LendingTree has revealed a new study that identifies certain US metropolitan areas with the highest student loan balances.

The study’s release comes at a time when total student loan debt has reached $1.6 trillion, set to unravel in the next economic downturn. The study gives an eye-opener to the cities where millennials will suffer the most significant financial distress when the crisis unfolds.

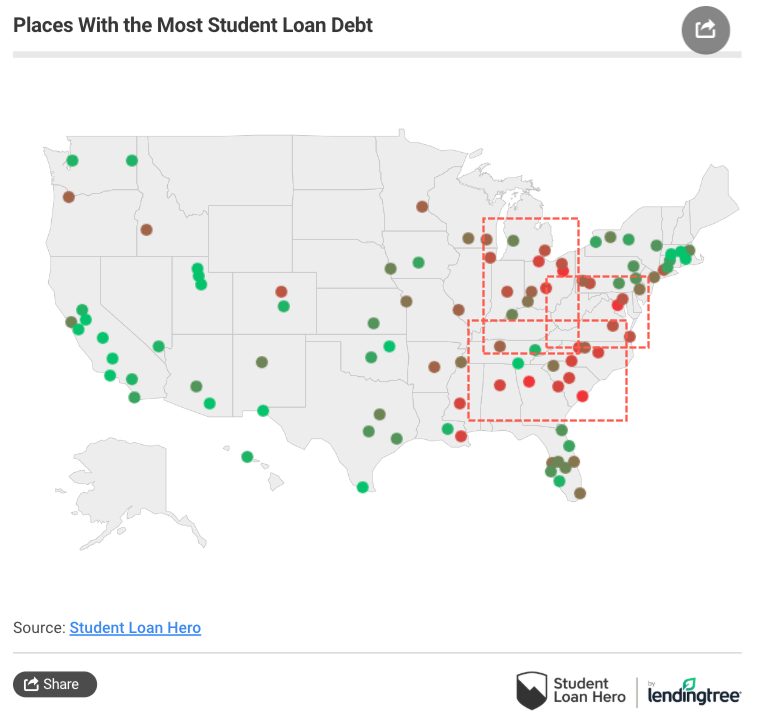

About 70% of the cities and surrounding areas with the highest median loan balances are located in the South, including large balances in Georgia, Alabama, Louisiana, and the Carolinas. These areas are known for widespread deindustrialization, high opioid addiction, and weak economic activity.

LendingTree’s map shows high concentrations of student loan balances in the South, Rust Belt, and Mid-Alantic.

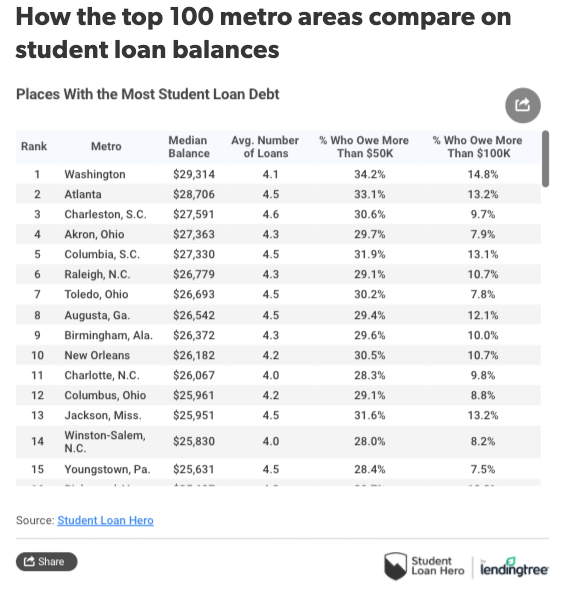

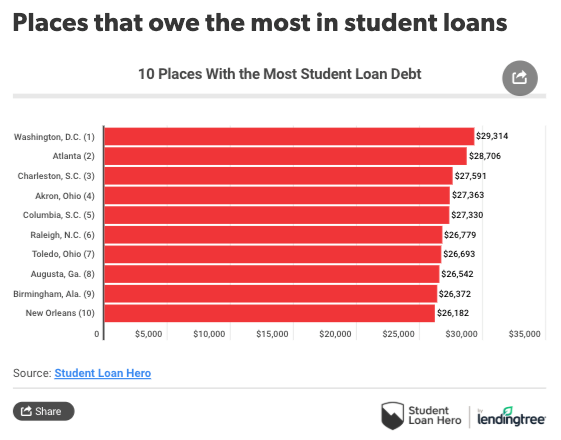

Borrowers in Washington, DC, carry the most student debt median balance of $29,314. And about 15% of those borrowers owe more than six figures, the highest percentage among the 100 metros surveyed.

Atlanta and Charleston, SC, have the second and third highest balances, averaging both around $28,000.

1. Washington, D.C. (Median balance: $29,314)

Roughly half of the people over the age of 25 in the Washington, D.C., metro have a postsecondary degree — that’s significantly higher than the 28% of all Americans who’ve earned a bachelor’s or higher.

Even more significant: Nearly 1 out of 4 have professional or graduate degrees, more than double the national rate of 10.5%. This helps explain why Washington also has the highest percentage of student debt holders who owe more than $100,000.

But that doesn’t necessarily mean these borrowers are in financial crisis, as most completed their degrees and are earning accordingly. While 22% of Americans left college before finishing, the same is true for only 16.5% of those residing in and around the nation’s capital.

2. Atlanta (Median balance: $28,706)

Atlanta is another highly educated city — 37% of Atlanta residents ages 25 and older have completed at least a four-year education, and nearly 14% have a graduate or professional degree, which is higher than the nation as a whole (10.5%).

However, that doesn’t completely explain why about 13% owe more than $100,000, well above the 8.7% average of the metros we reviewed. The area is home to a plethora of higher learning institutions, including the Georgia Institute of Technology, Georgia State University, Emory University, Morehouse College and Spelman College. Perhaps the need for so many professors helps to explain why Atlanta is more educated — and in more student debt — than the nation as a whole.

Unfortunately, 1 in 5 Atlanta residents left college before finishing a degree, which is in line with the rest of the country.

3. Charleston, S.C. (Median balance: $27,591)

The first of two South Carolina metros among our top five overall, Charleston placed third by a narrow margin. Still, the average borrower here has 4.6 loans, more than any of the 99 other metros we studied.

More students going to college also equals more student loans overall: About 34% of the metro area’s population has at least a bachelor’s degree, trumping the national average of 28%.

4. Akron, Ohio (Median balance: $27,363)

High balances brought Columbia into the top five of metros with the most education debt. About 45% of borrowers in the metro area had at least $50,000 in student debt — and more than 13% of were staring at a six-figure hole.

Interestingly, while the fellow Palmetto State cities of Columbia and Charleston ranked high on the list, Greenville, S.C., did much better, coming in at 39th overall for median education debt.

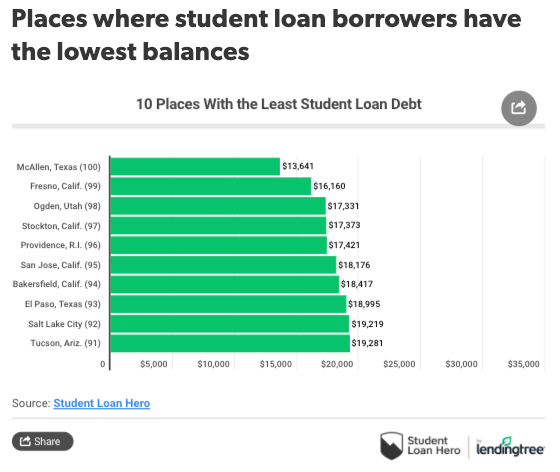

And metro areas with the lowest median balances were mostly west of the Mississippi River. College graduates in California, Texas, and Utah had some of the tiniest balances in the country.

Student debt is the fastest-growing consumer debt in the country, with $1.6 trillion outstanding, cracks are already starting to appear with 22% of borrowers defaulting.

The economic downturn which started in the summer of 2018, has already manifested into a broad industrial slowdown that is already starting to spread into other parts of the economy.

Millennials will be most impacted in the next recession, and thanks to LendingTree’s study, the exact metro areas of this financial stress are now known.

via ZeroHedge News https://ift.tt/2KalWFA Tyler Durden