Yesterday, in the immediate aftermath of the historic collapse of all Argentine assets, coupled with the record plunge in the Argentine Peso which only added to the USD-denominated pain of those who were unlucky enough to be long Argentina stocks and bonds, we asked if Michael Hasenstab – the man who may have bought every single sovereign bond dip in history in hopes of being bailed out by central banks – was on Epsteinwatch, for the simple reason that this time a bailout was not forthcoming, resulting in unprecedented losses.

As a reminder, back in May 2018, when it was on the verge of the biggest ever IMF bailout in history (some $57 billion and counting in money that will never be recovered), Argentina received a “vote of confidence” from Franklin Templeton’s Michael Hasenstab after he injected $2.25 billion into the country, which has been battling to save its currency. As the Financial Times reported then, funds run by Hasenstab, including his flagship $38 billion Templeton Global Bond fund, snapped up more than three quarters of a 73 billion peso ($3 billion) ‘Bote’ bond issuance by Argentina in May 2018. .

The purchase reportedly made the asset manager Argentina’s single largest creditors, with holdings in most Argentina bond securities, including the country’s infamous 100 year bond due 2117, which has been eviscerated in the past two days as it now appears the country’s market-friendly regime is on its way out, and will be replaced with the second coming of Cristina Kirchner.

Following the $3 billion issuance, Luis Caputo, Argentina’s finance minister and former central bank president, told Bloomberg: “You can’t get a bigger sign of confidence from markets when you place a bond in pesos at a fixed-rate on one of the worst days in emerging markets this year. It is a sign of confidence in president Macri, and the policies he is putting in place.”

A little over one year later, that “sign of confidence” has come back to haunt both Hasenstab and Templeton, because as we first suggested yesterday…

Hasenstab on Epsteinwatchhttps://t.co/Qkl1ugFlJh

— zerohedge (@zerohedge) August 12, 2019

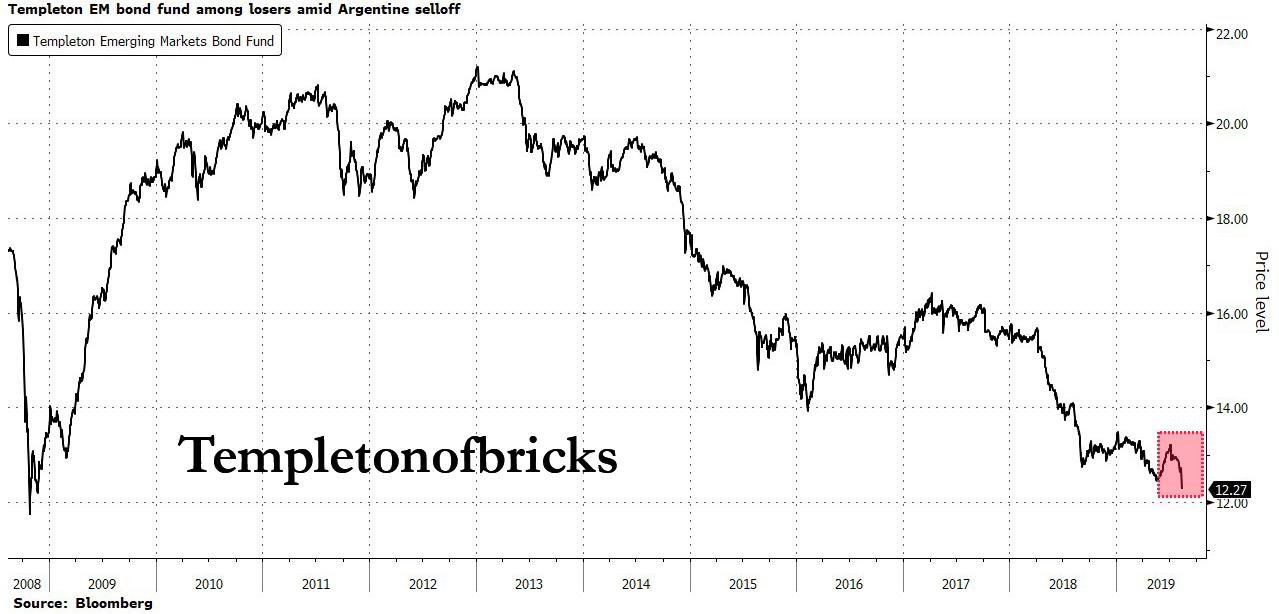

…. today Bloomberg confirms that the record crash in Argentine assets is “wreaking “havoc on some of the largest U.S. money managers, but none more so than Hasenstab’s employer, the $720 billion mutual fund, Franklin Templeton. According to Bloomberg calculations, the biggest loser was the $11.3 billion Templeton Emerging Markets Bond Fund, which fell by 3.5%, a drop that has continued on Tuesday as the selling was nowhere near done. That was its largest daily drop since the October 2008 global financial crisis.

What is perhaps surprising is that the fund’s loss wasn’t even bigger: The Templeton fund had a 12% allocation to Argentina as of June 30, including Treasury bonds and notes linked to the nation’s benchmark rate. As discussed yesterday, Argentine stocks (denominated in USD) lost more than half their value in one day – an unprecedented event – while sovereign and corporate bonds erased $16.8 billion of their value in the Bloomberg Barclays emerging-market index on Monday.

The plunge “shows the painful and long-lasting impact of Argentina’s belligerent treatment of creditors,” said Mike Conelius, a money manager at T. Rowe Price , whose $5.8 billion emerging-market bond fund slumped by 2.2% on Monday, the most in six years. Over 7% of the T. Rowe portfolio was exposed to the country.

To be sure, Templeton wasn’t the only one hammered this week by Argentina’s spectacular implosion: other large funds also suffered, such as the $7.5 billion Ashmore Emerging Markets Short Duration Fund which fell by 3.2%, while the $1.4 billion Fidelity Series Emerging Markets Debt Fund dropped by 3.1%.

Meanwhile, we wonder if for Hasenstab who may have lost more money in one day than he made over the past decade with all his prior, haphazard bets on central bank bailouts, will finally face the proverbial “swimming naked when the tide runs out” moment, or if investors are dumb enough to keep giving him more money.

via ZeroHedge News https://ift.tt/2YJdCqw Tyler Durden