Following up on our previous article discussing the unexpected collapse of US corporate operating profits in yesterday’s post-revision GDP data, JPMorgan makes an interesting observation.

First the good news. As we noted on Friday morning, US GDP grew more rapidly than expected last quarter as a strong 3.5% rise in domestic final sales offset a large drag from net trade and inventories. However, the slowing in stock building was less than expected and corporate efforts to lower its pace further likely will continue.

However, it was the annual revision to US national accounts that showed a significant change in two key items.

On one hand, there was a substantial upward revision in labor compensation. This, according to JPMorgan, is encouraging as it promotes a necessary normalization in labor’s income share and breathes life into the wage Phillips curve relationship.

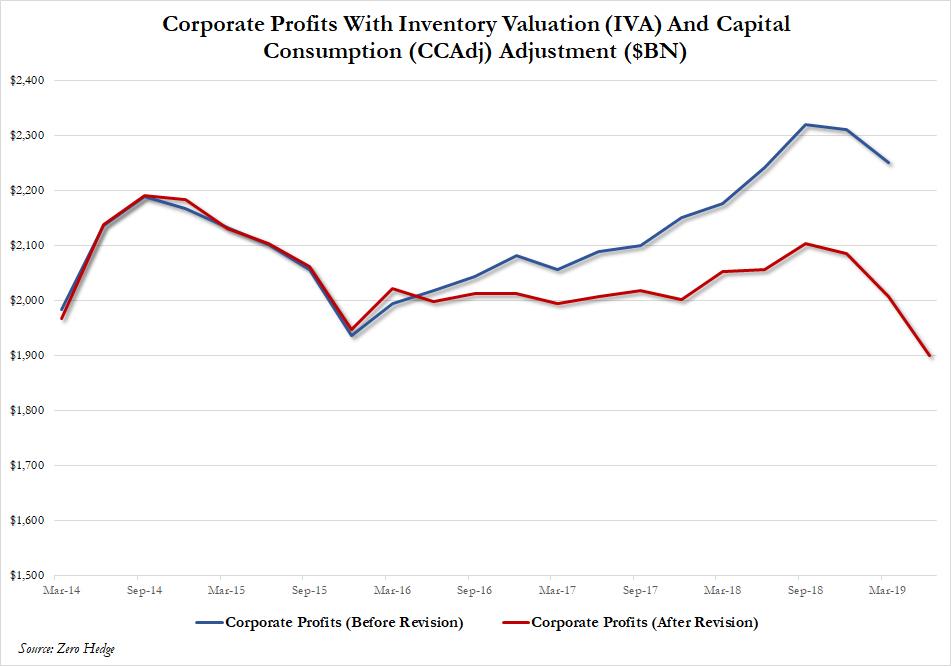

However, this was more than offset by negative revisions to US corporate profitability showing a sustained decline in US corporate profits, which have slumped to the lowest level in over 5 years even as the S&P has risen by 50% in the same period, indicating that all of the upside in the stock market was due to PE multiple expansion, something Goldman discussed earlier.

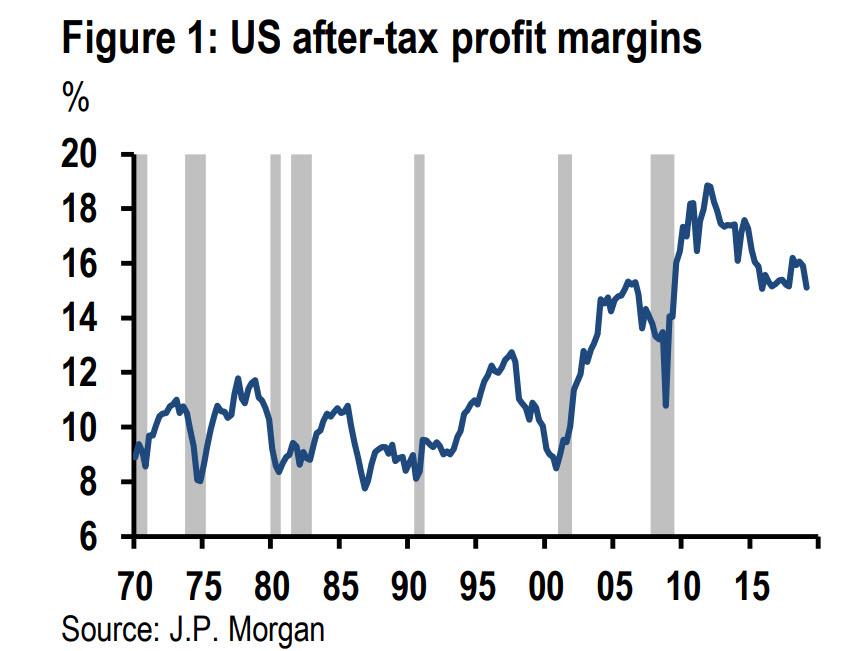

It gets worse: in light of solid revenue growth in recent years, and considering stagnant corporate profits, this implies that profit margins have been tumbling, and as shown in the chart below from JPMorgan, US after-tax profit margins have plunged to the lowest level since the financial crisis, despite – as JPM chief economist Bruce Kasman observes – the benefits from last year’s tax cuts.

This is notable for two reasons: non-GAAP profit margins are just off all time highs, yet profit margins as calculated by national accounts which is far more indicative of the underlying profit reality, are near the financial crisis lows, begging the question – just how fake is the non-GAAP world used by analysts and economists to justify the all time high in the S&P 500?

The second reason this is important is that while margins remain at high levels, such sustained compression has been a sign of vulnerability preceding recession, according to JPMMorgan, and as a result of this, JPM’s 12-month-ahead US recession probability model rose another 2pts this week, largely because of this news.

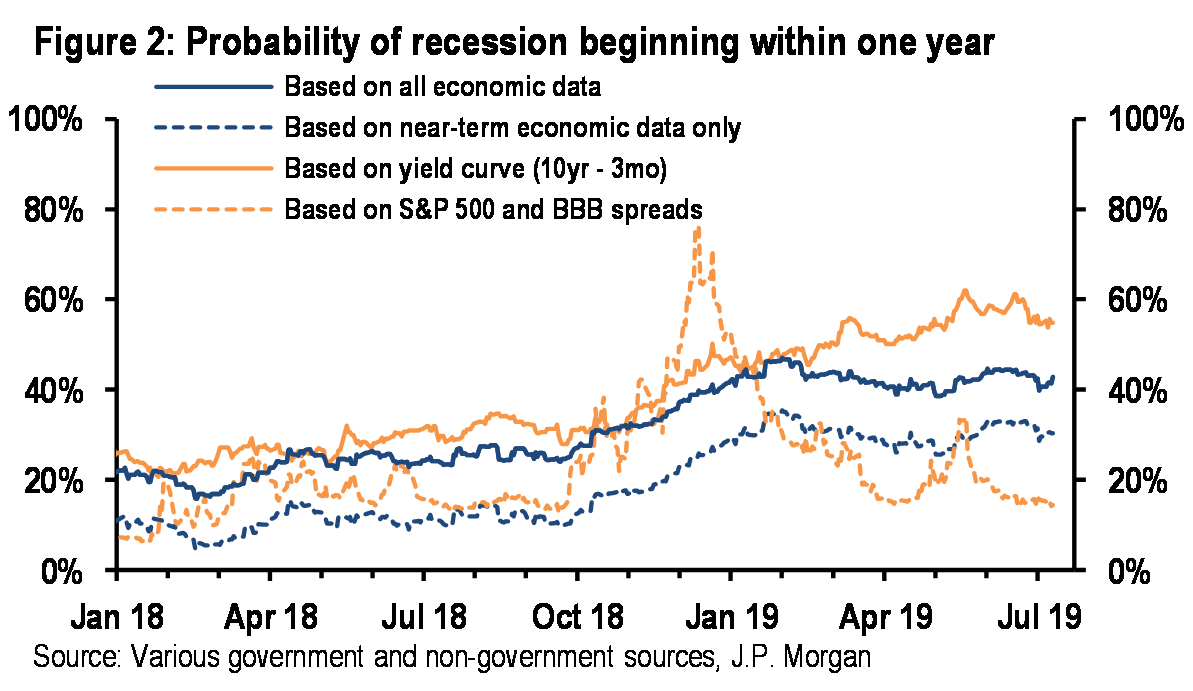

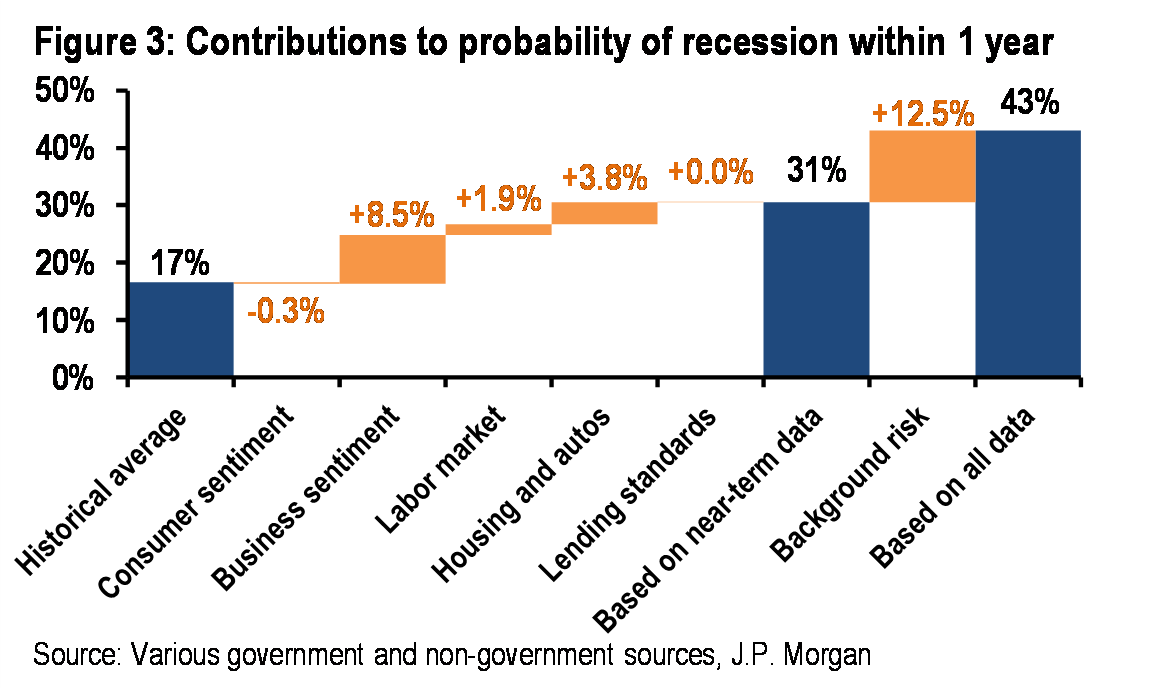

And speaking of a coming recession, considering the unexpected revised plunge in corporate profits which has clear adverse consequences for the entire economy, JPM’s model estimate of the risk of recession beginning within one year based on economic data has remained above 40% for much of 2019, as most survey measures of business confidence have stubbornly refused to rebound despite a string of positive policy news. This experience suggests that caution in the business sector could linger even after this week’s budget deal removes another source of tail risk.

The silver lining: this caution has thus far remained quite contained, suggesting additional shocks would be necessary to produce a broader downturn.

via ZeroHedge News https://ift.tt/2JZPmHP Tyler Durden