Authored by Omid Malekan via Medium.com,

Economics is the only profession where the more an idea fails, the more it is believed. Consider the following theory:

Low interest rates lead to higher growth and higher inflation.

If it were true, then a decade of the lowest rates in recorded history would have seen the global economy go gangbusters. Instead it’s been mostly the opposite, leading any reasonable person to at least question this theory.

But wait a second! A wunderkind econ whippersnapper fresh from Davos interrupts.

If not for low interest rates, things would have been even worse!

This kind of defensive argument is popular among failed forecasters. And to be fair, I can’t prove that it isn’t true and low rates didn’t prevent some unforeseen calamity. That’s the beauty of the Hyperbolic Avoided Hypothetical (HAH! for short) and why it has become a favorite of the Central Banking elite. But it’s junk science, because you can’t disprove it either. For example: I just used my superpowers to prevent a zombie apocalypse. Go ahead and prove that I didn’t. (Do you see any zombies? No? You’re welcome.)

These twin tendencies of believing an idea that keeps disappointing and justifying it with all the worse outcomes that didn’t happen are the pillars of the global liquidity trap that is slowly pulling us all under. Ten years ago, there was a plausible theory that lower rates were a good idea. When they failed, rates were taken to zero (zero interest rate policy, or ZIRP). When that failed, they were taken negative (negative interest rate policy, or NIRP). At no point was it ever even considered that maybe, just maybe, it’s the theory that’s wrong.

My belief is that in the short term, artificially low rates are deflationary, as they result in investing booms that create excess capacity and misallocation of resources that hurts growth. Uber, Lyft, WeWork and AirBnb have caused plenty of deflation by constantly raising money to operate at a loss. Cheap debt enabled a fracking boom that’s flooded the oil market. Public companies that can borrow for nothing are more likely to spend that money on buybacks than wages.

But don’t say any of that to a central banker. In a profession where the things that didn’t happen matter more than the things that did, where giving free money to billionaires reduces income inequality and iPad prices matter more than the cost of food, the only thing that’s wrong with low interest rates is that they aren’t low enough.

And so, the ECB has just announced it will cut rates from negative 0.4% to negative 0.5%, because clearly what’s ailing Europe in the year 2019, a year of hard Brexits, Yellow Vests and right-wing uprisings is the fact that NIRP isn’t NIRPy enough, and should in fact be even NIRPier.

Here in the US we don’t have NIRP (yet) but the Fed is about to cut rates, despite the fact that unemployment is at an all time low, the stock market is at an all time high, and inflation is sitting just below the Fed’s own target. So why start easing? The Wall Street Journal asks the same question and concludes:

Federal Reserve Chairman Jerome Powell is leading his colleagues to cut interest rates this week for the first time since 2008, even though the economy looks healthy, partly because it isn’t behaving as expected.

Translation: The Fed’s economic models have once again failed to predict the behavior of millions of people, and that could only mean one thing: the people are wrong. It’s tempting to get on these economists for their folly, and lord knows they deserve it, but what we are witnessing is the all too common tendency among smart people to double down on a false belief when confronted with the limitations of their own intelligence. (Unfortunately, and unlike a degenerate gambler, Central Bankers get to double down with our money.)

The great philosopher Homer (Simpson, not the Greek dude) once toasted: “To alcohol: The cause, and cure, of all of life’s problems.” The same can be said for low rates. As the extremity of these policies continue to cause a widening wealth gap, social discord and populist uprisings, they will accelerate the feedback loop. As the drama unfolds, two assets, gold and crypto, will become increasingly sought after.

Yes, you can also use equities, venture capital and real estate to hedge against negative rates. And in fact, that’s exactly what Central Bankers want you to do, along with buying shit you don’t need and taking on debt you might not be able to repay. But too many of us lived through the financial crisis to forget its lessons, and stocks, startups and skyscrapers have already had an epic run anyway.

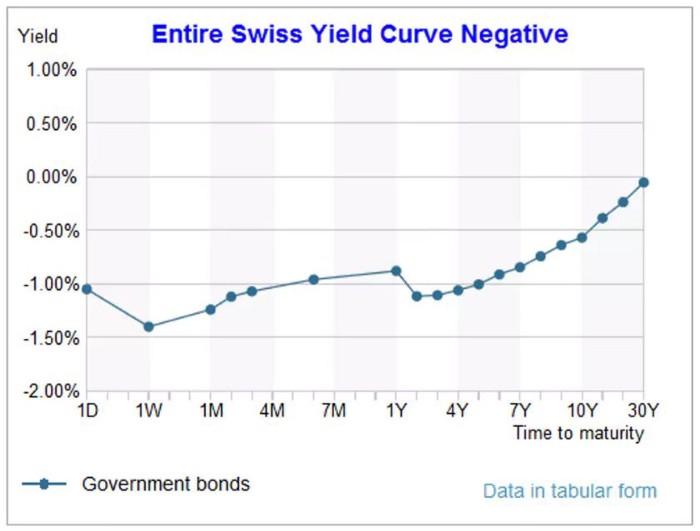

Gold has been a great hedge against insanity for thousands of years, and with crazy shit like the entire Swiss yield curve being negative out to 50 years being the new normal, these are historically insane times.

Crypto represents a lot of things to a lot of different people, and it remains to be seen whether it ends up being more of a store of value, medium of exchange, equity in decentralized network or some combination therein. But going forward, it will also start to act as a vote against the insanity, for the simple reason that it exists entirely outside of the traditional financial system. In that regard, it is rather undervalued.

via ZeroHedge News https://ift.tt/2ZkBz3R Tyler Durden