Submitted by Steve Englander, Head, Global G10 FX Research and North America Macro Strategy at Standard Chartered Bank

-

Currency wars are likely to be won by the countries that can afford the consequences

-

DM economies are likely to have an advantage over EM

-

In DM, inflation rates are lower, bond issuance is domestic, and bond yields are less likely to back up

-

If both the Fed and Treasury want to weaken the USD, we think they are likely to succeed …

-

… except if the consequent risk-off response generates buying of USD along with other safe havens

Riding the horse is easy, affording the stable is hard

Most analysis of currency wars begins and ends with the view that the country that depreciates the most wins. We argue here that the likely winner is the country that can best handle the consequences of depreciation. A wealthy economy with a current account deficit, low inflation, a flat Phillips curve, room to cut policy rates, long-term rates that track policy rates down, and local currency-denominated debt is at an advantage in winning a currency war, in our view. Keeping in mind that ‘victory’ in a currency war is a sustained weaker currency, our conclusions are:

- Developed-market (DM) economies in general have an advantage over emerging-market (EM) economies in dealing with the consequences of currency weakness

- The US would likely have an advantage over other DM economies if it aggressively pursued currency depreciation, but not under all circumstances

- The USD, JPY, CHF and possibly EUR are safe-haven currencies; a currency war that led to risk selling would likely cause them to strengthen

- Currency weakness is often associated with poor outcomes in EM, making it harder for EM policy makers to commit fully to aggressive easing

- EM currencies tend to fall in a strongly risk-off environment, but this is hardly a currency war victory because EM asset markets and economies are damaged

Domestic markets are more forgiving when DM currencies depreciate

DM investors tolerate easing better than EM

We define winning a currency war as successfully weakening one’s currency to induce a pick-up in net exports, without significant negative inflation or domestic asset-market consequences. Developed economies have an advantage because their bond markets generally respond favourably to monetary easing, even when the currency weakens.

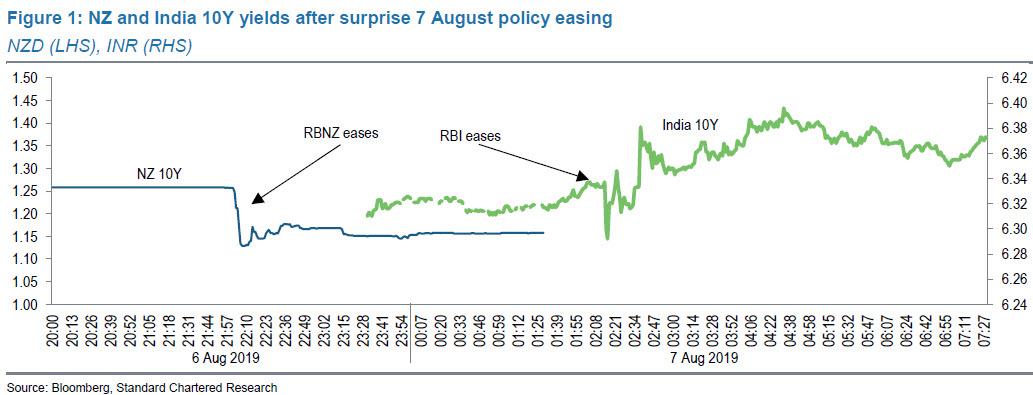

In EM countries, easing at the short end does not always translate into lower long-term yields (Figure 1). EM rates do not always back up on easing, but this risk creates a headwind to aggressive easing. Winning a currency war that pushes inflation to unacceptable levels, drives up long-term rates, damages business confidence, disturbs financial markets and financial institutions, or leads to undesired capital outflows is a pyrrhic victory.

DM economies do not face the issues of long-term credibility that many EM economies face. Long-term DM yields rarely go in the opposite direction to short-term yields in response to policy moves, even when the currency drops. EM countries face the risk that policy easing and currency weakness will backfire if long-term yields rise. On 7 August, New Zealand and India cut policy rates more than expected; New Zealand’s 10Y yields fell and India’s 10Y yields rose.

We think this phenomenon makes it more difficult for EM countries to maintain weak currencies than for DM countries. As a result, we think that currency wars are broadly a long EM, short DM currency trade unless risk sells off sharply. Like polo, the issue is not whether you can ride the horse, but whether you can afford the upkeep.

Below-target inflation makes it easier to deal with currency weakness

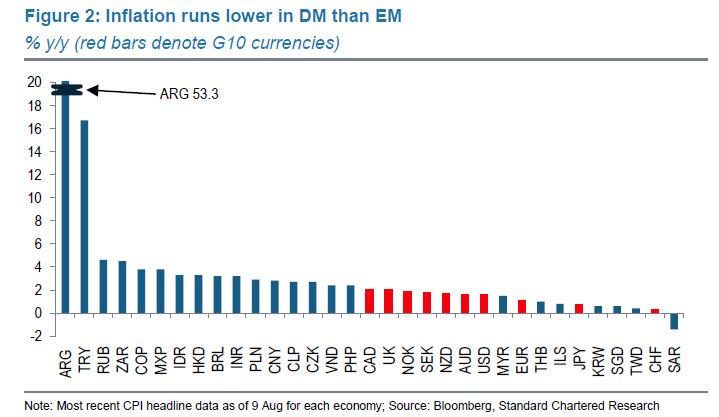

The credibility of currency wars is enhanced if inflation is below target, so that the weaker exchange rate helps inflation move closer to the target rather than away from it. In the G20, no DM country currently has inflation above 2.25% y/y. In EM, Asia has the biggest concentration of low-inflation EM economies (Figure 2), with Taiwan, Singapore, South Korea, Thailand and Malaysia below 2.25% and the Philippines,

China, India, Hong Kong, Indonesia and Vietnam above 2.25%. Few economies face major inflation constraints at present, but encouraging depreciation is less risky when inflation is approaching the target from below and is unlikely to significantly breach it.

Food and energy are relatively small percentages of the DM consumption basket. Rising prices of commodities that are largely priced in global markets do not create social tensions because the impact on living standards is relatively modest. In the US, food and energy make up 11% of the consumption basket and have about a 20% weight in the CPI.

Countries where prices of essentials are closely tied to the exchange rate and where these essentials are a large share of consumption are more vulnerable to depreciation. If domestic food and energy prices are largely driven by world markets, driving the exchange rate down sharply deals a major blow to living standards. In Brazil, food and energy together represent 30% of the CPI. In Vietnam, food and beverages alone are almost 40% of the CPI.

Borrowing abroad makes currency depreciation risky

We think it is less risky to engage in a currency war if domestic debt is almost entirely in local currency. The boost to trade competitiveness from currency depreciation quickly turns sour if depreciation leads to corporate or sovereign debt repayment problems or financial-sector stress. Few DM economies issue in foreign currencies, while many EM economies do. This may limit some EM countries to currency skirmishes, where they try to prevent appreciation or encourage modest depreciation rather than engaging in all-out war to weaken their currencies.

In principle, countries with current account deficits should have an easier time weakening their currencies, particularly if intervention is unsterilised. The logic is that if a country already has a current account deficit and is trying to reduce or eliminate the capital account surplus, it will be hard for the currency to move anywhere but down.

A current account deficit is often accompanied by high interest rates that may make capital flows sticky. However, the combination of a deficit and low rates could be a powerful factor driving both the current and capital accounts into deficit – provided that other factors, such as safe-haven flows, are neutral. The drop in the exchange rate is the mechanism by which the current account-capital account identity is maintained. Along the same lines, if potential capital outflows are hampered by regulation, liberalisation of the capital account would quickly depreciate the currency, but could also have spillover effects on domestic assets.

Safe-haven status is a similar consideration. If the currency war is taking place during, or contributing to, a risk-off episode, safe-haven currencies may find that intervention has limited success in deterring or offsetting capital inflows. The US might find it easier to weaken the USD if investor sentiment were more robust and there was less safe-haven buying of US Treasuries. Again, while easing rates and providing ample liquidity – essentially unsterilised intervention – could mitigate the risk-negative consequences, this is not certain against a backdrop of trade tensions.

Do you want to be a central bank or an asset manager?

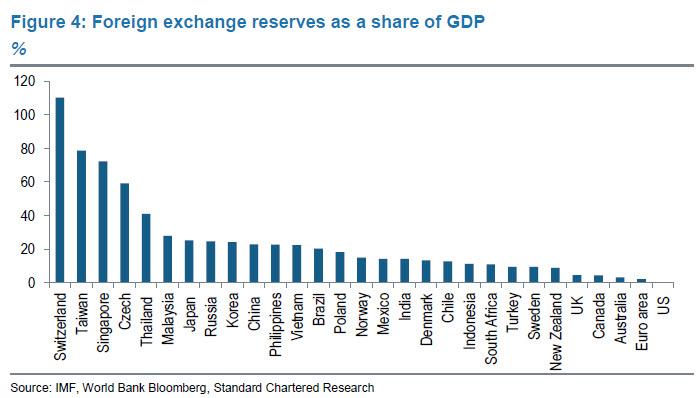

Some reserve managers oversee large FX reserve portfolios (Figure 4). The Swiss National Bank’s (SNB’s) interventions have made it one of the world’s biggest asset managers, with reserves approaching 110% of GDP. If the reserve portfolio is more than 40% of GDP, a 10% capital gain or loss on the portfolio due to currency shifts can represent a big percentage of annual growth. Moreover, after intervention, reserve managers are stuck with a portfolio of foreign currencies that no private portfolio manager would have selected (see US can intervene, but what would it buy?). When the reserve portfolio increases in size, so does the potential for conflict between the portfolio management and monetary policy management roles.

Is it worth winning a currency war?

In the best of circumstances, a weaker currency enables a country’s producers to sell more to the rest of the world, at the cost of the country’s consumers being able to afford a smaller consumption basket. If a currency drops 10%, the country’s producers will likely gain market share, but its consumers will have lower purchasing power abroad. The narrow case for currency weakness is that it may generate employment for workers who would otherwise be unemployed.

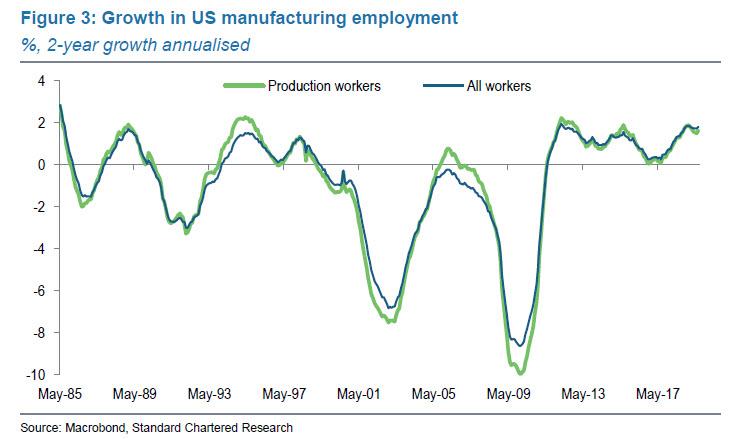

In the US, two-year growth in employment of manufacturing production workers has not exceeded 2.25% since 1985, well before trade with China was an issue (Figure 3). Increasing that growth rate to 3.25% over an extended period would require generating an additional 90,000 production worker jobs a year beyond the peak of the last the 35 years. This is only 7,500 workers per month more on a non-farm payroll basis than otherwise, about one-sixth the standard error of m/m employment growth.

US may have a small currency-war advantage within G10

The US has lots of room to ease compared to others

We think DM policy makers could succeed in broadly weakening their currencies against EM currencies. Within G10, we believe the US has significant advantages, although they are not absolute. The US has low inflation and can force short- and long-end rates down further than other G10 economies without hitting zero-bound constraints; however, Barkis (the Fed) must be willing (see The why and how of a potential Fed FX intervention). The FX intervention literature emphasises that intervention signals central bank objectives. Not participating in Treasury intervention would be a negative signal to markets and other central banks, unless there were a simultaneous easing of policy rates and increase in liquidity.

A risk-off currency war weakens small G10 and EM

The US’ problem is that the USD is in the top tier of safe havens: not quite the JPY and CHF, but ahead of other G10 and EM currencies. So a currency war that raises risk-off tensions would limit broad USD weakness. The USD’s liquidity and reserve status may also make foreigners more willing to hold it, even at lower rates.

Negative-rate currencies may depreciate faster on easing

The European Central Bank (ECB) and the Bank of Japan (BoJ) already have rates in negative territory and may find it harder to cut rates significantly. Sterilised intervention would mean selling the EUR or JPY for foreign currency and selling an equivalent amount of domestic assets to offset the liquidity injection from the intervention. The outcome would be a shift in the composition of the BoJ or ECB monetary base to holding more foreign assets and fewer domestic assets. Sterilised intervention could be surprisingly effective, as foreign investors may be reluctant to hold more negative-yielding EUR or JPY assets without a hefty discount.

Unsterilised intervention would entail flooding the FX market with newly printed money to buy foreign currencies. The ECB or BoJ balance sheet would have more foreign assets, foreigners would have fewer domestic assets and more EUR or JPY assets, and the overall supply of EUR or JPY in asset markets would be higher. Such an intervention may work very well to weaken the EUR or JPY, but poorly in terms of the impact on domestic financial markets and the financial system if it makes rates more negative. Fiscal stimulus makes more sense, but there are institutional and policy barriers to this in both countries.

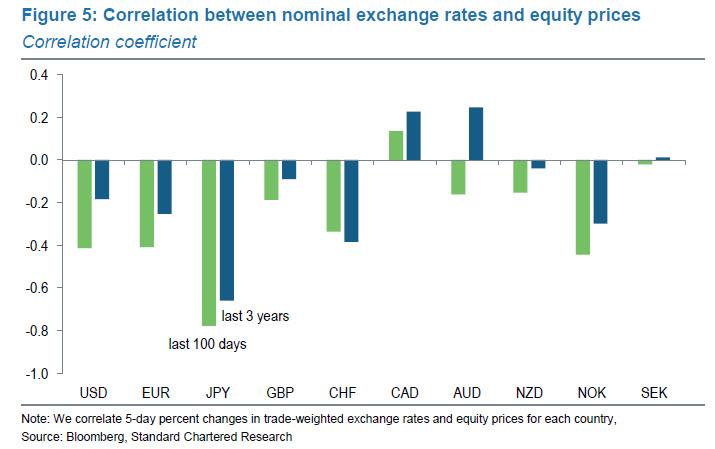

Japanese equity markets are typically very responsive to up-and-down moves in the trade-weighted JPY (Figure 5). This is another way currency weakness could have positive effects for Japan. Euro-area, US, Swiss and Norwegian equity markets also generally respond positively, but the US and euro-area equity-market response is somewhat more variable. We think most of the equity impact would be via valuation effects on corporate profits rather than higher export volumes. Commodity-currency equity prices show less consistent effects from currency depreciation – possibly because their exchange rates and equity prices often respond to common commodity-price shocks. We suspect that the EM equity price response resembles that of DM commodity currencies more than G3 currencies.

The ECB is unlikely to initiate a currency war due to the risk of US retaliation and the soft EUR. USD-JPY is already under downward pressure as a consequence of low US rates and broad risk-off sentiment. Under G20 rules, it would be hard for the BoJ to justify intervening on the basis of rate differentials narrowing and supporting the JPY. There is a reasonable case that central banks of safe-haven currencies should intervene counter-cyclically, but this would likely provoke heavy US criticism and possibly countermeasures. Most likely, the Japanese authorities would stop short of intervention but intervene verbally as long as USD-JPY were falling gradually. A sharp drop towards and past the 100 level for USD-JPY could prompt limited intervention aimed at smoothing, but this could fail if investors see US opposition limiting Japan’s ability to respond.

The Bank of England (BoE) and Bank of Canada (BoC) are not far off their inflation targets – they could act resolutely in pushing rates down, but may have to deal with inflation consequences down the road. Fiscal stimulus, accompanied by central bank balance-sheet expansion, makes more sense than targeting the currency. With Swiss reserves having risen to almost 110% of GDP in Q1-2019 from less than 10% in 2008, it is unclear how much more appetite for intervention the SNB has.

Of the remaining G10 countries, Norway and Sweden have already-weak currencies, plenty of fiscal room, and inflation close to target. Australia and New Zealand have been encouraging their currencies weaker for some time, but also have plenty of fiscal room.

via ZeroHedge News https://ift.tt/2Z1XADI Tyler Durden