Submitted by Takashi Miwa of Nomura

The Bank of Japan chose to leave its monetary policy unchanged at its 29-30 July monetary policy meeting. This was an unsurprising outcome, as forecasters had by a wide margin expected no policy changes: 38 of 47 of those surveyed by Bloomberg in July indicated that they expected the BOJ to leave its policy as is. This BOJ monetary policy meeting was lined up to occur just prior to an FOMC meeting that is widely expected to end in a rate cut, and the concern has been raised that the BOJ may have no viable options with which to respond to the yen appreciation that could result from a US rate cut. For this reason, some forecasters had posited that the BOJ might extend the timeline given in its forward guidance that currently indicates that the Bank will “maintain the current extremely low levels of short- and long-term interest rates…at least through around spring 2020”. (14 of those surveyed by Bloomberg indicated that they expected forward guidance to be adjusted in a more accommodative direction.) Ultimately, the BOJ decided not to adjust its forward guidance at this meeting.

Why the BOJ took a pass on amending its forward guidance

There are two possible reasons why the BOJ chose not to revise its forward guidance on this occasion.

- First, USD/JPY was quite consistently parked in the 108.5-109.0 range in the immediate run-up to the meeting.

- Second, the BOJ may have worried that frequent adjustments to forward guidance might give off the impression that the Bank had used up all of its actual monetary policy ammunition.

However, we note that the statement that the BOJ will “make policy adjustments as appropriate…with a view to maintaining the momentum toward achieving the price stability target” is now followed by the assertion that the Bank “will not hesitate to take additional easing measures if there is a greater possibility that the momentum toward achieving the price stability target will be lost”. This addition was arguably inserted as an alternative to the sort of change in forward guidance that some forecasters had expected.

Forecasts in the Outlook Report also left mostly untouched

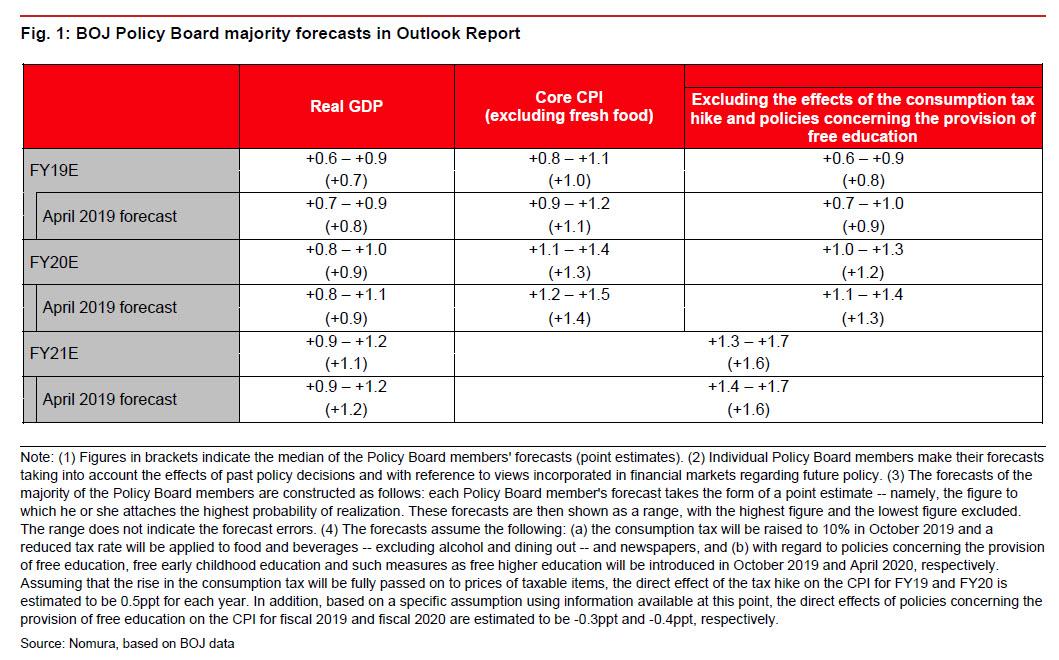

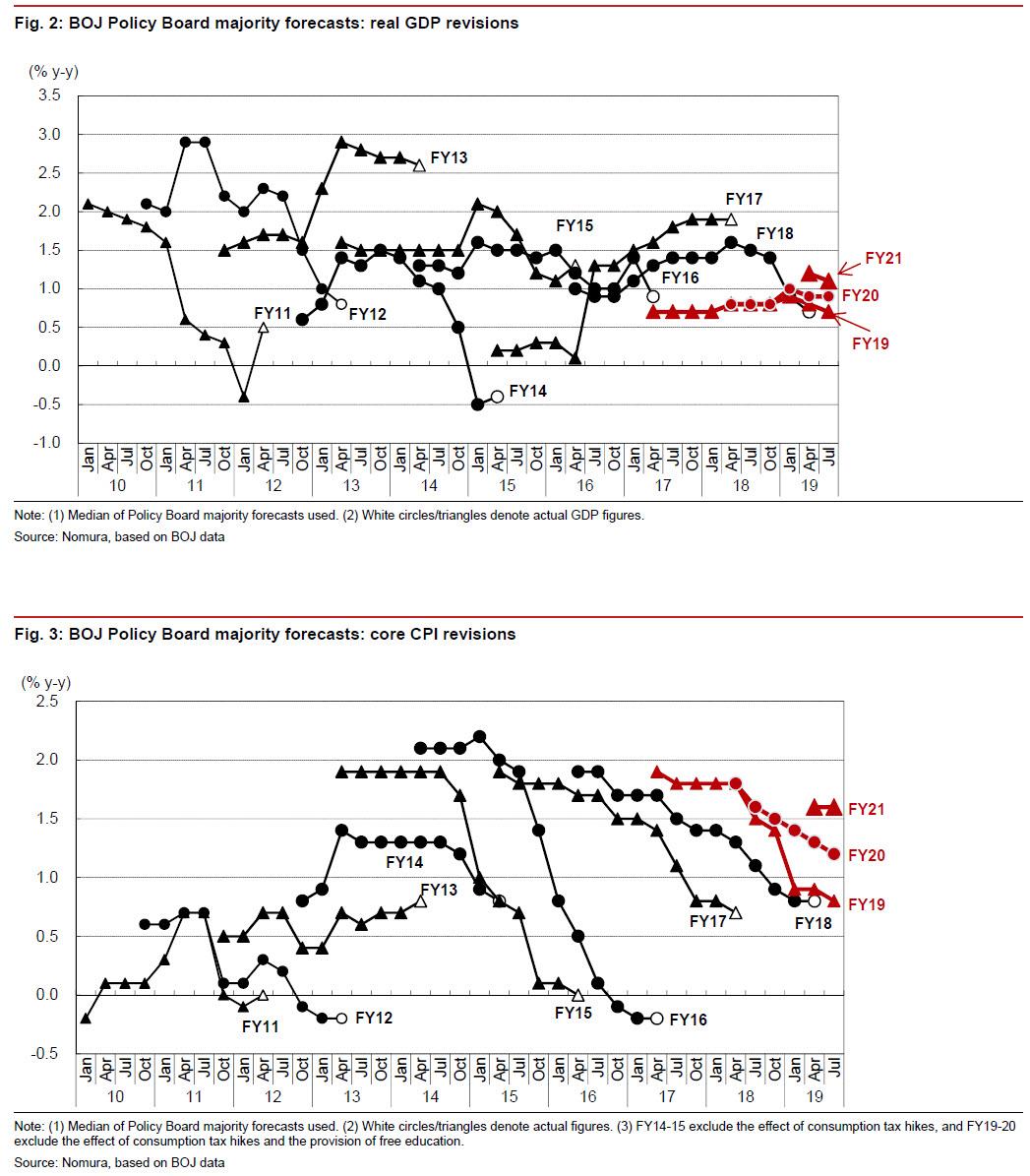

On the same day as the Statement on Monetary Policy, the BOJ also issued the July 2019 edition of its Outlook for Economic Activity and Prices (the Outlook Report). Policy Board members’ median forecasts for FY19 real GDP growth, FY19 CPI, FY20 CPI, and FY21 real GDP growth were all slightly lowered, but Policy Board members continued to forecast sustained gradual improvement in both real GDP growth and CPI (Figure 1).

In the Outlook Report, the BOJ reiterated its view that momentum toward achieving the price stability target of 2% has been maintained, and this seems to have been used as a justification for standing pat on monetary policy.

Policy will likely be left alone barring a steep rise in the yen

The BOJ has publicly stated that it would pursue additional easing measures if needed, but its only practicable option for further easing is that of accelerating its expansion of the monetary base, accomplished by means of stepped-up purchases of JGBs made in coordination with increased fiscal outlays and increased issuance of JGBs to fund those outlays. Nomura expects the BOJ to pursue additional easing only if yen appreciation were to take USD/JPY to around 100. In any other circumstances, we expect the BOJ to simply carry on with its current monetary policies.

via ZeroHedge News https://ift.tt/2YuKLS6 Tyler Durden