Authored by EconomicPrism’s MN Gordon, annotated by Acting-Man’s Pater Tenebrarum,

“Facilis descensus Averno.” – Virgil (Publius Vergilius Maro)

Delivering Tomorrow’s Curses

Roman poet Virgil penned these words in his epic, The Aeneid, roughly a generation before the birth of Jesus of Nazareth. They can be loosely translated to, “the descent to hell is easy.” Those who’ve traversed this passage can attest to the veracity of this axiom.

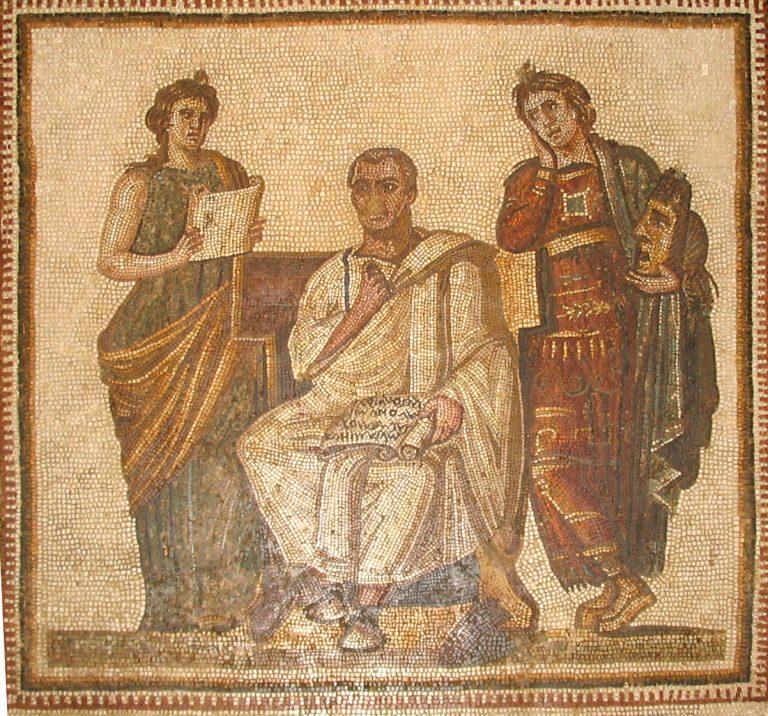

Virgil reading the Aeneid to Augustus, Octavia and Livia. Contrary to what one might think at first blush, Octavia didn’t fall asleep because she was bored by it – rather, when Virgil recited Book Six, she fainted (the veracity of this account is not undisputed, but it’s a good story anyway). A little side note: Virgil caught a fever while returning from to Rome from Greece and died in Brundisium in 19 BC. It was Virgil’s wish that the poem be burned, but Augustus ordered his literary executors to preserve it and publish it with as few editorial changes as possible. Thus Augustus rescued the Aeneid for posterity. [PT]

Though not apparent in the milieu of Virgil’s poem, for our purposes today, we will extend its application to the insidious progression of currency debasement. What short utterance more aptly characterizes the steady degradation, as currently practiced by today’s church of state?

On Thursday, for example, the House acted with untroubled ease to further America’s descent to hell. With little resistance, federal spending was increased and the debt ceiling was suspended for two years. Having delivered tomorrow’s curses, the nation’s Representatives can skip town without missing a moment of summer recess.

As you can see, the allure of getting something for nothing is far too enticing for even the most honest politician to pass up. And with an endless supply of fake money behind you, why stick your neck out and get clobbered? The public debt encumbered is already well beyond honest repayment. But that’s a problem for tomorrow; not today.

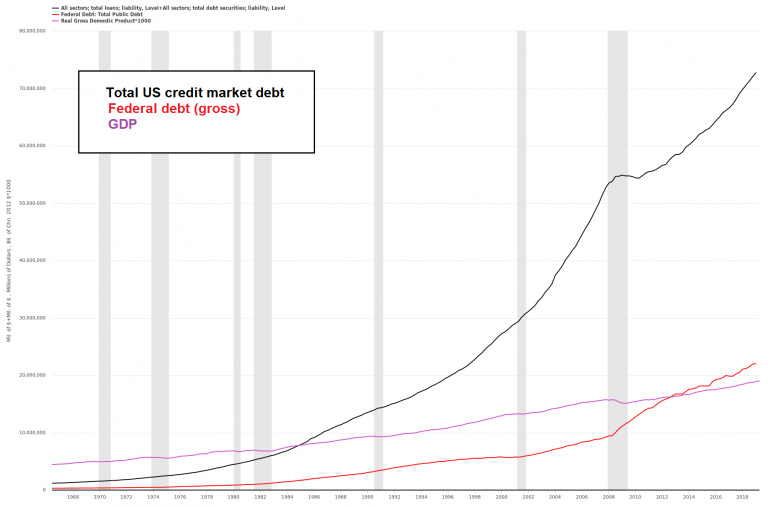

Total US credit market debt (~USD 73 trillion), total federal debt (~USD 22 trillion) and GDP (~USD 19 trillion). The growing mismatch between economic output and debt is an unsustainable trend, which is to say, one day it will stop. What happens then is anyone’s guess – the precise shape of the eventual denouement will largely depend on the response by assorted central economic planning agencies, above all on the measures of the central bank. [PT]

Representative government in America, circa now, has nothing to do with upholding individual freedoms and liberties. Nor is it about making tough decisions in the interest of the long-term health of the nation. It’s about doing the expedient – and suspending the debt ceiling so the descent to hell can be made as comfortable as possible.

Wreckage from the Past

Rarely are people capable of understanding the full implications of a forthcoming catastrophe of their making. Perhaps, it’s not because they are truly incapable of it. More likely, it’s because they’d rather ignore it.

Facing up to the facts of an unpleasant reality can be painful. It also implies a recognition that what one has been doing isn’t working. And that the arduous task of righting one’s wrongs must be initiated forthright.

Pursuing delusion, of course, is abundantly easier – for a time. However, as the wreckage piles up from the past to the present, the day of reckoning becomes much more ominous. There really is no escaping it.

Certainly, Congress is far from this recognition. Otherwise, they would get serious about the nation’s fiscal doom, tighten their belts, reverse course, and suffer the immediate consequences. But that is not what is happening at all.

Instead, Congress is doubling down on their wreckage from the past. They are blowing the debt out like there’s no tomorrow. The insanity of it, even for a casual observer, is near impossible to ignore.

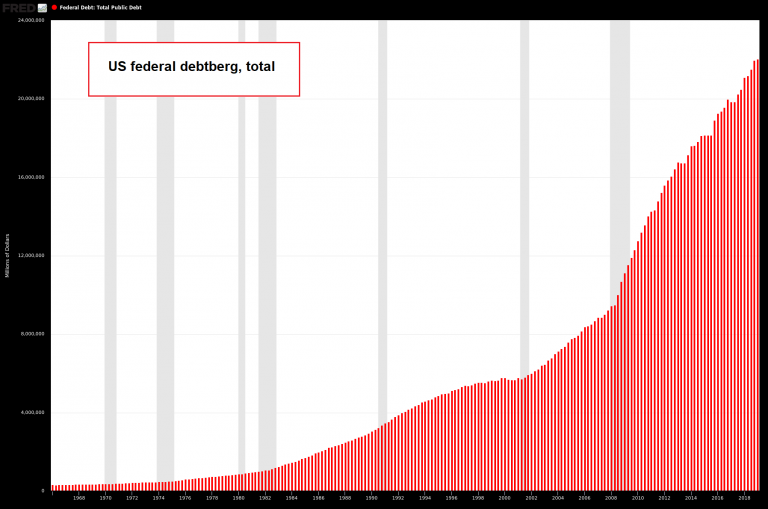

The federal debtberg – if it were a stock, people would admire its strong momentum. With the “debt ceiling” problem removed, another jump is already baked in the cake. [PT]

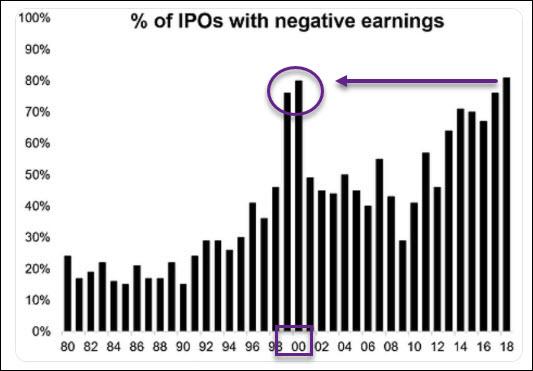

For example, at the turn of the new millennium, the national debt was $5.7 trillion. By 2010 it had more than doubled to $13.5 trillion. By 2020, it will be over $24 trillion.

Hence, over the last 20 years the national debt has increased 320 percent. But over this same period, nominal gross domestic product (GDP) has only increased 100 percent. What’s more, this divergence stands to get much more extreme…

Realizing the Full Implications of the Forthcoming Catastrophe

When the next recession arrives, and Washington pulls out all the stops to counteract it with massive new applications of debt based stimulus, the debt will go vertical while GDP flat lines or contracts. These different trajectories will be reconciled by default or price inflation. Washington, no doubt, prefers price inflation.

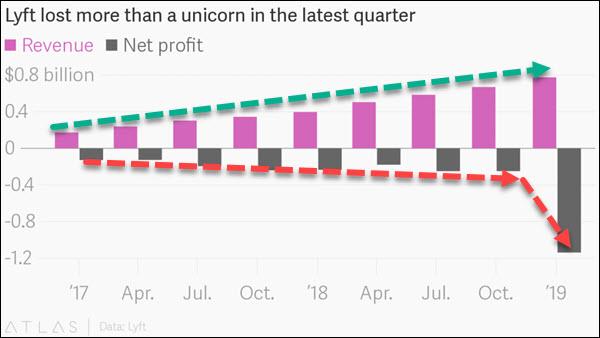

The popular delusion of the 21st century is to assume the highest virtues of democracy. This faulty assumption propagates a dangerous archetype: the tyranny of the masses and its twin consequences, deficits and inflation.

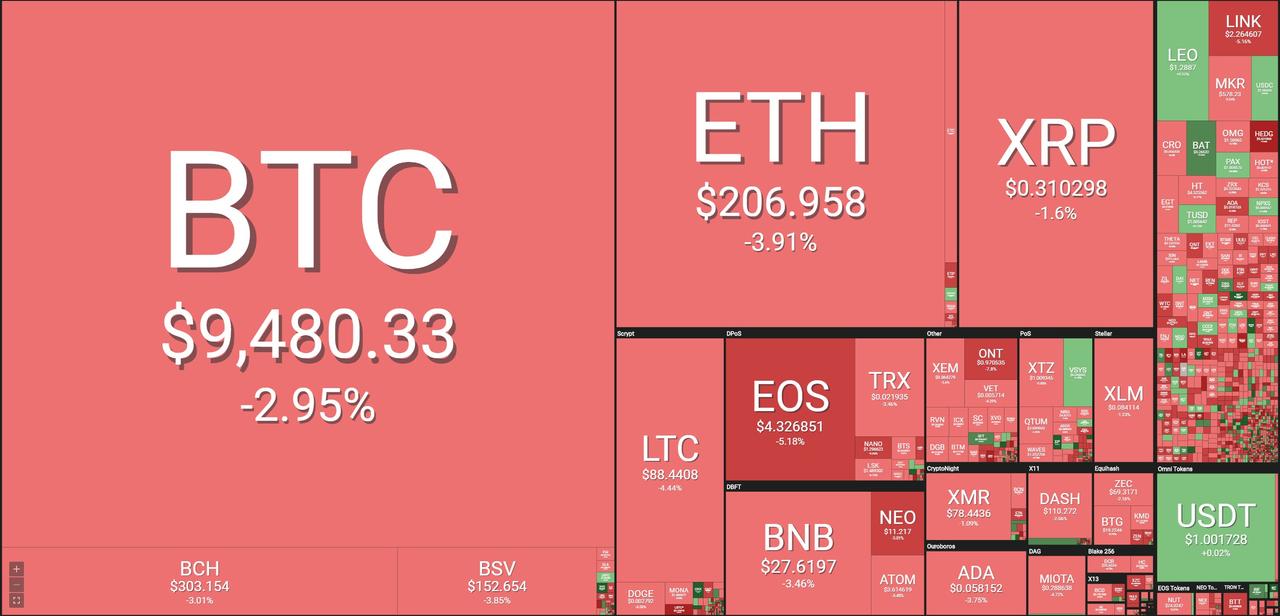

What the heck, let’s raise the ceiling just one more time… no-one is likely to notice or care. [PT]

Voters want a free lunch. They want their neighbors to pay for it. They elect stooges to office who promise massive social welfare, public works, and defense spending programs. Then, the hack economists advance an absurd theory – like Modern Monetary Theory – to deliver something for nothing.

The deficits mount up year after year, the currency’s debased year after year, until something gives. In short order, confidence evaporates and price inflation explodes. The country succumbs to political, economic, and cultural destruction.

Indeed, the descent to hell is easy. But Virgil also adds a lesser known corollary, “Sed revocare gradum, superasque evadere ad auras, Hoc opus, hic labor est,” which can generally mean, “But to retrace the way and return to the upper airs; this is the task, and where the mighty labor lies.”

A 3rd century mosaic showing Vergilius seated between Clio and Melpomene. It is widely held that the Aeneid ends with Book 12, in which Aeneas defeats Turnus and spurns his pleas for mercy. The lamenting soul of Turnus then enters the Hades to dwell in the Stygian swamps. What is not so well known is that Virgil actually wrote a 13thbook; the mosaic depicts him reciting the most famous verse from it to his enraptured audience: “…and now it has come to pass, that we are totally screwed. Stick a fork in it.” (it sounds better in dactylic hexameter). [PT]

Congress may still ignore it. The Treasury Secretary may still ignore it. The President too. But for more and more Americans the full implications of the forthcoming catastrophe are becoming painfully clear. That is, the realization that we are absolutely and utterly screwed.

Woohoo!

via ZeroHedge News https://ift.tt/2ZgLNCf Tyler Durden