Following the collapse of the yuan overnight…

President Trump has escalated his rhetoric against China’s interventionsit lack-of-intervention, blasting “China dropped the price of their currency to an almost a historic low. It’s called ‘currency manipulation’…”

Then Trump added – clearly pushing Powell to do more: “Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!”

China dropped the price of their currency to an almost a historic low. It’s called “currency manipulation.” Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!

— Donald J. Trump (@realDonaldTrump) August 5, 2019

Trump’s response comes shortly after PBOC’s Yi Gang wrote:

Recently, some new situations have emerged in the international economic situation and trade frictions, and market expectations have also undergone some changes. Affected by this, many currencies have depreciated against the US dollar since August, and the RMB exchange rate has also been affected to some extent. This fluctuation is driven and determined by the market.

As a responsible big country, China will abide by the spirit of the G20 leaders’ summit on the exchange rate issue, adhere to the market-determined exchange rate system, not engage in competitive devaluation, and not use the exchange rate for competitive purposes. Use the exchange rate as a tool to deal with external disturbances such as trade disputes. All along, the People’s Bank of China is committed to maintaining a stable and balanced RMB exchange rate at a reasonable and balanced level. This effort is believed to be obvious to all.

At present, China’s economy is stable and progressing, and its economic growth ranks among the top in the major economies, showing great resilience, potential and room for maneuver. The balance of international payments is balanced, foreign exchange reserves are sufficient, and there are more and more hedge enterprises in the foreign exchange market. The spread between China and major developed economies is in a suitable range and can support the basic stability of the RMB exchange rate.

The People’s Bank of China and the State Administration of Foreign Exchange will maintain the stability and continuity of foreign exchange management policies and guarantee the legitimate and legitimate use of foreign exchange by market players such as enterprises and individuals. We will deepen reform and opening up in the foreign exchange sector, further enhance the level of liberalization and facilitation of cross-border trade and investment, and serve the development of the real economy and the new pattern of comprehensive national opening up.

Whether it is from the fundamentals of the Chinese economy or from the balance of market supply and demand, the current RMB exchange rate is at an appropriate level. Although the RMB exchange rate has fluctuated due to recent external uncertainties, I am confident that the RMB will continue to be a strong currency. The People’s Bank of China has full experience and ability to maintain the smooth operation of the foreign exchange market and keep the RMB exchange rate basically stable at a reasonable and balanced level.

When China devalues the yuan (or allows the market to devalue the yuan), it exports deflation to the rest of the world which is the ominous threat that central banks have been so vigorously attempting to fight.

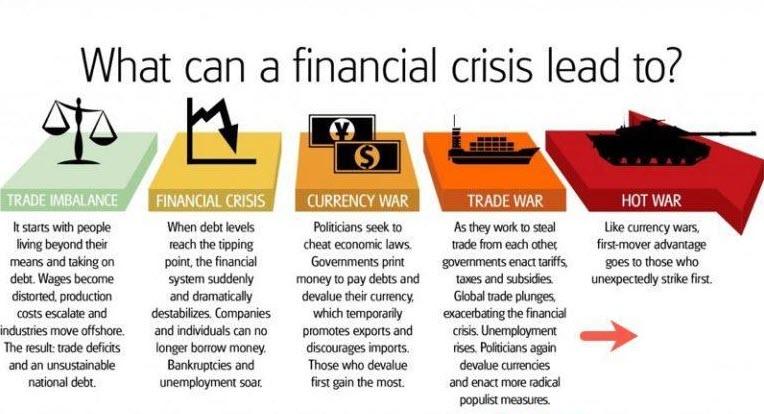

Pretty clear to everyone – currency wars begun they have – as this feedback loop pressures Powell and The Fed to cut rates further to weaken the dollar.

via ZeroHedge News https://ift.tt/2ZyBr0F Tyler Durden