Authored by Richard Breslow via Bloomberg,

The Fed Is Busy Fighting Yesterday’s Battles

It’s a busy week ahead, and, I guess, only one thing matters. The Fed is poised to make its latest policy error.

And the economic numbers are largely irrelevant. The press has been chock-a-block this weekend with stories about income and wealth inequality…

The U.S. fares particularly poorly in recent reports. By some official measures it ranks worst in the developed world. So, naturally, as the FOMC views the world, anything they can do to get the stock market higher seems like just the prescription..

They are going to trickle down on the little people because, in the words of Chairman Jerome Powell, the improvement in employment has, “started to reach communities at the edge of the workforce.” It’s starting to take hold, they are sure of it. Their models insist that it works.

How dumb were people who thought savings were a prudent way to plan for the future…

The S&P 500 sits at record highs. That’s a good thing. Yet we need to get it higher to combat growing inequality and populism? Stocks will continue to be attractive as the concept of earnings multiples becomes largely irrelevant in a world of negative interest rates. Something is better than nothing. But that hasn’t and won’t be a way to conduct social policy. Frankly, using global headwinds as a justification for rate cuts is a more satisfying explanation.

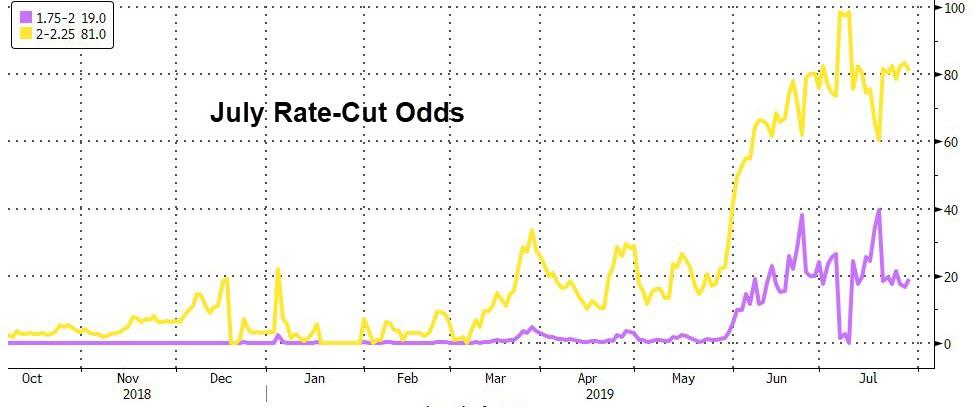

This Friday’s non-farm payrolls report will surely be an interesting one. It’s expected to be pretty good. In fact, most of the numbers on the calendar are slated to show decent strength or, at least, movement in the right direction. But the Fed needs to convince people that it will remain on an accommodative path. We’re still debating 25 versus 50 basis points.

There’s a lot of game theory that goes into successful trading. But managing the economy isn’t supposed to be an exercise where we strategize about how to get maximum shock and awe bang for the buck with financial conditions with our policy pronouncements. Buying the rumor, selling the fact is meant to be something investors, not rate setters should be thinking about.

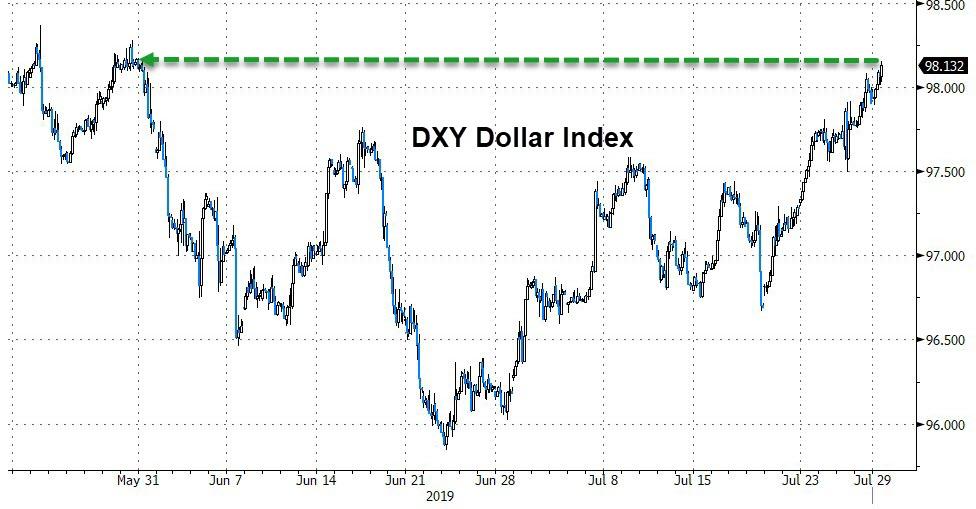

The dollar is bid. As we head into month end, the longer term charts look pretty good. The latest comments from the administration eschewing the likelihood of efforts to cheapen it have relieved a lot of anxiety about chasing it higher, or at least constantly looking for places to sell. Although many traders wish they had said so a percent or so lower. Buying it with the dollar index within hailing distance of 98.50 is hard but it feels like there will now be bids all the way down toward 96.00. Especially because the euro-at-$1.20 crowd has gone mercifully quiet.

Most interesting, is the inability of Treasury yields to move in either direction. Especially since we expect more QE from Europe imminently. They should be watched very carefully how they behave on any pullbacks, because the assumption that they are a one-way bet seems a bit up in the air.

via ZeroHedge News https://ift.tt/2K1Xurt Tyler Durden