The “deflationary ice age” predicted by SocGen’s Albert Edwards some 25 years ago is upon us.

The one-two punch of a dovish Draghi and Powell unleashing the “deflationary spirits” has resulted not only in the S&P hitting a new all time high, but in an unprecedneted flight to safety as investors freak out that a recession may be imminent (judging by the forceful jawboning by central bankers hinting of imminent easing), pushing gold above $1,400 – its highest price since 2013 – and global yields to new all time lows.

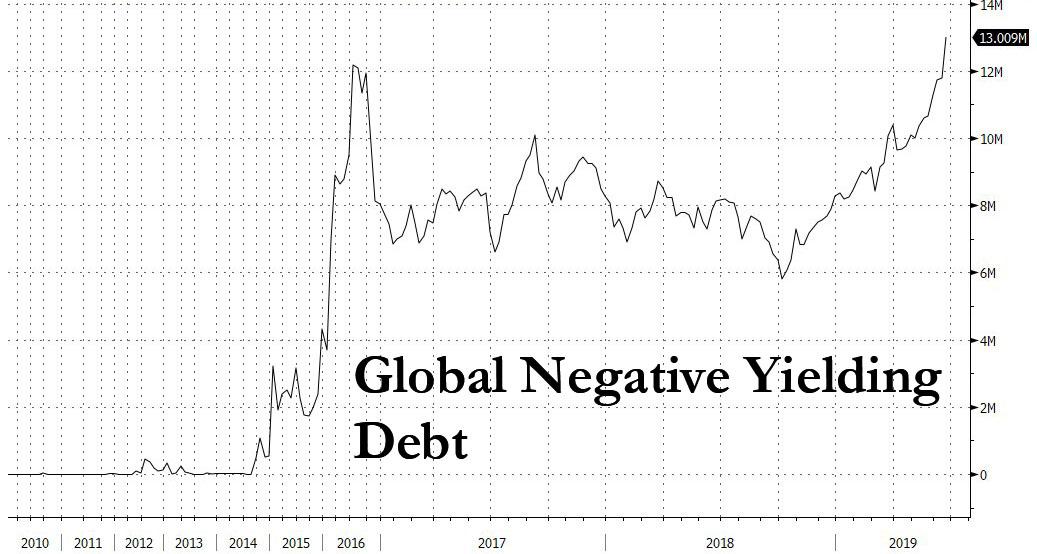

As a result, the total notional amount of global debt trading with negative yields soared by $700 billion in just one day, and a whopping $1.2 trillion this week, the biggest weekly increase in at least three years.

This has pushed the amount of negative yielding debt to a new all time high of $13 trillion.

We won’t paraphrase everything else we said in the context of this very troubling observation (see our latest post from yesterday discussing the surge in (-) yielding debt), we’ll just repeat the big picture summary: such a collapse in yields is not bullish, or indicative of a new golden age for the global economy. Quite the contrary – it signifies that debt investors are more confident than ever that the global growth rate is collapsing and only central bank intervention may possibly delay (not prevent) the world sliding into recession. Worse, rates are set to only drop, because as Rabobank’s Michael Every wrote yesterday “if the Fed do cut ahead then yields fall, more so at the shorter end; but if they don’t cut then yields still fall, but more so at the longer end (now around 2.02%).”

His conclusion: “Either way US (and global) yields are going to fall – which tells its own sad story.“

via ZeroHedge News http://bit.ly/2KuWgGB Tyler Durden