from 28 key indicators of economic performance and growth from the island state, determined its economy is the worst in the country because of slow GDP growth, low exports per capita, and relatively few tech jobs.

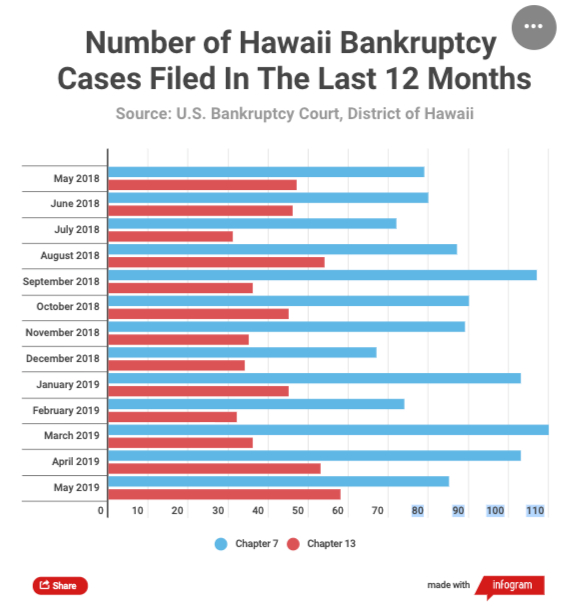

US Bankruptcy Court District of Hawaii reported last week that the number of Hawaiians filing for bankruptcy in May jumped by double digits over the same month the previous year. May cases showed a 14.3% increase from 2018, with 144 cases filed last month as compared to 126 cases in May last year. May’s readings are the highest since 2014, a sign that the consumer is experiencing financial stress.

Some of the stress is due to massive student loan debt, the housing affordability crisis, and out of control living costs.

Growth in student loan debt is expected to outpace mortgage debt in the state in the near term. Student debt also exceeds credit card debt.

Hawaii ranked 26th in the country for its household income, even though the cost of living is the highest in the country.

The sobering reports come as travel experts warn Hawaii could see an imminent downturn, as tourism dollars are expected slow and the labor market softens.

Americans, and more importantly, Hawaiians, continue to drown even deeper in debt as the economy cycles down.

via ZeroHedge News http://bit.ly/2KjuWeh Tyler Durden