As discussed earlier, and as both Bank of America and JPM explained, the biggest risk for the market next week is if the Fed not only doesn’t cut – the market assigns a very low probability to such a “pre-emptive” move – but fails to signal an aggressive dovish reversal in the form of a rate cut in July. And yet, despite its upbeat outlook – it still expects the S&P to close the year at 3,000, Goldman’s strategists are certainly taking the over on how hawkish the Fed will sound next week.

As Goldman’s chief economist Jan Hatzius writes, the bank expects “unchanged” policy at the June 18-19 FOMC meeting and sees the subjective odds of a June cut at only 10%. More importantly, while Goldman looks for a dovish tilt to the proceedings it won’t be nearly enough to appease markets that have aggressively priced rate cuts in the fall.

Barring an unlikely surprise on the funds rate, we expect the market to focus on four key developments:

- the statement’s policy stance/balance of risks paragraph,

- the number of participants projecting cuts in the Summary of Economic Projections (SEP),

- the extent of dovish changes to the statement and economic forecasts, and

- the tone of Powell’s press conference.

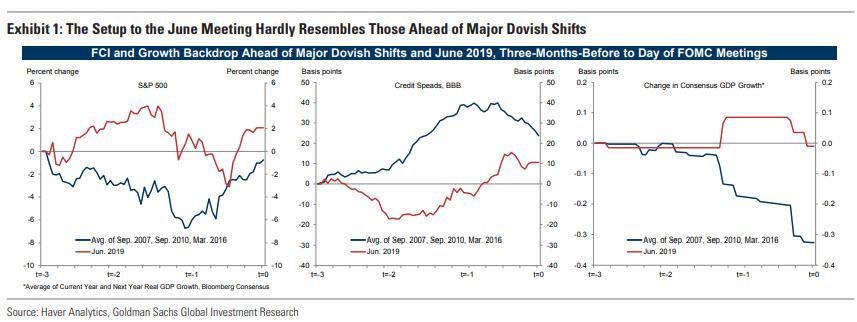

In Goldman’s view, the main reason why the Fed is poised to disappoint markets is simply that not enough has changed to warrant a clear signal of an upcoming cut. Indeed, “since the March SEP meeting, stock prices are higher, the unemployment rate fell to a 50-year low, consensus growth forecasts are unchanged, and the very tariffs on Mexico that prompted the latest calls for rate cuts have been taken off the table.” Not only that, but the economy continues to chug along largely as expected: outside of May payrolls, the growth data still look decent: Goldman’s Q2 GDP tracking estimate has rebounded to +1.6%, Atlanta Fed GDPNow is +2.1%, and the bank’s own tracker of private final demand is at an even healthier pace (+2.8%).

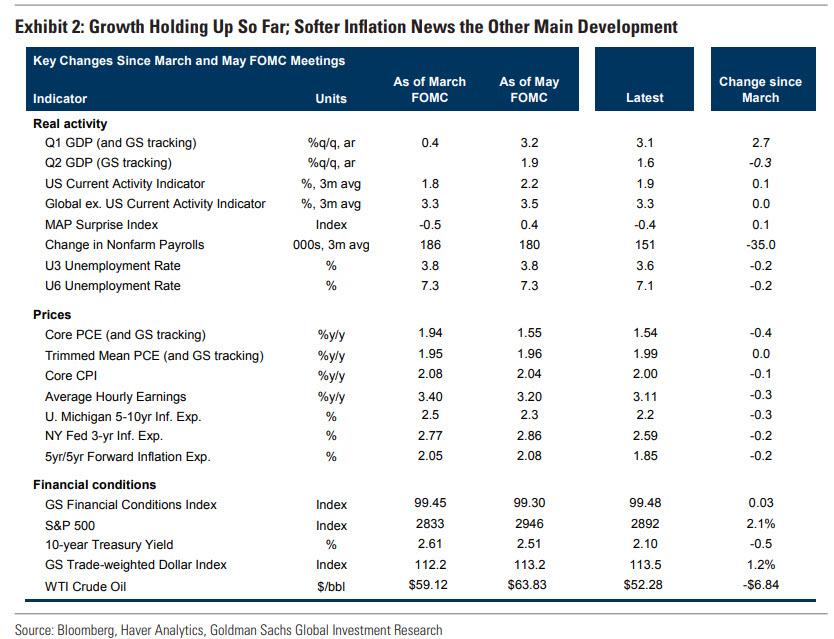

Rather than Goldman’s standard “Then and Now” table, the chart below “plots the setup for next week’s meeting across three dimensions, as well as their averages ahead of three major dovish shifts: September 2007 (at which the Fed abandoned the hiking bias and cut 50bps in response to subprime turmoil), September 2010 (formally signaled QE2), and March 2016 (scuttled the hiking cycle until global risks abated). Here, Hatzius also shows the three-month evolution of these four variables: stock prices, IG credit spreads, and consensus GDP growth.

What is remarkable, is that the June 2019 values show little resemblance ro prior dovish reversals: “risk assets performed much better, and annual GDP forecasts are little changed, vs. -0.3pp on average across the three alternate episodes.“

So how do one reconcile this with the outspoken consensus forecasting major dovish changes next week? According to Hatzius, one possibility is that most salient changes over the last 6 weeks “relate to investor sentiment and global news headlines” instead of the actual economy and market conditions. If so, there may not be sufficient reasons to expect or implement changes in the path of monetary policy, Goldman concludes in what may be a major disappointment for the market bulls.

So what about all those predictions of an upcoming recession? Here, too, Goldman is skeptical and writes that it remains to be seen whether US growth will fall below potential in the back half of the year because of the trade war and related uncertainty. But, as shown in the first chart above, outside of May payrolls, the growth data still look decent —particularly the solid rise and significant upward revisions in Friday’s retail sales report.

Taken together, Goldman’s chief economist thinks Fed officials “will view recent data as evidence that growth has indeed slowed from its brisk mid-2018 clip (of 3.5-4.0%) but remains at a healthy pace (of around 1.75%-2.0%).“

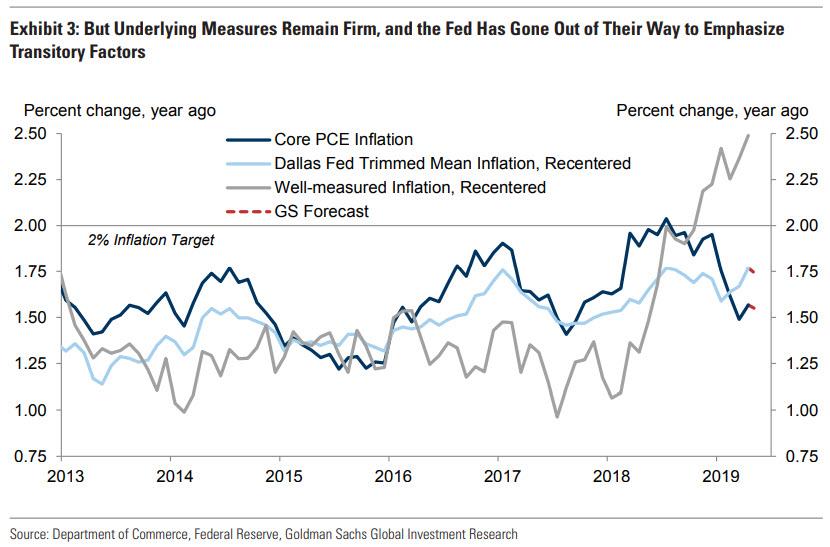

Will this be sufficient to sway those expecting a major dovish concession by the Fed? Probably not, and they will point to the recent slowdown in inflation. And while inflation it has undoubtedly been soft (four consecutive core CPI misses, core PCE inflation hovering just above 1.5%), the Committee has gone out of their way recently to attribute the weakness to transitory factors, Hatzius writes. In fact, the FOMC has emphasized the Dallas Fed trimmed-mean measure—which based on CPI and PPI source data is similar to its levels at the March and May meetings (in fact, slightly higher at 1.99%).

Furthermore, as shown in Exhibit 4, the Dallas Fed measure is consistent with core inflation of 1.75%, and it has also more clearly trended up in recent years. Such well-measured inflation (also adjusted for its average gap vs. core PCE) is consistent with above-target inflation for the first time since 2010 (of around 2.5%).

Looking ahead, the inflationary outlook is even more conflicted, and Goldman believes core PCE inflation is on its way back to 2% by late 2019, especially given the 0.3-0.4% boost from tariffs that is expected to hit shortly after Trump hikes tariffs on the remaining $300BN in Chinese imports. On the other hand, don’t expect a hike either:

But even if inflation has resurfaced as a predominant concern on the Committee in recent weeks, now would be a curious time to launch a reflation campaign, given vocal pressure from the White House to cut rates and the fact that the framework review itself won’t be completed for another 6+ months.

But while all this is known, why is the market pricing in roughly 4 rate cuts by the end of 2020, and why does Goldman refuse to drink the Dove-Aid? Playing Devils’ advocate, Hatzius explains that “one common pushback to our view is that if the Fed fails to deliver the rate cuts now priced, financial conditions will tighten and force the Fed’s hand anyway” To this, Goldman counters that it expects Fed officials to be “very careful not to deliver an unconditional hawkish message, but to continue emphasizing that they will respond to shocks as needed to attain their mandate.” And so, with hikes very unlikely (for now, although the market has started to price in rising rates in 2020 and early 2021), this would keep the market priced for a reasonable amount of easing.

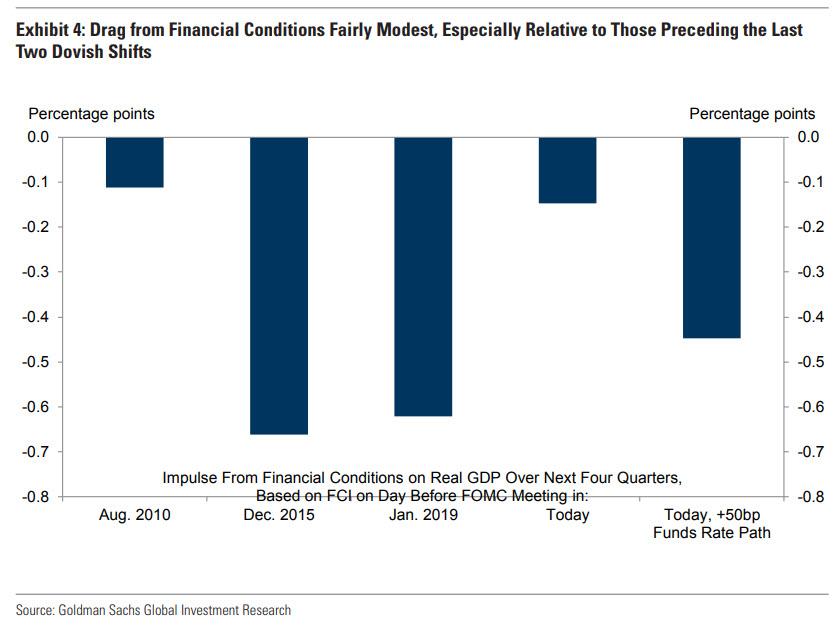

Meanwhile, even if the Fed does shock the market in the opposite direction, and the Committee disappoints markets this summer and Treasury yields rebound sharply, Goldman’s statistical estimates, identified via changes in bond yields around FOMC meetings, suggest that a 50bp exogenous rise in short-term rate expectations tightens our FCI by 30-40bp on average. This is not insignificant, but neither is it dramatic when measured against the last two major FCI tightening episodes, according to Goldman.

Some examples: the index moved up by 150bp in 2018 Q4, and even that change affected only the expected pace of monetary tightening as opposed to producing outright increases in accommodation.

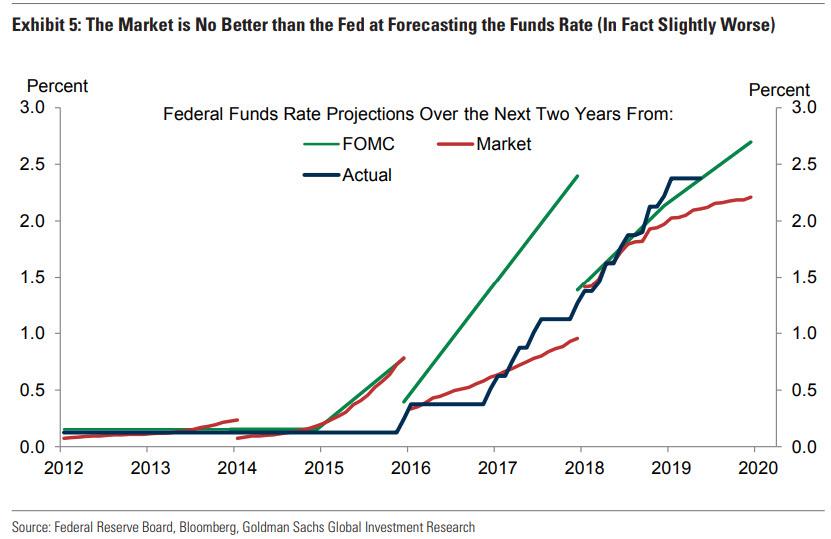

Here Goldman brings up another key consideration: the market has recently been even more inaccurate in its predictions than the notoriously terrible at forecasting Federal Reserve.

Case in point: market pricing implies four rate cuts by the end of next year, a sharp divergence to the FOMC’s median projection at that horizon (one hike as of March). Goldman next compares the policy rate paths implied by the median SEP dot with those of Fed funds futures. And over the seven years that the Committee has tracked and published their projections (an admittedly small sample), the bank finds that the Fed’s two-year-ahead forecasting performance has actually been somewhat better than the market’s: more accurate forecasts in both 2012 and in 2018, a comparable forecast in 2014, and a less accurate one in 2016.

Which brings us to perhaps the biggest concern of all: will the Fed’s own rate cuts telegraph that a recession is about to commence? Goldman’s answer is that history suggests that the hurdle for mid-cycle easing is rather high (perhaps as opposed to late-cycle, as a recession looms anyway). The 1990s saw two such episodes, in 1995 and 1998, the former of which represented a normalization in policy from clearly restrictive levels (from 6.0% to 5.25% from July 1995 to February 1996). At the same time, pre-emptive ”insurance” cuts of 1998 seem more relevant today, as interest rates are low, global risks appear to be rising, and US data has shown only pockets of weakness. Chairman Greenspan said at the time, “There are only limited hard data that suggest any loss of momentum in the current expansion… The crucial development… is that we are observing an important shift in attitudes toward risk… a change in psychology clearly is what we are observing. The opening up of risk spreads is a very significant indication of increased risk aversion.”

But, Hatzius observes, just as today’s FCI evolution and growth outlook look very different from those that preceded the Fed’s dovish pivots in 2007, 2010, and 2016, the tightening in credit spreads in summer 1998 was nearly 10 times as large as that of recent experience (+102bp in the three months leading up to the Sep ‘98 meeting vs. +11bps currently, US IG). And even in that instance (1998), fixed income markets too aggressively priced the Fed’s intentions: markets priced more than a 125bp cumulative decline in Fed Funds, whereas the Fed only cut by 75bps and resumed the hiking cycle less than a year later.

The bottom line, according to Goldman, is that:

“…while markets are aggressively priced for rate cuts, we believe the dovish shift indicated by Fed commentary has been more marginal in nature. For example, we take much less signal than other commentators and market participants from Chair Powell’s promise that “as always, we will act as appropriate to sustain the expansion.” In our view, this was not a strong hint of an upcoming cut but was simply meant to provide reassurance that the FOMC is well aware of the risks.

Additionally, Hatzius sees the “as always” caveat declaring an ever-present ability to ease policy if the situation warrants—as opposed to an imminent rate cut this summer, and furthermore doubts it is a coincidence that New York Fed President John Williams used the same language two days later: “My baseline is a very good one but at the same time we obviously, as always, need to be prepared to adjust our views.”

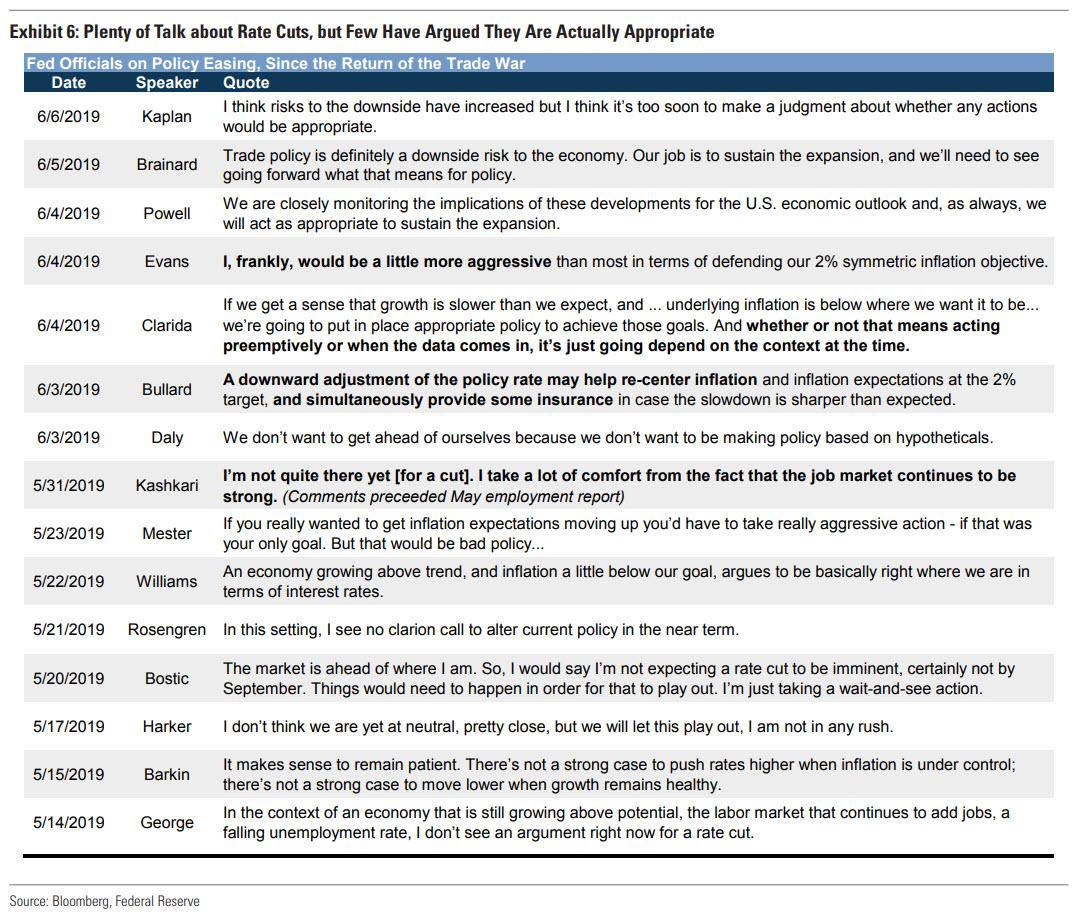

In sum, and broadening the analysis to all participants that have offered a view on monetary policy since the May meeting, Goldman – unlike the majority of the market – has trouble finding more than a couple outright endorsements of easier policy.

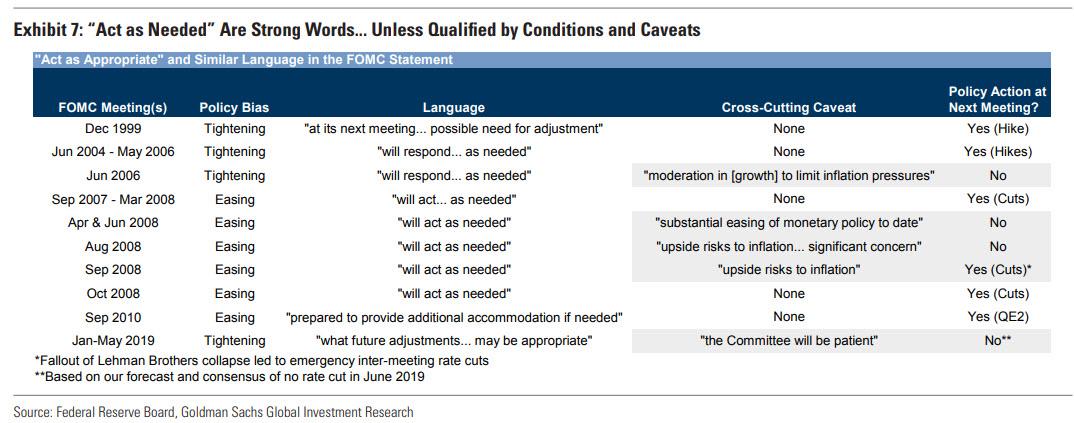

The importance of this caveat is also visible in the history of the FOMC statement itself, Hatzius writes, and shows in the next chart that “act as appropriate” / “act as needed” is a strong signal of imminent policy change (in contrast to, “monitor/closely monitoring,” which has been used over 30 times since 2010 alone). For the Fed-watching pedants, since 1999, Goldman has found only four examples of “as needed” or synonymous verbiage that did not signal a policy action at the upcoming meeting, out of 34 meetings in which this language was used to explain the policy outlook. In each of these four exceptions, the statement included strongly worded caveats that leaned in the other direction (slowing “aggregate demand” in June 2006 and the “uncertain” inflation outlook in April, June, and August 2008). This may underscore just how important Powell’s and Williams’s “as always” caveats truly are.

One final semantic note: when the “as needed” language includes a qualification (that leans against the policy bias), Goldman has found that since 1999, there is only one instance where the Committee followed through at the next meeting, and those were truly exceptional circumstances (Lehman Brothers bankruptcy in September/October 2008).

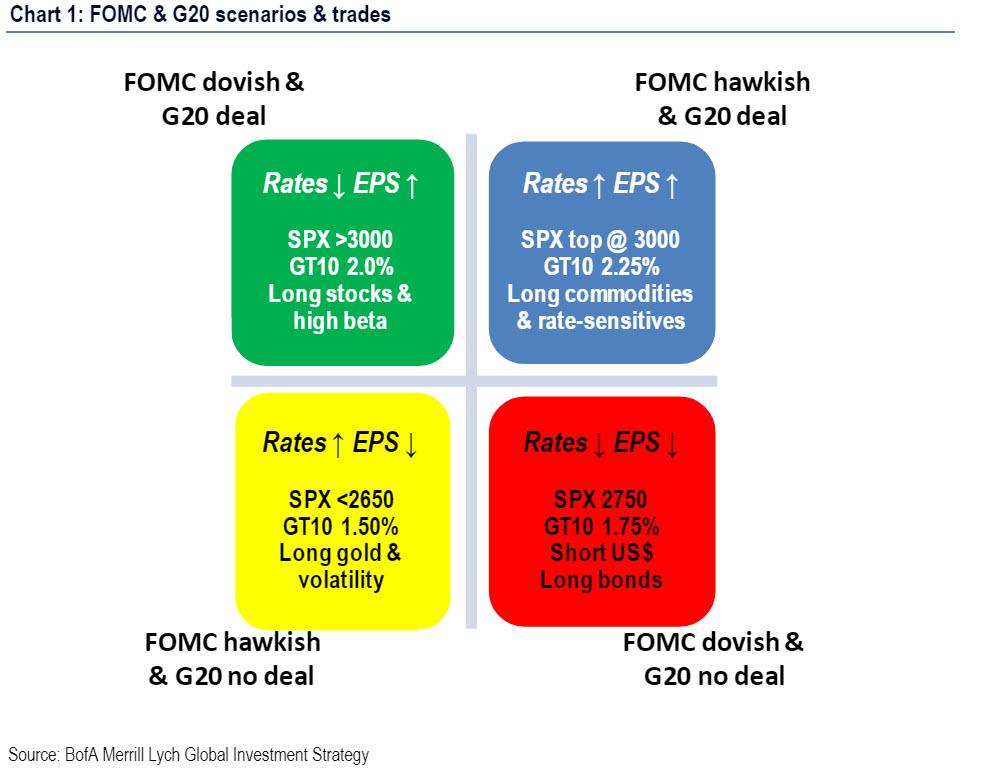

So unless a major bank defaults in the next few days, Goldman is confident that the odds of a major dovish signal by the Fed are virtually nil, and in that case, should Trump fail to strike a trade war deal with Xi Jinping at the G-20, then the worst case scenario as laid out by Bank of America…

… is in play, which to those who may have missed it, is the following:

… the worst possible outcome would be if there is a 1) a hawkish Fed surprise and 2) no Deal at the G-20, which would send the S&P below 2,650, or potentially resulting in a 12% drop in the market, while slamming 10Y yields to 1.50% and helping gold rise above its 5 year breakout zone as the VIX surges.

In short: if Goldman is right (and that’s a big if), brace for market correction.

via ZeroHedge News http://bit.ly/2WM2wQS Tyler Durden