A “Dollar Funding Storm” Is Set To Make Landfall In Weeks: What Happens Next

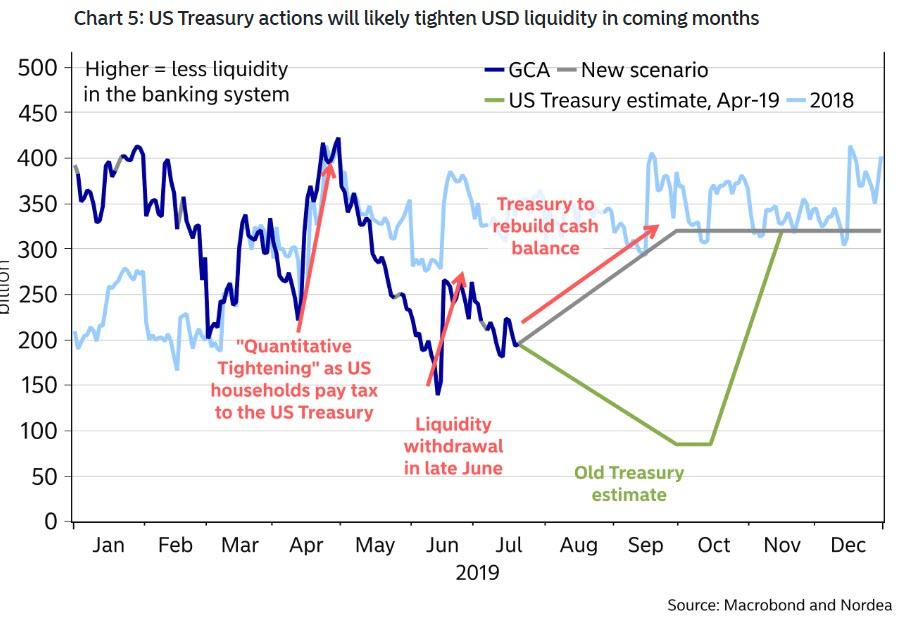

One month ago we explained why, regardless of the outcome of the US-China trade war and the fate of the US economy, the Fed may have no choice but to resume QE in the coming weeks – potentially as early as 4Q – in order ease funding pressures expected during the coming wave of accelerated Treasury supply as the US Treasury seeks to rebuild its cash balance up to $350 by mid-November.

And while the Treasury has taken its time in rebuilding the cash over the past month, with the latest Treasury cash balance just $184BN as of Sept 11, it only means the ramp up in the coming weeks will be that much more acute. So acute in fact, that as BofA rates strategist Mark Cabana writes today, “the USD funding storm has been brewing for months and is likely to make landfall in Q4.”

For those still unfamiliar with the core reasons behind the coming dollar shortage, BofA recaps the converging sources of pressure that will likely result in secured funding markets breaking higher, including

- elevated UST supply,

- bloated dealer balance sheets and year-end regulatory constraints, and

- a banking system near reserve scarcity.

Ironically, it was the rising recession concerns in August – manifesting in the form of an inverted yield curve, cash hiding in repo, and a slow build in UST supply – that kept secured funding pressures at bay. However, Cabana believes that “clear signs of funding pressure could emerge starting next week with sizeable coupon settlements and the mid-September corporate tax date.“

So what happens next?

According to BofA, the Fed will have no choice but to respond to these funding pressures by year end. As of this moment, the Fed has a number of tools to deal with these pressures including:

- repos, i.e. temporary ad hoc reserve adding open market operations,

- Treasury purchases, i.e. permanent open market operations, similar to outright UST QE only without a clear QE mandate (for now), and

- standing repo facility (SRF), i.e. a new facility that could “automatically” add reserves to the banking system when GC or fed funds reaches a threshold above IOER.

As Cabana explains, all three of these have the same Fed balance sheet and funding impact; they only differ in their design and implementation; furthermore in terms of deployment, BofA expected traditional repos will be first tool employed by the Fed and SRF likely the last.

Here are the details on how the Fed will scramble to offset what BofA sees as a coming dollar “funding storm” starting with the most conventional sources of short-term funding:

1. Old school funding pressure lessons: repos & outrights

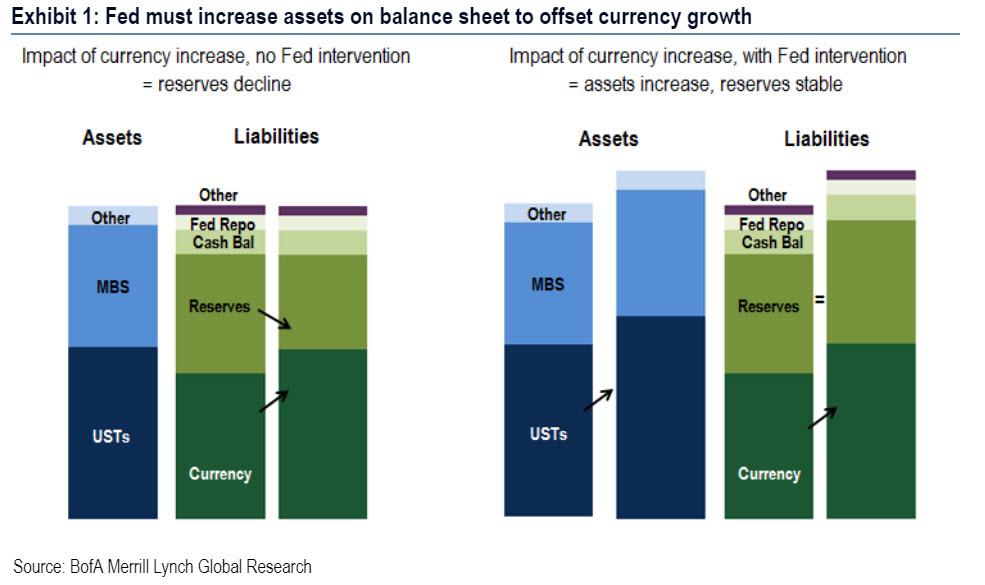

Pre-crisis the Fed relied on two types of open market operations to manage funding markets and their balance sheet: (1) temporary repo or reverse repo operations (2) outright UST purchases. Repo operations were used to “fine tune” the amount of reserves in the banking system to hit the fed funds target rate while outright UST purchases were used to offset currency in circulation growth. As a reminder, currency growth – of which we have seen a dramatic increase in recent years as the amount of $100 bills in circulation has soared – eats away at reserves in the banking system; this would pressure fed funds higher if the Fed did not growth their balance sheet to offset this (Exhibit 1).

- Reserve adding operations: both repos and outright UST purchases have the same impact on the Fed’s balance sheet: on the asset side they increase SOMA holdings and on the liability side they increase reserves (Table 1). The only difference is that repos are relatively short-lived and unwind on an overnight or short-term basis; outright Treasury purchases have a permanent impact on the Fed’s balance sheet.

- Reserve draining operations: pre-crisis the Fed only ever engaged in open market operations to drain reserves as a “fine tuning” fed funds management exercise. Prior to 2008 the Fed never engaged in any permanent open market operations to drain reserves (such as UST sales) since they only ever used this tool to offset currency growth.

Next, Cabana provides some historical perspective on each of the temporary repo and permanent UST purchase open market operations focuses on those operations that add reserves. As funding pressures begin to emerge and likely worsen in Q4, the BofA rates strategist expects the Fed to step in and use both sets of tools to contain these pressures and keep the fed funds in its target range.

Temporary repo operations

Temporary open market operations were a common practice prior to the crisis, when the Fed was in a scarce reserve regime. The New York Fed conducted frequent repo operations to fine tune the amount of reserves in the system and to ensure that the fed funds effective hit its target point. Below is a review of the mechanics of such repo operations as well as historical activity from 2000-2008. If the Fed conducts repo operations again to offset funding pressures, there will likely be parallels to their historical operations.

The mechanics

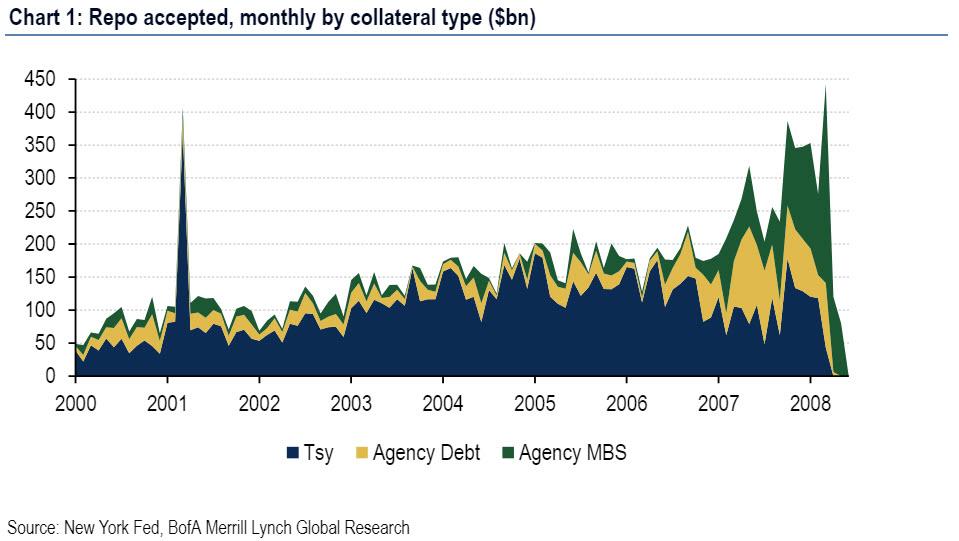

Temporary repo operations were executed in the tri-party market and were conducted only with primary dealers. Historically, repos were

- multiple price and fixed amount

- announced only at the outset of the open market operation

- executed across Treasury, agency debt, & agency MBS collateral types (Chart 1).

The Fed provides data on repo operations starting in July 2000. An increase in Fed repo operations corresponds to a similar increase in reserves, all else equal (Exhibit 1).

Historical repo operations

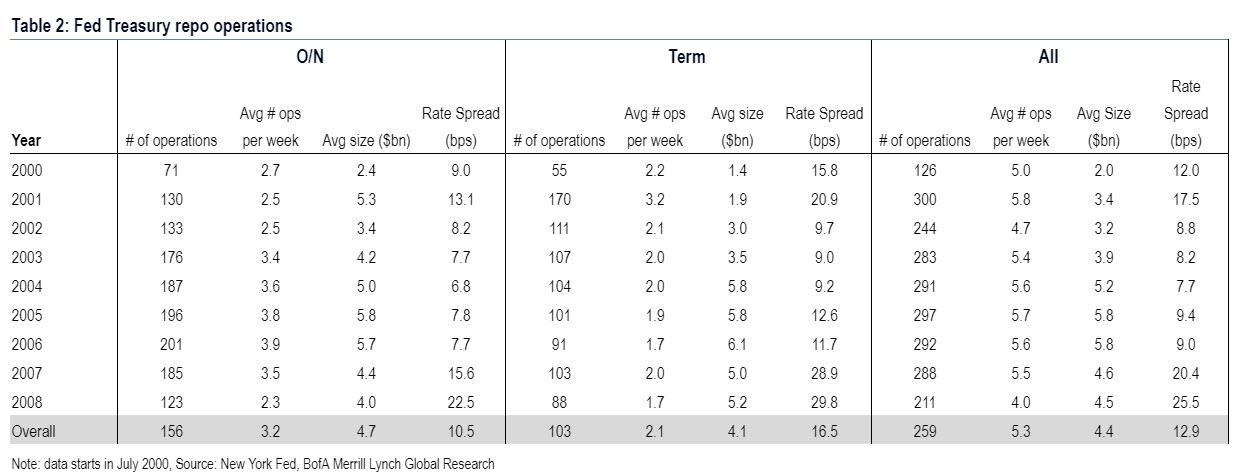

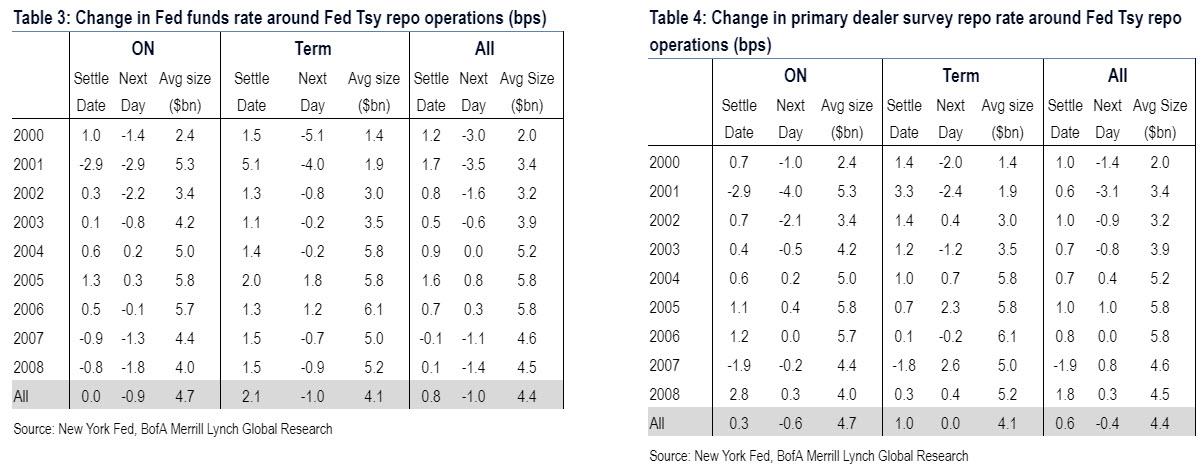

From mid-2000 to the end of 2008, the NY Fed conducted 5 UST repo operations on average each week. Overnight operations averaged around $5bn in size while term operations averaged around $4bn (Table 2). Fed repo operations were all fixed quantity and multiple price, which means that dealers were able to submit varying rates at which they would underwrite the repo operation. The Fed reports the high and low rate that dealers showed into the Fed: the range of rates averaged 13bps and was unsurprisingly wider for term rates. Operations were typically conducted between 8:30 and 10:00AM.

What to expect this time

If funding markets face stress in the next few months – which Bank of America expects will happen – the Fed could easily conduct repo operations to stem upward pressure. Since the recession, the NY Fed has periodically conducted small repo operations in order to “test operational readiness.” There have been 21 operations in total since 2012 – which is somewhat bizarre considering there are well over $1 trillion in reserves floating around the financial system – and the last set of Fed test repo operations was conducted in May. In the past few years the repo tests have been very small (around $23mn in size for USTs), were multiple price, and were overnight or matured in 2-3 business days. The tests have also been across UST, agency debt, & agency MBS collateral. The tests indicate that the NY Fed is prepared to conduct such repo operations at any time and that this is a readily available solution for any sharp increase in funding markets.

Outright Treasury purchases

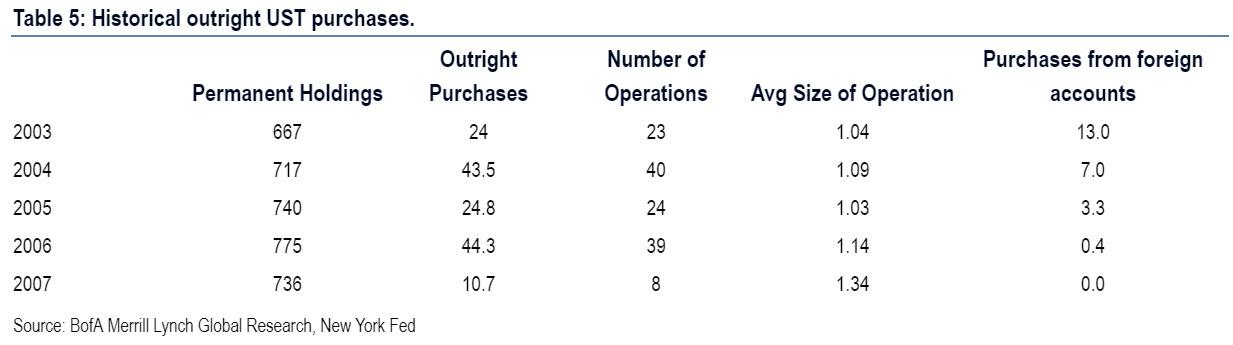

Before the crisis, Fed outright purchases of Treasuries averaged $30bn per year, with individual operations sizes around $1bn (Table 5). Purchases ranged across the entire Treasury curve but were concentrated in the belly. The NY Fed limited its purchases to 35% of any single issue but has subsequently increased this limit to 70%. The Fed also avoided purchasing issues with less than 5 weeks remaining to maturity, issues trading with significant specialness, and newly issued securities

Extending on this, if the Fed wanted to offset elevated funding pressures today and was leery of using repos, it would first utilize ad-hoc repo operations and then shift to use outright Treasury purchases, i.e. Q.E., according to BofA.

Fed funding intervention today: when, what level, why?

According to BofA, in recent weeks client speculation has increased that the Fed might announce measures to offset potential Q4 funding pressures at the September FOMC meeting; the bank itself is skeptical, and believes the Fed will need to see both GC repo and fed funds rise materially in relation to IOER before intervening in the repo market.

September FOMC expectations: the Fed is unlikely to provide much concrete guidance on its plans to intervene in funding markets at the September meeting, according to Cabana. The reason is that with less than a week to go until the FOMC meeting, funding markets have been relatively well behaved over recent weeks and the Fed would likely need to see more upward pressure in money markets before committing to take any specific actions. As such, BofA is “skeptical that the Fed is ready to unveil a new SRF, especially since the Fed has repo and outright operations they can rely on to manage money markets.” New SRF detail is most likely to come through the September FOMC meeting minutes on October 9 rather than through communications next week.

That said, not even BofA believes the September meeting will be completely devoid of communications around Fed activity in money markets, and expects the Fed to send a reminder that it stands ready to act to ensure that the fed funds effective remains comfortably in the target range. The most logical place for such communications would be through the “implementation note” that accompanies all recent FOMC meetings. The Fed could note that “the Federal Open Market Committee directs the Desk to undertake open market operations as necessary to maintain the federal funds rate in a target range of 1 ¾ – 2 percent, including repurchase operations and reverse repurchase operations…”. The inclusion of repos in this language would likely signal to the market that the Fed remains ready to act in case funding markets come under greater pressure.

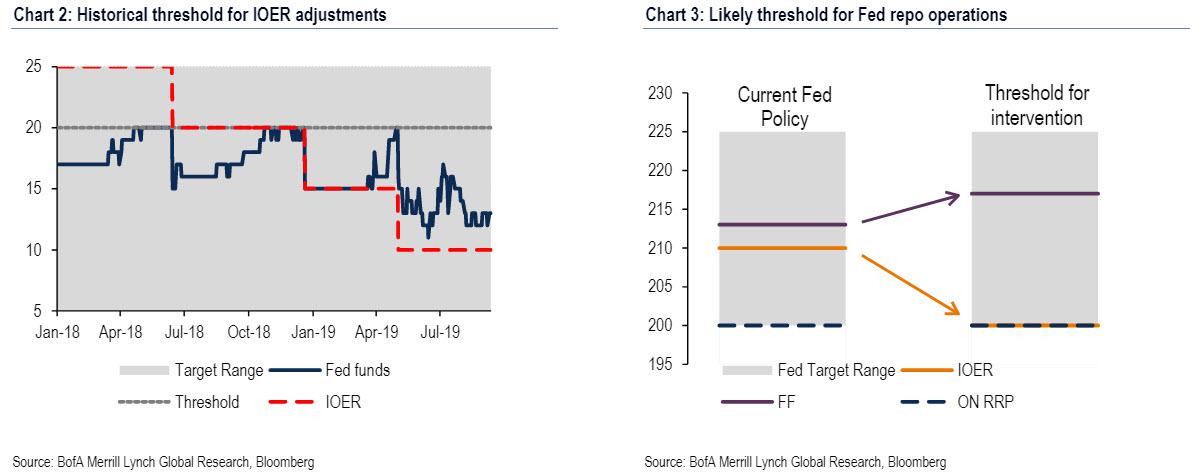

Threshold: TSYs will need to get notably cheaper before the Fed conducts temporary repo operations or outright UST purchases. As funding pressure begins to emerge, the Fed will cut IOER at least once if not twice more to the bottom of their target range, per BofA. In the past, technical IOER adjustments have taken place when EFFR is 5bps from the top of the range.

Curiously, despite the recent rate cut, the effective FFR has remained stable around 2.13% or 12bps from the top of the range, if still above the IOED level. Here BofA claims that since the Fed has never “preemptively” lowered IOER, the fed funds will need to be near 2.20% in order for the Fed to take such action at the September meeting.

So when will the Fed re-enter the market aggressively and restart open market operations?

According to Cabana, BofA’s best guess is that “the Fed re-starts open market operations when fed funds trades at IOER+15 to +20 bps, assuming IOER is dropped to the bottom of the target range”, with the caveat that the Fed might choose to intervene at less extreme levels of money market cheapness vs IOER but believe fed funds will need to be higher than 10 bps above IOER since the Fed did not engage in repo operations when fed funds traded near similar levels in the past. The key takeaway is USTs still have room to cheapen in the near-term until the Fed backstops the funding markets.

So why wait?

As BofA reveals, a number of its clients have asked why the Fed would wait to see more material funding pressures emerge before seeking to intervene in repo markets. The answer stems from the Fed’s balance sheet normalization principles (which sadly have now been trampled) and plans where it states that it wants to hold “no more securities than necessary for efficient and effective policy implementation”. This, to Cabana, suggests that the Fed wants to find the minimum quantity of reserves necessary in the banking system before it will be willing to expand its securities portfolio. Stated differently, the Fed needs to see the “whites of the funding pressure eyes” before they will act to offset these pressures. Here, the fact that this potential reserve shortage is taking place with nearly $1.4 trillion in “excess” reserves in the system, is probably not lost on anyone.

Further to this point, the necessity to see the funding pressures materialize in markets is aided by the fact that the Fed has received inconsistent guidance about the minimum level of reserves from their various surveys:

Assumptions drawn from the June ’19 Survey of Primary Dealers and Market Participants suggests that reserves are to bottom out at a level between $1.1 – $1.25 tn. However, when the Fed asked banks in their most recent February ’19 Senior Financial Officer Survey these respondents generally indicated a minimum level of reserves in the $800-$950 bn range. While the Fed will want to have a “reserve buffer” likely ranging from $100-$200 bn on top of the estimates provided in the Senior Financial Officer Survey it still suggests a relatively wide range.

Why does this matter? Since the Fed does not know the minimum quantity of reserves needed in the banking system and it desires to hold “no more securities than necessary” for the efficient implementation of monetary policy, BofA believes that the Fed will likely want to test how low reserves can fall before intervening in funding markets. “This runs the risk of a temporary overshoot on the extent of money market tightness as the Fed plumbs how low reserves can fall before it ultimately needs to start growing its balance sheet.“

This matters because the last time the market freaked out about insufficient reserves in the market was in Q4 2018 when QT was on “auto pilot” and stocks tumbled.

Which brings the $64 trillion question: how to determine if the dollar funding squeeze will cause another major risk off episode? Here, Cabana answers that as the Fed starts to test these reserve lows, “we expect funding markets to react by showing further Treasury cheapening, widening of FRA-OIS, and narrowing of front-end spreads & SOFR-FF basis.”

However, once the Fed responds by engaging in repo or outright UST purchase operations we expect these markets to move in the opposite direction. We suggest clients continue to trade these themes tactically and consider moving out of UST cheapening positions as fed funds rises towards the IOER +15 to +20 bps level.

Of course, if the Fed wants to front-run the funding shortage, and aggressively inject liquidity into the system, nothing prevents it from following in the ECB’s footsteps and hint at another round of QE in the near future: not only would that send stocks soaring in the asset bubble’s “Icarus song”, but it would also make Trump happy, if only until it all comes crashing down.

Tyler Durden

Fri, 09/13/2019 – 15:53

via ZeroHedge News https://ift.tt/2LM8dFY Tyler Durden