Last Friday, when describing the period which he called “the most manic 36 hours of trading in my 18 year career“, Nomura’s Charlie McElligott hit the nail on the head as to the two main reasons why risk assets are tumbling today alongside the dramatic spike in the VIX:

- Dealers were clearly “Short Gamma” in Index / ETF at the start of the month, and

- Dealers are clearly “Short Vol” in-bulk, thanks to the “50 Cent” VIX upside flows which have been trading in SIZE over the past few weeks.

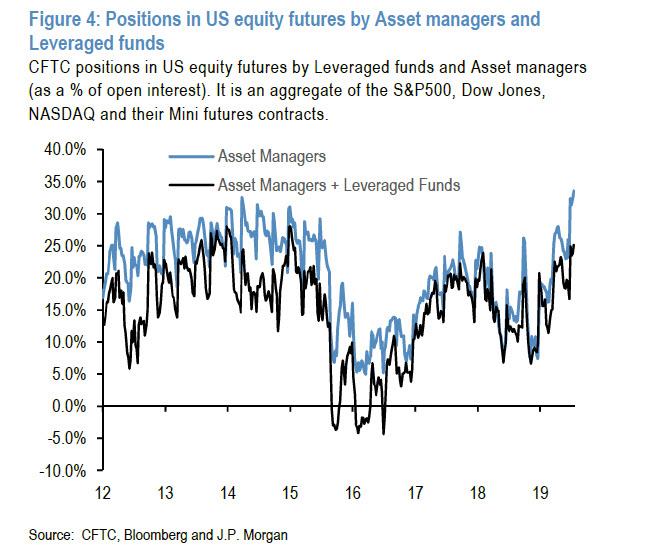

In addition to dealers being off side, McElligott cautioned that systematic VIX Roll-down players in recent weeks had also reapplied significant size to the “Short Vol” trade, as per VIX futures positioning—thus, with the curve again “inverted,” they will be forced / unemotional hedging of these front-end shorts in UX1 and UX2 (none of this is surprising to those who read our piece from last weekend which found that, contrary to conventional wisdom, stocks were actually massively overbought across the board, according to JPMorgan data).

So fast forward to today, when after a hectic weekend, Charlie can soon tack on another 24 hours to “the most manic period”, because as he writes in his blitz post-mortem this morning, risk and safe haven assets are undergoing “extreme moves”, following the Chinese retaliation “double-whammy”, which initially spooked markets on the Sunday reopen, as reports stated that 1) Beijing had asked state-owned firms to suspend US crop purchases and 2) allowed the Yuan to plunge to the weakest level in more than a decade (offshore currently at 7.084)—both direct spites to the US administration, as the agricultural purchases and currency management were top priorities for the White House

While there has been debate whether the PBOC engineered or merely encouraged the overnight devaluation, semantics aside, the Nomura quant notes that the Yuan freefall has reinvigorated the “worst fears” of outright currency warfare across global CBs in “beggar thy neighbor” fashion (Japanese MoF official Takeuchi said he is watching FX markets “with a sense of urgency,” while S.Korean FX authority called the USDKRW moves “excessive, abnormal”), with the Yuan in-and-of-itself capable of triggering a global disinflationary impulse (Iron Ore in Singapore tumbled -7.0% overnight).

Looking ahead, McElligott expects the PBoC to use fixings, capital controls and potentially FX swaps with local banks (deter USD buying) in order to manage the Yuan and prevent full-fledged capital outflows / market breakdown, while at the same time try to minimize the depletion of FX reserves (as opposed to ’15 – ’16), although judging by the surge in cryptos this morning, Beijing’s bitcoin firewall has some very serious holes in it.

Further, as the Nomura quant points out, MNI has a PBoC “advisor sources” piece out stating that that the central bank may allow Yuan to weaken further if the US continues to play tough in trade negotiations; However, depreciation should be limited for now as authorities would step in to to limit heavy selling should it pose a threat to financial markets or trigger capital outflow.

There was a modest improvement in risk sentiment around at 530am ET, following headline reports from Chinese state TV that:

- CHINA SAYS U.S. ACCUSATION ON NO FARM GOODS PURCHASE UNTRUE: TV

- CHINA STATE PLANNER SAYS 2 MLN TONNES OF U.S. SOYBEANS DESTINED FOR CHINA WILL BE LOADED IN AUGUST – STATE MEDIA

And while Bloomberg since clarified that it was private purchasers who stopped buying US soybeans over uncertainty in the China – US trade relationship, the “risk-off” wave has returned, oblivious of any attempt to mitigate the selloff as all eyes are now solely on the USDCNH which continues to rise, and was last trading at 7.08, leaving the PBOC with little ammo to fix the USDCNY below 7.00 on Tuesday.

As a result, the “risk-off” was extreme and as Nomura notes, has largely held:

- 10Y UST nominal yields plunged to near 3-year lows;

- Red Eurodollars exploded higher once-again as the cross-asset hedge of choice (Z0 +17bps at the highs of the session, largest cumulative 3d upside move since 11/01/11 @ +3.5SD);

- Receiving across the board in Swaps via Banks- and Gamma Hedgers- as we broke-out to new multi-year levels;

- Yen and Swiss Franc power ‘bid’ as the best performing G10 FX;

- And as US Real Yields collapsed and the Yuan cratered, we saw Gold- and Crypto- rip higher overnight—as there is no central bank on the other side to devalue

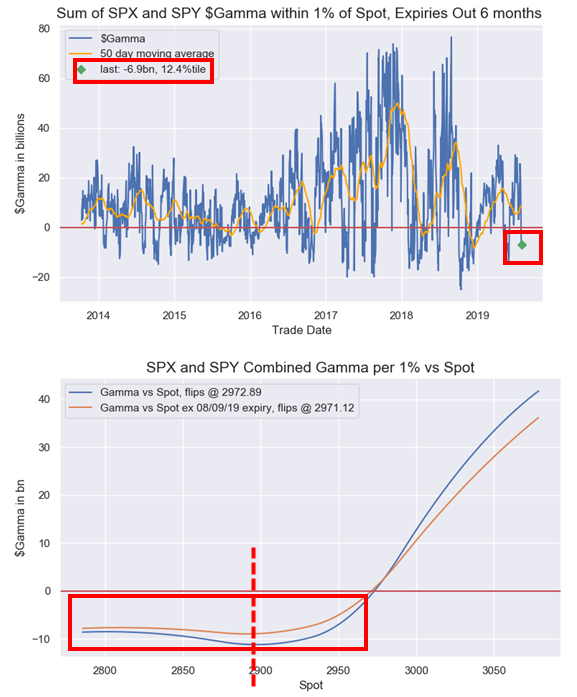

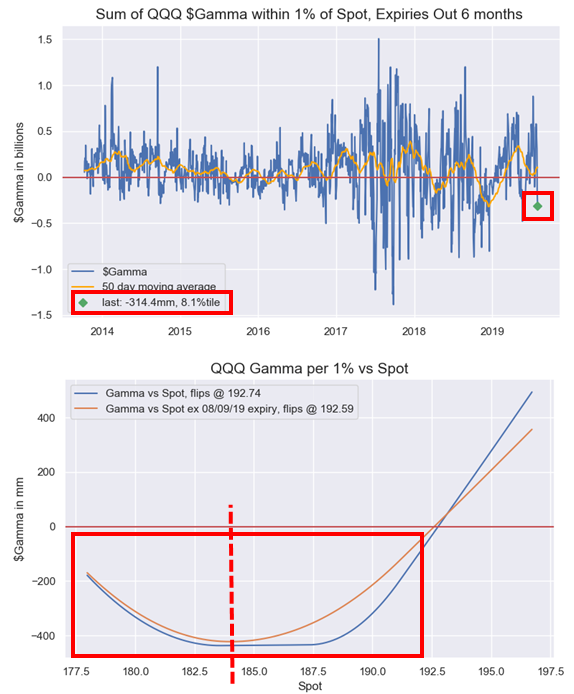

And here comes the bad news for the dip buyers who are hopeful that the ES slide below 2,900 will form a floor to risk: as McElligott cautions, from the key risk-sentiment bellwether that is US Equities, not only did Dealer options positions in S&P- and Nasdaq- both shift “Short Gamma” by midweek (each now EXTREME with Negative $Gamma percentile rank for SPX @ just 12th %ile and QQQ @ 8th %ile), but the feedback loop on the gap lower has now triggered CTA Trend model deleveraging in each as well.

In short, that massively overbought position that we – and BofA over the weekend – warned about, is now being massively sold, which in turn is causing even more selling in a feedback loop as margined positions are force-stopped out, or as those deeply versed in trading vernacular call it, we are having a breakout of “negative gamma”:

- The CTA model’s S&P position below 2946 (spot currently WELL-through at 2900) sees a signal cut from +100% to +66%, triggering deleveraging; the next “sell” level is at 2830, where the model would flip “Short” at a -59% position, and “Max Short” under 2714

- The Nasdaq position already reduced on Friday below 7732 to see the signal decline from +100% to +66%; the next “sell” level is7375 where we would flip to outright “Short”

- Russell is already -59.4% Short, more selling under 1515 to get to get to “Max Short”

- Internationally, HSI CH and Nikkei are both back “Short” already, while Eurostoxx will deleverage & “flip Short” under 3308

And visually, this is what the extreme negative gamma that McElligott has been warning about looks like:

No wonder that Charlie picked the following title for his note today: “Never get caught “short gamma” in August.”

via ZeroHedge News https://ift.tt/2Yo780d Tyler Durden