Via Greg Hunter’s USAWatchdog.com,

Best-selling financial author James Rickards says “We are still in the aftermath of the 2008 – 2009 financial crisis.” In the up-coming book titled “Aftermath: Seven Secrets of Wealth Preservation in the Coming Chaos,” the crisis of the Great Recession may be over, but “nothing is fixed.”

Rickards explains, “I understand the economy has been expanding for 10 years, and we are not in a liquidity crisis at the moment and unemployment is low. We have come a long way from that. The fundamental problems that gave rise to that have not been solved…”

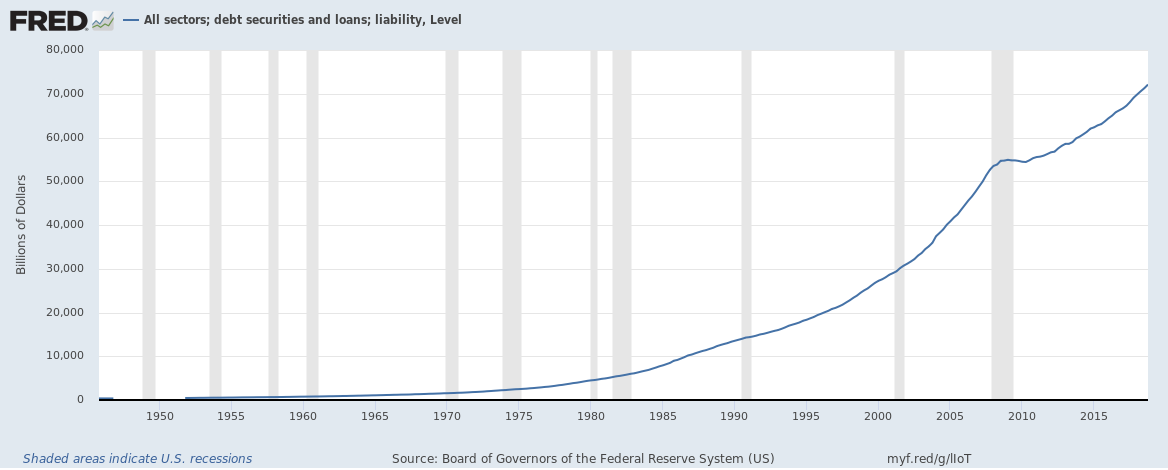

“So, unlimited guarantees, unlimited money printing and unlimited currency swaps and, yeah, they truncated the crisis, but all that happened was the bad debts, the leverage and the problems were now lifted up to the central bank level. You’ve got this progression. First, it is the hedge fund. Then, it’s Wall Street. Now, it’s the central banks. Who is going to bail out the central banks? That problem has not been solved, and it’s still on the table.”

Rickards says don’t think the Federal Reserve is going to come in and ride to the rescue in what Rickards is predicting to be a “coming chaos.” Rickards contends,

“Interest rates are 2.25%, but that is not what you need to get out of a recession. I am not predicting one, but if the U.S. economy went into a recession… history in economics says you need to cut interest rates 4% to 5% to get the U.S. out of a recession. How do you cut interest rates 4% when you are at 2.25%? You can’t because there is not enough room. You get to 0% pretty quickly, and now what do you do? You are still in a recession and you go to QE4 (money printing), but how do you do that when the Fed balance sheet is at $4 trillion. You are at a boundary. You are at a confidence limit. So, the Fed is not ready for the next recession, and they can’t get there.”

Rickards is not seeing a recession anytime soon. In fact, he is not forecasting a recession until after the 2020 Presidential Election. What does that mean for the chances of a second Trump Presidency? Rickards says,

“If you put recession odds at 35%, and that is probably high, then the inverse of 65% is his probability of winning. . . . Every month that goes by, the odds of a recession by next summer go down. So, the odds of Trump winning go up. . . . I don’t want to debate the economics of the Fed and what they are doing, but the Fed is doing what it needs to do to avoid a recession, and that improves Trump’s odds. Right now, I have Trump as the winner.”

After the 2020 Presidential Election, Rickards is much less optimistic and so are the wealthy elite. Rickards says,

“The rich are building bunkers. Entrepreneurs are actually buying abandoned missile siloes with armed guards and steel doors…

Here’s another interesting thing, hedge fund billionaires may trade stocks, bonds and currencies all day long, but when you ask them where do you have your own money, every one of them that I have spoken to have gold, physical gold…They all have gold. They don’t trade it, but they have it.”

Rickards covers a lot of ground in this in-depth interview that is more than one hour in length. Rickards talks about the new gold (and silver) bull market, what everybody, especially the small investors, needs to buy now, and talks about a gold price that is exponentially higher than today’s price. Rickards discusses the world’s massive debt, probability of big defaults and huge inflation all coming in the “Aftermath” of the coming crisis. Rickards also tells people what they can do to protect themselves.”

Join Greg Hunter as he goes One-on-One with James Rickards, multiple best-selling author of a new book titled “Aftermath: Seven Secrets of Wealth Preservation in the Coming Chaos.”

To Donate to USAWatchdog.com Click Here

via ZeroHedge News https://ift.tt/2Swt2Z8 Tyler Durden