Submitted by RanSquawk

The ECB will announce its monetary policy decision at 745am ET (1345 CET), with a press conference 45 minutes later.

- Consensus looks for the ECB to leave its three key rates unchanged

- Market pricing places the chances of a 10bps cut as a much tighter call

- July seen as a staging meeting for a broader stimulus package to be unveiled in September

62 of 67 analysts surveyed by Reuters look for the Deposit Rate to be held at – 0.4%, with four looking for a 10bps cut, and one looking for a 20bps cut; Main Refi and Marginal Lending rates are unanimously expected to remain unchanged at 0% and 0.25% respectively. Note, markets currently price in 53.4% chance of a cut this week. With the ECB expected to stand pat on rates this week, participants will be eyeing any tweaks to the Bank’s forward guidance that would pave the way for a potential move in September, possibly as part of a broader easing package.

BACKGROUND

PREVIOUS MEETING: The latest policy announcement from the ECB saw policymakers stand pat on rates as expected, whilst unexpectedly (according to consensus) pushing back guidance on rates. Furthermore, the Bank unveiled details of the lending terms for TLTRO3 with the interest rate set at the MRO + 10bps, but eligible entities able to seek financing at the deposit rate +10bps. President Draghi noted that incoming data points to weaker growth in Q2 and Q3, whilst Euro Area risks remain tilted to the downside. During the Q&A, Draghi noted that there was a discussion on the ECB’s readiness to act in the event of an emergency with policymakers raising the possibility of lowering rates (deposit), restarting APP and a further extension of forward guidance. On the subject of forward guidance for rates, Draghi later stated that it is not correct to suggest that guidance is tilted towards rate hikes. Discussions on other measures included the prospect of a tiered rate system, however, the ECB President pushed back against such action.

ECB MINUTES: The account from the June meeting provided little in the way of surprises with the minutes largely reflecting the tone of the press conference. Policymakers stated that there should be no room for complacency over the fall of market expectations and as such, there was a broad agreement (interestingly, not unanimous) for the need to shift the Bank’s stance and demonstrate a determination to act. Elsewhere, the argument was made for TLTRO3 pricing to be in line with the prior round. From a guidance perspective, one interesting takeaway was that the “point was made that the value of calendar-element of guidance could seen to be diminished”, which appears to provide some concern over the Bank having pushed back their guidance multiple times. The account also showed policymakers continuing to push back on the need for a tiered deposit rate system by suggesting that the “costs of negative rates are outweighed by benefits,” however, there was an acknowledgement that “this might not hold for lower rates or longer horizons”.

ECB RHETORIC: The most noteworthy interjection of any policymaker since the last meeting came from President Draghi at the Sintra conference in June with Draghi noting that “In the absence of improvement, such that the sustained return of inflation to the Bank’s aim is threatened, additional stimulus will be required”. Adding that, “in the coming weeks, the Governing Council will deliberate how their instruments can be adapted commensurate to the severity of the risk to price stability”. Since his appearance at Sintra, other policymakers have followed suit with VP de Guindos noting that the ECB could opt for a combination of actions to restore inflation and QE is among the wide range of tools available. Whilst jostling for the top job at the Bank, Finland’s Rehn stated that the ECB is ready to adjust all of its instruments as appropriate, and with a symmetric approach, inflation in the short run may vary around the 2% mark. What is also telling, is that hawks Weidmann and Knot have also hinted a more dovish leaning to their policy view. Finally, the influential Coeure noted that the protracted period of low inflation has caused concerns among financial market participants that current subdued underlying price pressures will persist in the medium term, adding that the Governing Council is taking these concerns seriously.

SOURCE REPORTS: After Draghi’s appearance at Sintra, source reports suggested differing accounts surrounding the balance of views at the Bank, with an initial article suggesting that officials at the ECB view rate cuts as the primary tool for further stimulus, whereas a follow-up article a few hours later suggested policymakers were more divided between rate cuts and QE. Elsewhere, sources at the end of last month stated that a loophole may allow a way for the ECB to purchase more state debt via a bond clause, although it is yet to be discussed by policymakers. Another report in early July, suggested that policymakers see no rush for a rate cut this month, whilst more recently journalists revealed that policymakers are considering a potential revamp to their inflation goal in favour of a more symmetrical approach.

DATA: On the inflation front, CPI continues to reside well below the 2% mark even with headline inflation for June revised higher to 1.3% from the prelim 1.2% print. Core readings also remain subdued with the ‘super-core’ metric running at 1.1%. From a growth perspective, markets still await the release of Q2 growth metrics, next month, however, UBS suggest the bloc remains on track for growth of 0.2% Q/Q, 1.0% Y/Y. Survey data this week saw the July Eurozone Composite PMI slip to 51.5 from 52.2 (Manufacturing 46.4 vs. Prev. 47.6, Services 53.3 vs. Prev. 53.6) with IHS noting “the Eurozone economy relapsed in July, with the PMI giving up the gains seen in May and June to signal one of the weakest expansions seen over the past six years”. Subsequently, IHS concluded “the pace of GDP growth looks set to weaken from the 0.2% rate indicated for the second quarter closer to 0.1% in the third quarter”. Elsewhere, Eurozone Consumer Confidence rose to -6.6 from -7.2, whilst the latest Bank Lending Survey added to the evidence that the Eurozone economy will remain sluggish as concluded by Capital Economics.

CURRENT ECB FORWARD GUIDANCE (INTRODUCTORY STATEMENT)

- RATES: We now expect them to remain at their present levels at least through the first half of 2020, and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term. (Jun 6th)

- ASSET PURCHASES: We intend to continue reinvesting, in full, the principal payments from maturing securities purchased under the asset purchase programme for an extended period of time past the date when we start raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation. (Jun 6th)

- GROWTH/TRADE: The risks surrounding the euro area growth outlook remain tilted to the downside, on account of the prolonged presence of uncertainties, related to geopolitical factors, the rising threat of protectionism and vulnerabilities in emerging markets. (Jun 6th)

- INFLATION: Measures of underlying inflation remain generally muted, but labour cost pressures continue to strengthen and broaden amid high levels of capacity utilisation and tightening labour markets. Looking ahead, underlying inflation is expected to increase over the medium term, supported by our monetary policy measures, the ongoing economic expansion and stronger wage growth. (Jun 6th)

POTENTIAL ADJUSTMENTS TO ECB FORWARD GUIDANCE (INTRODUCTORY STATEMENT)

RATES: This part of the statement will likely garner the greatest source of market focus, particularly in the absence of a rate cut this week. With consensus looking for the ECB to stand pat on rates, analysts (66% of those surveyed by Reuters) suggest that instead, policymakers will likely tweak guidance on rates to include the option of “or lower rates”; a move that Danske Bank suggest would allow for the unveiling of a comprehensive easing package in September. Furthermore, the statement might also see the removal of the timeframe provided by forward guidance on rates with the minutes from the June meeting noting that the “point was made that the value of calendar-element of guidance could seen to be diminished”.

ASSET PURCHASES: Adjustments on this front are unlikely to be made at the June meeting with 60% of surveyed economists by Reuters not looking for the Bank to unveil a relaunch on QE this year. That said, the figure of 60% is down from around 85% seen in June and thus shows that an increasingly dovish ECB could tip the balance in favour of a resumption of bond purchases in 2019.

However, such a move is not expected to be made this month with some analysts suggesting that such a programme would likely follow any potential rate cuts, rather than precede them. Nonetheless, ABN AMRO suggest that if a tweak was to be made the statement could include a line stating that the Bank would “…re-start net asset purchases if necessary to ensure sustained convergence of inflation to levels that are below, but close to, 2% over the medium term”, with the Dutch bank noting that the current guidance only refers to re-investments.

GROWTH/TRADE: Risks surrounding the euro area growth outlook will likely remain classified as tilted to the downside with Citi highlighting that there are no signs of uncertainty dissipating.

INFLATION: This aspect of the statement will likely garner more attention than it has done in recent months given a recent source report suggesting that staff at the Bank are looking at a potential revamp of the ECB’s inflation goal in favour of a more ‘symmetrical’ approach. Such a move, could see policy set in a manner that would tolerate an above-target inflation rate in order to compensate for a prolonged period of persistently low inflation. Despite the current debate surrounding such a decision, the July meeting feels too premature for a move on this front; a view backed by Danske Bank who also make the point that it would need to be implemented on the basis that markets believe the ECB would be capable of such an over-shoot. Instead, this will like ly be afocus for the prospective Lagarde-era at the Bank.

PRESS CONFERENCE

In terms of the press conference (1330BST), the focus for Draghi’s opening remarks and line of questioning from journalists will likely centre around what measures (if any)/tweaks are unveiled at the policy announcement (1245BST). Note, this press conference will not be accompanied with ECB staff macroeconomic projections.

Rates – Should the ECB refrain from cutting rates (as forecast by economists) and as expected, tweak guidance to imply the possibility of lower rates, markets will be looking for any hints as to when such action could come with journalists likely to try and pin Draghi into naming a specific date (something which historically he has been keen to avoid) for an adjustment. In terms of a market outlook, 12bps worth of tightening is priced in by the September meeting and appears to very much be consensus amongst analysts. The September meeting, will allow policymakers to see what course of action the Fed takes, see how EZ data unfolds and the subsequent next round of ECB staff macroeconomic projections. Despite September being widely flagged as an opportune time

for the Bank to lower rates, Draghi will unlikely want to tie the hands of policymakers by being too suggestive of a reduction at the

end of Q3. Instead, the President could opt to hint that a discussion on the matter will take place at the September meeting (if it

hasn’t already), whilst overall conveying the message that policymakers stand ready to act as necessary to provide stimulus for the

Eurozone economy.

QE – Aside from potential easing via rate reductions, a resumption of the Bank’s QE programme will likely be used as another weapon in Draghi’s arsenal to reassure markets that the ECB has the tools to revive the Eurozone. As discussed above, this week’s meeting will likely be seen as too premature for the unveiling of such a programme. However, Draghi could hint that policymakers will not hesitate to act if needs be. In terms of an outlook, ABN AMRO expects policymakers to unveil a EUR 630bln QE package by December, to be implemented in January 2020 for a 9-month stretch (at a pace of EUR 70bln/month). Elsewhere, Citi suggest that QE of EUR 360bln over a 12-month period as part of a broader easing package, could have the support of a sizeable majority of Governing Council members. Any QE relaunch would likely draw scrutiny over purchase limitations, however, Citi suggest “…the self-imposed 33% issue/issuers share of government bonds that the ECB can hold is a matter of past preference, not a hard constraint for the future”. Finally, UBS suggest that such a programme could be unveiled at some stage but it is less of a done-deal than further rate reductions, with a decision on QE to likely be made on a more data-dependent approach which would require a deterioration in the Eurozone’s growth and inflation outlook.

Tiered rate system – With the Bank’s policy bias likely turning towards an easing one, the prospect of prolonged and deeper negative rates has seen increased focus on a potential tiered rate system. Over the past several months, policymakers have rebuffed the idea of implementing a tiered deposit rate system with the monetary policy case having seemingly not been made yet. Furthermore, a recent research piece by the ECB also concluded that the current system of negative rates has not impeded bank profitability. However, ahead of a potential impending rate cut at the Bank, this viewpoint will likely need to be revisited, as highlighted by the account of the June meeting which revealed “costs of negative rates outweighed by benefits, but this might not hold for lower rates or longer horizons”. With this in mind, some suggest that a tiered rate system is more a question of “when” rather than “if”. At this stage, there is very little evidence to suggest that the technical work on what such a system should look like or how it will be implemented has been carried out. However, looking ahead, Danske Bank look for a tiered system to be unveiled in September as part of a broader policy package which will aim to “ensure the average deposit rate paid by banks to the ECB remains close to the current level of just shy of -40bps”. Elsewhere, Rabobank believe “designing a tiered deposit rate is quite complex, and we are doubtful that the ECB would go through this trouble just for one or two rate cuts”. As such, once mitigating measures are in place, Rabo “see little obstacles in the way of further rate cuts”.

Overall, this week’s meeting is likely to be a staging exercise for Draghi et al with greater measures to come in September in the form of a broader easing package. Nonetheless, in the interim, the main message will likely be that policymakers will use all flexibility within their toolkit to fulfil their mandate. However, market participants must be cautioned that Draghi has had a tendency to try and over-deliver on market expectations and therefore investors should not discount the possibility of a more detailed announcement this week.

MARKET REACTION

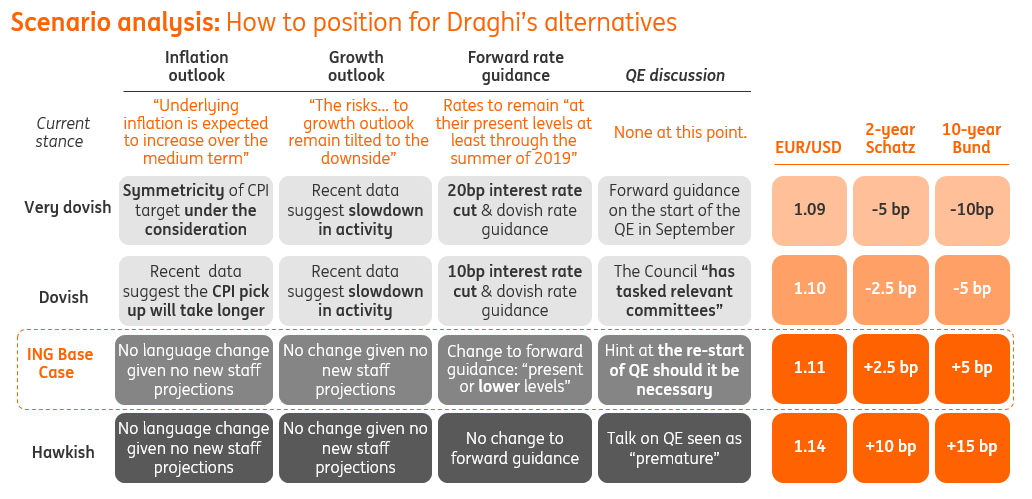

Please see below for ING’s ECB Scenario Analysis

via ZeroHedge News https://ift.tt/2SD1jpw Tyler Durden