Authored by Ted Dabrowski and John Klingner via WirePoints.org,

You have to wonder whether Chicago Mayor Lori Lightfoot really thought she could get away with it.

Just three weeks ago, she was demanding a state taxpayer bailout of her city’s nearly bankrupt pension funds. The problem was so big, she said, she’d risk her “re-election” over it. Eventually, Gov. J.B. Pritzker denied her bailout request for obvious reasons – the state is just one notch from a junk rating.

Now news reports confirm that Lightfoot has offered the Chicago Teachers’ Union a five-year contract that will cost taxpayers another $325 million. That includes guaranteed raises of more than 14 percent over the life of the contract. And that, of course, turns into more pension benefits and an even bigger pension hole for CPS.

That’s an expensive gift for a city that Lightfoot claims is in need of a multi-billion dollar bailout.

That about-face should infuriate every downstate Illinoisan. If the bailout had gone through, here’s what all Illinoisans would have been paying for:

1. Chicago teachers are already highest paid vs. teachers in similar districts.

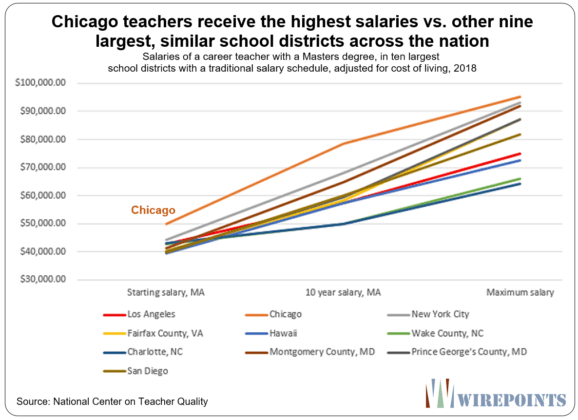

Chicago teachers are the nation’s highest paid when compared to the largest school districts with traditional salary schedules, according to data from the National Center on Teacher Quality.

For example, a Chicago teacher with a master’s degree receives $80,000 a year after ten years of work. In contrast, an equivalent teacher in New York City makes $70,000 and a Los Angeles teacher makes $60,000.

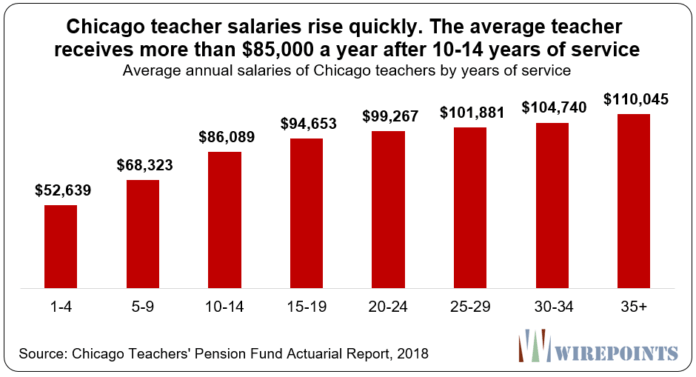

A big reason for that is due to how fast Chicago teacher salaries grow. The average new teacher with one to four years under her belt starts out with a salary just above $50,000. By the time that teacher reaches 10 to 14 years of service, her salary grows to more than $85,000 annually.

2. The average career Chicago teacher will get $2 million in total pension benefits, far more than ordinary Illinoisans.

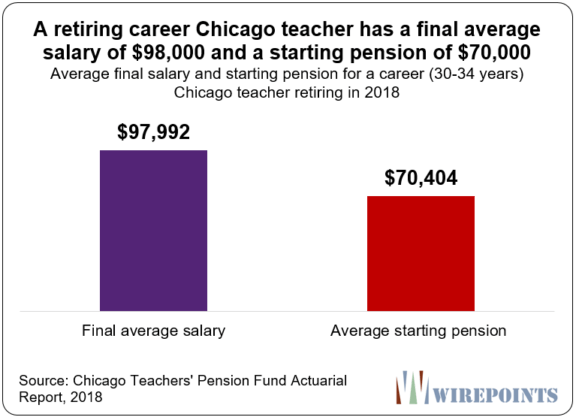

High salaries translate into big pension benefits for career teachers. The average CPS teacher who retired in 2018 with 30-34 years of service had a final average salary of nearly $98,000 and a starting pension of over $70,000. Their average retirement age was 61.

That pension will increase automatically by 3 percent each year and by year 25 of retirement, the pension will be double its starting amount. In all, the average retired career Chicago teacher will collect over $2.1 million in benefits over the course of her retirement.

In contrast, an ordinary Illinoisan at retirement would need to have around $1.5 million in his or her account at retirement to collect the same amount of benefits as a career Chicago teacher. Most Illinoisans will never save that amount of money.

3. Taxpayers still “pick up” a majority of Chicago teacher pension contributions.

Not only do Chicago teachers receive millions in pension benefits, they contribute almost nothing towards them over the course of their careers.

Chicago teachers are supposed to contribute 9 percent of their salary every year towards their pensions. But every year since 1981, CPS has paid for, or “picked up” 7 of that 9 percent.

That means Chicago teachers only have to pay 2 percent of their salary towards their own pensions every year. That costs Chicagoans over $100 million a year.

Rahm tried to reform pickups in 2016, but he was rebuffed by the union. Only new workers lost the pickup. And even then, the district gave out extra 3.5 percent raises in exchange.

4. CPS is losing students but spending more on them than ever before.

One of the CTU’s contract demands calls on CPS to spend money to hire more teachers and even more support staff. That might make sense in a dynamic, rapidly growing city with a growing school population.

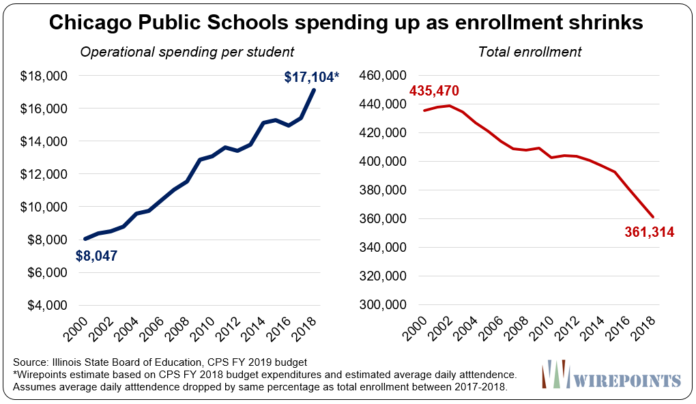

But CPS is losing students and has been for nearly 20 years. At the same time, the district’s spending per student has jumped.

In all, CPS’ per student spending has doubled since 2000 according to ISBE, even as the district’s enrollment has fallen by nearly 75,000 students, or 17 percent, over the same time period.

5. Near empty, failing schools should be closed and their resources redirected.

Declining enrollment is hitting some Chicago schools particularly hard.

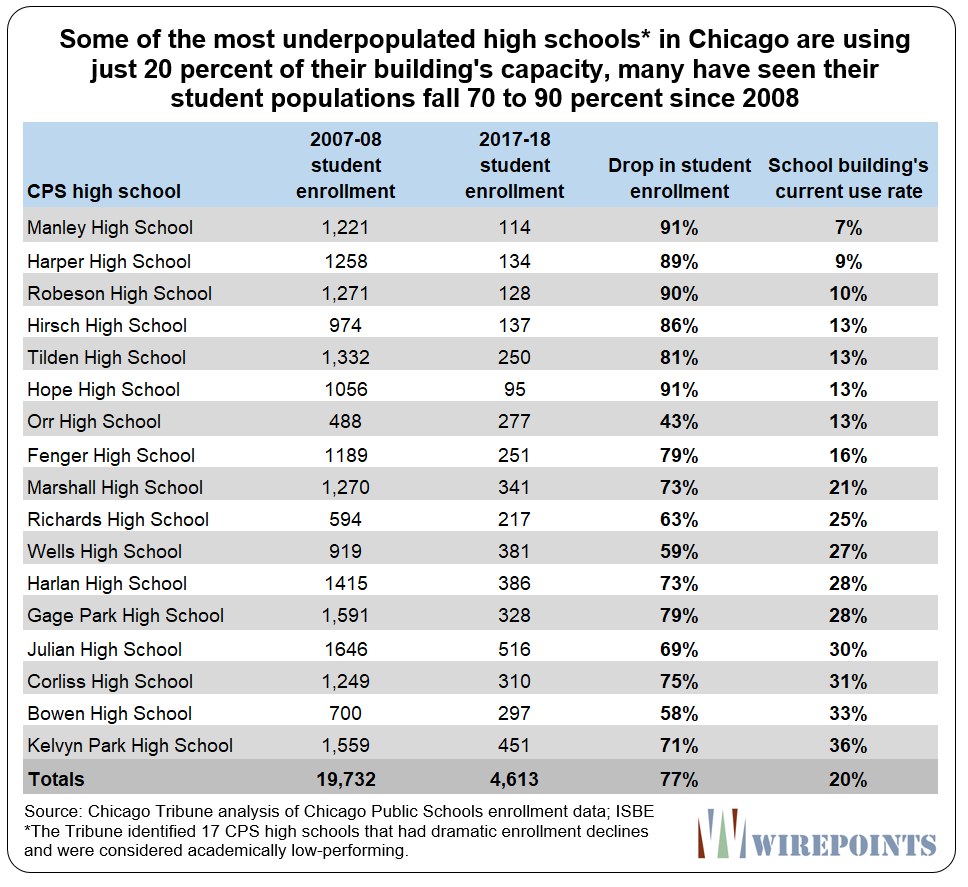

In 2017, the Chicago Tribune examined the demographics of some of the most underpopulated schools in Chicago. It found the enrollment of the 17 worst schools has dropped from nearly 20,000 in 2008 to just over 4,600 today. Their buildings are, on average, filled to just 20 percent capacity.

And the few students that do attend aren’t getting a good education. In those schools, no more than 8 percent of students are ready for college. Despite that, the CPS hasn’t closed the nearly-empty, failing schools.

* * *

Lightfoot has landed some great punches when taking on corruption in City Hall, but when it comes to finances, she’s acting just like any other Chicago politician.

She said she’d “risk her political career” to tackle pensions. Making downstate taxpayers foot the city’s pension bills is hardly a “risk.”

via ZeroHedge News https://ift.tt/2JNcRTc Tyler Durden