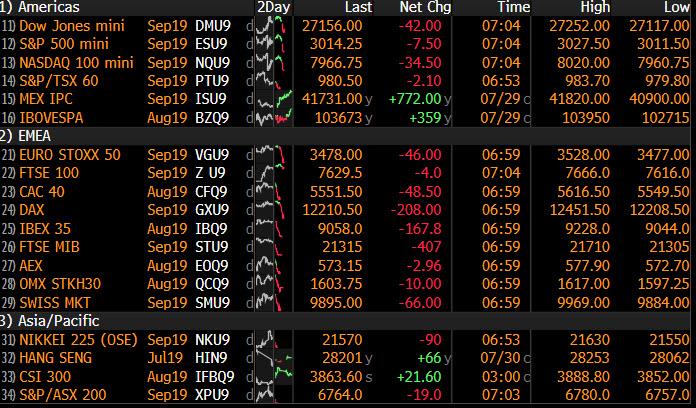

One day before the Fed’s 25bps rate cut, traders are suddenly getting cold feet and global stocks are a (shallow) sea of red, with US equity futures and European markets all sliding, weighed down by corporate results and economic data while awaiting news from the resumption of U.S.-China trade talks even as Trump launches another anti-China tirade on twitter.

Meanwhile, Europe’s markets suffered a stormy start as the pound followed its worst day of the year with another 0.5% swoon against all the major currencies. A blizzard of fiery talk on Monday that included the new UK Prime Minister Boris Johnson calling his predecessor’s Brexit plans dead and its new foreign minister labeling the European Union “stubborn” kept the slide intact. Sterling fell as far as $1.2120, which was its lowest against the dollar since March 2017, and to 91.85 pence per euro, the weakest since September 2017.

Options markets were pointing to more pain too. Three-month implied volatility, a contract that expires just before the Oct. 31 Brexit deadline, jumped to over 11 vols, the highest since before March 29, the original date for Britain to leave the European Union.

“The pound is in a very precarious state, it is as simple as that,” said TD Securities’ European head of currency strategy Ned Rumpeltin. “We are now in a different regime,” he said, referring to Johnson’s explicit agenda of taking Britain out of the EU, whether or not transitional trading agreements are in place.

US equity futures, down -0.3% and below yesterday’s lows, were hit following a plunge in the stock of Beyond Meat which used its surprise outlook boost to surprise markets with a 3.25 million share offering, while traders looked for earnings reports due from industry leaders including Procter & Gamble, Pfizer and Mastercard. Disappointing forecasts from Reckitt Benckiser and Bayer weighed on the Stoxx Europe 600 Index, while grim forecasts from German chemicals and drugs giant Bayer and airline Lufthansa soured sentiment, although the weakness of the pound kept London’s blue-chip index just about out of the red. The EuroStoxx 50 dropped -0.9%, pushing lower through the European morning as disappointing earnings weighed on European stocks. The U.K.’s FTSE 100 index outperformed as the pound plunged and strong earnings boosted shares of BP.

With concerns about global growth still bubbling among investors, a GfK survey also showed German consumer morale worsening for the third month in a row heading into August as trade disputes bit in Europe’s biggest exporter.

“Most markets are down this morning,” said Simona Gambarini, a markets economist at Capital Economics. “The S&P closed lower yesterday. We have a few data releases regarding the eurozone that could push equity prices down but I think everyone is waiting for the Fed meeting.”

Earlier, stocks were higher across Asia, rising in Japan, South Korea and China, and closed at a record in Australia, while Hong Kong stocks also rose despite continuing protests in the city. Investors awaited headlines from U.S.-China trade talks and the Federal Reserve’s rate decision later this week. The region’s benchmark MSCI Asia Pacific Index gained 0.3%, led by Indonesia and Japan stocks. The Jakarta Stock Price Index jumped as much as 1.2% after the central bank said there is room for accommodative policy in future. Japan’s Nikkei rose 0.4%, showing limited reaction to the Bank of Japan’s widely anticipated decision to stand pat on monetary policy. Shanghai rose 0.3% and Hong Kong’s Hang Seng edged up 0.2%. Elsewhere, Hong Kong’s Hang Seng Index rebounded on a rally in Chinese insurance companies. India’s Sensex Index fell 0.2% in its second day of decline.

As expected, the BOJ did nothing, but added that it would ease policy again “without hesitation” if the economy loses momentum for achieving the central bank’s 2% inflation target. Specifically, Kuroda kept all monetary policy settings unchanged as expected with NIRP held at -0.1% and 10yr JGB yield target at around 0% with the decision made by vote of 7-2 in which Kataoka and Harada dissented again. BoJ also maintained its forward guidance on keeping rates at extremely low rates at least through to Spring 2020 and added that it will ease without hesitation if momentum to reaching the price goal is lost, while it reduced FY19/20 Real GDP forecast to 0.7% from 0.8% and cut FY19/20 Core CPI forecast to 1.0% from 1.1%.

Also drawing some attention were U.S.-China trade negotiations which begin in Shanghai on Tuesday, although expectations for progress during the two-day meeting are low with the markets hoping the two sides can at least detail commitments for “goodwill” gestures.

In rates, Irish government bond yield spreads over Germany hit their widest levels in over a month at 24 basis points, on worries about the damage a no-deal Brexit would do to Ireland’s economy. Other euro zone government bond yields were holding near recent lows ahead of the Federal Reserve meeting which is expected to deliver a 25 basis point rate cut on Wednesday and potentially signal more on the way. Germany’s 10-year government bond yield was hovering near the minus 0.40% mark. In the US, Treasury yields edged lower and the dollar touched its highest in almost two months.

In FX, as noted above, the slump in the pound dominated the overnight trading session as the currency headed for its biggest four-day drop since 2016. Besides the pound’s slow motion crash, the Euro drifted and core euro-zone bonds were steady as the latest data added to the gloomy outlook for the region’s economy. The yen gained as the Bank of Japan left interest rates unchanged. Oil extended gains after rising the most in three weeks on Monday.

In commodities, crude oil extended the previous day’s gains, with the Fed’s expected easing fueling optimism that it would boost the economy and fuel demand in the world’s biggest oil consumer. U.S. crude futures were up 0.65% at $57.24 per barrel and Brent crude added 0.6% to $64.09. Gold was down 0.1% at $1,425 per ounce.

Expected data include personal income and spending, and Conference Board Consumer Confidence. Altria, Conoco, Mastercard, Merck & Co., Amgen, Apple, and Mondelez are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.2% to 3,017.25

- STOXX Europe 600 down 0.7% to 388.18

- MXAP up 0.3% to 159.77

- MXAPJ up 0.2% to 524.10

- Nikkei up 0.4% to 21,709.31

- Topix up 0.5% to 1,575.58

- Hang Seng Index up 0.1% to 28,146.50

- Shanghai Composite up 0.4% to 2,952.34

- Sensex up 0.2% to 37,752.99

- Australia S&P/ASX 200 up 0.3% to 6,845.08

- Kospi up 0.5% to 2,038.68

- German 10Y yield fell 0.8 bps to -0.399%

- Euro down 0.02% to $1.1143

- Italian 10Y yield rose 0.7 bps to 1.221%

- Spanish 10Y yield fell 0.3 bps to 0.355%

- Brent futures up 0.9% to $64.27/bbl

- Gold spot up 0.1% to $1,428.03

- U.S. Dollar Index up 0.1% to 98.12

Top Overnight News from Bloomberg

- Prime Minister Boris Johnson will not start talks with European Union leaders over Brexit unless they first agree to his demand to reopen the divorce deal they struck with his predecessor, Theresa May, his office warned. So far, EU leaders have refused. U.K. will push EU to negotiate a new Brexit deal within weeks

- The Bank of Japan kept its monetary policy unchanged while trimming its inflation forecasts, taking a wait-and-see stance ahead of an expected interest rate cut from the Federal Reserve tomorrow.

- French economic growth unexpectedly slowed, adding to risks for a euro area already shaken by a manufacturing slump and frailties in its largest economy, Germany.

- The U.S. Treasury Department said it plans to borrow more than twice as much as previously anticipated in the third quarter, assuming lawmakers free up spending by lifting the debt ceiling

- Mexico’s interest rates are too high for a slowing economy, President Andres Manuel Lopez Obrador said in an interview, though he added that he respects the central bank’s freedom to set them independently

- Japan’s factory output suffered its second-largest drop in the last five years in June as trade tensions and a slowdown in the global economy dragged exports lower for a seventh straight month

- Oil extended gains on speculation that demand will get a boost from a potential rate cut by the Federal Reserve, while investors await news from the resumption of U.S.-China trade talks

- Citigroup Inc. is preparing to cut hundreds of jobs in its trading division — stark new evidence that an industry wide slump in revenue this year may be more permanent than the tweets and policy moves rattling clients

Asian equity indices shrugged off the lacklustre lead from their global peers and traded higher across the board, but with gains mostly modest as there was not much in terms of fresh catalysts and as markets look ahead to the looming risk events. ASX 200 (+0.3%) gained from the open with continued strength in telecoms leading the index to unprecedented highs, while the Nikkei 225 (+0.4%) ignored disappointing Industrial Production data and what has so far been a predominantly softer earnings season, with early outperformance fuelled by recent currency weakness although BoJ disappointment later saw some of the gains pared. Elsewhere, Hang Seng (+0.1%) and Shanghai Comp. (+0.4%) conformed to the mild optimism despite further liquidity inaction by the PBoC as focus turned to the resumption of US-China trade talks in Shanghai today. Finally, 10yr JGBs traded sideways with price action indecisive heading into today’s BoJ policy conclusion where the central bank kept policy settings unchanged as expected but also maintained its forward guidance which disappointed some outside calls for a potential dovish tweak.

Top Asian News

- BOJ Stands Pat and Trims Inflation Outlook Ahead of Fed Meeting

- Japan’s Industrial Output Falls More Than Expected in June

- Singapore Property Developer Top Global Slumps After Acquisition

- Indonesia’s FSA Orders Duniatex to Restructure, Pay Off Debt

European equities are firmly in negative territory this morning [Euro Stoxx 50 -1.0%]; however, once again the FTSE 100 (U/C) is the notable outperformer continuing to be buoyed by the weak sterling performance and also benefitting from BP (+2.6%) post earnings where adj. net beat on Exp. and Co. stated that at the mid-point of their 5yr plan they are on target. Unsurprisingly, sectors are all in the red with Energy names outperforming on the aforementioned BP release, with the Co. compromising around 15% of the sector. Other notable movers include Centrica (-13.0%) at the bottom of the Stoxx 600 as both revenue and adj. operating profit missed on the prior figures, though the Co. did caveat this by stating they expect earnings to be weighted towards H2. Separately, Bayer (-3.9%) are also in the red after Q2 revenue missed on Exp. and even though the Co. confirmed outlook this did come with a warning that the outlook is becoming increasingly ambitious for them to achieve. Finally, both Fresenius SE (-2.8%) and Fresenius Medical Care (-6.3%) are under-pressure post earnings with focus being on the Co. anticipating net income growth as flat and as some metrics came in softer than their priors for Q2 respectively.

Top European News

- ABB Is Said to Pick Sandvik CEO as Front-Runner for Top Job

- BP Bucks Trend of Big Oil Earnings Misses as Output Rises

- Centrica CEO to Step Down After First Dividend Cut Since 2015

- Delivery Hero Pours Cold Water on Just Eat Counter-Bid Talk

In FX, the broad Dollar and Index remains cautious as US-China talks are underway and as participants gear up for tomorrow’s FOMC meeting, with money markets currently pricing in a 78% chance of a 25bps cut and 22% for a 50bps cut to the Fed Fund Rate. DXY had earlier eclipsed yesterday’s high (98.17), ahead of the YTD peak at 98.37. Looking ahead on the docket, US PCE could influence a short-term move in the Buck, although sentiment for the currency is largely constrained to trade talks in Shanghai and positioning ahead of the Fed.

- GBP – More torment for the Pound as further no-deal woes engulf investor sentiment with the latest reports from the Telegraph further solidifying PM Johnson’s hard-line stance. Cable downside was exacerbated during Asia-Pac hours in which the pair retreated below the 1.2200 level for the first time since March 2017 to a current intraday low of 1.2121 (vs. 1.2217 at the open), albeit the pair saw a small bounce in recent trade as the Buck drifted off highs and potentially on some short covering. To the downside, technicians will be eyeing the following levels for support: 1.2110 (March 17 low), 1.2085 (Jan 17 low), 1.2000 (psychological) and 1.1841 (Flash crash low).

- JPY – Firmer on the day in the aftermath of the BoJ Policy Decision in which the Central Bank failed to satisfy some dovish calls by holding its NIRP at -10bps and its 10yr JGB yield target at around 0% whilst maintaining its forward guidance. The vote split also showed no change from the prior meeting (7-2) despite the recent sources suggesting divergence between board members on the timing of easing. USD/JPY currently hovers closer to the bottom of its 108.50-94 range ahead of tis 50 DMA at 108.35. Moreover, today’s NY cut sees 764mln expiring at strike 108.15-25 and around 860mln at 108.00.

- EUR, AUD, NZD – All largely unchanged intraday and mostly moving at the whim of the Buck, albeit the EUR is again somewhat cushioned by its EUR/GBP cross. EUR/USD remains just under the 1.1150 level and was overall little impacted by slightly cooler Y/Y German state CPIs, which is in-fitting with the National forecast due to be release at 1300BST. Elsewhere, the Antipodeans await developments from US-Sino talks with little to report on a domestic front. AUD/USD and NZD/USD remain within tight ranges (0.6887-6907 and 0.6619-34 respectively), with the latter hovering around its 50DMA (0.6624).

In commodities, Brent and WTI prices are firmer this morning, and currently trade just below the USD 64.50/bbl and USD 57.50/bbl marks respectively. This positivity is in-spite of a quiet session of newsflow for the complex, though today does see the resumption of US-China trade talks which alongside the ongoing geopolitical tension. Additionally, markets are likely looking ahead to today’s API release in which participants expect a headline crude draw of 2.5mln. Elsewhere, gold is flat in a tight range as the yellow metal awaits this week’s main events. Finally, copper trades lacklustre and is back below 2.7/lb amid cautious ahead of trade developments.

US Event Calendar

- 8:30am: Personal Income, est. 0.4%, prior 0.5%; Personal Spending, est. 0.3%, prior 0.4%

- Real Personal Spending, est. 0.2%, prior 0.2%

- PCE Deflator MoM, est. 0.1%, prior 0.2%l PCE Deflator YoY, est. 1.5%, prior 1.5%

- PCE Core Deflator MoM, est. 0.2%, prior 0.2%; PCE Core Deflator YoY, est. 1.7%, prior 1.6%

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.2%, prior 0.0%; S&P CoreLogic CS 20-City YoY NSA, est. 2.4%, prior 2.54%

- 10am: Pending Home Sales MoM, est. 0.5%, prior 1.1%; Pending Home Sales NSA YoY, est. 0.7%, prior -0.8%

- 10am: Conf. Board Consumer Confidence, est. 125, prior 121.5; Present Situation, prior 162.6; Expectations, prior 94.1

DB’s Jim Reid concludes the overnight wrap

Yesterday I mentioned how we’ve all been getting it wrong in discouraging children not to play video games all day as it’s becoming clear that the e-sports revolution is the path to untold riches after the weekend’s Fortnite World Cup. Well here in the UK we saw an alternative route to success last night as the final of “Love Island” concluded with the winners expected to earn a few million each in endorsements etc. I’ve never watched it but I read over the weekend that a hard Brexit may mean problems for next year’s show given it’s hosted in the EU. If there was a second referendum this is the sort of news I’d have to consider when allocating my vote!!

The main event today is the resumption of trade talks between the US and China, which are taking place in Shanghai. So watch for any headlines. To recap where we are, following the escalation in May where the US imposed higher tariffs on China and President Trump accused China of trying to renegotiate the agreement at the last minute, the US and China reached a truce and agreed to resume talks last month at the G20 meeting in Osaka. At the meeting, President Trump opted not to put tariffs on the remaining $300bn of Chinese imports which had been threatened, and also offered a concession on Huawei, while China agreed to buy more products from the US. Little has been heard since though on how things are progressing. The longer things remain uncertain the more risks there are to the global economy. This is one of the biggest dilemmas for the FOMC as they today start their 2-day meeting ahead of tomorrow’s announcement.

US markets were in wait-and-see mode yesterday ahead of tomorrow’s main planned event of the summer, with S&P 500 trading volumes around -11% lower than usual. The index ultimately ended -0.17% lower, while the NASDAQ dropped -0.44%. The DOW (+0.11%) outperformed, the first time in over a month that it gained in the same session when the S&P 500 fell. Company-specific news drove the biggest moves, with drug maker Mylan up +12.57% after it announced plans to merge with Pfizer (-3.81%). Pfizer will spin off a few of its popular brands into a new company along with Mylan, and its shareholders will receive 57% of the new company. Mylan owners will get 43% of the new combined firm. The utilities (+0.49%) and real estate (+0.46%) sectors led sector gains as bond yields slid, with 10-year treasury yields -1.4bps. Two-year yields traded sideways, taking the 2y10y curve -1.0bps flatter.

European markets were also in that same holding pattern with the STOXX 600 up +0.03% as the UK led advances on a weaker currency, up +1.82%, which was the biggest gain for the index since last August. The London Stock Exchange Group surged by +15.34% as investors reacted to the news of its $27bn acquisition of Refinitiv. Meanwhile the DAX, CAC 40 and the FTSE MIB slid a bit, by -0.02%, -0.16%, and -0.59% respectively. Bond yields fell, with ten-year bunds -1.5bps, ten-year French debt -1.7bps, and ten-year gilts falling –3.3bps to yield their lowest since 2016. European HY credit spreads tightened -1.4bps and are now at their narrowest level in almost a full year. There was little in the way of data to impact proceedings, although data ahead of this Thursday’s Bank of England meeting showed UK consumer credit growth continued to slow, falling to 5.5% yoy in June, the lowest since April 2014. Mortgage approvals were stronger than expected however, at 66.4k in June (vs. 65.8k expected).

Sticking with the UK, Sterling weakened by -1.31% against the dollar, its steepest drop since last November, and has continued to slide (-0.52%) this morning with heavier volumes than normal in Asia trading hours. It is currently trading at 1.2157, the lowest level since February 2017, and just a percent away from hitting a 34-year low. With 93 days until the UK’s scheduled departure from the EU on October 31, and with Johnson’s policy of leaving that day “no ifs or buts”, fears of a no-deal outcome are increasingly being reflected in the currency.

Turning to Asia, the BoJ kept its monetary policy unchanged at their meeting overnight maintaining the settings on its yield curve-control program and asset purchases while also keeping its interest rate pledge the same as before. The accompanying statement added a new sentence that, “In particular, in a situation where downside risks to economic activity and prices, mainly regarding developments in overseas economies, are significant, the Bank will not hesitate to take additional easing measures if there is a greater possibility that the momentum towards achieving the price stability target will be lost.”

We are slowly moving that way as the BoJ revised down both the core inflation and growth forecasts for 2019 by one-tenth to +1.0% and +0.7%, respectively. The Japanese yen is trading up (+0.14%) this morning while yields on 10yr JGBs are unchanged at -0.156%. Elsewhere, Japan’s June industrial production came in at -3.6% mom (vs. +2.0% mom last month), the biggest drop since January 2017 and was dragged down by the decline in output of autos and flat panels.

Asian equity markets are largely trading higher with the Nikkei (+0.27%), Hang Seng (+0.34%), Shanghai Comp (+0.65%) and Kospi (+0.56%) all advancing. However, the Nikkei has pared back gains of around +0.8% earlier in the session, prior to the BoJ announcement. Elsewhere, futures on the S&P 500 are up +0.12%.

In other overnight news, USTR Robert Lighthizer said that the US has a growing trade shortfall with Vietnam, and the government “has been clear with Vietnam that it has to take action to reduce the unsustainable trade deficit,” in written responses to the US Senate Finance Committee while adding that, Vietnam should take action including “expanding its imports of goods from the United States and by resolving market access restrictions related to goods, services, agricultural products, and intellectual property.” In May, the US Treasury had added Vietnam to a watch list of countries being monitored for possible currency manipulation with President Trump calling the country out as “almost the single-worst abuser of everybody” when asked if he wanted to impose tariffs on the nation.

Bloomberg reported yesterday that in the race to succeed Christine Lagarde as Managing Director of the IMF, the EU had narrowed its shortlist down to 3, although the French finance ministry denied this. The candidates mentioned are Jeroen Dijsselbloem, the former Eurogroup chair and Dutch finance minister; Olli Rehn, the central bank governor of Finland; and Kristalina Georgieva, the chief executive of the World Bank. Although of course it’s not solely up to the EU who gets the position, the IMF has always been run by a European since its formation, while the World Bank has always been headed by an American. It should also be noted that for Georgieva to get the position, the IMF would need to change its age-limit rules, as currently the Managing Director has to be under 65 years old when they’re appointed. Nominations for the position opened yesterday and close on September 6, and the IMF Executive Board are aiming to conclude the process by October 4.

As for US politics, the second Democratic party presidential debates are due tonight, with front-runners Bernie Sanders and Elizabeth Warren due to take the stage with 8 other candidates. Joe Biden and Kamala Harris will join the second group of candidates tomorrow night. Ahead of the debate, Warren released the details of her trade plan, which includes provisions to bar preferential trade with countries that manipulate their currencies, violate human rights, or fail to protect labour standards. Such measures could ensnare China and other current US trading partners, illustrating that trade confrontation is, at least for now, a bipartisan initiative.

In terms of rounding out yesterday’s data before we move to the day ahead, the Dallas Fed Manufacturing Survey came in slightly below expectations at -6.3 in July (vs. -6.0 expected), although this was a rebound from the previous month’s 3-year low of -12.1. Combining this print with other regional Fed surveys from New York, Philadelphia, and Richmond, results in an ISM estimate of 51.6, slightly below last month’s reading of 51.7, which would be the lowest since September 2016 but wouldn’t sink into contractionary territory. The ISM is due on Thursday.

In terms of the day ahead, in addition to the resumption of US-China talks, the FOMC will begin their much-anticipated 2-day meeting, although the decision won’t of course be announced until tomorrow. In terms of data, from the US we have personal income and spending releases for June, as well as the Conference Board’s consumer confidence reading for July. Meanwhile in Europe, we’ve got the first look at Q2 GDP from France, Eurozone consumer confidence figures, and from Germany we have CPI data for July, and the GfK consumer confidence reading. There are also a number of earnings highlights including Apple, BP, Procter & Gamble, Mastercard and Pfizer, while it’s the first of two nights of Democratic primary debates.

via ZeroHedge News https://ift.tt/2ylIqOy Tyler Durden