The “most important week of the year” is finally here, when in addition to an avalanche of economic data including US payrolls, European PMIs, BOE and BOJ announcements, and the restart of US-China trade talks, we are in for a historic treat with the Fed set to cut rates for the first time in over a decade, effectively ushering in the next recession (the US economy contracted within 3 months of the first rate cut in the last three economic cycles; this time won’t be different).

As Deutsche Bank’s Craig Nicol summarizes, it’s an incredibly busy schedule for markets this week as they anticipate what will be the first (fully priced-in) rate cut from the Federal Reserve since 2008, as well as the latest decisions from the Bank of England and the Bank of Japan. There are also a number of key data releases, with the US jobs report, Q2 Euro Area GDP and manufacturing PMIs the main highlights. As all this occurs, we’ll see the resumption of US-China trade talks, along with further earnings releases as over 150 S&P 500 companies report.

With the much-anticipated FOMC decision finally taking place on Wednesday, that will be the key focus for markets over the coming week. Markets are expecting a rate cut, but the question of whether that will be a 25bp or 50bp cut is still on investors’ minds. At time of writing, markets put the probabilities at 82.5% for a 25bp cut and 17.5% for a larger 50bp cut, with DB’s US economists are expecting a 25bp cut in July, before further cuts in September and December, while Morgan Stanley is alone in expecting the Fed will go against the grain – and the NY Fed’s own warnings – and cut by 50 bps.

While the Fed can be expected to dominate the agenda, they aren’t the only major central bank that’s meeting next week. Ahead of the Fed, the Bank of Japan will be setting rates on Tuesday, with the consensus expecting policy will be unchanged. On Friday, they will also be publishing the minutes of their June Monetary Policy Meeting. Meanwhile on Thursday, we’ll have the Bank of England’s latest decision, as well as a press conference from Governor Carney and their quarterly inflation report. Although no change in rates is expected this week, markets are now expecting the BoE’s next move to be a cut rather than a hike.

The data highlight this week will also be from the US, with the monthly jobs report out this Friday. After last month’s strong nonfarm payrolls number of 224k, the consensus is for the number to fall to 160k for July, with the unemployment rate remaining at 3.7%. Another data release to watch out for in the US will be the Conference Board Consumer Confidence number, which is out on Tuesday. June’s 121.50 reading was the lowest number since September 2017, so it’ll be interesting to see if there’s a pickup as expected.

In the Euro Area, we’ll get the first look at Q2 GDP numbers, with the consensus that growth will fall to 0.2%, down from 0.4% in Q1. We’ll also get the country breakdowns for France, Italy, and Spain, so it’ll be interesting to see whether there’s any divergence across the currency union. The other highlights this week will be the Euro Area unemployment rate for June on Tuesday, as well as the final manufacturing PMI on Thursday.

Turning to politics, this week will see the resumption of trade talks between the US and China. The US team, including Trade Representative Lighthizer and Treasury Secretary Mnuchin, travel to Shanghai next week to meet their Chinese counterparts, beginning on Tuesday. The meeting comes after the G20 meeting between Presidents Trump and Xi, where they agreed to resume talks and Trump didn’t put further tariffs on $300bn worth of Chinese imports. Sticking with the US, this week will see the second round of the Democratic primary debates for the 2020 Presidential election, with the two debates taking place on Tuesday and Wednesday night. Meanwhile in the UK, there’ll be a parliamentary by-election on Thursday in the Welsh constituency of Brecon and Radnorshire.

Finally, earnings season will continue, with 168 S&P 500 companies report this week. So far, of the 205 companies in the S&P 500 which have reported at time of writing, 78% have beat on earnings, and 59% have beat on sales. Highlights in the coming week include Apple, BP, Procter & Gamble, Mastercard and Pfizer on Tuesday; General Electric, Airbus and Lloyds Banking Group on Wednesday; Royal Dutch Shell, Barclays, Verizon Communications, General Motors, Rio Tinto and Siemens on Thursday; and Exxon Mobil, Chevron and RBS on Friday.

Summary of key events by day, courtesy of Deutsche Bank

- Monday: It’s a light start to the week with the key releases of note being Japan’s June retail sales overnight. After that we will get Spain’s preliminary July CPI, Italy’s June PPI and the UK’s June consumer credit, mortgage approvals and money supply data. In the US the only release of note is July’s Dallas Fed manufacturing activity index.

- Tuesday: The main highlight of the day is going to be the outcome of the BoJ’s monetary policy meeting while in the US June core PCE is also due. In terms of data, we will get the Euro Area’s June unemployment rate, preliminary Q2 GDP in France along with June consumer spending, preliminary July CPI in Germany along with August GfK consumer confidence and July confidence indicators for the Euro Area. In the US, we will get June personal income and spending data, May S&P Corelogic house price index and July Conference Board consumer confidence indicator. Trade talks between the US and China will resume and it’s the first of two nights of Democratic primary debates. Earnings releases include Apple, BP, Procter & Gamble, Mastercard and Pfizer.

- Wednesday: The outcome of the FOMC meeting followed by Chair Powell’s press conference (07:30pm London Time) will be the main event of the day. Overnight China’s official July PMIs are also due. In terms of data, we’ll get the UK’s July GfK consumer confidence, the Euro Area, France and Italy’s preliminary July CPI, Euro Area, Spain and Italy’s preliminary Q2 GDP, and Germany’s July unemployment report. In the US, we will get July’s ADP employment change and MNI Chicago PMI. It’s also the second night of Democratic primary debates while earnings releasesinclude General Electric, Airbus and Lloyds Banking Group.

- Thursday: The main highlight of the day is going to be the outcome of the BoE’s monetary policy meeting followed by Governor Carney’s press conference, while the release of final July manufacturing PMIs is also due in Japan, China, the Euro Area, UK, Germany, France, Spain, Italy and the US. In the US, we will also get July Challenger job cuts, ISM manufacturing data and total vehicle sales along with latest weekly initial and continuing claims, and June construction spending. Away from data, BoJ’s Amamiya is also due to speak, while the UK has a parliamentary by-election. Earnings releases include Royal Dutch Shell, Barclays, Verizon Communications, General Motors, Rio Tinto and Siemens.

- Friday: It’s a payrolls Friday with July’s nonfarm payrolls report due in the US (1:30pm London Time). Prior to that, we will get the BoJ’s June Monetary Policy Meeting minutes, the UK’s July construction PMI and the Euro Area’s June PPI and retail sales. In the US, we’ll get the June trade balance, factory orders, and final durable and capital goods orders along with the final University of Michigan survey results. Earnings releases include Exxon Mobil, Chevron and RBS.

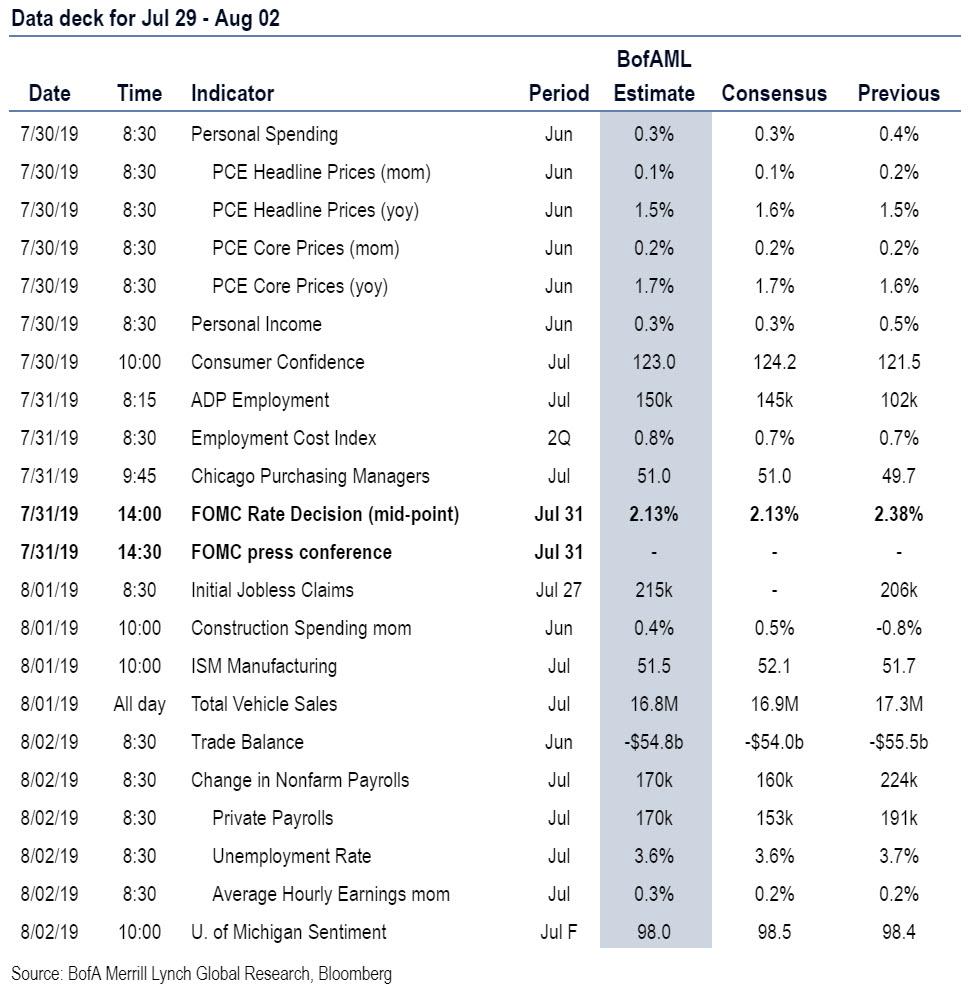

Looking at just the US, the key event this week is the July FOMC meeting, with the release of the statement at 2:00 PM ET followed by Chair Powell’s press conference at 2:30 PM. The ISM manufacturing report will be released on Thursday and the employment report on Friday. There are no other scheduled speaking engagements from Fed officials this week.

Monday, July 29

- 10:30 AM Dallas Fed manufacturing index, July (consensus -5.3, last -12.1).

Tuesday, July 30

- 08:30 AM Personal income, June (GS +0.4%, consensus +0.3%, last +0.5%); Personal spending, June (GS +0.3%, consensus +0.3%, last +0.4%); PCE price index, June (GS +0.06%, consensus +0.1%, last +0.16%); Core PCE price index, June (GS +0.19%, consensus +0.2%, last +0.19%); PCE price index (yoy), June (GS +1.32%, consensus +1.5%, last +1.52%); Core PCE price index (yoy), June (GS +1.57%, consensus +1.7%, last +1.60%): Based on details in the PPI, CPI, import price, and GDP reports, we forecast that the core PCE index rose 0.19% month-over-month in June, or 1.57% from a year ago. Additionally, we expect that the headline PCE index increased 0.06% in June, or 1.32% from a year earlier. We expect a 0.4% increase in personal income in June and a 0.3% increase in personal spending.

- 09:00 AM S&P/Case-Shiller 20-city home price index, May (GS +0.3%, consensus +0.2%, last flat): We estimate the S&P/Case-Shiller 20-city home price index increased 0.3% in May, following a flat reading in April. Our forecast reflects the appreciation in other home price indices such as the CoreLogic house price index in May.

- 10:00 AM Pending home sales, June (GS +1.5%, consensus +0.4%, last +1.1%): We estimate that pending home sales rose 1.5% in June based on regional home sales data, following a 1.1% increase in May. We have found pending home sales to be a useful leading indicator of existing home sales with a one- to two-month lag.

- 10:00 AM Conference Board consumer confidence, July (GS 126.0, consensus 125.0, last 121.5): We estimate that the Conference Board consumer confidence index rebounded by 4.5pt to 126.0 in July, reflecting continued increases in stock prices and other confidence measures.

Wednesday, July 31

- 08:15 AM ADP employment report, July (GS +140k, consensus +150k, last +102k): We expect a 140k gain in ADP payroll employment, reflecting roughly stable jobless claims but a potential drag from other ADP inputs. While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 08:30 AM Employment Cost Index, Q2 (GS +0.7% vs. consensus +0.7%, prior +0.7%): We estimate that the employment cost index rose 0.7% in Q2 (qoq sa), raising the year-over-year rate to +2.9%. Our Q2 wage tracker stands at +3.0% year-over-year (up from 2.7% for Q1).

- 09:45 AM Chicago PMI, July (GS 51.2, consensus 51.5, last 49.7): We estimate that the Chicago PMI rebounded out of contractionary territory in July, though we note that weak global manufacturing growth likely continues to weigh on the index.

- 2:00 PM FOMC statement, July 30-31 meeting: As discussed in our FOMC preview, we expect the FOMC to cut the funds rate by 25bp at the July meeting, as virtually all the signals from the Committee point this way. While we cannot entirely rule out a 50bp move, we assign subjective probabilities of 90% to a 25bp cut and 10% to a 50bp cut. Our view remains that the justification for cuts remains tenuous, as growth, employment, and inflation remain close to the Fed’s goals, financial conditions are very easy, and data have mostly surprised to the upside since the June FOMC meeting.

Thursday, August 1

- 08:30 AM Initial jobless claims, week ended July 27 (GS 215k, consensus 212k, last 206k); Continuing jobless claims, week ended July 20 (last 1,676k): We estimate jobless claims increased 9k to 215k in the week ended July 27, after decreasing by 10k in the prior week. The claims reports of recent weeks suggest that the pace of layoffs remains very low.

- 10:00 AM ISM manufacturing index, July (GS 52.5, consensus 52.0, last 51.7): After three straight declines, we expect the ISM manufacturing index to rebound by 0.8pt to 52.5 in July, reflecting a pickup in various business confidence measures.

- 10:00 AM Construction spending, June (GS +0.3%, consensus +0.3%, last -0.8%): We estimate a 0.3% increase in construction spending in June, with scope for an increase in private nonresidential construction and public construction.

Friday, August 2

- 08:30 AM Nonfarm payroll employment, July (GS +190k, consensus +170k, last +224k); Private payroll employment, July (GS +175k, consensus +170k, last +191k); Average hourly earnings (mom), July (GS +0.2%, consensus +0.2%, last +0.2%); Average hourly earnings (yoy), July (GS +3.1%, consensus +3.2%, last +3.1%); Unemployment rate, July (GS 3.7%, consensus 3.7%, last 3.7%): We estimate nonfarm payrolls increased 190k in July. Our forecast reflects low jobless claims, a 10-20k boost from Census hiring ahead of August canvassing, and minimal drag from Hurricane Barry—which struck at the end of the survey week. We expect the unemployment rate to remain at 3.7%, as continuing claims were broadly stable. Finally, we estimate average hourly earnings increased 0.2% month-over-month with the year-over-year rate stable at 3.1%, reflecting negative calendar effects but some scope for a further rebound in the supervisory category.

- 08:30 AM Trade balance, June (GS -$54.7, consensus -$54.5bn, last -$55.5bn): We estimate the trade deficit declined by $0.8bn in June, reflecting a decline in the goods trade deficit.

- 10:00 AM Factory Orders, June (GS +0.6%, consensus +0.7%, last -0.7%): Durable goods orders, June final (last +2.0%); Durable goods orders ex-transportation, June final (last +1.2%); Core capital goods orders, June final (last +1.9%); Core capital goods shipments, June final (last +0.6%): We estimate factory orders increased by 0.6% in June following a 0.7% decline in May. Durable goods orders rose in the June advance report, driven by a rebound in orders of aircraft and parts.

- 10:00 AM University of Michigan consumer sentiment, July final (GS 98.4, consensus 98.5, last 98.4): We expect University of Michigan consumer sentiment remained flat from the preliminary estimate for July. The report’s measure of 5- to 10-year inflation expectations increased by three tenths to 2.6% in the preliminary report for July.

Source: Goldman, Deutsche, Bank of America

via ZeroHedge News https://ift.tt/2Mx5xyb Tyler Durden