Authored by Chris Whalen via TheInstitutionalRiskAnalayst.com,

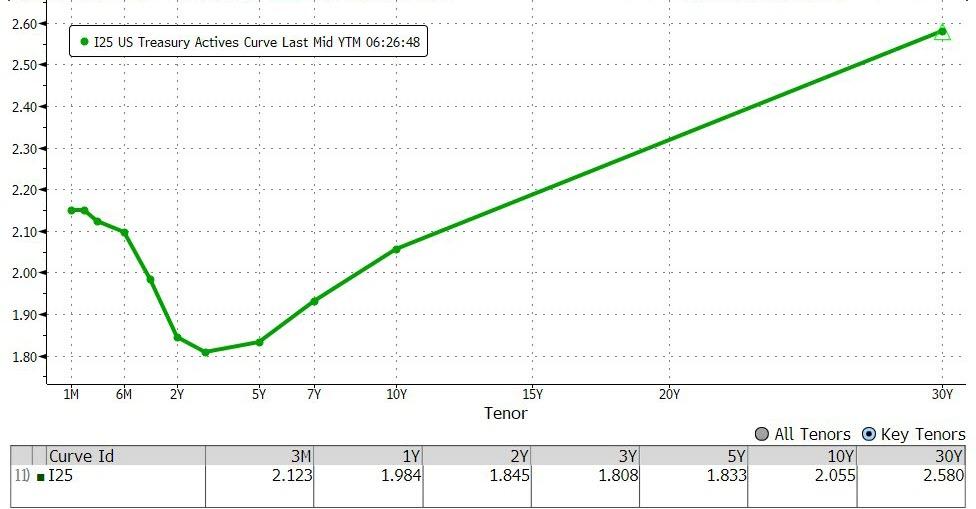

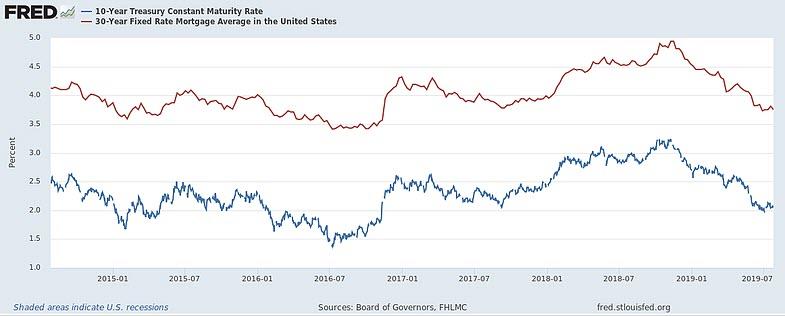

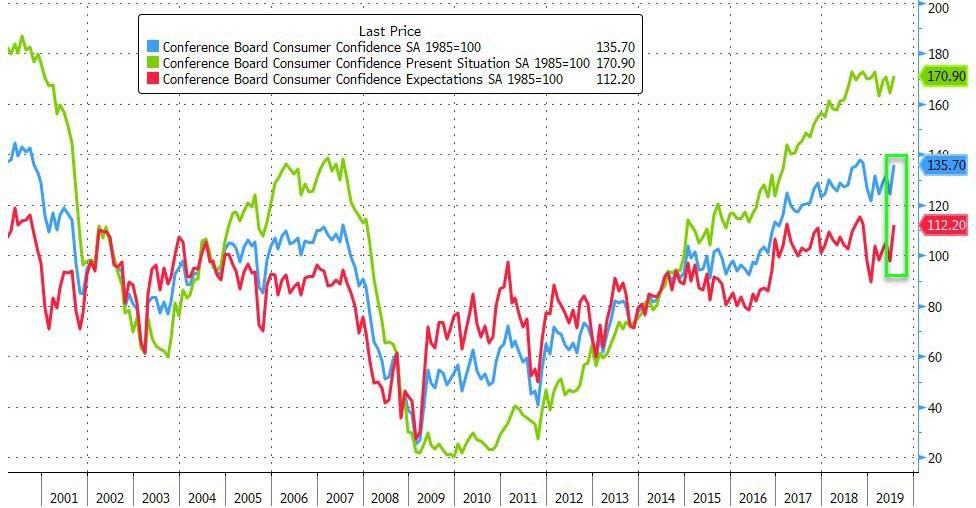

With the end of Q2 2019 earnings in sight, there is good news and bad news. The good news is that the rate of change in US bank funding costs is slowing, from 50-60% year-over-year rates of increase to 30-40% or so this past quarter. Indeed, even though the middle of the Treasury yield curve has essentially collapsed, there is no indication that funding costs are following suit. Interest rates in the US remain buoyant outside of the government bond market.

Across the Atlantic, the European Central Bank is preparing to make another futile round of asset purchase operations as Britain prepares to crash out of the European Union. For those of you who missed the spectacle, former Goldman Sachs banker Mario “Whatever it Takes” Draghi, who is leaving the ECB in October, wants to provide more stimulus to Europe’s flagging economy.

“The European Central Bank on Thursday made clear it stands ready to cut rates and deliver “highly accommodative” monetary policy,” reports Market Watch, “including additional asset purchases, in its effort to push stubbornly low inflation back toward its target amid signs of deteriorating economic conditions in the eurozone.”

Despite growing evidence that negative interest rates are injurious to economic growth, housing affordability and employment, among other things, economists at the various central banks persist in calling for more of the same bad medicine. How many times must we hear central bankers express “surprise” that inflation remains low when they are busily transferring resources from private savers to public sector debtors?

The only people who seem to be in favor of a resumption of asset purchases (aka quantitative easing or “QE”) are increasingly worried equity managers. Writing in the Financial Times over the weekend, Merryn Somerset Webb, editor in chief of MoneyWeek, boldly chastises BlackRock (BLK) executives for suggesting that the ECB should start to buy equities. She writes:

“Our senses have been dulled by increasingly extreme monetary policy over the past decade, so we must try to look afresh. What is being suggested here is that the ECB, a publicly owned institution, prints money and uses it to buy equity stakes in private companies. In other words, the only way to save capitalism is to begin to nationalize it.”

Well, yes. The global equity manager community is positively soiling its nappies at the thought that the central banks will stop buying assets. An end to QE means an end to constantly rising asset prices. Once asset prices start to fall, as is the case with the top half of the real estate market in the US, credit will return as an issue. But can we actually deflate the various asset bubbles including global equities without causing an equally global liquidity crisis?

We tend to think that the cheering for rate cuts and resumption of asset purchases is a function of the Buy Side managers talking their shrinking liquidity book. The suggestion of equity market purchases is apparently to prevent a larger, nastier repeat of the H2O investor run. But isn’t that the point? Now that the FOMC has set up the global equity markets for a sharp come down, does not that imply a whole series of new Maiden Lane type vehicles to buy illiquid crap and thereby provide ready cash to investors?

Short-term market liquidity aside, we suspect that the true motive of central bankers with respect to negative rates has nothing to do with growth or jobs and everything to do with the imminent insolvency of large industrial nations. Italy, Japan and even that darling of the Buy Side equity manager, mainland China, belong on this list.

Only the fact of $14 trillion in government debt trading at negative yields keeps the grim reaper of sovereign debt restructuring from its work. Yet even with negative rates, so much of the debt markets is visibly mispriced, to us begging the question as to when the great reset will commence.

CLO: Falling Volumes and Loan Quality

Speaking of falling liquidity and bad ratings, ponder the world of leverage loans and collateralized debt obligations (CLOs). Since the start of the year, the performance of CLOs and leveraged loans has been stellar, but on falling volumes of new issuance. Investors are quietly running away from the once popular asset class.

Two interesting trends have appeared in recent weeks, according to the astute folks at TCW: Increased dispersion in terms of the spreads among different sectors of issuers and a flow of decidedly lower rated assets into new deals. This situation reminds us of 2007, when the Street tried to issue just a few more private mortgage securities deals containing the worst production from the subprime sausage factory.

Funny thing about CLOs is that they tend to trade way below the prices suggested by the usual suspects in the rating agency world. Just for a bit of context, let’s have a look at the old corporate ratings scale from S&P which is shown below:

AAA: 1 bp

AA: 4 bp

A: 12 bp

BBB: 50 bp

BB: 300 bp

B: 1,100 bp

CCC: 2,800 bp

Default: 10,000 bp

So a “AAA” corporate rating is about 1bp of default risk or 1/100th of 1% of probability of default P(D). An actual default is 10,000bp or 100%. This is an interesting point because if you look at the yield spreads for CLOs, the “AAA” rated paper trades about 100-130bp over the Treasury yield curve or the spread for a “BBB” rating. The “BBB” paper trades about 300-400bp over the curve, which maps to a “B” rating. And the “B” paper trades about 1,000bp over or about the same spread as the corporate ratings breakpoints above. So why the discount on the investment grade rated CLO tranches?

Could it be that investors don’t believe those “AAA” CLO ratings from Moody’s, S&P et al, this even though the CLO market has rallied since January? Maybe that’s why investors continue to flee the sector. TCW notes that asset under management (AUM) dedicated to CLOs among mutual funds have been cut by a third since the FOMC’s December’s massacre. Yet loan fund outflows have apparently been offset by high-yield investors grazing on new, lower rated CLO issuance, albeit at greatly reduced volumes vs a year ago. Maybe a new asset class? “Junk CLOs.”

As we told our friends at CNBC last week, the biggest risk in the market today is not credit – that comes later – but rather liquidity risk. When investors head for the exits after an extended, central bank fueled asset bubble, bad things happen. When you see BLK executives openly asking the ECB to come to the rescue, sure makes you wonder. Truth is that all of the Buy Side managers want and need to be “too big to fail” since nobody can surf the waves of volatility being created by the lunatics on the FOMC.

Ditech, Bank America and the NY AG

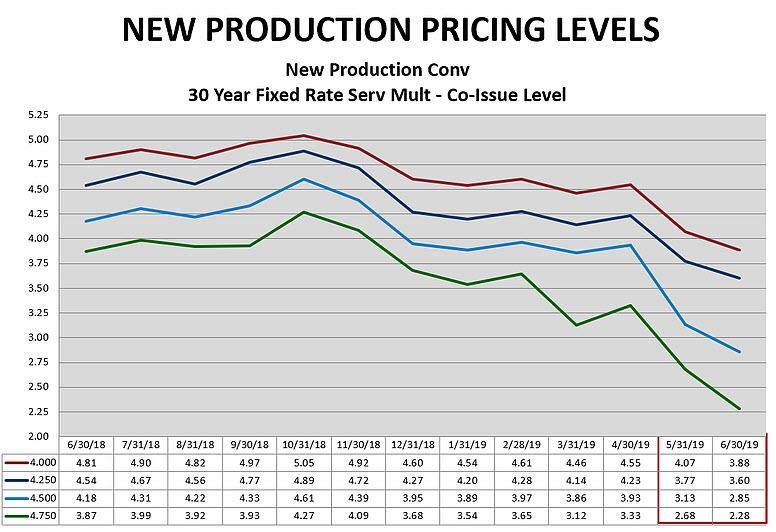

To that point about central bank induced volatility, do make sure that you listen to the earnings call for the Fortress Investment (FIG) managed REIT, New Residential Investment Corp (NRZ) on Tuesday before the open. Pay attention to the negative mark on the mortgage servicing assets. The chart below from Mountain View Financial gives a frightening example of how higher coupon asset values have collapsed since Chairman Jay Powell changed the FOMC’s posture on interest rates last December. Caution: Mortgage bankers may feel an involuntary sense of nausea upon viewing the chart below.

Source: MountainView Financial

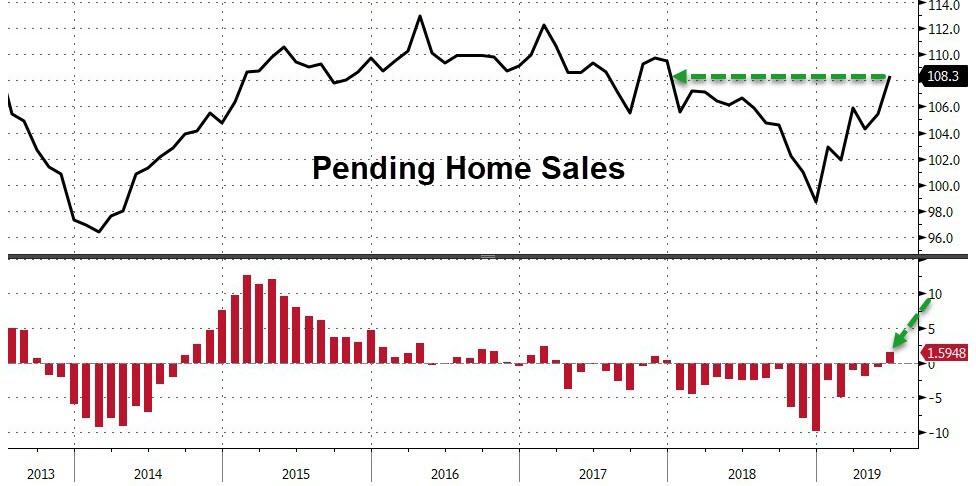

As we noted in the column for National Mortgage News referenced last week, the Fed has wreaked havoc on the world of mortgage finance since 2008. Positive duration loans and securities have soared since December, but negative duration assets like mortgage servicing rights have fallen sharply from record multiples. Meanwhile lenders are barely making money and lending volumes are falling again after a spurt of refinance activity in Q2 2019.

From December 2018 through June, we saw the 4.75% coupons in conventional mortgage servicing fall from 3.8x annual cash flow to 2.3x annual cash flow. So as you listen to the NRZ earnings call early Tuesday morning, pay close attention to the markdown on servicing. And also ponder the fact that the State of New York has decided to get involved with the bankruptcy of Dietech, a troubled residential loan servicer with close ties to NRZ.

You see, NRZ was the only viable bidder for the Ditech forward loan book, in part because the giant residential mortgage REIT had acquired servicing assets from Ditech over a year ago. But these sale transactions have not yet closed, owing to the years of delay sometimes required by risk-averse trustees and the highly politicized state regulators that now control servicing transfers.

Did we mention that Ditech’s predecessor, Walter Investment Management Corp., in 2013 bought a fetid Bank of America (BAC) portfolio of more than 650,000 loans? A decade later, the cleanup of BAC continues and still consumes value. Now you know why we waned to put BAC through bankruptcy a decade ago. Finality.

The State of New York and, ironically, Bank of America, have objected to the sale of Ditech’s reverse mortgage book to an affiliate of another REIT manager, Waterfall Asset Management LLC, according to Josh Saul and Jeremy Hill of Bloomberg News. They write:

“The objection from BofA comes on top of separate complaints and objections from borrowers who oppose the bankruptcy plan; they say Ditech is trying to sell its business to a new owner free-and-clear of their claims against the company for mishandling their mortgages. The U.S. Trustee this week voiced similar concerns.”

Will the State of New York put the kibosh on the entire Ditech sale transaction? If the Ditech sale transaction pending in the Bankruptcy Court is delayed, will the New York AG attack the earlier, as yet unperfected sales of servicing from Ditech to NRZ? One wonders if the State of New York AGs office understands just how little it would take to make this entire situation go sideways. It’s all about liquidity.

via ZeroHedge News https://ift.tt/2LPdGyl Tyler Durden